Endoscopy Procedures Market Research, 2034

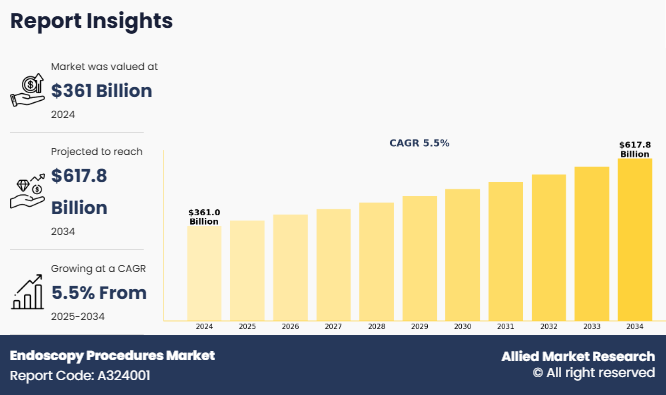

The global endoscopy procedures market size was valued at $361 billion in 2024, and is projected to reach $617.8 billion by 2034, growing at a CAGR of 5.5% from 2025 to 2034. The growth of the endoscopy procedures market is driven by rising prevalence of chronic and gastrointestinal diseases, increasing geriatric population, and a growing preference for minimally invasive procedures. Technological advancements such as AI-assisted imaging, robotic endoscopy, and capsule endoscopy enhance diagnostic accuracy and patient comfort. Improved healthcare infrastructure, especially in developing regions, and expanding awareness about early disease detection further support endoscopy procedures market growth. According to a 2025 article by the National Library of Medicine, in the U.S., more than 50 million endoscopic procedures are performed annually. In addition, favorable reimbursement policies and the shift toward outpatient and value-based care models are increasing procedure volumes.

Endoscopy is a minimally invasive medical procedure that involves the use of an endoscope, a flexible tube with a light and camera attached to examine the interior of organs and cavities within the body. This technique allows physicians to diagnose, monitor, and sometimes treat various conditions without the need for major surgery. Common types of endoscopies include gastrointestinal endoscopy, laparoscopy, bronchoscopy, and others. The procedure can be both diagnostic and therapeutic, aiding in the detection of conditions like ulcers, tumors, inflammation, or internal bleeding, and allowing for interventions such as biopsies, polyp removal, or treatment of bleeding lesions. Endoscopic procedures are generally performed under mild sedation or local anesthesia, resulting in shorter recovery times, minimal discomfort, and reduced risk compared to traditional surgical methods.

Key Takeaways

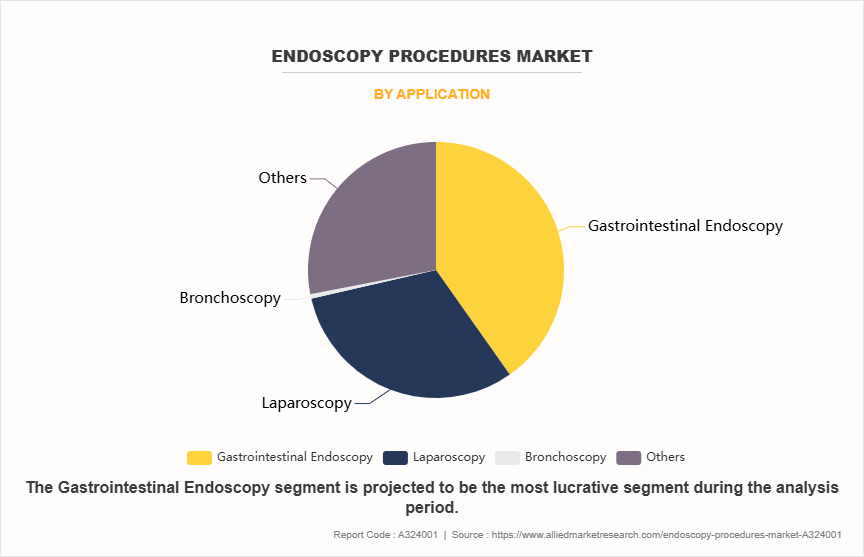

- By application, the gastrointestinal endoscopy segment was the highest contributor to the endoscopy procedures market in 2024.

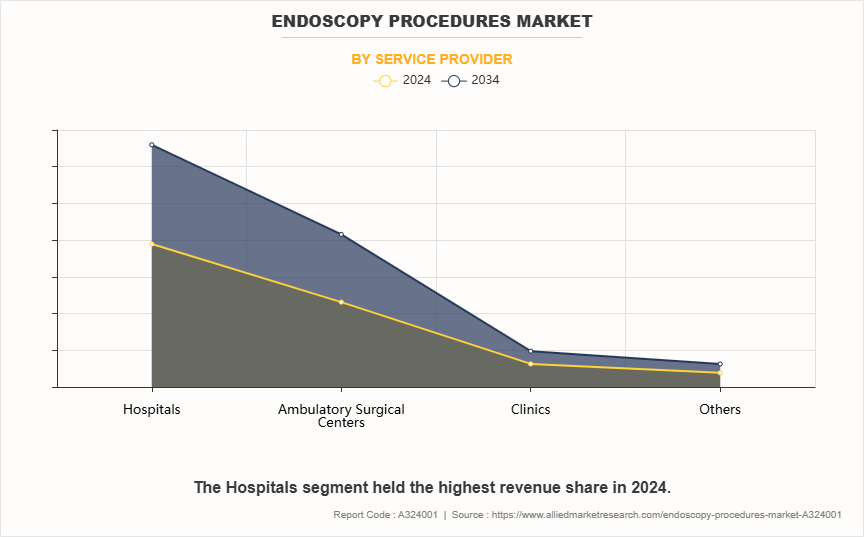

- By service provider, the hospitals segment was the highest contributor to the endoscopy procedures market in 2024.

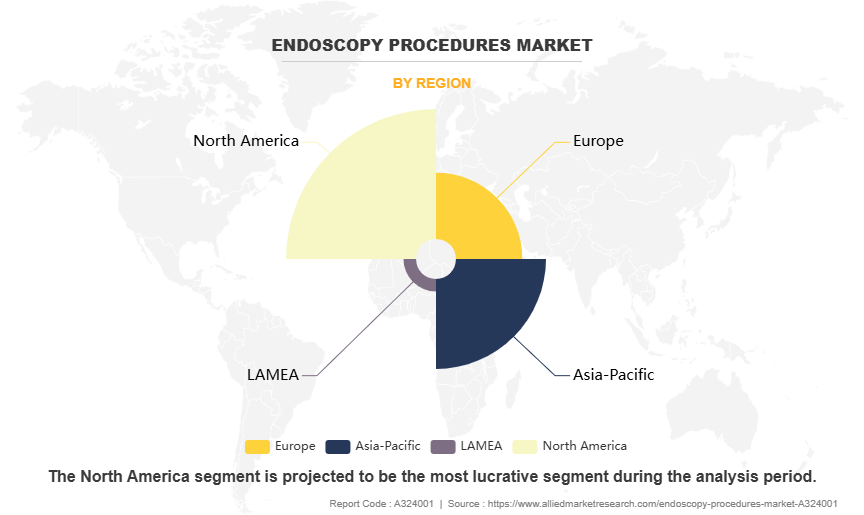

- By region, North America garnered the largest revenue share in endoscopy procedures market in 2024. However, Asia-Pacific is expected to grow at the fastest rate during the forecast period.

Market Dynamics

The rise in the prevalence of chronic diseases and the expanding geriatric population are major factors driving the endoscopy procedures market growth. Chronic conditions such as gastrointestinal cancers, including stomach cancer, require early diagnosis and ongoing monitoring, which often involves endoscopic techniques. According to a 2025 article by the American Cancer Society, approximately 30,300 new cases of stomach cancer are expected to be diagnosed in the U.S. alone in 2025, highlighting the critical role of endoscopy in cancer detection and management. In addition, aging significantly increases susceptibility to chronic illnesses, thus elevating the need for routine diagnostic evaluation which drive the growth of the endoscopy procedures market.

As reported by the World Health Organization in 2025, global life expectancy at birth reached 73.3 years in 2024, an increase of 8.4 years since 1995. Moreover, the number of people aged 60 and above worldwide is expected to grow from 1.1 billion in 2023 to 1.4 billion by 2030. The rise in geriatric population is expected to drive the volume of endoscopic procedures further, making geriatric care a major component of growth of the endoscopy procedures market size.

The growing number of endoscopic procedures performed globally, coupled with the rising adoption of health insurance, is significantly driving the growth of the endoscopy procedures market. Endoscopy has become an essential diagnostic and therapeutic tool for a wide range of conditions, including gastrointestinal, pulmonary, and orthopedic disorders. The increasing prevalence of such conditions has led to a sharp rise in demand for minimally invasive diagnostic solutions which further drive the growth of the endoscopy procedures market. According to a 2025 article by the National Library of Medicine, more than 50 million endoscopic procedures are performed annually in the U.S. alone, and this number continues to grow each year.

Furthermore, the increased adoption of health insurance has made endoscopic procedures more affordable and accessible for patients which further drive the growth of the endoscopy procedures market. According to the U.S. Census Bureau, in 2023, around 92% of population in the U.S. had health insurance. As more individuals gain access to health coverage, financial barriers to undergoing diagnostic and therapeutic procedures like endoscopy are significantly reduced. Health insurance facilitates the affordability of routine screenings such as colonoscopies, upper GI endoscopies, and bronchoscopies, which are essential for early disease detection and management. This increased accessibility has led to a higher volume of endoscopic procedures being performed across both public and private healthcare settings. In addition, insurers increasingly support preventive healthcare services, further boosting the demand for endoscopy as a reliable diagnostic tool which further drive the growth of the endoscopy procedures market.

Furthermore, technological advancements present a significant endoscopy procedures market opportunity for growth of the market, enabling improved endoscopy devices, enhanced patient outcomes, and minimally invasive surgical interventions. Innovations such as high-definition (HD) and 4K endoscopy, narrow-band imaging (NBI), confocal laser endomicroscopy, and robotic-assisted endoscopy have elevated the precision and clarity of internal visualization, allowing for early detection and accurate diagnosis of gastrointestinal, pulmonary, and urological conditions. The integration of artificial intelligence (AI) and machine learning into endoscopic systems further enhances lesion detection and real-time decision-making during procedures. Technological advancements have greatly facilitated easier disease diagnosis and enabled minimally invasive procedures, thereby driving the growth of endoscopy procedures market.

Moreover, expansion of healthcare infrastructure in developing regions is a major driver for the growth of the endoscopy procedures market. Countries across Asia-Pacific, Latin America, the Middle East, and Africa are making significant efforts in strengthening their healthcare systems by building new hospitals, upgrading existing facilities, and investing in modern diagnostic and surgical technologies. According to India Brand Equity Foundation, the government of India has allocated $11.50 billion to the healthcare sector in the Union Budget 2025-26 for the development, maintenance, and enhancement of the country's healthcare system. This reflects a 9.78% increase from the previous allocation of $10.47 billion (Rs. 90,958 crore) in FY25. With the establishment of specialty clinics in both urban and rural areas, there is a growing availability of advanced endoscopic equipment and skilled medical professionals trained to perform these minimally invasive procedures.

As healthcare infrastructure improves, patients in these regions are experiencing better access to diagnostic and therapeutic endoscopic services for conditions such as gastrointestinal diseases, respiratory disorders, and cancers. Furthermore, infrastructure development has facilitated the incorporation of cutting-edge technologies such as high-definition imaging, capsule endoscopy, and robotic-assisted endoscopic surgery in healthcare settings that previously lacked such capabilities. This has not only enhanced the accuracy and safety of procedures but also reduced recovery times and hospital stays, making endoscopy procedures a more attractive option for both physicians and patients. As these advancements become more widespread and healthcare services become more accessible and affordable, the demand for endoscopic procedures is expected to grow significantly in developing regions, thereby contributing to the overall expansion of the global endoscopy procedures market outlook.

Segmental Overview

The endoscopy procedures industry is segmented on the basis of application, service provider, and region. On the basis of application, the market is divided into gastrointestinal endoscopy, laparoscopy, bronchoscopy, and others. On the basis of service provider, the market is divided into hospitals, ambulatory surgical centers (ASCs), clinics, and others. On the basis of region, the market is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea and rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, Rest of LAMEA).

By Application

The gastrointestinal (GI) endoscopy segment held the largest endoscopy procedures market share in 2024. This is attributed to high global prevalence of gastrointestinal disorders, such as colorectal cancer, ulcers, Crohn’s disease, and irritable bowel syndrome. GI endoscopy, including procedures like colonoscopy, gastroscopy, and sigmoidoscopy, plays a critical role in early detection, diagnosis, and monitoring of these conditions. The increasing incidence of colorectal cancer, particularly in aging populations, has further driven demand for routine screening through endoscopic methods. In addition, advancements in endoscopic technologies such as high-definition imaging and minimally invasive techniques have made GI endoscopy safer, more accurate, and more widely accessible. Hospitals and clinics increasingly prefer endoscopy over surgical alternatives due to reduced recovery times and lower complication rates.

By Service Provider

The hospital segment held the largest endoscopy procedures market share in 2024. Hospitals are typically equipped with advanced infrastructure, a wide range of endoscopic equipment, and specialized medical personnel, enabling them to perform complex diagnostic and therapeutic procedures with high precision. They serve as primary centers for treating severe and acute gastrointestinal, respiratory, and urological conditions that require endoscopic intervention. In addition, hospitals often function as referral centers, receiving patients from smaller clinics and primary care facilities, which significantly increases their procedure volumes. The availability of emergency care, intensive care units, and post-procedure recovery services further positions hospitals as the preferred choice for both patients and healthcare providers.

However, the ambulatory surgical centers segment is expected to register the highest CAGR during the forecast period. This is attributed to their cost-efficiency, convenience, and increasing patient preference for outpatient care. Ambulatory surgical centers offer same-day procedures with shorter wait times and lower overall healthcare costs compared to hospitals, making them highly attractive to both patients and insurers. They are particularly well-suited for routine and minimally invasive endoscopic procedures such as colonoscopies and upper GI endoscopies, which do not require extended hospitalization.

By Region

On the basis of the region, North America accounted for a majority of the endoscopy procedures market share in 2024 and is anticipated to remain dominant during the endoscopy procedures market forecast, owing to its well-established healthcare infrastructure, high adoption of advanced medical technologies, and growth in prevalence of chronic diseases such as gastrointestinal disorders, colorectal cancer, and obesity. The region benefits from widespread availability of skilled healthcare professionals and access to minimally invasive surgical procedures, which are increasingly preferred over traditional surgeries due to shorter recovery times and lower complication rates. In addition, favorable reimbursement policies, strong presence of key market players, and a higher per capita healthcare expenditure further contribute to the dominant market share of North America.

However, the Asia-Pacific region is expected to register the highest CAGR during the forecast period. This is attributed to the rapid expansion of healthcare infrastructure, increase in awareness about the benefits of endoscopic procedures, and a large and aging population susceptible to chronic diseases. Countries such as China, India, and Japan, are witnessing a surge in demand for minimally invasive surgeries, supported by government initiatives to modernize healthcare systems and increase accessibility.

Competition Analysis

Major key players that operate in the global endoscopy procedures market are Apollo Hospitals Enterprise Ltd., Kaizen Gastro Care, Clínic Barcelona, Cedars-Sinai, Stanford Health Care, SingHealth Group, Northwestern Memorial HealthCare, Fortis Healthcare, Brigham and Women's Hospital, and Ramsay Health Care. Key players, such as Stanford Health Care, have adopted innovation as a key developmental strategy to drive market growth.

Recent Developments in the Endoscopy Procedures Industry

In April 2024, Stanford Health Care announced an innovation in its novel interventional pulmonology approach for the detection and treatment of lung cancer. Stanford Health Care is pioneering the use of robotic bronchoscopy combined with cone beam CT (CBCT) guidance to improve the diagnosis and treatment of lung cancer. Traditional methods for lung nodule biopsies, such as flexible bronchoscopy and percutaneous needle biopsy, have limitations either lacking accuracy or carrying higher risks like lung collapse

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the endoscopy procedures market analysis from 2024 to 2034 to identify the prevailing endoscopy procedures market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the endoscopy procedures market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global endoscopy procedures market trends, key players, market segments, application areas, and market growth strategies.

Endoscopy Procedures Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 617.8 billion |

| Growth Rate | CAGR of 5.5% |

| Forecast period | 2024 - 2034 |

| Report Pages | 263 |

| By Application |

|

| By Service Provider |

|

| By Region |

|

| Key Market Players | Kaizen Gastro Care, Stanford Health Care, Brigham and Women's Hospital, Northwestern Memorial HealthCare, Apollo Hospitals Enterprise Ltd., Cedars-Sinai, Clínic Barcelona, SingHealth Group, Fortis Healthcare, Ramsay Health Care Limited |

Analyst Review

The endoscopic procedures market is driven by increasing demand for minimally invasive surgeries, rising prevalence of chronic diseases, and growing geriatric population. Minimally invasive procedures offer advantages such as reduced postoperative pain, shorter hospital stays, and quicker recovery times, which are appealing to both patients and healthcare providers. In addition, the rising incidence of chronic conditions such as gastrointestinal disorders, cancer, and cardiovascular diseases has led to a greater need for diagnostic and therapeutic endoscopic interventions. The global aging population, which is more susceptible to these conditions, further contributes to the market’s expansion. Moreover, technological advancements in endoscopic devices, including high-definition imaging systems, robotic-assisted endoscopy, and capsule endoscopy, have significantly improved the accuracy, safety, and efficiency of procedures, thus boosting adoption.

Rapid integration of AI?enabled diagnostics, including smart polyp detection, confocal laser endomicroscopy, and capsule-based systems with real?time image analysis, is significantly boosting accuracy and procedural efficiency. Simultaneously, robotic and disposable endoscopy platforms, along with miniaturized and ambulatory solutions, are enhancing precision, safety, and accessibility, particularly in outpatient and emerging markets.

The leading application of the endoscopy procedures market is gastrointestinal (GI) endoscopy, driven by the high prevalence of gastrointestinal disorders such as colorectal cancer, GERD, and inflammatory bowel diseases. Its wide diagnostic and therapeutic utility across upper and lower GI tracts makes it the most commonly performed and in-demand endoscopic procedure globally.

The Asia-Pacific (APAC) region is the largest regional market for endoscopy procedures, fueled by a growing aging population, rising incidence of gastrointestinal and cancer-related conditions, rapid healthcare infrastructure development, and increasing adoption of minimally invasive technologies across countries like China, India, and Japan.

The endoscopy procedures market was valued at $360,974.58 million in 2024 and is estimated to reach $617,761.37 million by 2034, exhibiting a CAGR of 5.5% from 2025 to 2034.

Major key players that operate in the global endoscopic procedures market are Apollo Hospitals Enterprise Ltd, Kaizen Gastro Care, Clínic Barcelona, Cedars-Sinai, Stanford Health Care, SingHealth Group, Northwestern Memorial HealthCare, Fortis Healthcare, Brigham and Women's Hospital, and Ramsay Health Care.

Loading Table Of Content...

Loading Research Methodology...