Endovascular Aneurysm Repair Market Research, 2030

The global endovascular aneurysm repair market size was valued at $2,646.60 million in 2020, and is projected to reach $4,359.20 million by 2030, growing at a CAGR of 4.8% from 2021 to 2030. Endovascular aneurysm repair (EVAR) is a preferred treatment option for aortic aneurysm given its advantages over open surgery. These advantages include shorter hospital stay, quick recovery time, improved patient outcomes, and no abdominal surgery. Hence, this EVAR procedure is known as standard intervention for abdominal aortic aneurysm (AAA). In this procedure, a stent is placed in an aneurysmal area of the aorta to provide permanent alternative channel for blood flow within the patient’s vasculature, thereby preventing the aneurysmal sac from blood flow pressure and rupturing.

Although EVAR has significantly reduced the operative risks and recovery time as compared to conventional open surgery, but further improvisations in the EVAR can be easily accomplished. This is because there have been cases of endoleaks post-EVAR procedure. However, to meet such challenges, the market players have developed the next generation and advanced technologies. For instance, Endologix Inc. recently gained FDA approval for its percutaneous endograft delivery system and possesses a game challenging, new-generation Nellix technology, a first and only endovascular sealing product useful in mitigation of all types of endoleak. Moreover, the scope of improvement in the technology acts as an opportunity for the endovascular aneurysm repair market. The endovascular aneurysm repair market forecast was $4,359.2 million by 2030.

The factors that drive the endovascular aneurysm repair market growth are the rise in the incidence of aortic aneurysm, growth in the geriatric population, technological advancements in EVAR, availability of favorable reimbursements for EVAR procedures & devices, and increase in the smoking population. However, this growth is restricted by the inflated cost associated with endovascular aneurysm repair treatment procedures and a lack of awareness among people. In addition, various risks are associated with this procedure such as iliac perforation, aneurysmal rupture, stent stenosis, endoleaks, and end tension. Several technologies have been developed and introduced to meet such challenges, leading to market growth. Moreover, endovascular aneurysm repair market opportunity are technological advancements in the endovascular aneurysm repair market players.

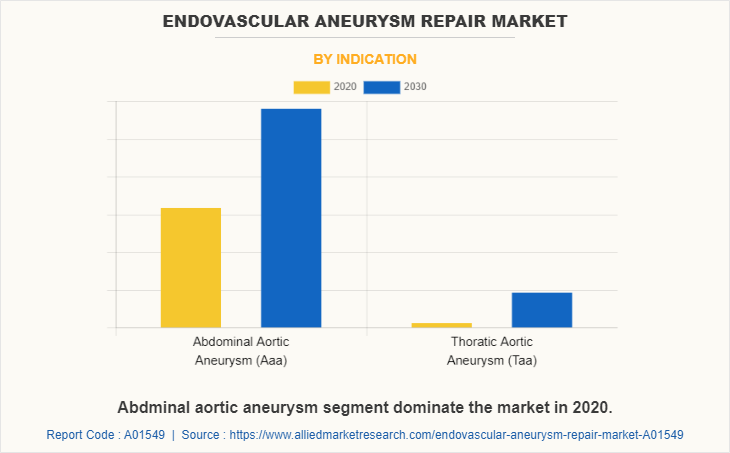

The endovascular aneurysm repair market is segmented on the basis of indication, product, site, anatomy, and region. Depending on indication, it is bifurcated into abdominal aortic aneurysm (AAA) and thoracic aortic aneurysm (TAA). The TAA segment is classified into ascending, descending, thoracoabdominal, and thoracic arch aortic aneurysm.

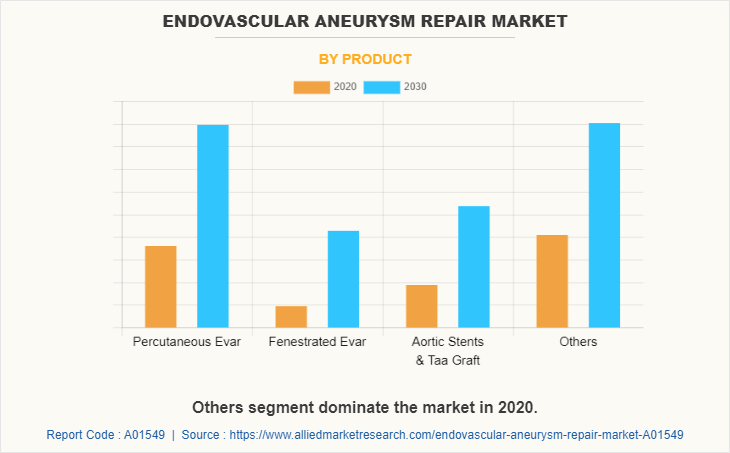

According to site, it is categorized as infrarenal and pararenal. The pararenal segment is segmented into juxtarenal and suprarenal. As per anatomy, it is classified into traditional and complex. By product, it is classified into percutaneous EVAR, fenestrated EVAR, aortic stents & TAA graft and others. The percutaneous EVAR segment registered the highest revenue in 2020.

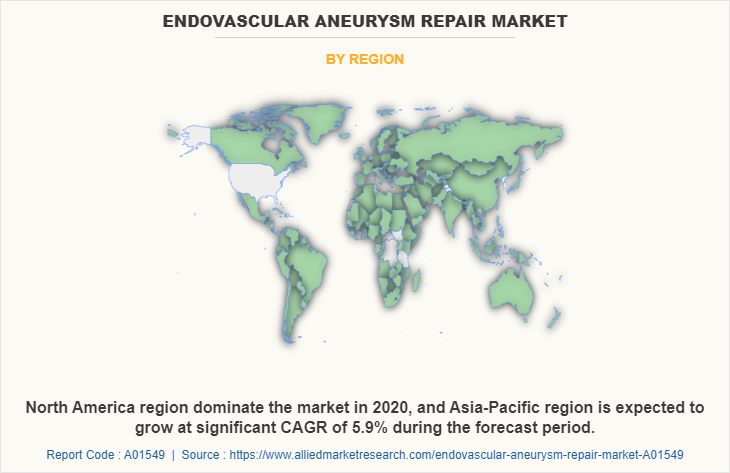

Region wise, the endovascular aneurysm repair market analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for the highest endovascular aneurysm repair market share in 2020, and is expected to maintain its dominance throughout the forecast period, owing to increase in number of EVAR procedures in the U.S. Furthermore, the market in the U.S. is growing at a CAGR of 8% per year. However, Asia-Pacific is expected to emerge as a lucrative area with maximum growth potential, owing to improvement in healthcare facilities, available disposable income, and rapid development in the economic conditions.

The key players in the global EVAR market include Medtronic plc., Cook Medical Inc., Endologix, Inc., Lombard Medical, Inc., W. L. Gore & Associates, Inc., Cardinal Health Inc., Becton Dickison and Company, Terumo Corporation, Abbott Laboratories, and Konninklijke Philips N.V.

Major players adopt product launch and acquisition as key developmental strategies to improve the product portfolio. For instance, in December 2021, Terumo announced the launch of the first commercial case of the aortic balloon in the U.S. This device assists physicians in the expansion of aorta, using TREO and RELAY stent-grafts in endovascular aortic repair. This will improve the product portfolio of the company.

Key Benefits For Stakeholders

- The endovascular aneurysm repair industry report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the endovascular aneurysm repair market analysis from 2020 to 2030 to identify the prevailing endovascular aneurysm repair market opportunities.

- The endovascular aneurysm repair market size research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the endovascular aneurysm repair market segmentation assists to determine the prevailing market opportunities.

- The endovascular aneurysm repair market size from 2020 to 2030 with a market drivers, and restraints.

- Major countries in each region are mapped according to their revenue contribution to the global endovascular aneurysm repair industry.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global endovascular aneurysm repair market trends, key players, market segments, application areas, and market growth strategies.

Endovascular Aneurysm Repair Market Report Highlights

| Aspects | Details |

| By Indication |

|

| By Site |

|

| By Anatomy |

|

| By Product |

|

| By Region |

|

| Key Market Players | Medtronic Plc, Cardinal Health Inc, Abbott Laboratories, Becton, Dickinson and Company, Koninklijke Philips N.V., Endologix Inc, Terumo Medical Corporation, Lombard Medical Inc, cook medical, W. L. Gore & Associates Inc |

Analyst Review

Presently, endovascular aneurysm repair (EVAR ) is a highly preferred treatment alternative among aneurysm patients, owing to its several advantages, including less recovery time and enhanced survival rate. Endovascular repair methods are designed to lower the fatality rates in the geriatric population and unhealthy patients..

A stent graft, vascular grafts, and components are some of the materials or accessories used in the endovascular aneurysm repair market growth. Endovascular aneurysm repair market opportunity are technological advancements in endovascular aneurysm products. Endovascular aneurysm repair market size was valued at $2,646.60 million in 2020, and is projected to reach $4,359.20 million by 2030, growing at a CAGR of 4.8% from 2021 to 2030.

Rise in geriatric population, increase in healthcare expenditure, and consistent growth in incidence of abdominal aortic aneurysm (AAA) screening across the globe fuel the growth of the endovascular aneurysm repair market. Postoperative complexities, including endoleaks and stent migration, are few challenges faced by the industry. However, regulations imposed by regulatory authorities, such as the Food and Drug Administration , limits the market players. A few trends that impact the market include progressive clinical trials, rise in utilization of percutaneous endovascular aneurysm repair, inclination for different AAA repair strategies, and innovative developments.

Technological advancements in the industry, which include advent of novel stent grafts & sealing systems and catheters have resulted in rapid growth of the market and increase the demand for EVAR techniques. Moreover, compatibility of endovascular aneurysm repair among patients and several aforementioned benefits have made EVAR as a standard intervention for AAA treatment.

A rise in number of endovacular diseases, and cardiac problems are the key trends for endovascular aneurysm repair market.

Endovascular aneurysm repair system is used in applications such as hospitals, specialty clinics, and ambulatory surgical centers.

North America region dominates the market in 2020, and LAMEA is expected to grow at significant CAGR.

The market size of endovascular aneurysm repair market is $ 2,646.6 million in 2020.

Abbott Industries, Endologix Inc, and Terumo Medical Corporation are some of the players in the endovascular aneurysm repair market.

Loading Table Of Content...