Energy Efficient Warehouse Lighting System Market Research, 2033

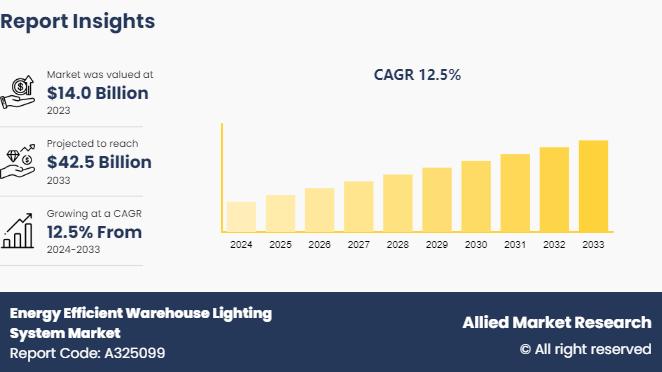

The global energy efficient warehouse lighting system market size was valued at $14.0 billion in 2023, and is projected to reach $42.5 billion by 2033, growing at a CAGR of 12.5% from 2024 to 2033.

Market Introduction

Warehouse lighting is a critical component for ensuring the safe and efficient execution of operations in logistics facilities. Beyond merely storing goods, warehouses are tasked with order processing, inventory management, and kitting, all of which necessitate proper illumination. Implementing an energy-efficient lighting system ensures that tasks are conducted safely and effectively while also offering cost savings through reduced power consumption and minimized errors. Due to the high level of activity and various operations within logistics centers, energy-efficient warehouse lighting is essential for maintaining smooth workflows, enhancing safety, and boosting productivity.

Beyond saving energy and lowering utility bills, an energy-efficient warehouse lighting system can enhance employee satisfaction and morale. Traditional lighting, such as HID lamps, often generates excessive heat and dim or flickering light, leading to worker frustration and fatigue. Energy-efficient lighting provides bright, consistent illumination, fostering a more comfortable and productive work environment. Employees working under such lighting conditions typically experience improved attitudes and higher energy levels throughout the demanding workday.

Key Takeaways

- The energy efficient warehouse lighting system market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period 2024-2033.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major energy efficient warehouse lighting system industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach intends to provide a balanced view of global markets and assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

Implementing energy-efficient warehouse lighting systems ensures that tasks are performed safely and efficiently while also providing cost savings through reduced power consumption and fewer operational errors. Proper warehouse lighting is crucial for protecting workers' health. Insufficient lighting can cause fatigue, headaches, stress, and temporary blindness due to sudden changes in light levels. Energy-efficient lighting solutions create a healthier work environment, allowing operators to perform their tasks without strain. Safety is significantly improved with adequate lighting in aisles and work areas, reducing the risk of accidents.

In addition, well-designed lighting systems enhance productivity by providing the right amount of light, preventing discomfort from both insufficient and excessive illumination. This optimal lighting allows workers to focus better and work more accurately. Lastly, energy-efficient lighting systems offer substantial energy savings, allowing organizations to significantly cut their electricity bills while maintaining a safe, productive, and healthy warehouse environment.

Existing infrastructure may present difficulties when integrating new energy-efficient lighting systems, as it may not always be compatible with the majority of recent lighting systems technologies. This incompatibility frequently requires extra changes to fit the new lighting options. Upgrading older electrical systems, changing mounting brackets, and ensuring adequate wiring can all involve significant cost and logistical issues. These changes are required to fully achieve the benefits of energy-efficient lighting, such as lower power usage and improved performance. Despite these obstacles, the long-term benefits of increased energy efficiency and lower operational costs generally exceed the initial expenditure and adjustments. These factors are anticipated to restrain the energy efficient warehouse lighting system market growth.

In the fast-evolving warehousing sector, efficient lighting is crucial for ensuring seamless operations, enhancing productivity, and supporting employee well-being. As traditional lighting solutions give way to more advanced technologies, energy-efficient warehouse lighting systems, particularly LEDs, have become transformative. LED lighting stands out for its exceptional energy efficiency, converting a larger proportion of electrical energy into light rather than heat. This efficiency results in lower electricity consumption compared to traditional options like fluorescent or high-intensity discharge (HID) lamps, leading to significant energy cost savings for warehouse operators.

Furthermore, the energy-efficient nature of LEDs contributes to a reduced carbon footprint, aligning with broader sustainability objectives. LED warehouse lighting also offers a remarkable lifespan, ranging from 50, 000 to 100, 000 hours, which is substantially longer than conventional bulbs. This extended lifespan minimizes maintenance costs and the inconvenience of frequent bulb replacements in large warehouse spaces. In addition, LEDs are known for their durability, withstanding shock, vibrations, and temperature variations, making them an ideal choice for the rigorous conditions of warehouse environments.

Macro and Micro Economic Analysis of Global Energy Efficient Warehouse Lighting System Market

The global energy efficient warehouse lighting system market share is influenced by both macro and micro economic factors that shape its dynamics and growth prospects. On a macroeconomic level, the increasing emphasis on sustainability and energy conservation drives demand for energy efficient lighting solutions across various industries. Government regulations and incentives aimed at reducing carbon footprints and lowering energy consumption further boost the adoption of advanced lighting technologies. Economic growth and the expansion of e-commerce and logistics sectors lead to an increase in demand for efficient warehouse lighting, as businesses seek to optimize operations and cut costs.

At the microeconomic level, individual warehouse operators and facility managers are increasingly investing in energy-efficient lighting systems to enhance operational efficiency and reduce long-term expenses. The significant cost savings from reduced energy consumption and lower maintenance requirements offer a compelling return on investment. In addition, improvements in lighting quality and employee well-being are critical factors influencing purchasing decisions. As companies strive to meet both economic and environmental goals, the demand for cutting-edge, energy-efficient warehouse lighting solutions continues to rise, driving innovation and market expansion.

Market Segmentation

The energy efficient warehouse lighting system market is segmented into type, application, and region. On the basis of type, the market is divided into high-intensity discharge lamps (HID) , linear fluorescent lamps (LFL) , light emitting diodes (LED) , and others. As per application, the market is classified into commercial, industrial, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

The energy efficient warehouse lighting system market size in North America is experiencing substantial growth, driven by several key drivers. The rise in warehouse leasing by logistics companies across the region reflects an increase in demand for efficient warehousing solutions. As e-commerce and same-day delivery services continue to expand, retailers are increasingly outsourcing their logistics operations to meet rising customer expectations. This trend is particularly evident among small businesses and local companies in the U.S., which are turning to external warehousing solutions to manage costs effectively. The need for energy-efficient lighting systems in these facilities is increasing as businesses seek to optimize operational efficiency, reduce energy expenses, and enhance overall performance. This robust energy efficient warehouse lighting system industry growth highlights the pivotal role of advanced lighting technologies in supporting the evolving demands of North America's warehousing sector.

- In May 2023, US LED, Ltd., a top provider of ultra-long-life LED lighting solutions, announced the relocation to a larger, state-of-the-art headquarters in Katy, Texas. The new 50, 000-square-foot facility at 500 Morris Oliver Way features modern offices, an expanded warehouse, and enhanced engineering and production capabilities. Designed to accommodate future growth, the upgraded facilities will enable US LED to maintain its position as an industry innovator while delivering faster and more efficient service to its customers.

Competitive Landscape

The major players operating in the energy efficient warehouse lighting system market forecast include Osram, Ligman Lighting, General Electric, Nichia, Dialight, Toshiba Lighting, Eaton, Philips Lighting, Cree, Acuity Brands, and others.

Recent Key Strategies and Developments

- In May 2021, Larson Electronics launched a flameproof LED Indicator Light with a buzzer alarm, capable of operating between 20-250V AC/DC and available in red.

- In April 2021, Signify introduced a UV-C tabletop lamp in Asia and the Middle East, aimed at improving safety in food establishments, retail spaces, industries, and offices.

Industry Trends

- In January 2023, OSRAM GmbH launched the BackLED CX G5 LED chain, designed primarily for the signage industry but also suitable for luminous ceilings. ‘CX’ in the product name stands for Core Xperience, reflecting its ability to create a lasting impression, even from a significant distance.

Key Sources Referred

- ATB Industrial Ltd.

- warehouse-lighting

- Kinglumi

- Meteor Electrical

- TCP Lighting

- Dialight

- Eaton

- Cree

- Acuity Brands

- Philips Lighting

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the energy efficient warehouse lighting system market analysis from 2024 to 2033 to identify the prevailing energy efficient warehouse lighting system market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the energy efficient warehouse lighting system market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

Apart from the points mentioned above, the report includes the analysis of the regional as well as global energy efficient warehouse lighting system market trends, key players, market segments, application areas, and market growth strategies.

Energy Efficient Warehouse Lighting System Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 42.5 Billion |

| Growth Rate | CAGR of 12.5% |

| Forecast period | 2024 - 2033 |

| Report Pages | 320 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Acuity Brands, OSRAM, General Electric, Toshiba Lighting, Ligman Lighting, Philips Lighting, Nichia, Cree, Dialight, Eaton |

Upcoming trends in the global energy-efficient warehouse lighting system market include the integration of smart technologies, advancements in LED performance, and increased focus on sustainability and cost reduction.

The leading end use of energy-efficient warehouse lighting systems is for enhancing illumination in industrial and logistics facilities to improve safety, productivity, and operational efficiency.

Asia-Pacific is the largest regional market for energy efficient warehouse lighting system.

The energy efficient warehouse lighting system market is estimated to reach $42.3 billion by 2033, exhibiting a CAGR of 12.5% from 2024 to 2033.

The major players operating in the energy efficient warehouse lighting system market include Osram, General Electric, Dialight, Eaton, Cree, Acuity Brands, Philips Lighting, Toshiba Lighting, Nichia, and Ligman Lighting.

Loading Table Of Content...