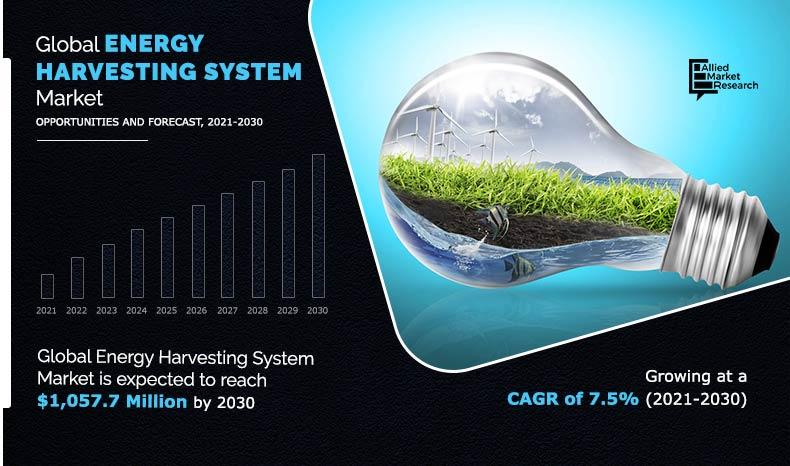

Energy Harvesting System Market Outlook - 2030

The global energy harvesting system market was valued at $511.6 million in 2020, and is projected to reach $1,057.7 million by 2030, growing at a CAGR of 7.5% from 2021 to 2030. Energy harvesting (energy scavenging) is the translation of ambient energy, which is derived from external resources existing in the atmosphere into electrical energy. Devices or systems that are used for energy harvesting are known as energy harvesting systems.

Growth in population has increased demand for energy consumption. In addition, technological advancements in sensor-based energy harvesting systems and energy efficient harvesting components drives growth of the global market. In addition, energy that is available in the environment is wasted directly or indirectly. Thus, the ability of these systems to capture this energy and convert that into electrical energy can be further used in autonomous electronic devices or circuits also drives growth of the global energy harvesting system market. Harvested energy can be further used in electrical utilities that consume minimal energy such as sensors, watches, and other home appliances. All these factors collectively increase demand for energy harvesting system, which propels the global energy harvesting system market growth.

However, underneath recurrent environmental power and unavailability of high-powered energy harvesting systems that are not designed to be operated efficiently under varying operating conditions is expected to restrain growth of the energy harvesting system market during the forecast period.

On the contrary, there is growth in importance and several research & development activities are being carried out on energy harvesting application. For instance, application of energy harvesting systems such as wireless sensor nodes are used in the healthcare sector and implanted sensor nodes that are used in medical applications are gaining importance. In addition, technological advancements in the automotive sector have led to development of tire pressure monitor. This device is also another example that works on the principle of energy harvesting technique. This factor is anticipated to open up new opportunities in the market.

The global energy harvesting system market analysis is done on the basis of technology, component, application, and region. Depending on technology, the market is divided into light energy harvesting, vibration energy harvesting, radio frequency energy harvesting, and thermal energy harvesting. On the basis of component, it is fragmented into energy harvesting transducers, power management integrated circuits (PMIC), and storage systems. The application covered in the study include building & home automation, consumer electronics, industrial, transportation, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The global static VAR compensator market profiles leading players that include Cymbet Corporation, Cedrat Technologies SA, Tekceleo, ZF Friedrichshafen AG, Physik Instrumente (PI) GmbH & Co. KG, Advanced Linear Devices Inc., Mide Technology Corporation, Powercast, Xidas, and Analog Devices.

The global market analysis covers in-depth information of the major energy harvesting system industry participants.

Energy harvesting system market, by region

The Asia-Pacific energy harvesting system market size is projected to grow at the highest CAGR of 8.2% during the forecast period and accounted for 23.4% of the energy harvesting system market share in 2020. The region accounts for more than half of the global energy consumption, owing to rise in industrialization as well increase in population. Renewable energy has increased considerably in countries such as China and India. Thus, there is constant rise in use of energy harvesting systems in this region.

By Region

Asia-Pacific would exhibit highest CAGR of 8.2% during 2021-2030.

Energy harvesting system market, by technology

In 2020, the light energy harvesting segment was the largest revenue generator, and is anticipated to grow at a CAGR of 7.9% during the forecast period. There is increase in number of key players that are engaged in production of solar energy-based products that are considered under the light energy harvesting sector. This harvested energy is further used efficiently in sectors such as building automation and consumer electronic devices.

By Technology

Ligh energy harvesting technology is the most lucrative segment

Energy harvesting system market, by component

By component, the energy harvesting transducers segment dominated the global market in 2020, and is anticipated to grow at a CAGR of 7.9% during forecast period. Rise in use of electromechanical transducers for harvesting vibration energy is the key factor that is driving the demand of the global market.

By Component

Energy harvesting transducer component is projected as the fastest growing segment

Energy harvesting system market, by application

In 2020, the building & home automation segment was the largest revenue generator, and is anticipated to grow at a CAGR of 8.1% during the forecast period. Installation of energy harvesting system in building & home automation offer advantages such as flexibility for distribution as there is no requirement for hardwiring. In addition, installment of these energy harvesting switches also minimizes maintenance and environmental impact as there is no disposal of batteries.

By Application

Building & home automation application is projected as the fastest growing segment

Key benefits for stakeholders

- Porter’s five forces analysis helps analyze the potential of buyers & suppliers and the competitive scenario of the industry for strategy building.

- It outlines the current energy harvesting system market trends and future estimations from 2020 to 2030 to understand the prevailing opportunities and potential investment pockets.

- The major countries in the region have been mapped according to their individual revenue contribution to the regional market.

- The key drivers, restraints, and opportunities and their detailed impact analysis are explained in the study.

- The profiles of key players and their key strategic developments are enlisted in the report.

Impact Of Covid-19 On The Global Energy Harvesting System Market

- The novel coronavirus is an incomparable global pandemic that has spread to over 180 countries and caused huge losses of lives and the economy around the globe.

- The energy harvesting system market has been negatively impacted due to the wake of the COVID-19 pandemic, owing to its dependence on building & construction, consumer electronics, industrial, and transportation.

- The construction sector is vulnerable to economic cycle that further has resulted in decline in construction projects, construction enterprise, and workers associated with construction sector owing to drastic change or decline in economic activity due to COVID-19 pandemic.

- In addition, rise in number of COVID-19 infection among workers in the construction sector has resulted in work deficits that further delays deadline of the project. This, in turn, has reduced demand and consumption of energy harvesting system in building & home automation.

- Other construction activities such as renovation, maintenance, and demolition are also negatively affected, owing to the wake of COVID-19 pandemic that has further declined growth of the global market in this situation. For instance, according to an article published by CNA, the construction Industry Joint Committee (CIJC) has said that shortage of manpower may lead to delay in construction projects attributed to workplace safety, and other factors.

- In addition, energy harvesting systems are also used in transportation i.e., automotive sector. The automotive sector is also negatively affected due to wake of COVID-19 pandemic. According to a report published by Wipro, the automotive industry witnessed 30% decline in sales in March 2020 as compared to March 2019, owing to lockdowns and shutdowns of auto plants.

Key market segments

By Technology

- Light Energy Harvesting

- Vibration Energy Harvesting

- Radio Frequency Energy Harvesting

- Thermal Energy Harvesting

By Component

- Energy Harvesting Transducer

- Power Management Integrated Circuits (PMIC)

- Storage System

By Application

- Building & Automation

- Consumer Electronics

- Industrial

- Transportation

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia-Pacific

- LAMEA

- Brazil

- Saudi Arabia

- South Africa

- Rest of LAMEA

Energy Harvesting System Market Report Highlights

| Aspects | Details |

| By Technology |

|

| By Component |

|

| By Application |

|

| By Region |

|

| Key Market Players | Physik Instrumente (PI) GmbH & Co. KG, Powercast, Mide Technology Corporation, Xidas, Tekceleo, ZF Friedrichshafen AG, Advanced Linear Devices Inc., Cedrat Technologies SA, Analog Devices, Cymbet Corporation |

Analyst Review

According to CXOs of leading companies, the global energy harvesting system market is expected to exhibit high growth potential, owing to its use in applications such wireless sensory nodes, mobile devices, and other biomedical implantable sensors. Rise in demand for energy has increased dependency on fossil fuels for production of energy. However, use of fossil fuels for production of energy leads to high carbon di-oxide emission that further leads to environmental degradation. Hence, to overcome this problem, there is development of energy harvesting techniques from building and urban infrastructure mainly roads. Annually large amount of energy in form of kinetic energy is wasted on roads. Thus, there are several developments in energy harvesting systems such as use of solar panels, piezoelectric devices, and thermoelectric & electromagnetic harvesters to harvest energy from roads are the major key market trends in the global market.

The transportation sector is the largest consumer of energy. For instance, the transportation sector in UK consumed about 56.5 million tons of oil out of which more than 97% was resourced from the oil industry. Consumption of such large amount of energy out of which some part of energy is wasted in the form of vibration and heat can be harvested. For instance, a moving truck in one lane with an average of 600 V/h of traffic can generate 150 kWh energy in one-kilometer range. This energy can be used to deform, vibrate, and warm up road surface and can be a good source of energy for harvesting and converting. Thus, implementation of energy harvesting techniques with proper use of systems is predicted to offer lucrative growth opportunities for the market in the future.

Business expansion and acquisition are the key growth strategies of energy harvesting system market players.

Europe region will provide more business opportunities for energy harvesting system in future.

To get latest version of energy harvesting system market report can be obtained on demand from the website.

Building & home automation are the potential customers of energy Harvesting System industry.

By technology, the light energy harvesting segment holds the maximum share of the energy harvesting system market.

The top ten market players are selected based on two key attributes - competitive strength and market positioning

Rise in demand for light energy harvesting and escalating demand for vibration energy harvesting are the driving factors. While, growing demand for energy harvesting system in building & home automation is predicted to offer new opportunity in the global market.

Cymbet Corporation, Cedrat Technologies SA, Tekceleo, ZF Friedrichshafen AG, Physik Instrumente (PI) GmbH & Co. KG, Advanced Linear Devices Inc., Mide Technology Corporation, Powercast, Xidas, and Analog Devices are the leading global players in the energy harvesting system market.

It outlines the current energy harvesting system market trends and future estimations from 2020 to 2030 to understand the prevailing opportunities and potential investment pockets. In addition, the major countries in the region have been mapped according to their individual revenue contribution to the regional market

Vibration energy harvesting in industrial application is the key market trend. For instance, industrial pumps that are used to supply the water to machineries in order to keep them cool are monitored by monitoring systems. But however, these pumps need to be monitored continuously so that they do not break down and if the pumps break down then the whole plant need to be shut down for maintenance and repair. Thus, in order to continually power these monitoring systems several industries use vibrations that are generated from pumps to power these monitoring systems. Piezoelectric systems are widely used vibration energy harvesting systems that are utilized to power actuators and portable devices.

Loading Table Of Content...