Energy Security Market Insights, 2031

The global energy security market size was valued at $15.6 billion in 2021, and is projected to reach $42 billion by 2031, growing at a CAGR of 10.5% from 2022 to 2031.

Increased government pressure and security compliance and regulation and increase in threats from terrorist and cyber-attacks is boosting the growth of the global market. In addition, increase in physical attacks and insider threats is positively impacts the growth of the energy security market. However, lack of apprehension about security implementation by operators is hampering the energy security market growth. On the contrary, rise of new energy markets in developing economies is expected to offer remunerative opportunities for expansion during the market forecast

Energy security refers to protecting power plants and the sources of energy generation from physical as well as cyber-attacks for the smooth functioning of the power plants for power generation. Moreover, rapid deployment of renewable energy increased energy efficiency, and diversification of energy sources, energy stores, and types of energy machines can use all result in significant energy security and economic benefits. The energy security market is segmented into Component, Technology and Power Plant.

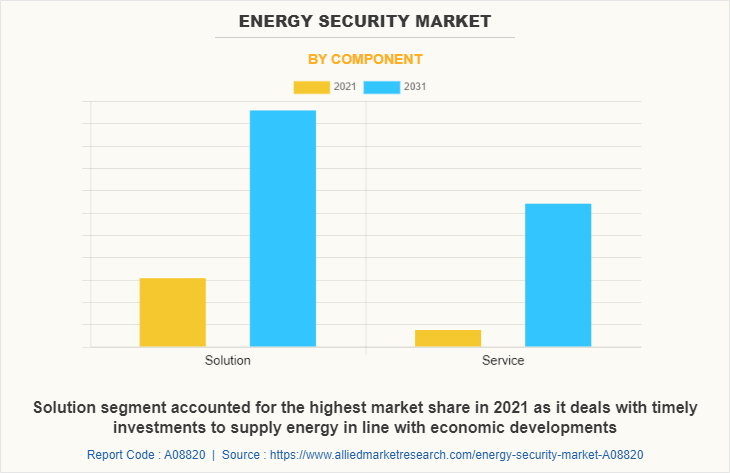

The energy security market is segmented on the basis of by component, technology, power plant, and region. On the basis of component, the market is categorized into solution and service. On the basis of technology, the market is fragmented into physical security, and network security. On the basis of power plant, it is classified into thermal and hydro, nuclear, oil and gas, and renewable energy. On the basis of region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

In terms of component, the solution segment holds the highest energy security market size as it provides improving, and modernizing energy infrastructure such as smart grid solutions. However, the service segment is expected to grow at the highest rate during the forecast period owing to, providing uninterrupted availability of energy sources at an affordable price.

By Region

North America accounted for the highest market share in 2021 owing to, increasing in adoption of balance of energy production in oil and natural gas industries.

Region-wise, the energy security market share was dominated by North America in 2021 and is expected to retain its position during the forecast period, owing to widening confirmation of certain solutions. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to the advancing society and government ambition in the province.

The key players that operate in the energy security industry are ABB Ltd., AEGIS Security & Investigations, BAE Systems plc, Elbit Systems Ltd., Thales, Teledyne FLIR LLC, Honeywell International Inc, hexagon ab, Lockheed Martin Corporation, and Siemens AG. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Top Impacting Factors

Increased government pressure and security compliance and regulation

An increase in government pressure and security compliance and regulation provides innovation that combines knowledge and execution with scripting. In addition, it is a blend of technological abilities that was a significant boost to back-office tasks. Furthermore, long-term energy safety refers to the time investment to supply energy along with sustainable environmental needs and economic development whereas short-term energy refers to the ability of the system to react to changes in the demand-supply balance.

In addition, several government authorities along with power plant owners are implementing network and physical solutions such as perimeter, microwave intrusion detection, secured communications, surveillance systems, access control systems, and detectors. For instance, U.S. and the European Commission are committed to reducing Europe’s dependency on Russian energy to joint commitment to Europe’s energy security and sustainability, and to accelerating the global transition to clean energy. Further, the implementation of network systems such as antivirus, firewall, and SCADA systems along with IPS/IDS systems for preventing cybercriminals from attacking the network power plant network is projected to elevate energy security industry growth over the next seven years, which drive the growth of the energy security market.

Increase in threats from terrorist and cyber attacks

Increase in threats from terrorists and cyber-attacks. The industry is expected to see new opportunities for market growth as well as new types of alternatives to invest in advanced technologies. With the rising number of cyber threats and growing market competition in modern-day business enterprises, energy security are becoming one of the most crucial and fastest-growing security technologies today because they provide cloud service visibility, data security, threat protection, and compliance. Energy security is an effective and easy way to mitigate the top cloud security threats. Security practitioners look to trusted energy security providers as strategic partners to help advise them on key energy security decisions.

For instance, in September 2022, ABB launched cyber security solution to simplify and improve the protection of industrial infrastructure When sensitive content is discovered in or en route to the cloud, energy security can allow IT teams the option to manage suspected violations efficiently to their local networks for further analysis. Moreover, deeper research on threat observations aids a company in identifying and stopping malicious activity before it escalates further. Such factors are propelling the growth of the energy security market.

Regional Insights

The global energy security market is growing significantly as nations strive to protect their energy infrastructure from physical threats and cyber-attacks, ensure uninterrupted energy supply, and reduce dependency on external sources. Energy security involves safeguarding resources, infrastructure, and energy transmission networks, with regional dynamics playing a key role in shaping market growth. Below are regional insights into the energy security market:

1. North America

North America dominates the global energy security market, driven by increasing concerns over cyber-attacks on critical energy infrastructure and rising investments in modernizing the energy grid. The U.S. leads this market, propelled by significant investments in securing energy networks, oil pipelines, nuclear plants, and electric grids. Government initiatives such as the Cybersecurity and Infrastructure Security Agency (CISA) and various energy sector cybersecurity frameworks have enhanced security measures. The rise of renewable energy sources such as solar and wind also necessitates enhanced security frameworks, as decentralized energy systems are becoming more vulnerable to cyber-attacks. Canada follows a similar trajectory, emphasizing protecting its energy infrastructure, especially in the oil and gas sector.

2. Europe

Europe is another significant player in the energy security market, driven by the region’s focus on reducing dependence on external energy sources and bolstering its infrastructure security. Countries like Germany, the UK, and France are leading in renewable energy production, which has led to an increased need for protecting distributed energy resources and grids. The European Union has also taken significant steps to address energy security concerns by introducing regulations and guidelines focused on securing energy networks. Moreover, Europe’s geopolitical situation, particularly the ongoing Russia-Ukraine conflict, has emphasized the importance of energy independence, prompting investments in local energy production and security measures to protect supply lines, especially gas pipelines.

3. Asia-Pacific

Asia-Pacific is expected to witness the highest growth in the energy security market during the forecast period. The rapid industrialization and urbanization in countries such as China, India, Japan, and South Korea are driving the need for robust energy security solutions. China, as the largest energy consumer in the world, has been investing heavily in securing its energy infrastructure, especially as it transitions to a more renewable energy-driven economy. The expansion of smart grid systems and the growing reliance on imported oil and natural gas have made energy security a top priority for China. Similarly, India’s expanding energy needs, driven by its booming population and industrial growth, are leading to heightened security measures across its energy infrastructure. Government initiatives such as India’s National Smart Grid Mission are contributing to the market’s growth.

4. Middle East and Africa

The Middle East and Africa (MEA) region is also a key player in the energy security market, given its rich reserves of oil and gas, which are critical to the global energy supply chain. Countries such as Saudi Arabia, the UAE, and Qatar have been focusing on securing their oil and gas infrastructure from physical attacks, including terrorism and geopolitical instability. The rise of cyber-attacks on critical infrastructure, including energy facilities, has further increased the demand for advanced cybersecurity measures in the region. The development of alternative energy sources, including solar power in countries like the UAE, also requires enhanced security measures to ensure an uninterrupted energy supply. In Africa, energy security is critical, especially as the region seeks to improve energy access and infrastructure while safeguarding against physical threats, such as theft and sabotage.

5. Latin America

Latin America’s energy security market is gaining momentum as countries like Brazil, Mexico, and Argentina focus on modernizing their energy infrastructure and enhancing security measures. With its vast renewable energy potential, particularly in hydroelectric power, Brazil is investing in energy security to protect its energy resources from physical threats and cyber-attacks. Mexico’s oil and gas industry, a key driver of its economy, is also facing rising challenges in securing its pipelines and refineries from theft and sabotage. The region’s increasing shift towards renewable energy sources, particularly wind and solar power, is creating new vulnerabilities that necessitate advanced energy security solutions.

Digital Capabilities:

Energy supply is fundamentally important to homes and workplaces. In addition, the energy supply has to be affordable, sustainable, stable, and secure, which makes energy systems a complex problem. digital energy systems is an emerging discipline using powerful digital tools and various digital models to solve and manage increasingly complex modern energy systems. Within the discipline, digital tools and models such as artificial intelligence and blockchain technology are used to analyze data from different energy systems and sources and drive new control and operational strategies and business models, whilst supporting key objectives such as reaching Net Zero emissions.

Moreover, cloud computing supports energy applications by allowing them to demand access to a shared pool of computing resourcing. It includes social and networked modifications to corporate intranets and other classic software platforms used by large companies to organize their communication. In contrast to traditional enterprise software, which imposes structure prior to use, enterprise social software tends to encourage use prior to providing structure.

Key Benefits:

Energy efficiency can bolster regional or national energy security. By reducing overall energy demand, it can reduce reliance on imports of oil, gas, and coal. Energy efficiency can therefore play a crucial role in ensuring both long- and short-term energy security in a cost-effective manner. Moreover, Energy security removes the size and complexity of earlier systems. It doesn’t need experts such as systems analysts and consultants to make these systems work and maintain. Unlike most corporate initiatives, Energy security tools, at least in their current incarnation, are not expensive to implement.

Furthermore, it also provides new avenues to open up a conversation with partners, suppliers or customers. Communication flows both ways, enabling to share information and ideas. With these technologies, there is an option to ask customers for pictures or videos using products in interesting ways and thus build brand equity with customer base or it helps to share information with partners who are working on a project with company. Companies can easily start a blog for a specific product category, enabling a small niche of market to communicate, a process that would have been much more difficult and expensive using earlier Web tools.

In addition, energy security reduces the likelihood of supply interruptions the only energy source that cannot be interrupted is the energy that is not used. Also, in the event of a disruption, efficiency measures can work with emergency conservation measures to reduce demand. In addition, with further growth in investment across the world and the rise in demand for energy security, various companies have expanded their current product portfolio with increased diversification among customers.

For instance, in October 2021, Siemens AG launched new artificial intelligence (AI)-based industrial cybersecurity service, Managed Detection and Response (MDR), powered by Eos.ii, to help small and medium-sized energy companies defend critical infrastructure against cyberattacks. MDR’s technology platform, Eos.ii, leverages AI and machine learning methodologies to gather and model real-time energy asset intelligence. This allows Siemens Energy’s cybersecurity experts to monitor, detect and uncover attacks before they execute. For instance, in January 2021, IBM corporation partnered with telephonic help to accelerate the modernization of application estates, while also letting them choose whether to run their workloads in on-premise or cloud-based setups.

Government Regulations:

All well-governed power plant industries should be able to demonstrate due diligence to ensure regulatory compliance in applicable fields, including IT. Organizations are adopting energy security to manage, store, and extract relevant and useful information from the data stored and it is logistical and legal challenges along with the expected benefits of using social collaboration tools. Governments of many countries help to promote cost-effective, environment-friendly and indigenous electric products. For instance, in February 2021, the central government of India launched the Go Electric campaign to boost the adoption of electric mobility vehicles and electric cooking appliances to ensure energy security in the country.

Moreover, Governments of many countries help to safe guard privacy. For instance, in January 2020, the government of California launched Consumer Privacy Act, and additional governments across the world formalized requirements for how businesses can collect data from visitors on their digital products. As a result, marketers are having to do more personalization with less personal data.

In addition, federal and state governments are improving their track plans for various privacy laws, which are applicable for data that participate in their operations. For instance, the Massachusetts Data Security regulations are majorly focused on security purpose and increasing the privacy of big data analytics. Europe is set to take the advantage of AI for providing data protection facilities to different organizations. For instance, the European Government adopted the new General Data Protection Regulation (GDPR). The act seeks to regulate the collection, storage, and processing of information about individuals. The key aim of GDPR is to protect critical data of consumers of the European nation.

Moreover, organizations are adopting analytical software to deal with applying advanced technologies like artificial intelligence (AI), Machine Learning (ML) to automate processes and augmented human activity. For instance, California’s Online Protection Privacy Act provides explicit privacy rights and allows users to know how their information will be used in the future. Furthermore, the cloud security regulations are strongly adhered by all AI service providers to operate as global service providers, for instance, the U.S. security regulation is mandatory to be adhered by majority of players located in this country.

Key Benefits for Stakeholders

The study provides an in-depth analysis of the global energy security market forecast along with current & future trends to explain the imminent investment pockets.

Information about key drivers, restraints, & opportunities and their impact analysis on global energy security market trends is provided in the report.

The Porter’s five forces analysis illustrates the potency of the buyers and suppliers operating in the industry.

The energy security market analysis from 2022 to 2031 is provided to determine the market potential.

Energy Security Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 42 billion |

| Growth Rate | CAGR of 10.5% |

| Forecast period | 2021 - 2031 |

| Report Pages | 283 |

| By Component |

|

| By Technology |

|

| By Power Plant |

|

| By Region |

|

| Key Market Players | hexagon ab, Teledyne FLIR LLC, AEGIS Security & Investigations, Honeywell International Inc., Elbit Systems Ltd., BAE Systems plc, Lockheed Martin Corporation, Thales, ABB Ltd., Siemens AG |

Analyst Review

Energy security is the association between national security and the availability of natural resources for energy consumption. In addition, its access to cheap energy has become essential to the functioning of modern economies. Furthermore, energy security has many aspects: long-term energy security mainly deals with timely investments to supply energy in line with economic developments and environmental needs.

The global energy security market is expected to register high growth due to improved administration stress and safety acquiescence and ordinances, additional in intimidations from cyber-attacks and terrorists, and physical intrusions and insider perils are expected to drive industry growth. Thus, increase in adoption of energy security, owing to its security is one of the most significant factors driving the growth of the market. With surge in demand for energy security, various companies have established alliances to increase their capabilities. For instance, in April 2022, HCL Technologies partnered with Microsoft Corporation to bring strong security capabilities to clients worldwide. HCL Technologies has achieved all four advanced security specializations available to Microsoft partners.

In addition, with further growth in investment across the world and the rise in demand for energy security, various companies have expanded their current product portfolio with increased diversification among customers. For instance, in September 2020, Honeywell launched Pro-Watch® Integrated Security Suite, a software platform designed to help protect people and property, optimize productivity and ensure compliance with industry regulations. The platform provides complete visibility of all connected systems and the scalability of the software makes it easy to grow with the changing needs of a business.

Moreover, with the increase in competition, major market players have started acquisition companies to expand their market penetration and reach. For instance, in March 2021, Pulse Power and Measurement Limited (PPM) acquired BAE Systems to increase the speed and ease of sharing large volumes of data over a network, giving users greater ability to exploit that data. As volumes of data grow, this ability is crucial to give military and security customers an information advantage.

The energy security market is estimated to grow at a CAGR of 10.5% from 2022 to 2031.

The energy security market is projected to reach $ 25,198.04 million by 2031.

Increased government pressure and security compliance and regulation and increase in threats from terrorist and cyber-attacks is boosting the growth of the global energy security market. In addition, increase in physical attacks and insider threats is positively impacts the growth of the energy security market.

The key players profiled in the report include ABB Ltd., AEGIS Security & Investigations, BAE Systems plc, Elbit Systems Ltd., Thales, Teledyne FLIR LLC, Honeywell International Inc, hexagon ab, Lockheed Martin Corporation, and Siemens AG.

The key growth strategies of energy security market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...