Engine Oil Market Insights, 2031

The global engine oil market was valued at USD 40.5 billion in 2021, and is projected to reach USD 55.1 billion by 2031, growing at a CAGR of 3.1% from 2022 to 2031.

Engine oil, also known as motor oil, is the lubricant that consist of base stock and additives. The base stock commonly makes up 95% of the solution and is either made from petroleum, synthetic chemicals, or the mixture of both. It is also prepared by addition of substances, such as viscosity index improvers, antioxidants, metal detergents, and others. In an automobile, friction is one of the major sources of engine heat, which produce more wear and deforms moving engine parts. Hence, the engine oil lubricates the engine parts for its efficient movement, thereby reducing the extent of metal contact, friction, and heat generation within the engine. In addition, cleaning & cooling the engine parts, sealing the gaps, and rust prevention are the other functions carried out by the engine oil.

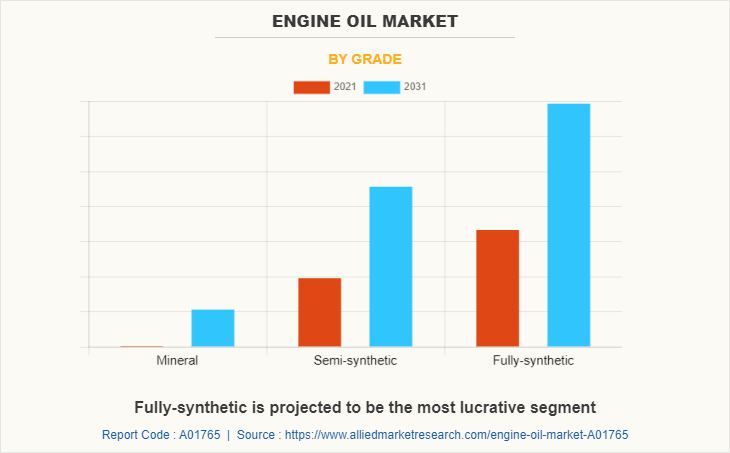

Currently, mineral-based engine oil is being replaced with synthetic engine oil, which offers enhancement in the vehicle’s fuel efficiency, lowering oil consumption, and extending the time between oil changes. For instance, in May 2019, Shell India announced the launch of the Rimula R5 LE 10W40 and R5 LE 10W30 synthetic engine oils designed for heavy-duty trucks in India. These engine oils offered enhanced engine protection and oxidation control following the latest BS-VI emission norms and significantly reduced air pollution. Additionally, synthetic engine oil is less volatile than mineral engine oil, more temperature-resistant, and unlikely to oxidize.

The factors such as increase in sales of automobiles in developing countries, growing demand for high mileage vehicles, and demand for lower viscosity motor oil supplement the growth of the engine oil market. However, rise in sales of electric vehicles and fluctuating raw material prices are the factors expected to hamper the growth of the automotive engine oil market. In addition, emerging demand for synthetic engine oil and trend of new rivals entering the engine oil industry creates market opportunities for the key players operating in the engine oil market share.

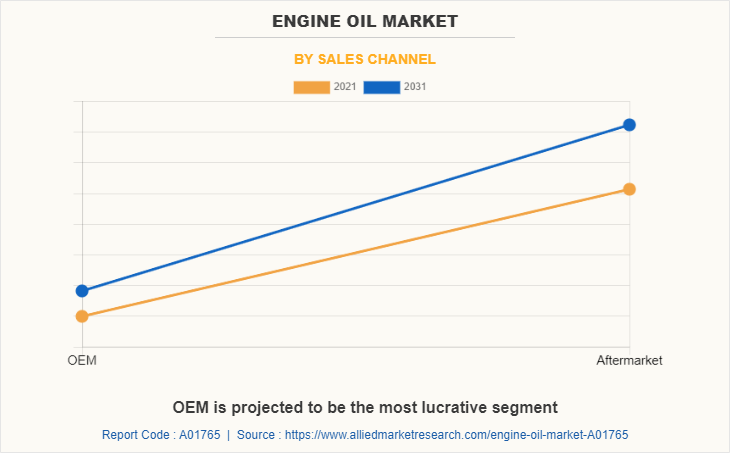

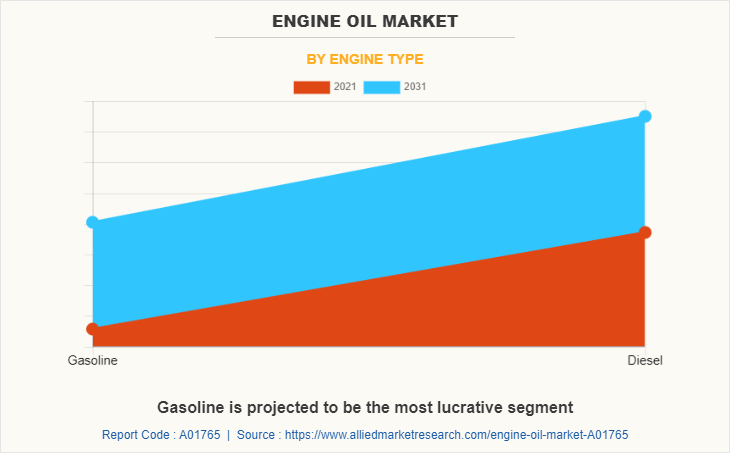

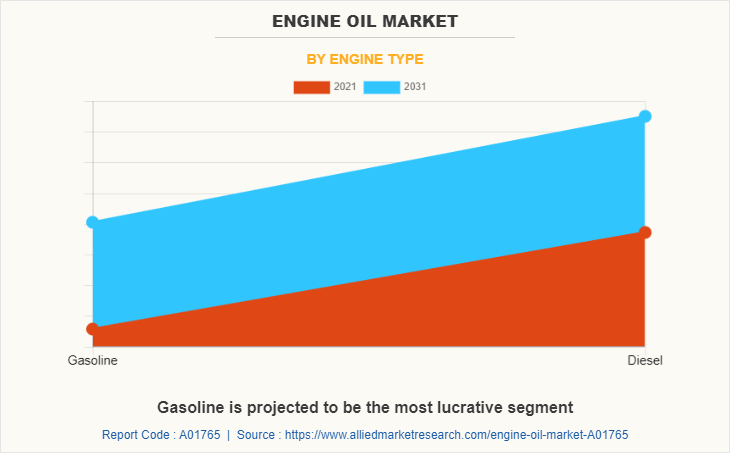

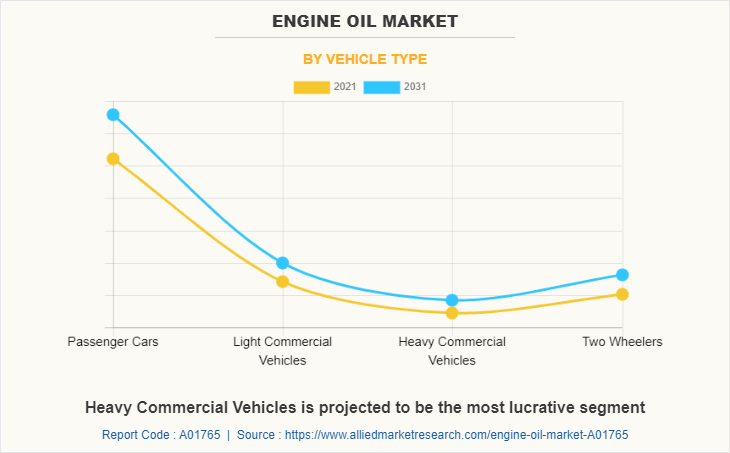

The engine oil market is segmented into grade, sales channel, engine type, vehicle type, and region. By grade, the market is divided into mineral, semi-synthetic, and fully synthetic. By sales channel, it is fragmented into OEM and aftermarket. By engine type, it is categorized into gasoline and diesel. By vehicle type, it is further classified into passenger cars, light commercial vehicles, heavy commercial vehicles, and two wheelers. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The leading players operating in the engine oil market are Adolf Würth GmbH & Co. KG, AMSOIL INC., Ashland, BP p.l.c, Castrol Limited, Chevron Corporation, Exxon Mobil Corporation, Gazpromneft - Lubricants, Ltd., GS Caltex India, Jiangsu Lopal Tech.Co., Ltd., Lukoil, RN-Lubricants LLC, Saudi Arabian Oil Co., Shell, TotalEnergies, Valvoline, and Vip Oil Products Ltd.

Increase in sales of automobiles in developing countries

The automotive industry is racing toward a new world with growing sustainability, changing consumer behavior, encompassing electric vehicles, connected cars, mobility fleet sharing, and improving lifestyles. Developing countries such as India, China, and Brazil are the most promising countries for the automotive sector. In addition, rise in competition among automotive manufacturers (such as General Motors, Volkswagen, Toyota, Daimler, Ford Motors, and others) due to the factors such as innovation and development time, reliability, fuel economy, safety, product quality & features, and pricing has created competition among the key players operating in the engine oil industry. Moreover, according to European Automobile Manufactures’ Association (ACEA), in June 2021, passenger car registrations in the European Union increased by 10% compared to last year's same month owing to their hybrid nature & increased fuel efficiency. As a result, engine oil manufacturers are now expanding their business with the growing sales of automobiles in developing countries which is anticipated to drive the engine oil market size.

Demand for lower viscosity motor oil

There has been a trend in the automotive industry toward using lower viscosity engine oils as fuel economy requirements in automobiles become more demanding globally. Meanwhile, the original equipment manufacturers (OEMs) recommend these oils to maximize vehicle performance and convert their factory and service fill requirements to low viscosity grade products. Also, lower viscosity fluids may improve the fuel economy of the vehicles due to their improved permeability, lower churning losses, and thinner lubricating films. For instance, in September 2021, Lukoil announced the launch of the low viscosity Lukoil Genesis engine oil for the European and Chinese markets. This oil was developed explicitly by Lukoil’s subsidiary, LLK-International, for the modern gasoline and diesel engines of Daimler AG, one of the world's largest car manufacturers. Thus, the growing trend of improved vehicle performance leads to the demand for lower viscosity motor oil in the automotive industry, which is expected to drive the automotive engine oil market.

Rise in sales of electric vehicles

Electric vehicles (EVs) are experiencing a rise in popularity over the past few years as the technology has matured & costs have declined, and support for clean transportation has promoted awareness, increased charging opportunities, and facilitated EV adoption. According to European Environment Agency, in 2020, electric car registrations surged, accounting for 11% of newly registered passenger cars in which battery electric vehicles (BEVs) accounted for 6% of total new car registrations, while plug-in hybrid electric vehicles (PHEVs) represented 5%. Hence, both independent and oil company forecasters expect that aggressive electric vehicle adoption would cause engine oil used for transportation to crumble. As a result, owing to the steady adoption of EVs worldwide, the engine oil manufacturers facing a strong negative impact, thereby hampering the engine oil market growth.

Emerging demand for synthetic engine oil

Mineral-based engine oil is assumed to be replaced with synthetic automobile engine oil. Synthetic engine oil has the advantage of enhancing fuel efficiency, lowering oil consumption, and extending the time between oil changes. Alpha-olefins, short-chain hydrocarbon molecules, are converted into polyalpha-olefins, long-chain hydrocarbon polymers, to create synthetic engine oils. Since they have chemical similarities with mineral oils that have been refined from crude oil, developed regions like North America and Europe have a significant demand for them. For instance, in May 2019, Shell India announced the launch of the Rimula R5 LE 10W40 and R5 LE 10W30 synthetic engine oils designed for heavy-duty trucks in India. These engine oils offered enhanced engine protection and oxidation control following the latest BS-VI emission norms and significantly reduced air pollution. Additionally, synthetic motor lubricants are less volatile than mineral engine oils, more temperature-resistant, and unlikely to oxidize. Thus, it is anticipated that demand for synthetic motor oil will rise throughout the predicted period and create a lucrative opportunity for the engine oil market.

Key Benefits For Stakeholders

- This study presents analytical depiction of the global engine oil market analysis along with current trends and future estimations to depict imminent investment pockets.

- The overall engine oil market opportunity is determined by understanding profitable trends to gain a stronger foothold.

- The report presents information related to the key drivers, restraints, and opportunities of the global engine oil market with a detailed impact analysis.

- The current engine oil market is quantitatively analyzed from 2021 to 2031 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the industry.

Engine Oil Market Report Highlights

| Aspects | Details |

| By Grade |

|

| By Sales Channel |

|

| By Engine Type |

|

| By Vehicle Type |

|

| By Region |

|

| Key Market Players | Lukoil, Adolf Würth GmbH & Co. KG, Exxon Mobil Corporation, Vip Oil Products Ltd., Saudi Arabian Oil Co., Shell, RN-Lubricants LLC, Jiangsu Lopal Tech.Co., Ltd., Gazpromneft Lubricants, Ltd., TotalEnergies, Valvoline, GS Caltex India, Amsoil Inc., Castrol Limited, Ashland Inc., BP plc., Chevron Corporation |

Analyst Review

This section provides the opinions of various top-level CXOs in the global engine oil market. Hence, based on the interviews of various top-level CXOs of leading companies, high level of technological innovations implemented in the overall automotive industry and adoption of high-performance engine oils owing to tactical vehicle mechanisms & operational blueprints implemented by multinational automobile manufacturers is expected to witness substantial growth of engine oil market during the forecast period. For instance, in September 2021, Lukoil announced the launch of the low viscosity Lukoil Genesis engine oil for the European and Chinese markets. This oil was developed explicitly by Lukoil’s subsidiary, LLK-International, for the modern gasoline and diesel engines of Daimler AG, one of the world's largest car manufacturers.

Furthermore, upsurge in demand for passenger cars in developing countries, such as China and India as well as reduced manufacturing & wage costs supplements the market growth. For instance, in November 2020, GS Caltex India launched the Kixx range of Bharat Stage (BS) VI compatible engine oil products. These engine oils were based on advanced additives technology to deliver excellent protection and superior performance, when used in BS VI-compliant vehicles such as passenger cars and motorcycles. This allowed vehicles to deliver superior performance along with reduced air pollution. In addition, rise in competition among automotive manufacturers (such as General Motors, Volkswagen, Toyota, Daimler, Ford Motors, and others) due to the factors such as innovation and development time, reliability, fuel economy, safety, product quality & features, and pricing has created competition among the key players operating in the engine oil industry.

The market growth is supplemented by factors such as increase in sales of automobiles in developing countries, growing demand for high mileage vehicles, and demand for lower viscosity motor oil supplement the growth of the engine oil market. However, rise in sales of electric vehicles and fluctuating raw material prices are the factors expected to hamper the growth of the engine oil market. In addition, emerging demand for synthetic engine oil and trend of new rivals entering the engine oil industry creates market opportunities for the key players operating in the engine oil market.

Among the analyzed regions, Asia-Pacific is the highest revenue contributor, followed by Europe, North America, and LAMEA. On the basis of forecast analysis, LAMEA is expected to lead during the forecast period, due to significant urbanization & industrialization in this region with various government initiatives and several foreign investments.

The global engine oil market was valued at USD 40.5 billion in 2021, and is projected to reach USD 55.1 billion by 2031.

The global engine oil market is projected to grow at a compound annual growth rate of 3.1% from 2022-2031 to reach USD 55.1 billion by 2031.

The key players that operate in the engine oil market such as Adolf Würth GmbH & Co. KG, AMSOIL INC., Ashland, BP p.l.c, Castrol Limited, Chevron Corporation, Exxon Mobil Corporation, Gazpromneft - Lubricants, Ltd., GS Caltex India, Jiangsu Lopal Tech.Co., Ltd., Lukoil, RN-Lubricants LLC, Saudi Arabian Oil Co., Shell, TotalEnergies, Valvoline, and Vip Oil Products Ltd.

Asia-Pacific is the highest revenue contributor.

The market growth is supplemented by factors such as increase in sales of automobiles in developing countries, growing demand for high mileage vehicles, and demand for lower viscosity motor oil supplement the growth of the engine oil market.

Loading Table Of Content...