Engineering Insurance Market Research, 2032

The global engineering insurance market was valued at $24.1 billion in 2022, and is projected to reach $56.7 billion by 2032, growing at a CAGR of 9.2% from 2023 to 2032.

Engineering insurance is a specialized type of insurance designed to protect businesses and individuals involved in construction, engineering, and infrastructure projects against potential risks and losses. It includes a wide range of coverages tailored to the unique hazards prevalent in these industries, including but not limited to machinery breakdown, construction risks, project delays, and liability arising from engineering-related activities. This insurance typically provides financial protection for physical damage to machinery and equipment, cost overruns due to project delays, third-party liabilities, and other unforeseen events that could disrupt or impact engineering projects. It offers a safety net for the complex and often high-value projects undertaken in the engineering sector, shielding stakeholders from financial setbacks and ensuring the continuity of operations in the face of adversity.

The engineering insurance market is driven by the rapid evolution of technology in engineering and construction which has led to more sophisticated machinery and complex projects. This increased complexity often necessitates tailored insurance coverage to mitigate risks associated with these advancements. Furthermore, growing investments in infrastructure projects worldwide drive the demand for engineering insurance as governments and private entities engage in large-scale construction ventures, creating a need for comprehensive insurance to safeguard against potential financial losses. Moreover, stringent regulations and contractual obligations often require project stakeholders to have specific insurance coverage. Compliance with these regulations drives the demand for engineering insurance market, as businesses seek to adhere to legal requirements and mitigate potential liabilities.

Therefore, these are the major driving factors for engineering insurance market growth. However, engineering insurance premiums can be large due to the high value of projects and equipment involved. This cost factor can act as a restraint for smaller firms or projects with limited budgets, impacting their ability to afford comprehensive insurance coverage. In addition, engineering projects involve complicated risks that are often challenging to quantify and assess accurately. Thus, insurers might face difficulties in evaluating and pricing these risks accurately, leading to potential gaps or limitations in coverage. On the contrary, the increasing reliance on technology within engineering and construction exposes these sectors to cyber threats and emerging risks. There is an opportunity for insurance providers to innovate and offer specialized coverage against cyber-attacks, data breaches, and other emerging risks specific to the engineering insurance market.

The report focuses on growth prospects, restraints, and trends of the engineering insurance market analysis. The study provides Porters five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the engineering insurance market.

Segment Review

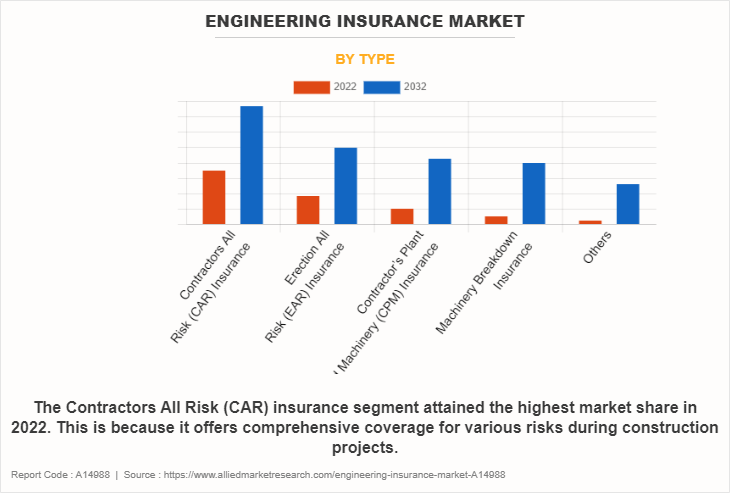

The engineering insurance market outlook is segmented on the basis of type, distribution channel, application, and region. On the basis of type, the engineering insurance market is segmented into contractors all risk (CAR) insurance, erection all risk (EAR) insurance, contractors plant and machinery (CPM) insurance, machinery breakdown insurance, and others. By distribution channel, the engineering insurance market is segmented into banks, insurance companies, and agents and brokers. By application, it is divided into construction sector, oil and gas sector, manufacturing sector, transportation sector, energy and utilities sector, and others. On the basis of region, the engineering insurance market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By type, the contractors' all risk (CAR) insurance segment attained the highest engineering insurance market share in the engineering insurance market. This is because it offers comprehensive coverage for various risks during construction projects. CAR insurance typically protects against damages to the construction site, materials, and third-party liabilities, making it popular among stakeholders due to its wide-ranging protection. It is often a go-to choice as it covers a broad spectrum of risks encountered in construction, providing financial security for contractors and project owners. On the other hand, the machinery breakdown insurance segment is attributed to be the fastest-growing segment during the forecast period. This is primarily due to the increasing reliance on specialized and expensive machinery in construction and engineering projects. As technology advances, machinery becomes more intricate and crucial for project success. Machinery breakdown insurance specifically targets the risks associated with these complex machines, offering coverage for repair or replacement costs in case of breakdowns, ensuring minimal disruption to project timelines and reducing financial losses. With the rising dependence on advanced machinery, this segment is expected to grow rapidly as more stakeholders seek specialized coverage for their equipment.

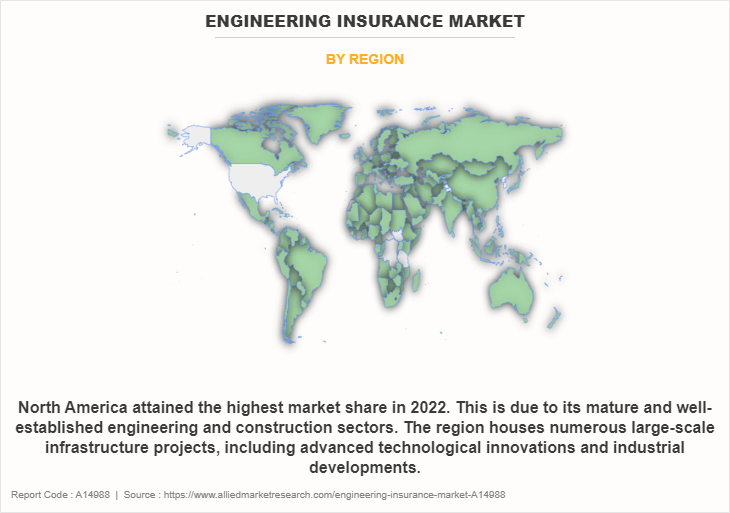

Region-wise, North America attained the highest growth in 2022, due to its mature and well-established engineering and construction sectors. The region houses numerous large-scale infrastructure projects, including advanced technological innovations and industrial developments. Robust regulatory frameworks and a high awareness of risk management practices drive the demand for comprehensive insurance coverage among businesses. Moreover, the prevalence of stringent safety standards and contractual obligations mandates insurance, contributing to North America's dominant market share in engineering insurance. On the other hand, Asia-Pacific is expected to be the fastest growing segment in the engineering insurance market during the forecast period due to increasing economic activities and substantial investments in infrastructure. Rapid urbanization, industrial expansion, and government initiatives for massive infrastructure projects fuel this growth. As the region witnesses a surge in construction ventures, there is an increased recognition of the need for risk mitigation through insurance. In addition, evolving regulatory environments and a growing awareness of the benefits of insurance coverage drive the growth in Asia-Pacific's engineering insurance segment, making it the fastest-growing region during the forecast period.

The report analyzes the profiles of key players operating in the engineering insurance market size such as AXA XL, Bajaj Allianz Life Insurance, Bank of China, Insureon, Munich, Reinsurance America, Inc., Progressive Casualty Insurance Company, RAKINSURANCE, SPA Insurance Brokers, Swiss Re, and The Travelers Indemnity Company. These players have adopted various strategies to increase their market penetration and strengthen their position in the engineering insurance market.

Competition Analysis

Recent Product Launches in the Engineering Insurance Market

On March 22, 2022, HSB (UK and Ireland), the specialist engineering and technology insurer, launched two specialist engineering and technology products on their UK e-trade platforms, further extending their suite of e-trade products available to brokers. The latest products, which are available on Acturis and HSB's own trading portal: HSB Fast Track, are aimed at making it easier for brokers to trade engineering inspection and equipment breakdown risks. HSB's Inspection Services product, serviced via HSB's network of engineer surveyors, provides businesses with periodic engineering inspections to comply with applicable health and safety legislation.

HSB's Machinery and Technology Combined product provides insurance cover for equipment breakdown risks. The product is designed to also include inspection services; offering customers combined protection for their equipment assets.

Furthermore, on June 14, 2023, Hutch Underwriting introduced an annual construction insurance policy on EBIX Sunrise Exchange on June 16th. This offering includes a standard cyber section and is intended to provide protection against the rising wave of cybercrime impacting Australia's construction industry. It offers flexible options that allow brokers to tailor coverage to meet their clients needs and budgets, including existing structures cover, display homes and their contents, plant and equipment, care custody and control and pollution liability, and flexible sub limits and excesses.

Recent Partnership in the Engineering Insurance Market

On November 7, 2022, Acturis, the leading Software-as-a-Service provider to the insurance industry, expanded the e-trade capabilities of its award-winning platform with the launch of its first cyber add-on product by HSB Engineering Insurance. The launch sees HSB Engineering Insurance, part of Munich Re, became the first insurer to go live with the cyber add-on solution on the Acturis platform. Following the successful launch of the HSB suite of construction insurance products on Acturis last March, the specialist engineering and construction insurer worked with Acturis to build a cyber product that will strengthen the insurers e-trade offering. Brokers can now quote and bind the HSB cyber add-on to other lines of business as an additional cover, alongside package policies.

Top Impacting Factors

Technological Advancements

Technological progressions within the engineering and construction sectors have revolutionized the landscape, introducing cutting-edge machinery, innovative materials, and advanced techniques. While these advancements enhance efficiency and productivity, they also introduce new risks. Modern equipment is highly specialized and often complex, making it vulnerable to breakdowns or malfunctions. Engineering insurance helps to address these vulnerabilities, offering coverage against machinery breakdowns, ensuring financial protection for repair or replacement costs, and minimizing project disruptions. Moreover, as construction methods evolve, insurers develop customized policies that adapt to these changes, encompassing new technologies and their associated risks. Therefore, this is one of the major growth factors for the engineering insurance industry.

Cost Constraints

The cost of engineering insurance can be a significant barrier, especially for smaller firms or projects operating on limited budgets. Engineering projects often involve high-value equipment, complex operations, and substantial risks. Insurers calculate premiums based on these factors, which can result in relatively expensive insurance policies. Small and medium-sized enterprises (SMEs) or contractors involved in smaller projects might find it challenging to afford comprehensive coverage. As a result, they may opt for basic policies or forgo insurance altogether, leaving them exposed to potential financial losses in case of unforeseen events. Therefore, creating a balance between comprehensive coverage and affordability remains a challenge for both insurers and project stakeholders.

Emerging Risks and Cyber Threats

The evolving landscape of engineering and construction brings new and unanticipated risks, particularly in the space of cybersecurity. As technology becomes more integral to these industries, the vulnerability to cyber threats increases. Engineering firms and construction projects rely extensively on digital systems, IoT (Internet of Things) devices, and interconnected networks, making them potential targets for cyber-attacks, data breaches, and operational disruptions. This presents a significant opportunity for insurance providers to innovate and expand their coverage to address these emerging risks. Insurers can develop specialized insurance products tailored to protect against cyber threats specific to the engineering sector. These policies may cover financial losses due to system breaches, ransomware attacks, data loss, or business interruption caused by cyber incidents.

Key Benefits for Stakeholders

- This engineering insurance market report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the engineering insurance market forecast from 2023 to 2032 to identify the prevailing engineering insurance market opportunity.

- Engineering insurance market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the engineering insurance market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global engineering insurance market.

- Engineering insurance market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The engineering insurance market report includes an analysis of the regional as well as global engineering insurance market trends, key players, market segments, application areas, and market growth strategies.

Engineering Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 56.7 billion |

| Growth Rate | CAGR of 9.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 420 |

| By Type |

|

| By Distribution Channel |

|

| By Application |

|

| By Region |

|

| Key Market Players | AXA XL., Insureon Solutions, LLC, RAKINSURANCE, SPA Insurance Brokers, Bank of China, The Travelers Indemnity Company, Bajaj Allianz Life Insurance, Co. Ltd., Swiss Re, Munich Reinsurance America, Inc., Progressive Casualty Insurance Company |

Analyst Review

Several significant growth factors contribute to the expansion of the engineering insurance market. The increasing complexity of engineering projects, driven by rapid technological advancements, necessitates tailored insurance coverage. Sophisticated machinery, innovative construction methods, and evolving risks demand specialized policies that mitigate these complexities, fostering the need for comprehensive insurance solutions. Furthermore, escalating global investments in infrastructure projects drive the demand for engineering insurance. Governments and private entities engaging in extensive construction ventures seek financial protection against potential losses, propelling the market's growth. In addition, stringent regulatory requirements, and contractual obligations mandate specific insurance coverages, further boosting the market as businesses strive to adhere to legal obligations and mitigate potential liabilities. These growth drivers collectively highlight the critical role of engineering insurance in safeguarding projects and stakeholders amidst evolving technological landscapes and expansive construction endeavors.

Another notable trend is the increasing emphasis on personalized, customer-centric approaches. Mortgage brokers are now focusing on understanding individual financial profiles and long-term goals to provide tailored solutions. This shift towards customization has helped build trust and loyalty among clients. In addition, regulatory changes and compliance requirements have played a significant role in shaping the mortgage brokerage landscape. Brokers are required to adhere to strict industry standards, ensuring transparency and accountability in their operations. This has instilled confidence in consumers, further fueling the market's growth.

Furthermore, there is a notable shift towards customized and comprehensive insurance solutions tailored to the evolving risks inherent in engineering projects. Insurers are increasingly focusing on offering specialized coverages that address specific project needs, such as modular policies for different project phases or enhanced coverage for emerging risks such as cyber threats. Moreover, the integration of technology, including data analytics and artificial intelligence, is revolutionizing risk assessment and underwriting processes. Insurers leverage these technological advancements to better understand and price risks, improving accuracy in coverage and enhancing overall efficiency. In addition, there's a growing emphasis on sustainability and resilience in engineering projects, prompting insurers to offer policies that incentivize and protect sustainable practices while mitigating risks associated with climate change and environmental impacts. Overall, these trends reflect an adaptive and forward-thinking landscape in engineering insurance, responding to the evolving complexities and demands of modern engineering endeavors.

Some key players profiled in the report include AXA XL, Bajaj Allianz Life Insurance, Bank of China, Insureon, Munich, Reinsurance America, Inc., Progressive Casualty Insurance Company, RAKINSURANCE, SPA Insurance Brokers, Swiss Re, and The Travelers Indemnity Company. These players have adopted various strategies to increase their market penetration and strengthen their position in the engineering insurance market.

Several key trends are shaping the landscape of the engineering insurance market. There is a notable shift towards more comprehensive and customized insurance solutions tailored to the evolving risks inherent in engineering projects.

Engineering insurance is a specialized type of insurance designed to protect businesses and individuals involved in construction, engineering, and infrastructure projects against potential risks and losses. It includes a wide range of coverages tailored to the unique hazards prevalent in these industries, including but not limited to machinery breakdown, construction risks, project delays, and liability arising from engineering-related activities.

North America is the largest regional market for Engineering Insurance

The estimated industry size of Engineering Insurance is projected to reach $56.72 billion by 2032, growing at a CAGR of 9.2% from 2023 to 2032.

The top companies to hold the market share in Engineering Insurance are AXA XL, Bajaj Allianz Life Insurance, Bank of China, Insureon, Munich, Reinsurance America, Inc., Progressive Casualty Insurance Company, RAKINSURANCE, SPA Insurance Brokers, Swiss Re, and The Travelers Indemnity Company

Loading Table Of Content...

Loading Research Methodology...