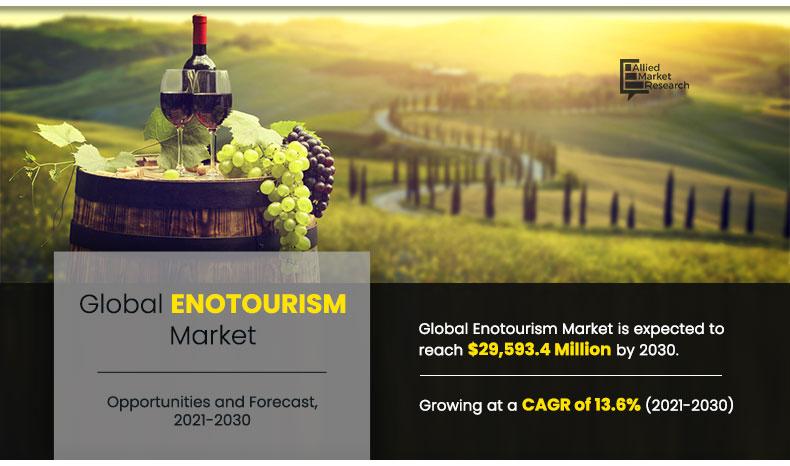

The global enotourism market size was valued at $8,653.4 million in 2020, and is projected to reach $29,593.4 million by 2030, registering a CAGR of 13.6% from 2021 to 2030.

Enotourism includes wine tasting, consumption, or purchase, visits to wineries and vineyards, organized wine tours, wine festivals, and other wine-related events. Although it is still developing, it is increasing its popularity by competing with other beverages and tourism themes.

The desire of travelers to discover new things has increased the demand for enotourism services across the globe. Furthermore, a significant increase in government initiatives to encourage tourism in the form of private and public partnerships is expected to drive the global enotourism market in the coming years.

The increase in social media penetration, on the other hand, is expected to provide enormous opportunities to the market throughout the forecast period. Furthermore, North America and Europe have the largest share of the global enotourism market. The Asia Pacific market is expected to grow at the fastest rate during the forecast period.

Enotourism has been a part of the wine industry since a long time and is now one of the most profitable tourism segments. Enotourism is increasing popularity in the wine and tourism value chains, as well as with government officials and academics. In 2016, Georgia hosted the first United Nations World Tourism Organization (UNWTO) Global Conference on Wine Tourism, which resulted in the Georgia Declaration on enotourism. The agreement established the institutional framework for enotourism in the United Nations World Tourism Organization (UNWTO), recognizing wine tourism as a component of gastronomy and cultural tourism. The framework includes rules and regulations for enotourism activities including vineyard tours and wine tastings. Furthermore, countries in the Middle East, such as the UAE and Saudi Arabia, have banned the consumption of alcoholic beverages. Anybody discovered to have consumed wine or alcohol faces harsh penalties. All of the stringent regulations of government restrain the enotourism market growth.

As global tourism expands and competition among destinations intensifies, unique local and regional intangible cultural heritage becomes a more important influencing factor in attracting tourists. Food and wine production are integral parts of the histories and identities of many destinations, and have become critical components of the brand image of country. Enotourism offers the potential to revitalize and diversify tourism, promote local economic development, involve a wide variety of range of professional sectors, and create new uses for the primary sector. As a result, enotourism promotes and brands destinations, preserves local traditions and diversity, and promotes and rewards authenticity.

The rise of the market is being driven by the economic growth and an increase in disposable income. Following the European and Chinese economic crises of 2009, the global economy came to a halt. A strong recovery from the crisis, on the other hand, leads to significant economic growth, particularly in developing economies, and has increased disposable income among middle-income groups, thereby increasing the middle-class population. Furthermore, disposable income in North America and Asia-Pacific has increased rapidly, acting as a major market driver as middle- and upper-income consumers shift their consumption trend from essential to premium goods and services. These developments support the industry while also improving service offerings across multiple segments, including wine tasting and winery tours.

By Tour Type

Self-guided tours segment is expected to grow at highest CAGR of 13.8% during the forecast period

The travel and tourism industry were completely shut down during a coronavirus pandemic outbreak as a result, the industry was declining. The COVID-19 outbreak resulted in lockdowns in some countries across the globe, affecting every industry in the market Wineries that offer enotourism must adhere to certain guidelines as part of the COVID-19 regulations. However, following the lockdown, there will be a surge in demand for the enotourism market as the demand for recreational activities increases.

By Traveler Type

Solo segment is expected to grow at highest CAGR of 13.8% during the forecast period.

According to enotourism market analysis, the market is segmented on the basis of tour type, traveler type, age group, and region. The enotourism market is divided as private guided tours and self-guided tours based on tour type. The market is divided into solo and group travelers. Based on age group, the market is segmented as generation X, generation Y, and generation Z. Region-wise, the enotourism market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Age Group

Generation Y segment is expected to grow at highest CAGR of 14.5% during the forecast period.

Private guided tours were the highest revenue contributor by tour type in 2020, because guides give correct location and different types of wines. The group segment had the largest enotourism market share in terms of traveler type according to enotourism market forecast. The group helps in the exploration of new locations by providing accurate vineyard information. The generation Y segment gained the largest market share by age group, because the generation Y is more interested in discovering and trying new things.

By Regions

Europe dominates the market and is expected to grow at highest CAGR of 14.4% during the forecast period.

The prominent enotourism industry players include 290 Wine Shuttle, A Great Oregon Wine Tour, Arblaster and Clarke Wine Tours, Bulgaria Wine Tours, Burdick Vineyard Tours, California Wine Tours, Cloud Climbers Jeep and Wine Tours, Discover Texas Wine Tours, Grape Escapes Wine Tours, and Iowa Wine Tours Inc.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the current enotourism market trends, estimations, and dynamics of the global market from 2021 to 2030 to identify the prevailing enotourism market opportunities.

- Porter’s five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier–buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global industry.

- The market player positioning segment facilitates benchmarking while providing a clear understanding of the present position of the key market players.

- The report includes analyses of the regional as well as global market, key players, market segments, application areas, and growth strategies.

Key Market Segments

By Tour Type

- Private guided tours

- Self-guided tours

By Traveler Type

- Solo

- Group

By Age Group

- Generation X

- Generation Y

- Generation Z

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Italy

- France

- Spain

- Germany

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia-Pacific

- LAMEA

- Brazil

- South Africa

- Argentina

- Rest of LAMEA

Enotourism Market Report Highlights

| Aspects | Details |

| By TOUR TYPE |

|

| By TRAVELER TYPE |

|

| By AGE GROUP |

|

| By Region |

|

| Key Market Players | 290 Wine Shuttle, .Burdick Vineyard Tours, Iowa Wine Tours Inc, Cloud Climbers Jeep and Wine Tours, California Wine Tours, Bulgaria Wine Tours, Grape Escapes Wine Tours, A Great Oregon Wine Tour, Arblaster & Clarke Wine Tours, LIXIL GROUP CORPORATION |

Analyst Review

Wine, according to the insights of CXOs of leading companies, is an essential component for the growth of enotourism because it can serve as the foundation for a number of tourism-attracting businesses. Enotourism is a new type of tourism. Enotourism is also known as oenotourism, vinitourism, or wine tourism.

The majority of winery visits take place at or near the production site of winery. Typically, visitors learn about the history, observe the winemaking process, and then taste the wines. Staying in a small winery guest house is also available at some wineries. Many visitors purchase the wine on-site, accounting for up to 33% of annual sales.

Throughout the first decade of the twenty-first century, the enotourism industry grew significantly. In the U.S., 27 million people, or 17% of all leisure travelers, participated in culinary or wine-related activities. In Italy, the number of tourists is estimated to be approximately around five million, with total revenue of $2.93 billion.

Every year on the second Sunday of November; Germany, Austria, Slovenia, Spain, France, Greece, Hungary, Italy, and Portugal commemorate "Enotourism Day" to promote cellar visits. The first Wine Tourism Day in North America was announced on May 11, 2013, with events scheduled across the continent. Enotourism industry of Chile has grown in recent years, with several tourist routes emerging across the country, many of which include overnight accommodations.

As the importance of enotourism increases, regions must deal with the consequences of continued success, such as crowds and higher tasting room fees. This may have the opposite effect desired, driving away potential visitors and turning them to enotourism.

At 13.6% CAGR, the Enotourism market will expand from 2021-2030.

The global enotourism market was valued at $8,653.4 million in 2020, and is projected to reach $29,593.4 million by 2030, registering a CAGR of 13.6% from 2021 to 2030.

Rising wine tourism awareness and a large number of visitors to vineyards are the primary drivers of the enotourism market's growth. Enotourism allows for the exploration of new places, the opportunity to socialize with the local community, and participation in wine tasting activities. Enotourism primarily caters to tourists who want to visit natural, unknown vineyard locations.

The leading players operating in the global enotourism market are 290 Wine Shuttle, A Great Oregon Wine Tour, Arblaster and Clarke Wine Tours, Bulgaria Wine Tours, Burdick Vineyard Tours, California Wine Tours, Cloud Climbers Jeep and Wine Tours, Discover Texas Wine Tours, Grape Escapes Wine Tours, and Iowa Wine Tours Inc.

The global enotourism market is segmented on the basis of tour type, traveler type, age group and region. On the basis of tour type, the market is categorized as private guided tours and self-guided tours. As per traveler type, the enotourism market is divided into solo and group. Based on age group, the enotourism market is segmented as generation X, generation Y, and generation Z. Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Italy, France, Spain, Germany, and the rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and the rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Argentina, and the rest of LAMEA).

The partnership and collaboration are key growth strategies of Enotourism players.

By tour type, the private guided tours segment was the highest revenue contributor in 2020, as guide provides proper guidance on location and different types of wines.

Loading Table Of Content...