Enteral Feeding Devices Market Research

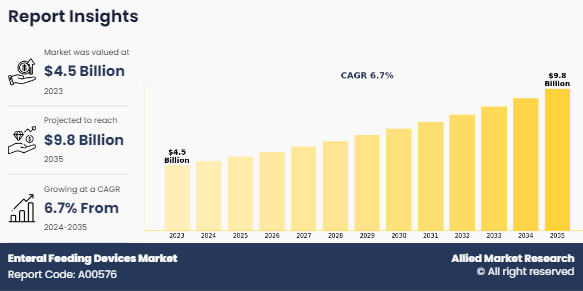

The global enteral feeding devices market size was valued at $4.5 billion in 2023, and is projected to reach $9.8 billion by 2035, growing at a CAGR of 6.7% from 2024 to 2035. The market is driven by rise in geriatric population, surge in preterm birth, and rise in prevalence of chronic diseases. In addition, technological advancement in the enteral feeding devices is expected to drive the growth of the market. According to the World Health Organization, the number of people aged 60 years and older will be around 1.4 billion by 2030. Furthermore, in an article published by the National Library of Medicine, it was reported that the prevalence rate of preterm birth was 10.86%.

Enteral feeding devices are medical instruments used to provide nutrition to individuals who are unable to ingest food orally. These devices deliver nutrients directly into the gastrointestinal tract, ensuring that patients receive the necessary caloric intake to maintain health and recover from illness. Enteral feeding devices include enteral feeding pumps, enteral feeding tubes, enteral syringes, giving set, and others. Enteral feeding devices are essential for patients with conditions such as neurological disorders, head and neck cancers, or severe burns, where oral intake is compromised. Proper management and maintenance of enteral feeding devices are crucial to prevent complications such as infections, blockages, and dislodgement.

Key Takeaways

By product, the enteral feeding pumps segment accounted largest share in 2023.

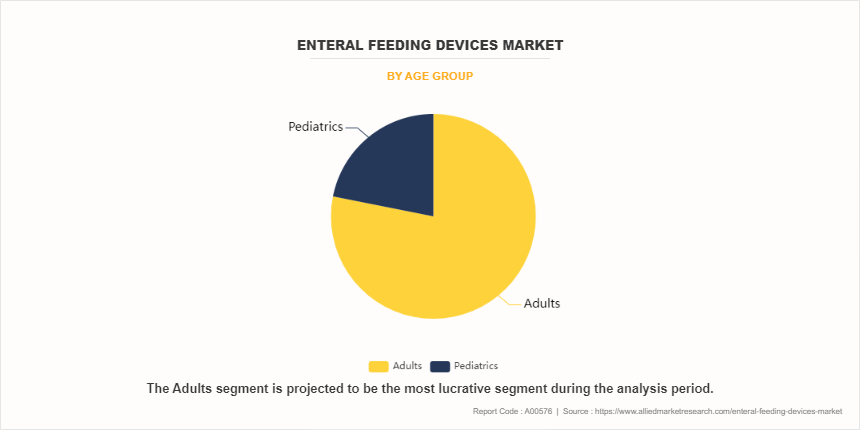

By age group, the adult segment dominated the market share in 2023.

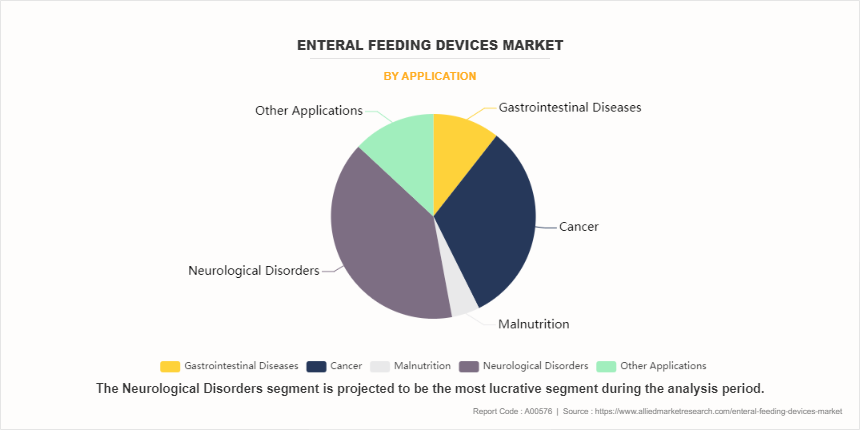

By application, the neurological disorders segment accounted for the largest share in 2023.

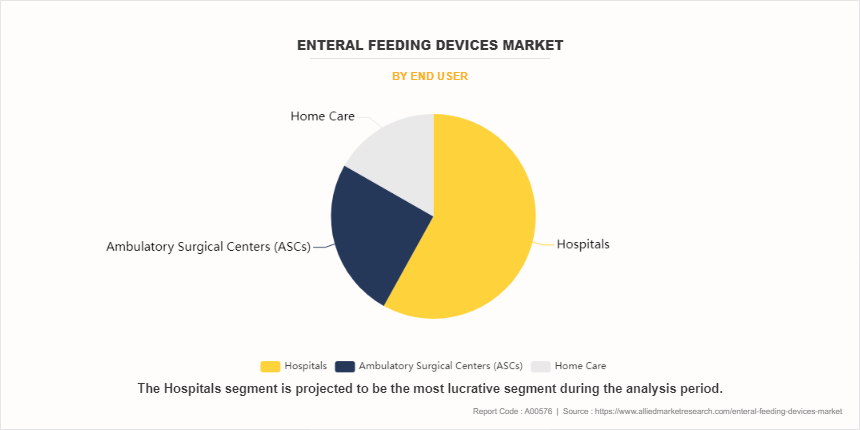

By end user, the hospital segment dominated the market share in 2023.

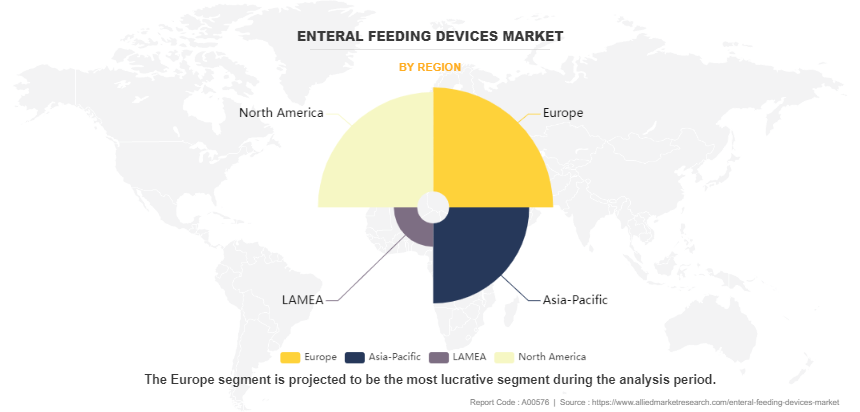

Region-wise, North America dominated the market share in 2023. However, Asia-Pacific is expected to grow at the fastest rate during the forecast period

Market Dynamics

The enteral feeding devices market size is expected to witness significant growth owing to rise in prevalence of chronic diseases, surge in number of preterm births, and rise in geriatric population. Chronic conditions such as diabetes, cancer, neurological disorders, and gastrointestinal diseases have seen a notable increase globally. According to the National Cancer Institute, in 2022, 20 million new cancer cases were diagnosed globally. This surge can be attributed to factors such as aging populations, lifestyle changes, and increased rates of obesity and sedentary habits. As these diseases often impair the ability to consume and digest food normally, there is a growing need for alternative nutritional support methods, such as enteral feeding. Enteral feeding devices play a pivotal role in ensuring that patients receive the required nutrients, vitamins, and minerals in a controlled and easily digestible form.

In addition, rise in incidence of preterm birth is expected to drive the enteral feeding devices market growth. According to the Center of Disease Control and Prevention, in 2021, preterm birth affected about 1 of every 10 infants born in the U.S. Premature infants often face challenges in feeding due to their underdeveloped digestive systems. Healthcare providers increasingly rely on enteral feeding devices to deliver essential nutrients directly into the stomach or intestines of these vulnerable neonates. Enteral feeding devices play a crucial role in ensuring adequate nutrition and promoting healthy growth and development in preterm infants, thereby reducing the risk of complications associated with inadequate nutrition, such as growth failure, infections, and neurodevelopmental disabilities. As healthcare facilities strive to enhance the quality of care for preterm infants and improve their survival rates, the demand for enteral feeding devices is expected to surge.

Furthermore, according to enteral feeding devices market forecast analysis rise in awareness about the importance of nutrition among patients and caregivers is expected to drive the demand for enteral feeding devices. For instance, in December 2021, Nestle Health Science created a website in collaboration with healthcare professionals to offer information and support at every phase of the disease. The company emphasized the value of nutrition as part of a new initiative to inform and support cancer patients and their caregivers. As the understanding of impact of nutrition on overall health and wellbeing becomes more widespread, there's a growing recognition of the critical need for efficient delivery mechanisms, particularly in cases where oral intake is compromised. This heightened awareness has not only been driven by healthcare professionals but also by patients and caregivers who are increasingly educated about the vital role nutrition plays in recovery and maintenance of health. Thus, rise in awareness about nutrition and its importance is expected to present significant enteral feeding devices market opportunity for growth.

Segments Overview

The enteral feeding devices industry is segmented into product, age group, application, end user, and region. By product, the market is segregated into enteral feeding pumps, enteral feeding tubes, enteral syringes, giving set, and consumables. The enteral feeding tubes segment is further classified into enterostomy feeding tube, nasoenteric feeding tube, and oroenteric feeding tube. The enterostomy feeding tube segment is further categorized into gastrostomy feeding tube, percutaneous endoscopic jejunostomy (PEJ) tube, and percutaneous radiological gastrostomy and jejunostomy tube. The gastrostomy feeding tube segment is further segmented into percutaneous endoscopic gastronomy feeding tube (PEG), balloon gastrostomy tube, and low-profile balloon gastrostomy (buttons).

By age group, the market is bifurcated into adult and pediatrics. On the basis of application, the market is categorized into gastrointestinal disease, cancer, malnutrition, neurological disorder, and other applications. The cancer segment is further segmented into head & neck cancer, gastrointestinal cancer, liver cancer, pancreatic cancer, esophageal cancer, and others. By end user, the market is classified into hospitals, ambulatory surgical centers (ASCs), and home care. Region wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and rest of Asia Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, and rest of LAMEA).

By Product

The enteral feeding pumps segment dominated the enteral feeding devices market share in 2023. This was attributed to enteral feeding pumps offering precise control over the rate and volume of nutrition delivered to patients, ensuring accurate administration of nutrients and medications. This level of control is particularly crucial in clinical settings where precise dosing is essential for patient health and recovery. Additionally, enteral feeding pumps are designed for versatility, accommodating various feeding regimens and patient needs, including continuous, intermittent, or bolus feeding schedules. This flexibility makes them indispensable tools for healthcare professionals managing a diverse range of patient conditions, from critical care to long-term nutrition support.

By Age Group

The adult segment dominated the enteral feeding devices market share in 2023, owing to surge in geriatric population and rise in chronic diseases. As adults age, they are more susceptible to diseases, requiring long-term or permanent enteral nutrition support to maintain their health and quality of life.

By Application

The neurological disorders segment held the largest market share in 2023. Neurological disorders such as stroke, Parkinson's disease, multiple sclerosis, and spinal cord injuries often result in dysphagia, a condition where individuals have difficulty swallowing. Dysphagia significantly impairs the ability to consume food and liquids orally, necessitating alternative methods of nutrition delivery, such as enteral feeding. As the prevalence of neurological disorders continues to rise globally due to aging populations and improved disease recognition, the demand for enteral feeding devices is expected to surge.

By End User

By end user, the hospital segment held the largest market share in 2023. Hospitals serve as primary centers for acute and critical care, where patients with a diverse range of medical conditions require specialized nutrition support, including enteral feeding. The prevalence of conditions such as trauma, surgery, cancer, neurological disorders, and critical illness necessitates the use of enteral feeding devices to ensure adequate nutrition and support optimal recovery.

By Region

By region, the enteral feeding devices market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major share of the enteral feeding devices market in 2023 and is expected to maintain its dominance during the forecast period. This is attributed to rise in prevalence of chronic diseases, well-developed healthcare infrastructure, strong presence of major key players, and rise in adoption of the enteral nutrition by both patients and healthcare professionals. However, Asia-Pacific is expected to register the highest CAGR during the forecast period owing to surge in the geriatric population, rise in chronic diseases, and increase in incidence of preterm birth.

Competitive Analysis

Competitive analysis and profiles of the major players in the enteral feeding devices market include Amsino International, Inc., Boston Scientific Corporation, Cardinal Health Inc., Moog Inc., Cook Group, Becton, Dickinson, and Company, Nestle S.A., Avanos Medical, Inc., Applied Medical Technology, Inc., B. Braun SE, Fresenius SE & Co. KGaA, and Danone. Major players have adopted product approval, product launch, expansion, and acquisition as a key developmental strategy to improve the product portfolio of the enteral feeding devices market.

Recent Development in the Enteral Feeding Devices Industry

In September 2023, Cardinal Health announced the U.S. launch of its Kangaroo OMNI Enteral Feeding Pump, which is designed to help provide enteral feeding patients with more options to meet their personalized needs throughout their enteral feeding journey.

In March 2022, Cardinal Health announced plans to build a 574,670 square feet medical distribution center in the Columbus, Ohio area. The new building will integrate automation and technology to work alongside Cardinal Health employees; improve safety, service and quality; deliver operational efficiencies; and better support fluctuations in volume and labor to provide customers with a predictable and stable customer experience.

In May 2024, Danone announced that it has successfully completed the acquisition of Functional Formularies, a leading whole food tube feeding business in the U.S., from Swander Pace Capital. As part of the Renew Danone strategy, this acquisition strengthens Danone’s Medical Nutrition portfolio in the U.S. by further expanding its enteral tube feeding ranges.

In November 2022, Applied Medical Technology, Inc. announced that the micro G-JET is licensed in Canada. The micro G-JET was designed to meet the enteral nutrition needs of pediatric patients and is the only low-profile gastric jejunal (GJ) feeding device with an 8F jejunal segment. This expansion reaffirms AMT’s commitment to patient populations currently reliant on GJ feeding tubes for their caloric intake.

In March 2021, Applied Medical Technology, Inc. (AMT) announced that it has expanded its family of gastric jejunal enteral feeding tubes(G-JETs) to include the low-profile micro G-JET. The micro G-JET was designed to meet the enteral nutrition needs of pediatric patients. The new device is offered with gastric lengths of 0.8 cm to 2.5 cm and with jejunal lengths of 10 cm, 15 cm, 22 cm, and 30 cm.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the enteral feeding devices market analysis from 2023 to 2035 to identify the prevailing enteral feeding devices market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the enteral feeding devices market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global enteral feeding devices market trends, key players, market segments, application areas, and market growth strategies.

Enteral Feeding Devices Market Report Highlights

| Aspects | Details |

| Market Size By 2035 | USD 9.8 billion |

| Growth Rate | CAGR of 6.7% |

| Forecast period | 2023 - 2035 |

| Report Pages | 394 |

| By Application |

|

| By End User |

|

| By Product |

|

| By Age Group |

|

| By Region |

|

| Key Market Players | Nestle S.A., Moog Inc., Cardinal Health Inc., Avanos Medical, Inc., Fresenius SE & Co. KGaA, Becton, Dickinson, and Company, Danone, B. Braun SE, Amsino International, Inc., Cook Group, Applied Medical Technology, Inc., Boston Scientific Corporation |

Analyst Review

Enteral feeding is a method of delivering nutrition or medications directly in the stomach or intestine, and is usually recommended for patients suffering from chronic illnesses such as head & neck cancer, dementia, and stroke. Enteral feeding is an established medical practice across pediatric and adult population, mainly to increase nutritional intake. Enteral feeding is preferred to intravenous parenteral feeding for those who have normal functioning GI tracts. Elderly and bedridden patients suffering from various chronic ailments such as cancer, neurological disorders, gastro-intestinal, and certain inherited metabolic diseases contribute to the major demand for enteral feeding devices across regions.

Rise in patients suffering from several chronic conditions, especially adults, is the major factor that drives the growth of the global enteral feeding devices market. Other factors such as rise in demand for enteral nutrition, increase in geriatric population, and rise in number of malnutrition cases are expected to have a significant impact the growth of the market. However, factors such as stringent governmental regulations and dislodgement of enteral feeding tubes, hamper the market growth.

The use of enteral feedings is the highest in Europe, owing to a large patient population and high adoption of enteral feeding pumps, and is followed by North America and Asia-Pacific. In addition, enteral feeding providers and distributors are focused on expanding their presence in the emerging economies, which in turn is anticipated to drive the market growth.

The market value of Enteral Feeding Devices Market is expected to be $9.8 billion by 2035.

The enteral feeding devices market was valued at $4.5 billion in 2023.

Europe is the largest regional market for enteral feeding devices market.

The base year is 2023 in enteral feeding devices market.

The forecast period for enteral feeding devices market is 2024-2035.

Loading Table Of Content...

Loading Research Methodology...