Enteral Feeding Formulas Market Research, 2032

The global enteral feeding formulas market size was valued at $6.3 billion in 2022 and is projected to reach $12.7 billion by 2032, growing at a CAGR of 7.4% from 2023 to 2032. Enteral feeding formulas, also known as enteral nutrition or tube feeding formulas, are specialized liquid nutrition solutions designed to provide essential nutrients and calories to individuals who are unable to consume food orally due to medical conditions, surgery, or other factors. These formulas are typically administered through a tube that is inserted into the gastrointestinal tract, such as a nasogastric tube, gastrostomy tube, or jejunostomy tube. Enteral feeding formulas are carefully formulated to meet the specific nutritional needs of patients, considering factors such as age, medical condition, and dietary restrictions.

Market Dynamics

The enteral feeding formula market size is expected to grow significantly, owing to a surge in the prevalence of chronic diseases such as neurological disorders, strokes, and cancer, a rise in the incidence of preterm births, and a rise in the geriatric population.

The surge in the prevalence of chronic diseases, including neurological disorders, strokes, and cancer, has emerged as a significant driving factor behind the rapid growth of the enteral feeding formula market share. These disorders often compromise a patient's ability to swallow or consume regular food, making enteral feeding an essential lifeline.

Furthermore, the prevalence of cancer has been on the rise, attributed to various factors including lifestyle choices and increased life expectancy. For instance, according to the American Cancer Society, in 2023, oral cavity or oropharyngeal cancer caused about 11,580 deaths in the U.S. According to the National Cancer Institute, in 2023, 54,540 new oral cavity and pharynx cancer cases were recorded. Cancer and its treatments, such as chemotherapy and radiation therapy, frequently result in severe side effects that affect a patient's ability to consume regular meals. In these cases, enteral feeding formulas offer a lifeline, delivering essential nutrients directly to the gastrointestinal tract when oral intake is compromised. Additionally, the rise in the prevalence of strokes is another critical contributor to the rise in enteral feeding formula demand. Stroke leads to severe swallowing difficulties and impairments in the ability to ingest solid or liquid food. In such cases, enteral feeding becomes a crucial method for delivering nutrition safely and effectively. Thus, the rise in the prevalence of chronic diseases is expected to drive the growth of the enteral feeding formula market.

Furthermore, the rise in the incidence of preterm births has emerged as a major driver for the Enteral Feeding Formulas Industry. According to a 2022 report by the National Library of Medicine, it was reported that the rate of preterm births worldwide is 5–18% with developing countries accounting for maximum deaths. This alarming trend can be attributed to various factors such as lifestyle changes, increased maternal age, and a rise in instances of multiple pregnancies due to fertility treatments. Preterm infants often face significant health challenges, as their underdeveloped digestive systems struggle to process regular breast milk or formula. This has necessitated the development of specialized enteral feeding formulas tailored to the unique nutritional needs of premature babies.

These formulas are designed to provide essential nutrients in easily digestible forms, aiding in the growth and development of preterm infants. They often contain higher levels of essential nutrients such as proteins, vitamins, minerals, and calories to support rapid growth and development. Additionally, these formulas may incorporate specific ingredients like human milk oligosaccharides (HMOs) to mimic the benefits of breast milk, aiding in the development of a preterm infant's immature immune system. Healthcare providers have increasingly recognized the importance of using enteral feeding formulas to ensure that preterm infants receive the vital nutrients they need for healthy growth and development. This growing awareness and the emphasis on improved neonatal care have driven the demand for enteral feeding formulas, fueling the expansion of the market.

In addition, according to the enteral feeding formulas market analysis, the market has experienced a significant surge in recent years, largely attributable to the rapidly growing geriatric population worldwide. For instance, according to America's Health Ranking, in 2021, more than 55.8 million adults aged 65 and older lived in the U.S., accounting for about 16.8% of the nation's population. This demographic shift, characterized by an increasing number of elderly individuals, has emerged as a major driver propelling the demand for enteral feeding formulas. As individuals age, they often encounter a variety of health challenges that can compromise their ability to consume regular meals, leading to a greater reliance on enteral nutrition. Moreover, the aging process itself can bring about physiological changes that make it harder for older adults to absorb essential nutrients from food. This makes enteral feeding formulas an invaluable resource for meeting their nutritional needs effectively and efficiently. Thus, the rise in geriatric population is expected to drive the growth of the market.

However, low patient compliance poses a significant challenge for the enteral feeding formula market share. Enteral feeding, which involves the delivery of essential nutrients directly into the gastrointestinal tract, is a crucial intervention for individuals who cannot consume food orally due to various medical conditions. However, ensuring that patients adhere to their prescribed enteral feeding regimens can be a daunting task. Several factors contribute to this issue. Enteral feeding often necessitates a major lifestyle adjustment for patients, as it involves the use of feeding tubes or pumps, restricting their ability to eat and drink orally. This abrupt change can lead to discomfort and resistance among patients, making them less willing to comply with the treatment plan. Additionally, the taste, texture, or consistency of the enteral feeding formulas may not be appealing to some patients, further reducing their motivation to adhere to the regimen.

The 2023 recession has significantly impacted the Enteral Feeding Formulas Industry. In 2023, consumers adjusted their spending habits in response to the economic uncertainty. Furthermore, the rising inflation rate has further strained the market, making it challenging for companies to maintain profitability. Budget cuts have also been imposed, limiting investment in research and development, innovation, and marketing efforts. Overall, the recession has created a challenging environment, hampering growth and hindering progress in the enteral feeding formulas market size.

Segmental Overview

The enteral feeding formulas market share is segmented on the basis of product type, age group, application, end user, and region. By product type, the market is categorized into the standard formula, disease-specific formulas, peptide-based, and immune-modulating, blenderized. By age group, the market is categorized into adults and children. By application, the market is categorized into cancer, neurological disorders, gastrointestinal disorders, malnutrition, and others. By end user, the market is categorized into hospitals, long-term care facilities, and others. Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and the rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

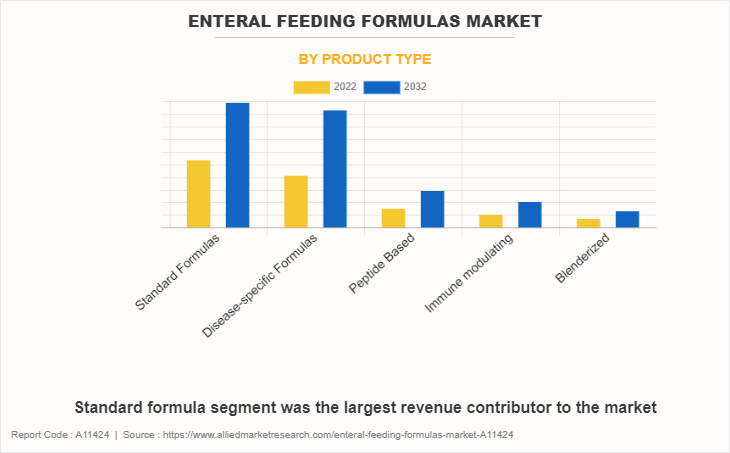

By Product Type

The enteral feeding formulas market share is categorized into standard formula, disease-specific formulas, peptide-based, and immune-modulating, blenderized. The standard formula segment was the largest revenue contributor to the market in 2022, owing to high adoption by healthcare professionals and cost-effectiveness. However, the disease-specific formulas segment is expected to register the fastest growth during for the enteral feeding formulas market forecast period owing to the rise in the prevalence of chronic diseases.

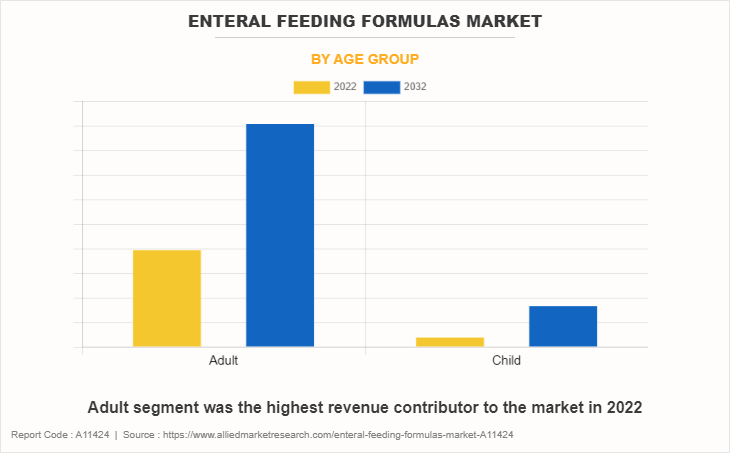

By Age Group

The enteral feeding formulas market is categorized into adult and adult and children. The adult segment was the highest revenue contributor to the market in 2022 and is the fastest-growing segment during the forecast period, due to the surge in the geriatric population and the high prevalence of chronic diseases such as cancer and neurological disorders among adults.

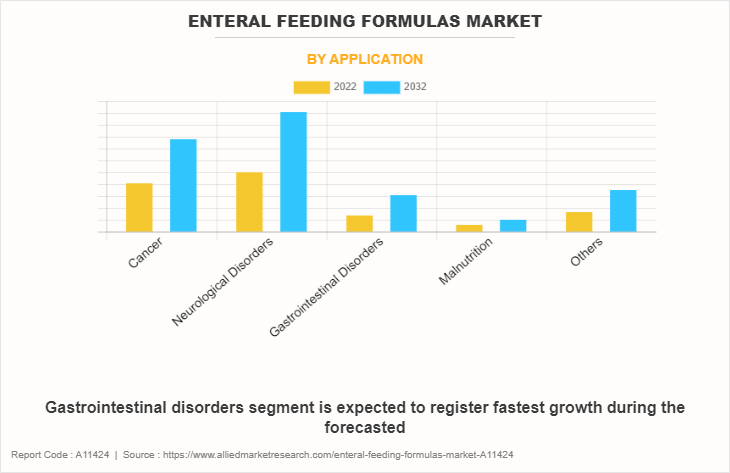

By Application

The enteral feeding formula market is categorized into cancer, neurological disorders, gastrointestinal disorders, malnutrition, and others. The neurological disorders segment was the highest revenue contributor to the market in 2022, owing to the surge in the prevalence of neurological disorders However, the gastrointestinal disorders segment is expected to register the fastest growth during the forecasted period, owing to the rise in gastrointestinal disorders especially in elderly patients.

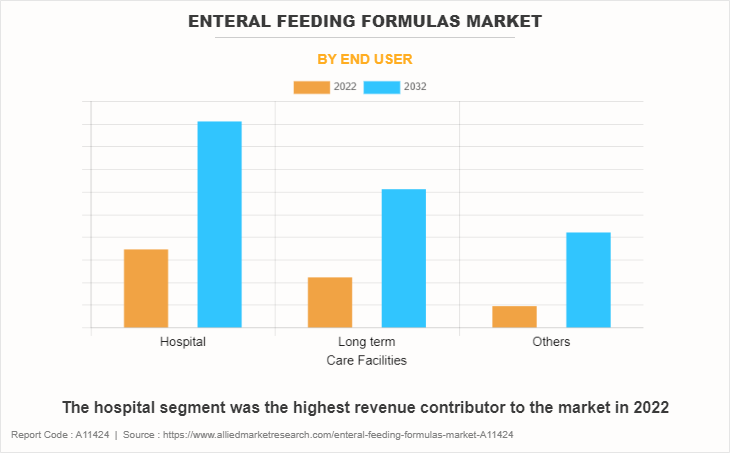

By End-user

On the basis of end users, the market is classified into hospitals, long-term care facilities, and others. The hospital segment was the highest revenue contributor to the market in 2022, owing to the high adoption of enteral feeding formulas for the large patient base. However, the other segment is expected to register the fastest growth during the forecasted period, owing to the high adoption of home healthcare.

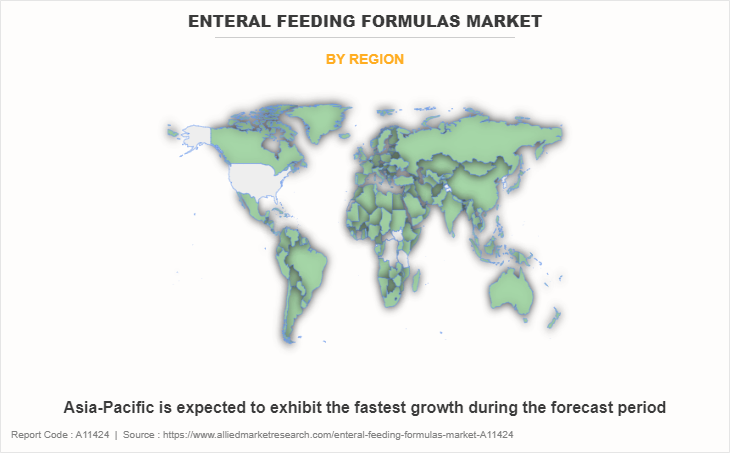

By Region

On the basis of region, the enteral feeding formulas market growth is analyzed across North America, Europe, Asia-Pacific, and LAMEA. On the basis of region, Europe has the highest market share in 2022, owing to a surge in the prevalence of chronic diseases well-developed healthcare infrastructure, and a rise in the prevalence of cancer. However, Asia-Pacific is expected to exhibit the fastest growth during the forecast period, with a rise in the number of geriatric patients and a surge in the incidence of preterm births.

Competition Aanalysis

Competitive analysis and profiles of the major players in the enteral feeding formulas market, such as Abbott Laboratories, Nestlé, Danone S.A, Fresenius SE and Co. KGaA, B. Braun SE, Otsuka Holdings, Nutritional Medicinals, LLC, Kate Farms, Global Health Products Inc, and DermaRite Industries, LLC. Major players have adopted product launches as key developmental strategies to improve the product portfolio and gain a strong foothold in the enteral feeding formulas market.

Recent Product Launch in the Enteral Feeding Formulas Market

- In May 2022, Abbott a global pharmaceutical company, announced that the U.S. District Court for the Western District of Michigan has amended the recent consent decree allowing Abbott to release limited quantities of its EleCare specialty amino acid-based formulas.

- In April 2022, Meiji Holdings Co. Ltd, a global nutritional supplement company, announced the launch of two baby formulas Meiji Hohoemi infant formula 800g, a powered milk product for infants to support their growth and development after medications to emulate breast milk.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the enteral feeding formulas market analysis from 2022 to 2032 to identify the prevailing enteral feeding formulas market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- An in-depth analysis of the enteral feeding formulas market segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global enteral feeding formulas market trends, key players, market segments, application areas, and market growth strategies.

Enteral Feeding Formulas Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 12.7 billion |

| Growth Rate | CAGR of 7.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 290 |

| By Product Type |

|

| By Age Group |

|

| By Application |

|

| By End user |

|

| By Region |

|

| Key Market Players | Nestle SA, Danone S.A, Fresenius SE & Co. KGaA, Medtrition Inc., Nutritional Medicinals, LLC, Meiji Holdings Co. Ltd, B. Braun Melsungen AG, DermaRite Industries, LLC., Hormel Foods Corporation, Abbott Laboratories |

Analyst Review

Enteral feeding formulas, also known as enteral nutrition formulas or tube feeding formulas, are specialized nutritional products designed to provide essential nutrients to individuals who are unable to consume food orally or have limited oral intake. These formulas are used when a person's gastrointestinal tract is functional, but they are unable to eat or drink normally due to medical conditions, surgery, or other factors. Enteral feeding formulas are administered through various types of feeding tubes that are inserted into the stomach or intestines, such as nasogastric tubes, gastrostomy tubes, or jejunostomy tubes. These tubes allow the direct delivery of the enteral feeding formula into the digestive tract, bypassing the need for normal chewing and swallowing. This market's dynamism is underscored by the increasing prevalence of chronic diseases, such as gastrointestinal disorders and cancers, which often necessitate long-term enteral nutrition. Moreover, the aging global population has intensified the demand for effective and convenient enteral feeding solutions, especially as geriatric patients frequently encounter difficulty in swallowing or absorbing nutrients.

Lifestyle changes, adoption of more supplements and rise in geriatric diseases are few recent trends in the Enteral Feeding Formulas Market

The neurological disorders segment was the highest revenue contributor to the market in 2022, owing to the surge in prevalence of neurological disorders

Europe is the largest regional market for Enteral Feeding Formulas Market

The global enteral feeding formulas market size was valued at $6,298.6 million in 2022 and is projected to reach $ 12,706.8 million by 2032, registering a CAGR of 7.4% from 2023 to 2032

Abbott Laboratories, B. Braun Melsungen AG, Nestle SA and Meiji Holdings Co. Ltd are few major companies in the Enteral Feeding Formulas Market report

Yes, the competitive landscape is included in the Enteral Feeding Formulas Market report

Patient incompatibility and allergies might act as a restraint for the enteral feeding formulas.

Asia Pacific is the most lucrative region in Enteral Feeding Formulas Market report

Loading Table Of Content...

Loading Research Methodology...