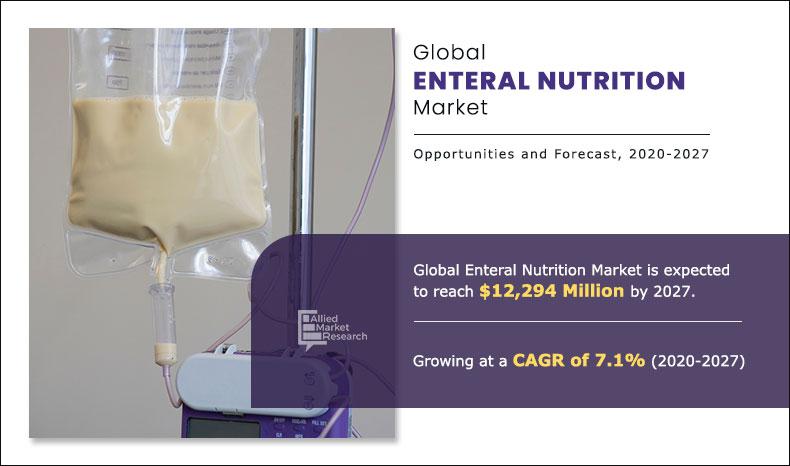

The global enteral nutrition market was valued at $6,762 million in 2018 and is projected to reach $12,294 million by 2027, registering a CAGR of 7.1% from 2020 to 2027.

Enteral nutrition refers to any method of feeding that involves the intake of food through gastrointestinal tract to fulfill an individual’s caloric requirements. Further, it can also include a normal diet, use of liquid or powdered supplements, and tube feeding. There are various equipment and instruments available for the patient to take enteral nutrition. These include tubes, pumps, and other pipes, which help in easy flow of fluid directly to the gastrointestinal tract. The enteral nutrition is required for the individuals suffering from diabetes, malnutrition, cancer, gastrointestinal disorders, and other complications. In addition, enteral nutrition can be provided for the patients with nutritional deficits.

The increase in prevalence of chronic disorders such as cancer and neurological disorders is the major factor that contributes toward the growth of the enteral nutrition market. Other factors that fuel the market growth include surge in geriatric population and rise in malnutrition cases. In addition, enteral nutrition is gaining high acceptance rate, owing to enhancement in techniques, and inclusion of proper ingredients into the composition of the products. However, decreased demand from the underdeveloped countries is anticipated to hamper the market growth. Conversely, high market potential in untapped emerging economies is expected to provide lucrative opportunities for the growth of the market.

The World Health Organization (WHO) on January 30, 2020 declared COVID-19 outbreak a public health emergency of international concern. COVID-19 has affected around 210 countries across the globe. The demand for enteral nutrition increased, with the advent of COVID-19, owing to the high nutritional risks of the COVID-19 patients. The patients suffering from COVID-19 require intensive care management. In addition, nutritional deficits caused during the condition offered growth opportunities for the enteral nutrition market. Furthermore, appropriate nutrition is required when the patient is suffering from COVID-19, owing to the alterations in metabolism pattern and gastrointestinal function. Hence, optimal nutrition therapy helps the patients manage the nutritional deficits and manage further complications such as poor glycemic control, and delay in gastric emptying. Enteral nutrition helps in faster absorption to the gastric walls, owing to the forms in which it is available such as powdered and liquid form.

Enteral Nutrition Market Segmentation

The enteral nutrition market is segmented into protein composition, form, age group, distribution channel, and region. By protein composition, the market is divided into standard protein diet, high protein supplement, protein for diabetes care patient, and others. By form, the market is categorized into powder and liquid. By age group, the market is bifurcated into adults (above 18) and pediatric (below 18). By distribution channel, the market is segmented into hospital sales, retail, and online. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Protein Composition

Standard protein diet segment holds a dominant position in 2018 and would continue to maintain the lead over the forecast period.

Segment review

Presently, on the basis of protein composition, the standard protein diet dominated the global enteral nutrition market in 2018, and is anticipated to continue this trend during the forecast period. Key factors such as high adoption of standard protein diet, owing to the fact that it is one of the most preferable composition prescribed for patients suffering from diabetes, cancer, and other conditions where they have difficulty in ingesting solid food. Different product launches of the standard protein rich products, are fulfilling the market demand. Furthermore, there has been a steep increase in products, which are originated from the organic products, and hence there has been a growth in demand for standard protein diet.

In addition, the enteral nutrition market on the basis of distribution channel is segmented into hospital sales, retail, and online. The hospital sales segment accounted for maximum market revenue in 2018, and is anticipated to gain dominance in the coming years. This attributes to the greater number of inpatients and outpatients in the hospital. Furthermore, the hospital sales segment is anticipated to grow owing to higher preference of the patients for hospitals.

By Distribution Channel

Hospital Sales segment is projected as one of the most lucrative segment.

Snapshot of Asia-Pacific Enteral Nutrition Market

Asia-Pacific presents lucrative opportunities for key players operating in the enteral nutrition market, owing to increase in patient population suffering from diseases such as cancer, neurological disorders, gastrointestinal disorders, diabetes, and other chronic conditions, increase in geriatric population in emerging economies, development of the R&D sector, rise in healthcare reforms, and technological advancements in enteral nutrition products. Moreover, surge in focus of leading manufacturers on expanding their geographical presence in emerging Asia-Pacific countries to capture high market share is expected to drive the growth of the enteral nutrition market in the region.

The key players profiled in this report include Abbott Laboratories, B. Braun Melsungen AG, Danone S.A., Fresenius Kabi AG, Global Health Products, Inc., Hormel Foods Corporation, Meiji Holdings Co., Ltd., Nestlé S.A., Reckitt Benckinser Group PLC, and Victus, Inc.

By Region

Asia-Pacific region would exhibit the highest CAGR of 8.2% during 2020-2027.

Key Benefits For Stakeholders

- The study provides an in-depth analysis of the enteral nutrition market size along with the current trends and future estimations to elucidate the imminent investment pockets.

- It offers enteral nutrition market analysis from 2018 to 2027, which is expected to enable stakeholders to capitalize on prevailing opportunities in the market.

- A comprehensive analysis of four regions is provided to determine the prevailing opportunities.

- The profiles and growth strategies of the key players are thoroughly analyzed to understand the competitive outlook and global enteral nutrition market growth.

Enteral Nutrition Market Report Highlights

| Aspects | Details |

| By Protein Composition |

|

| By Form |

|

| By Age Group |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | VICTUS, INC., ABBOTT LABORATORIES, GLOBAL HEALTH PRODUCTS, INC., FRESENIUS KABI AG, NESTLE S.A, RECKITT BENCKISER GROUP PLC., MEIJI HOLDINGS CO., LTD., HORMEL FOODS CORPORATION, DANONE S.A., B. BRAUN MELSUNGEN AG |

Analyst Review

Enteral nutrition is generally recommended for patients suffering from chronic illnesses such as head & neck cancer, dementia, and stroke. In enteral feeding system, nutrition or medications are directly administered in the stomach or intestine.

Enteral feeding is an established medical practice across pediatric and adult population, mainly to increase nutritional intake. Enteral feeding is preferred to intravenous parenteral feeding for those who have normal functioning GI tracts. Elderly and bedridden patients suffering from various chronic ailments such as cancer, neurological disorders, gastro-intestinal, and certain inherited metabolic diseases fuel the demand for enteral feeding devices across regions.

Rise in patients suffering from several chronic conditions, especially adults, is the major factor that drives the growth of the global enteral nutrition market. Other factors such as increase in geriatric population and rise in number of malnutrition cases are expected to have a significant impact on the growth of the market. However, factors such as poor demand and lack of awareness of enteral nutrition in underdeveloped countries hamper the market growth.

The consumption of enteral nutrition is the highest in North America, owing to a large patient population, and is followed by Europe and Asia-Pacific. In addition, enteral nutrition and distributors are focused on expanding their presence in the emerging economies, which in turn is anticipated to drive the market growth.

Top companies such as Abbott Laboratories, B. Braun Melsungen AG, and Danone S.A. held a high market position in 2018. These key players held a high market postion owing to the strong geographical foothold in different regions.

Standard protein diet segment is the most influencing segment owing to higher acceptance of the composition among healthcare professionals, one of the most common types of composition prescribed for patients and different product launches of the standard protein rich products, are known to fulfill the market demand.

Rise in prevalence of chronic diseases such as as cancer as well as neurological disorders across the world, surge in the adoption of enteral nutrition over parenteral nutrition, rise in geriatric population, and growth in malnutrition cases drive the growth of the market.

Asia-Pacific has the highest growth rate in the market which is growing due to the increase in number of initiatives and enhanced investments from governments for the overall development of Enteral Nutrition, and surge in prevalence of cancer in the region. Moreover, favorable reimbursement policies associated with cancer, diabetes and other chronic diseases treatment, and increase in public awareness towards the usage and benefits of these devices are the key reasons for the significant growth of the market.

Enteral nutrition is food supplement that provides nutrients directly in the gastrointestinal tract in patients who cannot swallow food or get enough nourishment by eating or drinking. This process of administrating nutrition involves the usage of enteral feeding devices such as pumps and tubes.

Enteral Nutrition products used for management of the nutritional deficits caused due to various chronic conditions, inability to swallow or chew food, whether due to surgical procedures or due to severe mouth ulcers.

The total market value of Enteral Nutrition market is $6,762 million in 2018.

The forcast period for Enteral Nutrition market is 2020 to 2027

The market value of Enteral Nutrition market in 2020 is $7589.76 million.

The base year is 2018 in Enteral Nutrition market

Loading Table Of Content...