Enterprise Artificial Intelligence (AI) Market Statistics, 2026

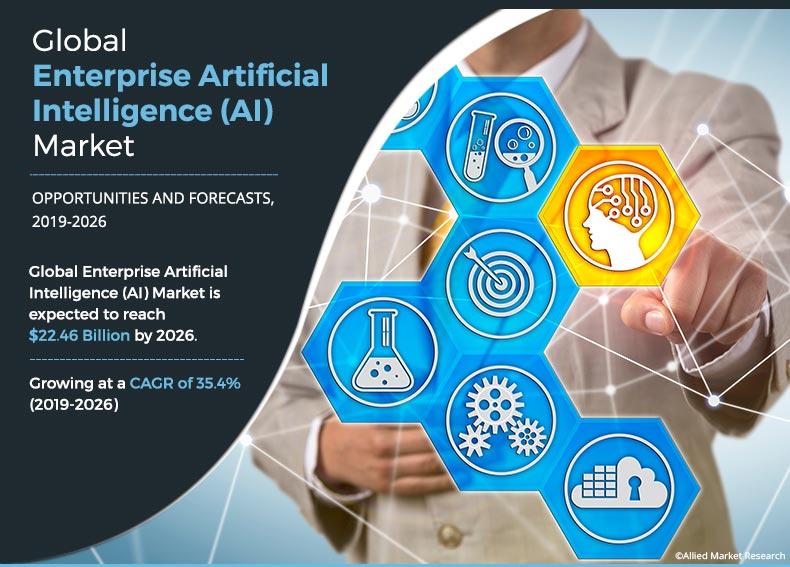

The global enterprise AI market size was valued at $4.68 billion in 2018, and is projected to reach $53.06 billion by 2026, registering a CAGR of 35.4% from 2019 to 2026. AI allows computer systems to build and perform tasks that usually require human interference and support, such as speech recognition, decision making, visual perception, and translation among languages. Artificial Intelligence (AI) might differ from people to people as per their own perspective. For instance, a few years ago, a recommendation engine of browsers might have been seen as AI but currently, the emergence of personalized bots, computers that can detect cancer, and self-driving cars are being seen as AI.

Manufacturers in the enterprise Artificial Intelligence (AI) market witness enormous underlying intellectual challenges in the development and revision of such technology. The market for artificial intelligence is primarily driven by the improved productivity, diversified application areas, increased customer satisfaction, and big data integration. However, lack of skilled workforce and threat to human dignity and other threats are some of the restraints of the market. Nonetheless, the impact of these factors is expected to be minimal because of the introduction of new technologies in the market.

In terms of industry vertical, the IT & telecom segment is expected to contribute the highest enterprise Artificial Intelligence (AI) market share in the coming years, as various new startups have been investing in artificial intelligence solutions. Moreover, the rapid urbanization, technological advancement, and increase in demand for cloud applications fuel the demand for AI technologies in developing economies.

By Deployment Type

Cloud would exhibit the highest CAGR of 38.9% during 2019-2026.

North America is one of the fastest-growing regions in the global market. It is expected to witness a higher growth rate during the enterprise artificial intelligence market forecast period, owing to presence of the key artificial intelligence companies in the region.

The report focuses on the growth prospects, restraints, and trends of the enterprise artificial intelligence (AI) market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the global enterprise (AI) market.

By Technology

Natural Language Processing would exhibit the highest CAGR of 42.3% during 2019-2026.

Segment Review

The global enterprise artificial intelligence (AI) market is segmented on the basis of deployment type, technology, organization size, industry vertical, and region. Based on deployment type, the market is bifurcated into cloud and on-premise. Based on technology, the market is divided into machine learning, natural language processing, image processing, and speech recognition. Based on organization size, the market is classified into large enterprises and small & medium enterprises. Depending on industry vertical, the market is segmented into media & advertising, BFSI, IT & telecom, retail, healthcare, automotive & transportation, and others. Based on region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Organization Size

Small and medium enterprises would exhibit the highest CAGR of 39.0% during 2019-2026.

The market is dominated by the global enterprise artificial intelligence (AI) players such as Alphabet Inc. (Google Inc.), Apple Inc., Amazon Web Services, Inc., International Business Machines Corporation, IPsoft Inc., MicroStrategy Incorporated, NVIDIA Corporation, SAP, Verint, and Wipro Limited.

Top Impacting Factors

Current and future enterprise Artificial Intelligence (AI) industry trends are outlined to determine the overall attractiveness of the market. Top impacting factors highlight the enterprise artificial intelligence (AI) market opportunities during the forecast period. Factors such as booming innovative start-ups and bursting advancements in technology have led to increase in investment in artificial intelligence technologies. Moreover, escalating demand for analyzing and interpreting large amount of data boosts the demand for artificial intelligence industry solutions. Furthermore, increase in adoption of AI in developing economies such as China, and India are expected to provide major opportunities for the enterprise AI market growth in the upcoming years.

By Industry Vertical

IT & Telecom would exhibit the highest revenue of $9578.04 during 2019-2026.

Increasing investment in AI technologies

The ability of the AI technology to analyze the collected data efficiently and forecast decisions through crucial algorithms helps in productivity improvement; for instance, Netflix suggests movies on the basis of users’ previous viewing experiences. In the current business scenario, AI has revolutionized business management through integration of workflow management tools, brand purchase advertising, trend predictions, and other tools. These are the major factors of the increasing investment in AI technologies. Moreover, many small startups and tech companies have been investing in the adoption of open-source AI platforms to achieve higher efficiencies in their value chains. Moreover, the rise in availability of low-cost quality AI technologies is expected to also contribute toward the enterprise artificial intelligence market growth.

By Region

Asia-Pacific would exhibit the highest CAGR of 41.4% during 2019-2026.

Rise in need for analyzing and interpreting large amounts of data

AI has varied application areas including media & advertising, finance, retail, healthcare, automotive & transportation, agriculture, law, educational institutions, oil & gas, and other industries. This has driven the market of AI across the globe, owing to developments, such as self-driving cars, space exploration, accurate weather predictions, and others. Furthermore, AI is expected to affect healthcare advancements, owing to its ability to analyze huge amounts of genomic data and ensure more accurate treatment and prevention of medical conditions. Moreover, several organizations are realizing the need of analyzing and interpreting large amounts of data due to increase in competitiveness in the enterprise AI market globally.

Key Benefits for Enterprise Artificial Intelligence (AI) Market:

- This study presents the analytical depiction of the global enterprise Artificial Intelligence (AI) market trends and future estimations to determine the imminent investment pockets.

- A detailed analysis of the segments measures the potential of the enterprise artificial intelligence (ai) market. These segments outline the favorable conditions for the market.

- The report presents information related to key drivers, restraints, and opportunities.

- The current enterprise artificial intelligence (ai) market is quantitatively analyzed from 2018 to 2026 to highlight the financial competency of the industry.

- Porter’s five forces analysis illustrates the potency of buyers & suppliers in the industry.

Enterprise Artificial Intelligence (AI) Market Report Highlights

| Aspects | Details |

| By DEPLOYMENT TYPE |

|

| By Technology |

|

| By Organization Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Wipro Limited, IPsoft Inc., SAP SE, Amazon Web Services, Inc., Alphabet Inc., NVIDIA Corporation, Verint Systems Inc., International Business Machines Corporation, Apple Inc., MicroStrategy Incorporated |

Analyst Review

According to the insights of the CXOs of leading companies, the global enterprise artificial intelligence (AI) market signifies a promising picture for the technological industry. The current business scenario has witnessed an increase in the adoption of this technology particularly in the developing regions. The companies have been adopting innovative techniques in an effort to provide customers with advanced and innovated product offerings.

So far, machine learning, natural language processing, image processing, and speech recognition are the major technologies of artificial intelligence (AI) in the market. Machine learning is extensively being adopted specifically in the IT & telecom and BFSI sectors. Among the industry verticals, the IT & telecom segment exhibited the highest revenue growth, owing to the increase in adoption in insurance, trend analysis, and fraud detection systems. However, technologies, such as cloud computing, virtual mentors, and drones in farming are some of the factors that drive the market for AI in the other sub-segments.

Furthermore, the enterprise artificial intelligence (AI) market is a consolidated market as players such as Alphabet Inc. (Google Inc.), Apple Inc., Amazon Web Services, Inc., International Business Machines Corporation, NVIDIA Corporation, SAP, and others hold major share globally. However, the market is expected to become fragmented in near future, as many players in the developing countries are evolving in this area and are coming up with enhanced and innovative AI solutions and strategies.

The key players operating in the global enterprise Artificial Intelligence (AI) market include Alphabet Inc. (Google Inc.), Apple Inc., Amazon Web Services, Inc., International Business Machines Corporation, IPsoft Inc., MicroStrategy Incorporated, NVIDIA Corporation, SAP, Verint, and Wipro Limited. The key players have adopted various growth strategies to enhance and develop their product portfolio, strengthen their virtual private server market share, and to increase their market penetration. For instance, in May 2019 Google launched the beta version of their AI Platform as a step to the enhancement of machine learning and artificial intelligence. Also, in February 2019 Apple Inc. acquired Pullstring, an AI voice assistant startup. The startup has worked on publishing and designing the voice-enabled apps earlier. The acquisition has helped Apple in enhancing abilities for its AI, Siri to compete with Amazon’s Alexa and the Google Assistant.

Loading Table Of Content...