Enzymes Market Research, 2031

The global enzymes market was valued at $5.8 billion in 2021, and is projected to reach $10.2 billion by 2031, growing at a CAGR of 6% from 2022 to 2031.Enzymes are biocatalysts that alter the reaction rate and produce the desired results in biological reactions. They are proteinaceous in nature and have gathered a special attention in recent years owing to their wide applications. Enzymes are employed in food and animal feed, textiles and detergents, pharmaceuticals and biotechnology R&D, manufacturing industries, and others (paper and pulp processing, leather processing and agriculture). Their application in the manufacturing processes, resulting in significant cost reductions and limited energy consumption along with better substrate activity has contributed to the expansion of enzymes industry.

Enzymes are responsible for controlling or speeding up the reaction, thus, providing numerous advantages over conventional chemical processes with respect to process efficiency and sustainability. Thus, enzymes have gained an increased popularity in industrial applications. Enzyme catalysis has been scaled up for various commercial processes such as food & beverage industry, textiles, detergents, paper & pulp, waste management, leather processing, biofuel industry, pharmaceuticals & biotechnology industry, as well as agriculture. The demand for enzymes is all set to increase across all industry verticals owing to their highly efficient bio-catalysis, product selectivity, lower physiological, and environmental toxicity. Moreover, utilization of lesser energy (temperature) and overall time reduction in manufacturing process has resulted in significant cost reductions. Therefore, this is expected to amplify the adoption and use of enzymes globally.

Numerous factors are responsible for driving the growth of the global enzymes market over the analysis period. Biotechnological, pharmaceutical, and food & beverage as well as the biofuel industry are reaping the benefits offered by enzymes. The surge in demand for enzymes in pharmaceutical industry to synthesize intermediates in active pharmaceutical ingredient (API) production for effective medications is anticipated to boost the growth of the enzymes market. Likewise, the ability of an enzyme to convert complex molecules to simpler molecules (starch to glucose) in food & beverage companies, removal of fats & oil stains in the detergent industry, bioethanol for biofuel production, and improved bleaching properties in paper & pulp industries are the factors anticipated to propel the demand for enzymes in the coming years. In addition, rise in prevalence of various chronic diseases such as digestive diseases & inflammation, and upsurge in demand for renewable energy sources such as biofuels are further supplement the market growth.

Moreover, enzyme-based drugs are used for the treatment of chronic conditions such as cancer and AIDS. In addition, enzymes are widely utilized in the biotechnology industry for research in the field of molecular biology. They are used in genetic engineering techniques to cut, replicate, and attach the DNA strands as per requirement. Furthermore, enzymes play a major role in the diagnosis of diseases such as cancer, cardiovascular diseases, and lysosomal disorder.

Conversely, factors such as handling & safety issues associated with enzymes and higher sensitivity to temperature & pH are anticipated to hamper the market growth. On the contrary, increase in awareness about the application of enzymes in protein engineering technology and higher market potential in the untapped emerging economies are expected to provide lucrative growth opportunities for the market expansion.

Enzymes Market Segmentation Overview

The enzymes market size is segmented into Source, Reaction Type, Application and Type. By type, the market is fragmented into protease, carbohydrase, lipase, polymerase & nuclease, and others. On the basis of source, the global enzymes market share is categorized into microorganisms, plants, and animals. By reaction type, the global enzymes market trends is classified into hydrolases, oxidoreductase, transferase, lyase, and others. The applications covered include food & beverages, household care, bioenergy, pharmaceutical & biotechnology, feed, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

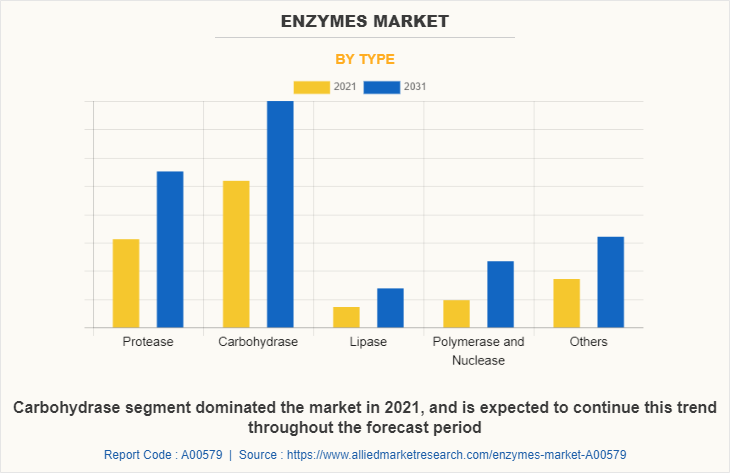

By Type

Depending on type, the carbohydrase segment dominated the market in 2021, and is expected to continue this trend throughout the forecast period, owing to its uses in pharmaceutical and food industries. Commercial applications of carbohydrase in food products and detergents are expected to fuel the growth of the segment throughout the forecast period. Having said that, the polymerases and nucleases segment is growing at the fastest rate in the market owing to wide range applications of polymerases and nucleases in the field of biotechnology. The development of technologies in the life sciences such as protein engineering drives the adoption of polymerase & nuclease enzymes in the enzymes market growth.

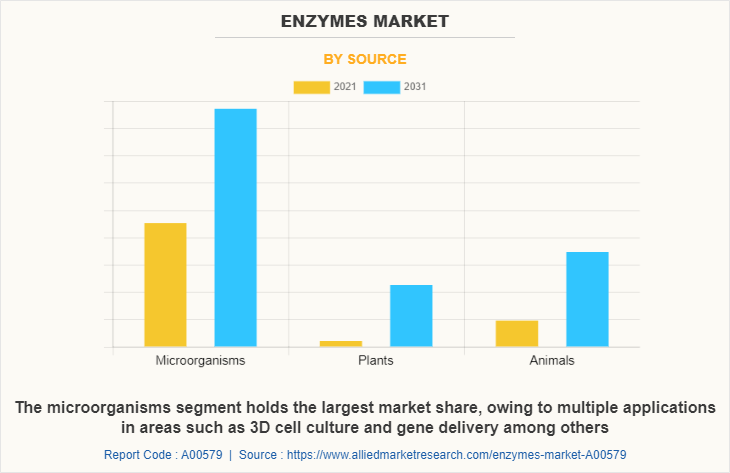

By Source

By source, the microorganisms segment holds the largest market share, owing to increase in use of microbial amylases is expected to fuel the overall growth of microorganism-based enzymes market analysis. Lipolytic enzymes, especially lipases are important enzymes used for lipid degradation. Having said that, the plants segment is growing at the fastest rate in the market owing to industrial applications of plants in various fields such as food & beverages, detergents, pharmaceuticals, biotechnology, and diagnostics. Some of the plants-derived enzymes include proteases such as papain, ficin, and bromelain and are used to produce therapeutic proteins.

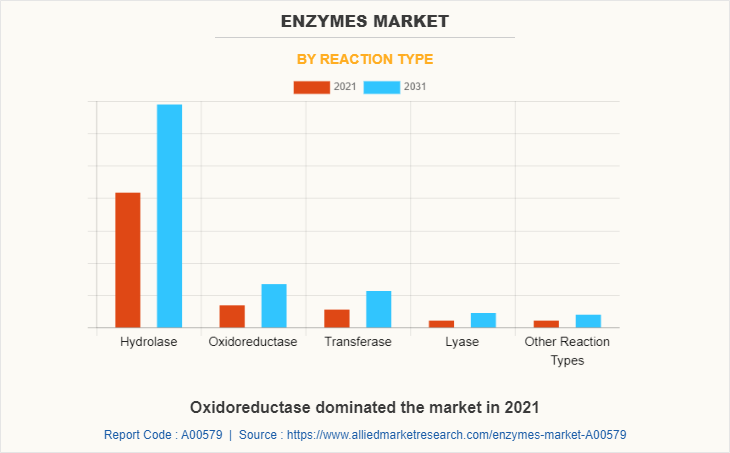

By Reaction Type

By reaction type, the hydrolase segment dominated the market in 2021, and is expected to continue this trend throughout the forecast period, owing to various applications of hydrolase across several industry verticals such as dairy, brewing, starch, paper, biofuel, detergents, and food processing. Some of the industrial enzymes that perform hydrolysis include cellulases, amylases, pectinases, lipases, phytases, and proteases. Having said that, the transferase segment is growing at the fastest rate in the market owing to rising applications of transferase in molecular biology and genetic engineering research experiments.

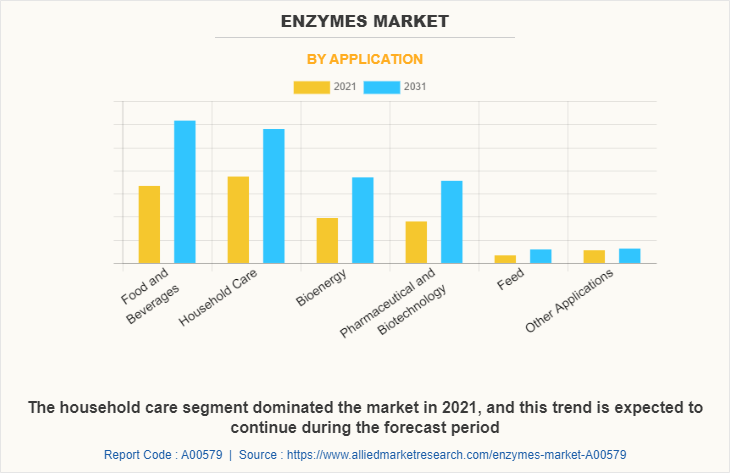

By Application

By application, the household care segment dominated the market in 2021, and this trend is expected to continue during the forecast period, owing increase in adoption of products containing enzymes rather than petrochemical-derived ingredients, as the latter tends to pollute the environment to a greater extent. Rise in awareness among the population regarding positive environmental impact of enzymes has greatly contributed toward the growth of the enzymes market forecast for household care. Moreover, the advantages of using enzymes in laundering garments has significantly driven the demand for these enzyme-based products. Having said that, the pharmaceutical and biotechnology segment is growing at the fastest rate in the market owing to applications of enzymes for the synthesis of antimicrobials, dynamic kinetic resolution of drugs, synthesis of APIs, enzyme therapy and synthesis of amino acids. The use of enzymes in drug formulations has enabled the treatment of conditions such as cancer and AIDS which is creating opportunities in the segment.

By Region

Region-wise, North America dominated the enzymes market opportunity in 2021, and is expected to be dominant during the forecast period, owing to early adoption of advanced technology in pharmaceutical & biotechnology industries owing to high per capita healthcare expenditure and introduction of new enzyme-based drugs.

Competiton Analysis

The key players that operate in the global enzymes market size include, Novozymes A/S, Koninklijke DSM N.V., DuPont de Nemours, Inc., BASF SE, Advanced Enzyme Technologies Ltd., AB Enzymes GmbH, Codexis, Inc., Amano Enzyme, Inc., F. Hoffmann-La Roche Ltd., Thermo Fisher Scientific Inc.

Key Benefits for Stakeholders

- The study provides an in-depth analysis of the enzymes market size and the current trends & future estimations to elucidate imminent investment pockets.

- It presents a quantitative analysis of the market from 2021 to 2031 to enable stakeholders to capitalize on the prevailing market opportunities.

- Extensive analysis of the market based on procedures and services assists to understand the trends in the industry.

- Key players and their strategies are thoroughly analyzed to understand the competitive outlook of the market.

Enzymes Market Report Highlights

| Aspects | Details |

| By Source |

|

| By Reaction Type |

|

| By Application |

|

| By Type |

|

| By Region |

|

| Key Market Players | BASF SE, AMANO ENZYME INC., Codexis, Inc., DUPONT DE NEMOURS, INC., THERMO FISHER SCIENTIFIC INC. (AFFYMETRIX, INC.), Koninklijke DSM N.V., Advanced Enzyme Technologies Ltd, F. HOFFMANN-LA ROCHE LTD., NOVOZYMES A/S, AB ENZYMES GmbH |

Analyst Review

Enzymes function as biocatalysts that modify the rate of chemical reactions in metabolic processes. In the recent years, owing to their numerous functional properties, enzymes are highly employed in various industries such as pharmaceutical & biotechnology, food, textiles, biofuels, and others. In food industry, enzymes not only improve food quality but also accelerate reaction specificity; for example, enzymes help in the conversion of protein and prolong the shelf life of products. In addition, they possess properties such as food softening and staleness inhibition, which make them ideal for use in food & beverages and other industries.

As per the CXOs, upsurge in number of patients suffering chronic disease leads to high demand of effective pharmaceuticals, which acts as the major driving factor for the global enzymes market. Other factors such as upsurge in adoption of biofuels, rise in digestive disorders, and wide applications of enzymes across several industry verticals are expected to have a significant impact on the market growth. According to the CXOs, the overall increase in consumption of functional food & beverages (which contain enzymes) and rise in healthcare expenditures in the developing regions is projected to have a positive impact on market growth.

The CXOs further added that the use of enzymes is the highest in North America, owing to technological advancements and recovering American economy, which has led to increase in healthcare expenditures in the region. However, the Asia-Pacific enzymes market is expected to grow at a significant rate, due to increase in healthcare facilities and growth in manufacturing base, especially in Japan, India, and China.

Increased utilization of enzymes in pharmaceutical industry for the production of drugs and vaccines coupled with its use as digestive enzymes are key trends in the market

The household care segment dominated the market in 2021, and this trend is expected to continue during the forecast period, owing increase in adoption of products containing enzymes rather than petrochemical-derived ingredients, as the latter tends to pollute the environment to a greater extent.

North America dominated the enzymes market in 2021, and is expected to be dominant during the forecast period, owing to early adoption of advanced technology in pharmaceutical & biotechnology industries owing to high per capita healthcare expenditure and introduction of new enzyme-based drugs.

The global enzymes market was valued at $5,830.5 million in 2021, and is projected to reach $10,215.2 million by 2031, registering a CAGR of 6.0% from 2022 to 2031.

Novozymes A/S, Koninklijke DSM N.V., BASF SE and F. Hoffmann-La Roche Ltd. are few key players operating in the market

Agreements, Product Launch, and Partnership were the top three strategies adopted by key players operating in the enzymes market

Handling and safety issues related to enzymes coupled with constraints pertaining to chemical and physical properties of enzymes are two major restraining factors for enzymes market

Asia Pacific is the fastest growing region in enzymes market and is expected to continue this trend during the forecast period. This is due to the gradually increase in awareness regarding potential benefits of enzymes in varied applications such as food & beverages and healthcare.

Loading Table Of Content...