Epilepsy Devices Market Research, 2031

The global epilepsy devices market size was valued at $675.23 million in 2021, and is projected to reach $1,112.47 million by 2031, growing at a CAGR of 5.1% from 2022 to 2031.

Epilepsy is a neurological disorder that is characterized by recurrent seizures, that may involve a part of the body or the entire body and sometimes by loss of consciousness. There are few devices available that can detect and reduce the frequency of seizures called epilepsy devices. There are only three devices approved by the FDA to reduce the frequency of seizures are, vagus nerve stimulation (VNS), responsive neurostimulation (RNS), and deep brain stimulation (DBS). The battery-powered vague nerve stimulator sends bursts of electric energy through the vagus nerve and brain and reduces seizures by 20-40%. The responsive neurostimulator monitors brain activity and delivers a small amount of electric current when seizure-like activity is detected. Furthermore, epilepsy devices include, EEG, electrocardiography (EKG), video detection systems, and surface electromyography (sEMG).

Historical Overview

The market was analyzed qualitatively and quantitatively from 2021-2031. The epilepsy devices market grew at a CAGR of around 5.1% during 2022-2031. Most of the growth during this period was derived from the Asia-Pacific owing to the rise in prevalence of epilepsy and improvement in healthcare facilities, rise in disposable incomes, as well as well-established presence of domestic companies in the region.

Market Dynamics

Growth & innovations in the medical devices industry for the manufacturing of epilepsy devices, owing to a massive pool of health-conscious consumers, creates an opportunity for the epilepsy devices market. Rise in the prevalence of old age population that are more vulnerable to epilepsy is the major key factor driving the market growth. For instance, according to an article published by UpToDate Inc., in August 2021, the incidence rate of epilepsy increases with age and is highest in patients over 75 years of age. Furthermore, the rise in demand for minimally invasive epilepsy devices, positively impacts market growth. Minimally invasive devices for epilepsy are being favored both by doctors and patients, owing to the advantages of minimally invasive surgeries such as high success rate, less painful, shorter hospital stay, and require a short recovery period.

In addition, the Epilepsy Devices Market Growth is expected to be driven by the high potential in untapped, emerging markets, due to the availability of improved healthcare infrastructure, increase in unmet healthcare needs, rise in the prevalence of epilepsy, and surge in demand for conventional and wearable epilepsy devices. Furthermore, the healthcare industry in emerging economies is developing at a significant rate, owing to rise in demand for enhanced healthcare services and significant investments by the government to improve healthcare infrastructure. The demand for epilepsy devices is not only limited to developed countries but is also being witnessed in developing countries, such as China, Japan, and India, which fuel the growth of the market.

Factors such as rise in the incidence of ischemic stroke, an increase in focus on developing cost-effective epilepsy devices, an increase in R&D investments in the discovery & development of advanced epilepsy devices, and a rise in awareness regarding the use of epilepsy devices for diagnosis and monitoring of epilepsy, are the key Epilepsy Devices Market Opportunity in upcoming years. For instance, according to the National Center for Health Statistics, every year, more than 795,000 people in the U.S. have a stroke. In addition, according to the Centers for Disease Control and Prevention (CDC), approximately 87% of all strokes reported are ischemic strokes.

However, strict government regulations are the main hurdles in the manufacturing of epilepsy device products and product approvals. For the introduction of new devices and technologies, many governments adopt different regulations. Different regulatory agencies create various guidelines, and the introduction of new items must adhere to them carefully. Due to the complex and time-consuming clearance procedures, the introduction of new products may be delayed. In addition, high cost of EEG and electrocardiography (ECG) devices is anticipated to hamper the Epilepsy Devices Market Size in upcoming years.

The outbreak of COVID-19 has disrupted workflows in the healthcare sector around the world. The disease has forced a number of industries to shut their doors temporarily, including several sub-domains of health care. The global epilepsy devices market experienced a decline in 2020 due to global economic recession led by COVID-19. In addition, the COVID-19 outbreak disrupted the supply chain across various end-user industries like food & beverage, healthcare, and industrial. However, the market is anticipated to witness recovery in 2021, and show stable growth for the epilepsy devices market in the coming future. This is attributed to the increase in the adoption of advanced conventional epilepsy devices such as surface electromyography (sEMG) systems and augmentation in demand for better-advanced manufacturing systems.

Segments Overview

The epilepsy devices market is segmented into product, technology, end-user, and region. By product, the market is categorized into conventional and wearable devices, EEG, electrocardiography (ECG), surface electromyography (sEMG), video detection systems, and others. On the basis of technology, the market is segregated into deep brain stimulation, vagus nerve stimulation, responsive neurostimulation, and accelerometry. By end user, the market is classified into hospitals, clinics, and others. Region-wise, the epilepsy devices market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Product Type

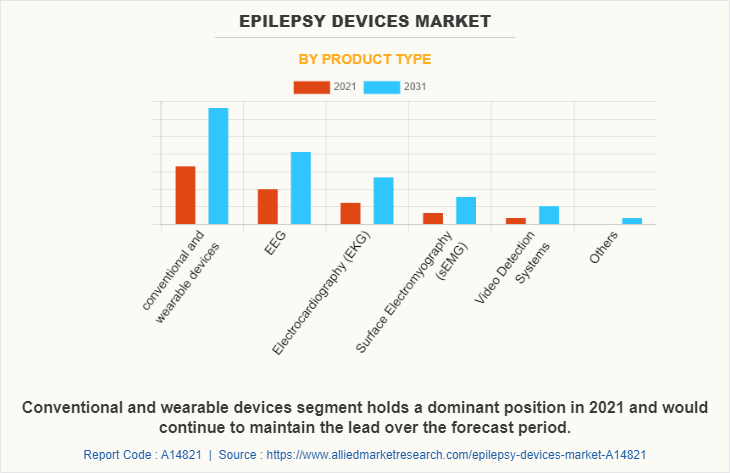

Based on product, the market is segmented into conventional and wearable devices, EEG, electrocardiography (ECG), surface electromyography (sEMG), video detection systems, and others. The conventional and wearable devices segment dominated the global epilepsy devices market in 2021, and is expected to remain dominant throughout the forecast period, owing to its advantages such as easy to carry, outstanding wireless readability, better sensitivity rates in detecting seizures, allow for better mobility and quality of life among patients with epilepsy, and help to track the remote location of the epileptic patients, which is beneficial in cases of a seizure attack, and availability of conventional and wearable devices in the market by various key players.

By Technology

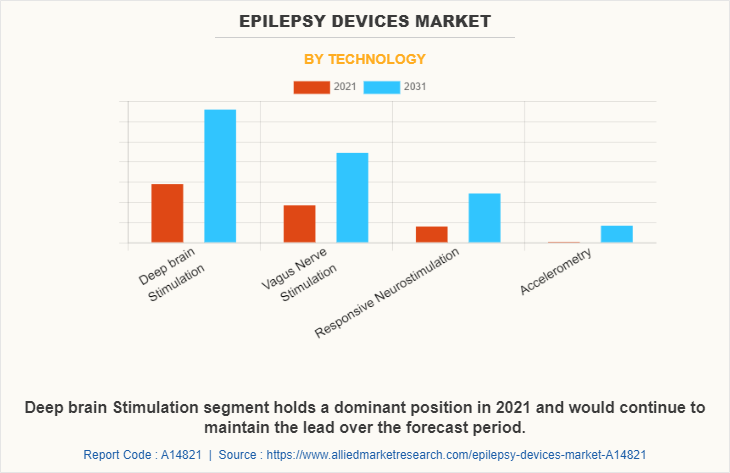

By technology, the epilepsy devices market is segregated into deep brain stimulation, vagus nerve stimulation, responsive neurostimulation, and accelerometry. The deep brain stimulation segment dominated the global market in 2021, and is anticipated to continue this trend during the forecast period. This is attributed to the increase in demand for deep brain stimulators. An increase in the application of deep brain stimulators in the treatment of various neuromuscular diseases such as Parkinson's disease, epilepsy, and dystonia further boosts segmental market growth.

By End User

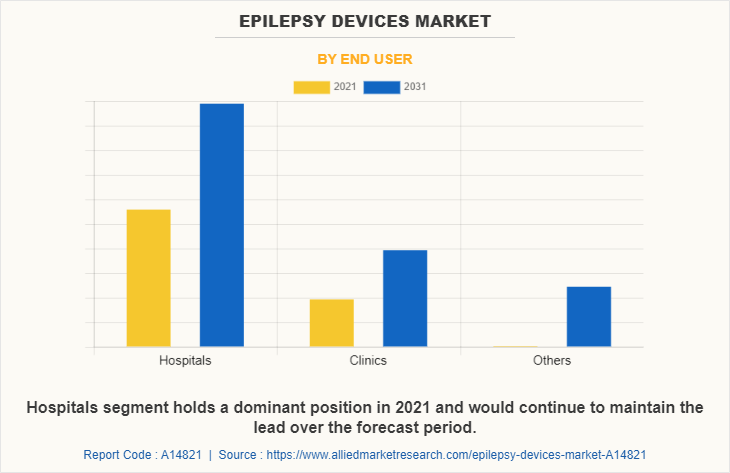

By end user, the Epilepsy Devices Industry is classified into hospitals, clinics, and others. The hospital's segment held the largest Epilepsy Devices Market Share in 2021 and is expected to remain dominant throughout the forecast period, owing to the availability of trained medical staff in hospitals that helps to provide better services to patients and it provides additional benefits of diagnosis and treatment of neuromuscular disorders including epilepsy.

By Region

By region, the epilepsy devices market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major share of the epilepsy devices market in 2021 and is expected to maintain its dominance during the forecast period, owing to the strong presence of several major players, such as Abbott Laboratories, Medtronic plc, and Boston Scientific Corporation, and technological advancement in wearable devices and deep brain stimulators. In addition, the rise in the number of patients undergoing neurosurgical procedures in this region also contributes to the market's growth. Moreover, high purchasing power and a rise in the adoption rate of epilepsy devices are expected to drive market growth.

Asia-Pacific is expected to grow at the fastest rate during the forecast period. This is attributed to the presence of medical device companies in the region as well as the growth in the purchasing power of populated countries, such as China and India. Moreover, the rise in healthcare expenditure and the growing adoption of various epilepsy devices such as surface electromyography, EEG systems, and accelerometers, drive the market growth. Furthermore, the Asia-Pacific is the larger medical devices industry with the availability of raw materials in abundance, which can be easily accessed by manufacturers of epilepsy devices, this, in turn, drives the growth of the market.

Asia-Pacific offers profitable opportunities for key players operating in the epilepsy devices market, thereby registering the fastest growth rate during the forecast period, owing to the rise in prevalence of stroke and epilepsy, increase in disposable incomes, as well as the well-established presence of domestic companies in the region. In addition, rise in contract manufacturing organizations within the region provides great opportunities for new entrants in this region.

Competitive Analysis

Competitive analysis and profiles of the major players in the epilepsy devices market, such as Abbott Laboratories, Boston Scientific Corporation, Cadwell Industries, Compumedics Limited, Empatica, Inc, LivaNova PLC, Masimo Corporation, Medpage Ltd, Medtronic plc, and Natus Medical Incorporated. are provided in this report. There are some important players in the market such as ADInstruments, Medtronic plc, and Biometrics Ltd. Major players have adopted product launches, product approval and agreement as key developmental strategies to improve the product portfolio of the epilepsy devices market.

Some examples of product approval in the market

- Medtronic plc, the leading global provider of advanced delivery technologies, development, and manufacturing of medical devices, has announced the U.S. Food and Drug Administration (FDA) approval of the NIM Vital nerve monitoring system, which enables physicians to identify, confirm, and monitor nerve functions. Launch of the NIM Vital nerve monitoring system will help to strengthen the product portfolio of Medtronic plc.

Product launch in the market

- In January 2022, Cadwell Industries Inc. announces the launch of new electromyography (EMG) product, Pudendal (Pelvic Floor) Stimulating and Recording Electrode used for evaluating the pudendal nerve terminal motor latency (PNTML). The launch of Pudendal Stimulating and Recording Electrode will help the company to strengthen its EMG product portfolio.

Product Innovation

- Neurava LLC, one of the startups in biopharmaceuticals, in November 2021, announced that it is developing a wearable device to monitor and alert the risk of sudden and unexpected death in epilepsy.

Agreement

- Magstim, the global leader in Transcranial Magnetic Stimulation (TMS), on July 2, 2020, announced an agreement to acquire the product portfolio of Electrical Geodesics, Inc. (EGI) from Royal Philips. EGI designs non-invasive multimodal technologies to monitor brain activity and deliver transcranial electrical stimulation in brain research.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the epilepsy devices market analysis from 2021 to 2031 to identify the prevailing epilepsy devices market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the epilepsy devices market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global epilepsy devices market trends, key players, market segments, application areas, and market growth strategies.

Epilepsy Devices Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 1.1 billion |

| Growth Rate | CAGR of 5.1% |

| Forecast period | 2021 - 2031 |

| Report Pages | 234 |

| By Product Type |

|

| By Technology |

|

| By End User |

|

| By Region |

|

| Key Market Players | LivaNova PLC, Masimo Corporation, Natus Medical Incorporated, Cadwell Industries, Medtronic plc, Medpage Ltd, Abbott Laboratories, Empatica, Inc, Compumedics Limited, Boston Scientific Corporation |

Analyst Review

This section provides various opinions of the top-level CXOs in the global epilepsy device industry. In accordance to several interviews conducted, the epilepsy devices market is expected to witness healthy growth with the rise in the demand for minimally invasive surgical devices. In addition, increase in number of geriatric populations suffering from epilepsy leads to high adoption of electromyography (EMG) devices which are expected to significantly boost the growth of the epilepsy devices market. However, high cost of EMG devices restricts the growth of the market.

According to perspective of CXO’s of leading companies in the market, the global epilepsy devices market is expected to exhibit high growth potential attributable to factor such as increase in awareness regarding advantages of epilepsy device.

The CXOs further added that North America is expected to witness the highest growth, in terms of revenue, owing to increase in the knowledge about novel devices are expected to boost the demand for epilepsy device in this region. However, Asia-Pacific is expected to register fastest CAGR during the forecast period due to rise in awareness regarding use of epilepsy devices in diagnosis of neuromuscular diseases, unmet medical demands and increase in public–private investments in the healthcare sector.

The upcoming trends are of Epilepsy Devices Market are rise in prevalence of epilepsy and rise in technological advancement in equipment of epilepsy devices. The rise in prevalence of epilepsy disease, propel high adoption of epilepsy devices for epilepsy monitoring

The forecast period in the report is from 2022 to 2031

North America is the largest regional market for Epilepsy Devices

$1,112.47 million is is the estimated industry size of Epilepsy Devices

Abbott Laboratories, Boston Scientific Corporation, Cadwell Industries, Compumedics Limited, Empatica, Inc, LivaNova plc, Masimo Corporation, Medpage Ltd, Medtronic plc, and Natus Medical Incorporated are the top companies to hold the market share in Epilepsy Devices

The base year for the report is 2021

Yes, Epilepsy Devices market companies are profiled in the report

No, there is value chain analysis provided in the Epilepsy Devices market report

Loading Table Of Content...