Epoxy Curing Agents Market Research, 2034

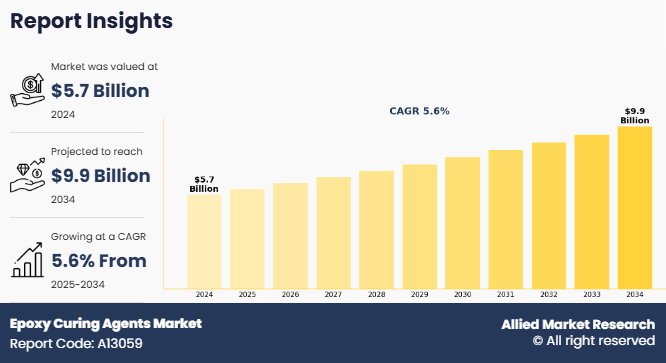

The global epoxy curing agents market size was valued at $5.7 billion in 2024, and is projected to reach $9.9 billion by 2034, growing at a CAGR of 5.6% from 2025 to 2034. The epoxy curing agents market size is witnessing steady growth, primarily driven by the expanding use of epoxy resins across construction, automotive, aerospace, electronics, wind energy, and industrial coatings.

The surge in infrastructure development, increasing demand for lightweight and high-performance materials, and rapid industrialization are significantly boosting the consumption of curing agents such as amines, polyamides, anhydrides, and modified systems. According to the International Energy Agency (IEA, 2024), global construction output is projected to rise by nearly 35% by 2030, supported by large-scale urbanization and government-led infrastructure programs, which directly increases demand for epoxy-based adhesives, coatings, and composites. Similarly, a 2025 study published by the American Composites Manufacturers Association (ACMA) noted that the global composites market surpassed 14 million metric tons in 2023, driven by strong uptake in automotive lightweighting and wind turbine blade production sectors that rely heavily on high-strength, chemically resistant epoxy systems. These strong industry indicators underscore the rising importance of epoxy curing agents as essential enablers of advanced materials performance, thereby supporting consistent epoxy curing agents market growth worldwide.

Epoxy curing agents are specialized chemical formulations used to initiate and control the polymerization of epoxy resins, enabling them to achieve the required strength, rigidity, thermal stability, and chemical resistance. They play a vital role in enhancing the mechanical performance and durability of epoxy systems across applications such as adhesives, coatings, composites, electrical encapsulation, and structural components. With industries increasingly demanding high-performance materials, curing agents have become essential in sectors like construction, automotive, aerospace, marine, and electronics, where reliability and long-term performance are critical. Moreover, the shift toward sustainable and high-solids coatings, growing preference for bio-based and low-VOC curing chemistries, and continuous innovation in fast-curing and specialty formulations are supporting the expansion of the market. In addition, the rising global focus on lightweighting, corrosion protection, and energy-efficient manufacturing is driving the adoption of advanced epoxy systems. Thus, the epoxy curing agent market is well-positioned for sustained growth as it continues to address evolving material performance needs across multiple high-value industries.

Key Takeaways

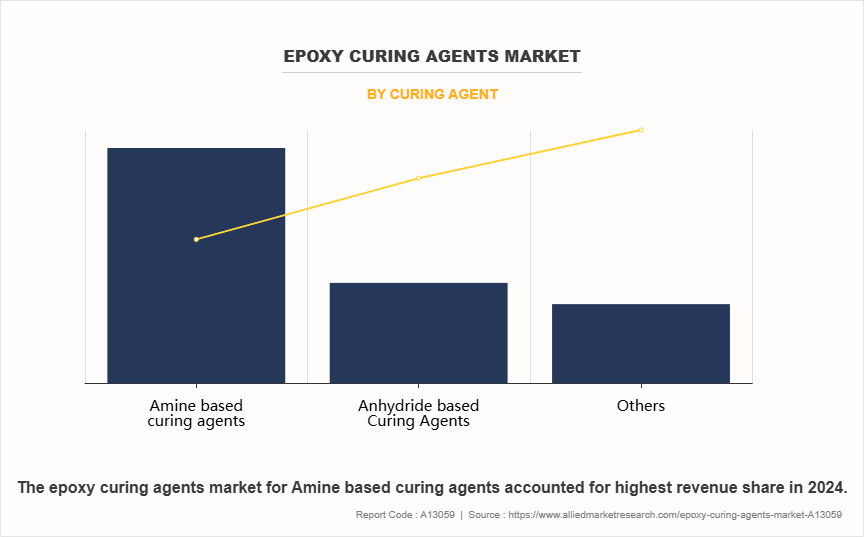

- On the basis of curing agent, the Amine based curing agents segment dominated the market in terms of revenue in 2024. However, the anhydride based curing agents segment is anticipated to grow at the fastest CAGR during the forecast period.

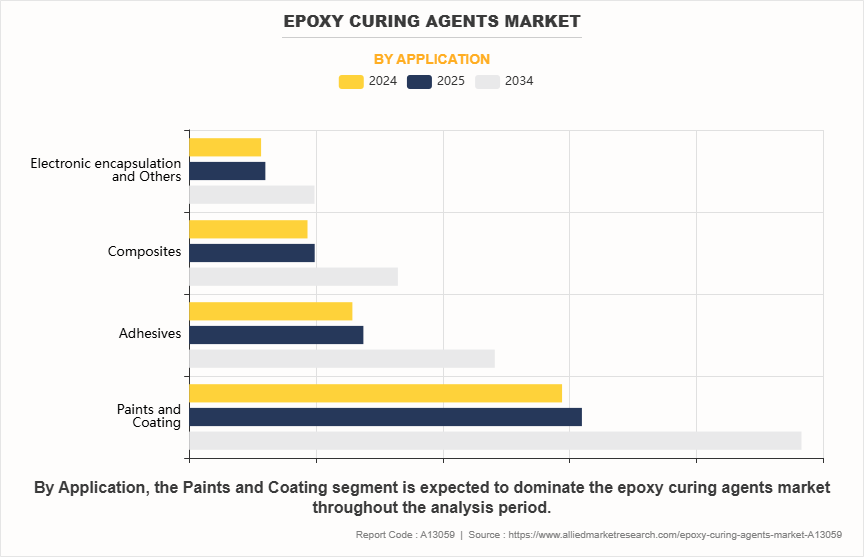

- On the basis of application, the paints and coating segment dominated the market in terms of revenue in 2024. However, the adhesive segment is anticipated to grow at the fastest CAGR during the forecast period.

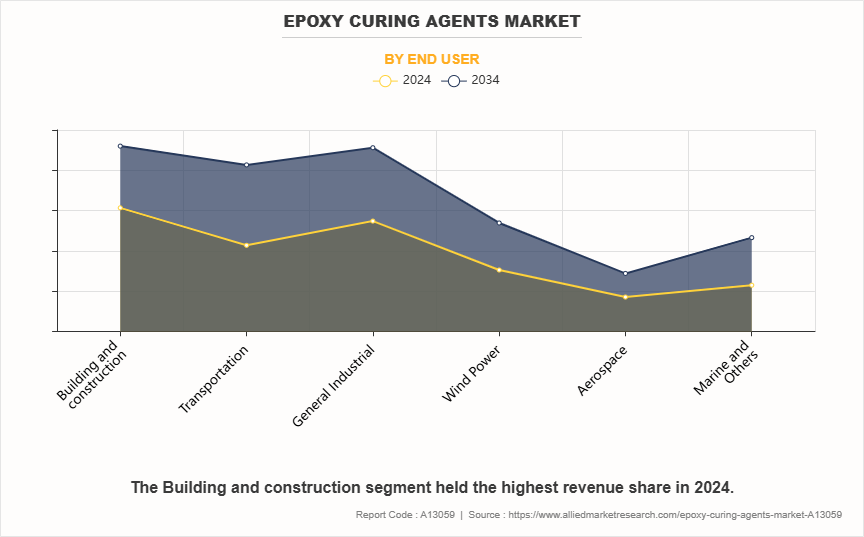

- On the basis of end user, the building and construction segment dominated the market in terms of revenue in 2024. However, the marine and others segment is anticipated to grow at the fastest CAGR during the forecast period.

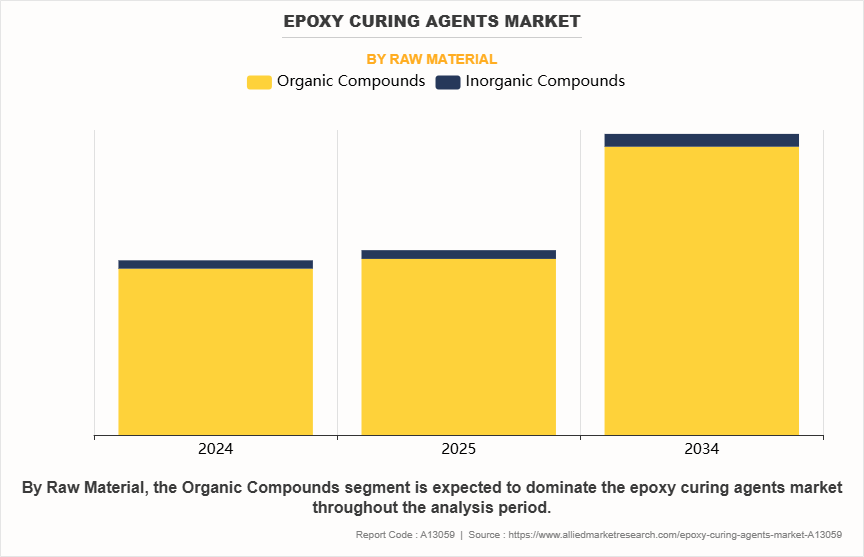

- On the basis of raw material, the organic compounds segment dominated the market in terms of revenue in 2024 and is anticipated to grow at the fastest CAGR during the forecast period.

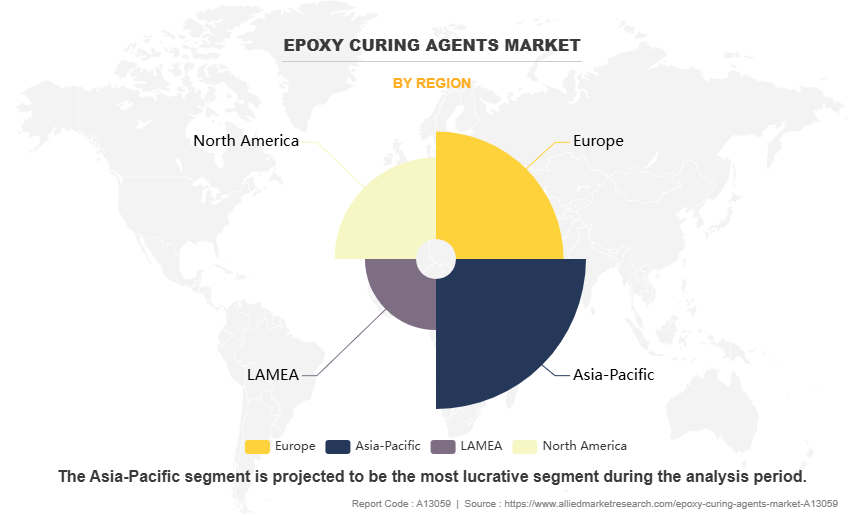

- Region-wise, Asia-Pacific generated the largest revenue in 2024 and is anticipated to grow at the highest CAGR during the forecast period.

Market Dynamics

Strong industrial demand driven by infrastructure growth, lightweight materials adoption, and high-performance composite applications is fueling the epoxy curing agent market globally. Increasing usage of epoxy systems in construction, automotive, electrical and electronics, aerospace, and wind energy sectors is accelerating the demand for advanced curing agents. Rapid urbanization and the expansion of residential and commercial building projects are supporting the use of epoxy-based coatings, adhesives, and sealants. In addition, global shift toward corrosion-resistant and chemically stable materials, particularly in harsh environmental conditions, is further strengthening epoxy consumption. In addition, the growing preference for high-strength and durable composite materials in electric vehicle components, aircraft structures, and wind turbine blades is contributing to the rising demand for amine-based and anhydride curing agents. Sustainability trends are also influencing market growth, as industries increasingly adopt low-VOC and bio-based curing agents to meet environmental and regulatory standards.

Despite strong demand, the market faces several limitations. Volatility in raw material prices, particularly petrochemical derivatives used in polyamines and anhydrides, creates cost unpredictability for manufacturers. Environmental and occupational safety regulations add additional complexity, because certain traditional curing agents, especially aromatic amines, have toxicity concerns that require reformulation and safety measures. Variations in environmental regulations across regions also create challenges related to product standardization and global commercialization. The technical complexity of epoxy formulations poses another restriction. Incorrect mixing ratios or curing conditions can lead to compromised mechanical properties, which limits adoption among small and medium enterprises that lack technical expertise. Slower curing times of certain agents in low-temperature conditions also reduce productivity in industries such as construction and automotive repair.

The epoxy curing agents industry presents substantial growth opportunities driven by advancements in materials science and sustainability-focused product development. Increasing investments in renewable energy infrastructure, particularly wind energy, are expected to significantly boost the adoption of high-performance epoxy curing agents for turbine blade production. Asia-Pacific, led by China, India, and Southeast Asia, continues to offer strong expansion prospects because of rapid industrialization, construction growth, and the expansion of electronics manufacturing. The development of fast-curing, low-emission, and bio-based curing agents is creating new opportunities for market differentiation, as industries increasingly seek environmentally friendly and regulatory-compliant solutions. Rising demand for lightweight vehicles and electric mobility is stimulating innovation in structural adhesives and composite materials. In addition, advancements in digital manufacturing, including automated composite processing and 3D printing, are likely to enhance the adoption of next-generation epoxy curing technologies across various industrial sectors.

Segmental Overview

The epoxy curing agents industry is segmented into curing agent, application, end user, raw material, and region. On the basis of curing agent, it is classified into amine based curing agents, anhydride based curing agents, and others. The amine based curing agents are further categorized into aliphatic amines, cycloaliphatic amines, aromatic amines, polyamides, and others. On the basis of application, the market is segregated into paints and coatings, adhesives, composites, electronic encapsulation and others. On the basis of end user, the market is categorized into building & construction, transportation, general industrial, wind power, aerospace, marine & others. On the basis of raw material, it is bifurcated into organic compounds and inorganic compounds. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

By Curing Agent

On the basis of the type, the amine based curing agents segment accounted for the largest share in terms of revenue in 2024 due to their fast curing capability, strong adhesion, and widespread use across construction, electronics, and composite applications. They also offer high mechanical strength and chemical resistance, making them the preferred choice in most industrial epoxy systems.

However, the anhydride based curing agents segment is expected to register the highest CAGR during the forecast period, owing to increasing demand for high-temperature resistance, low viscosity formulations, and superior electrical insulation properties, particularly in electronics, electrical components, and advanced composites.

By Application

On the basis of application, the paints and coating segment accounted for the largest share in terms of revenue in 2024, owing to rising infrastructure development, industrial maintenance needs, and increased demand for corrosion-resistant epoxy coatings in marine, automotive, and construction industries.

However, the adhesive segment is expected to register the highest CAGR during the forecast period, fueled by the growing adoption of lightweight materials, structural bonding in automotive and aerospace sectors, and the shift toward high-performance adhesives as an alternative to mechanical fasteners.

By End User

On the basis of end user, the building and construction segment accounted for the largest epoxy curing agents market share in terms of revenue in 2024, owing to the widespread use of epoxy curing agents in flooring, civil engineering, protective coatings, and repair applications driven by urbanization and large-scale infrastructure projects.

However, the marine and others segment is expected to register the highest CAGR during the forecast period, propelled by increasing demand for high-durability and anti-corrosion epoxy systems for shipbuilding, offshore structures, and water-resistant composite applications.

By Raw Material

On the basis of raw material, the organic compounds segment accounted for the largest epoxy curing agents market share in terms of revenue in 2024 and is expected to register the highest CAGR during the forecast period, owing to their compatibility with diverse epoxy formulations, superior curing efficiency, and broad industrial adoption in coatings, adhesives, electronics, and composite applications.

By Region

Region-wise, Asia-Pacific dominated the market share in 2024 and is expected to register the highest CAGR during the epoxy curing agents market forecast period, owing to rapid industrialization, large-scale manufacturing expansion, increasing construction activities, and growing electronics and automotive production across China, India, and Southeast Asian countries.

Competition Analysis

The major companies profiled in the report are Mitsubishi Chemical Group Corporation, Evonik Industries AG, Hexion Holdings LLC, Huntsman International LLC, BASF SE, Olin Corporation, Aditya Birla Chemicals Limited., Atul Ltd., Hexcel Corporation, Park Aerospace Corporation. The key players operating in the market have adopted product launch as their key strategies to expand their product portfolio.

Recent Developments in Epoxy Curing Agent Industry

- In June 2025, Aditya Birla Group announced the expansion of its U.S. Advanced Materials business with the acquisition of Cargill Incorporated's 17-acre specialty chemical manufacturing facility in Dalton, Georgia. The acquisition continues Aditya Birla's expansion in the U.S. manufacturing sector, a key aspect of Aditya Birla's growth strategy, which now totals over $15 billion in investment.

- In March 2025, BASF and Sika launched epoxy hardener for sustainable solutions in the construction industry.

- In September 2024, Evonik added two new polyamide-based epoxy curing agents for the Americas region, Ancamide 2853 and Ancamide 2865, to its comprehensive curing agent portfolio.

- In April 2024, Evonik launched a new fast-curing and UV-resistant epoxy curing agent, Ancamine 2880, that offers excellent mechanical properties, abrasion resistance, and color stability throughout its service life.

- In April 2024, Evonik added Ancamine 2844, a novel epoxy cure hardener designed for plural component spray applications, to its curing agent portfolio.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the epoxy curing agents market analysis from 2024 to 2034 to identify the prevailing epoxy curing agents market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the epoxy curing agents market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global epoxy curing agents market trends, key players, market segments, application areas, and market growth strategies.

Epoxy Curing Agents Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 9.9 billion |

| Growth Rate | CAGR of 5.6% |

| Forecast period | 2024 - 2034 |

| Report Pages | 384 |

| By Curing Agent |

|

| By Application |

|

| By End User |

|

| By Raw Material |

|

| By Region |

|

| Key Market Players | Mitsubishi Chemical Group Corporation., Hexcel Corporation, Hexion Inc., Aditya Birla Group, Park Aerospace Corporation, Olin Corporation, Huntsman Corporation, BASF SE, Evonik Industries AG, Atul Ltd. |

Analyst Review

The market for epoxy curing agents has witnessed steady growth driven by the rising demand for high-performance epoxy systems across construction, automotive, electrical and electronics, aerospace, and industrial coatings applications. The expanding infrastructure activities globally, particularly the development of smart cities, commercial buildings, and industrial facilities have significantly boosted the adoption of epoxy systems requiring reliable curing agents to enhance strength, durability, and chemical resistance.

The shift toward lightweight and energy-efficient materials, especially in automotive and aerospace industries, has increased the use of epoxy composites, directly supporting the demand for advanced curing agents. Additionally, growing focus on corrosion protection in marine and industrial environments has further accelerated product consumption. The increasing adoption of epoxy floor coatings in commercial and industrial settings, driven by the need for enhanced aesthetics and long-lasting performance, also remains a major growth contributor.

Technological advancements such as low-VOC, faster-curing, moisture-tolerant, and bio-based curing agents are gaining strong traction as manufacturers and end users prioritize sustainability and operational efficiency. Innovations in amine-based, anhydride, and phenalkamine curing systems are helping improve mechanical properties, curing speed, and temperature resistance, making them more appealing for high-performance applications. Favorable government regulations supporting green construction chemicals and environmentally compliant materials are also aiding market penetration.

Asia-Pacific accounted for the largest revenue share in 2024 and is anticipated to record the highest CAGR during the forecast period. This growth is supported by rapid industrialization, expanding construction activities, and strong electronics manufacturing hubs in China, India, South Korea, and Southeast Asia. The region also benefits from rising investments in infrastructure modernization and increasing demand for technologically advanced epoxy formulations. Leading players such as Huntsman, BASF, Cardolite, and Aditya Birla Chemicals continue to strengthen their regional presence through capacity expansions, product innovations, and strategic partnerships.

The Epoxy Curing Agents Market is dominated by leading players such as Hexion, BASF SE, Evonik Industries, Huntsman Corporation, all of which hold significant global market shares due to their strong product portfolios and technological capabilities. These companies are key suppliers of advanced amine, polyamide, anhydride and eco-friendly bio-based curing agents used across coatings, adhesives, composites and electronics applications. In addition, regional leaders like Atul Ltd., and Mitsubishi Chemical further strengthen market competition, especially across the rapidly growing Asia-Pacific region.

The epoxy curing agents market was valued at $5,727.14 million in 2024 and is estimated to reach $9,872.03 million by 2034, exhibiting a CAGR of 5.6% from 2025 to 2034.

Asia-Pacific is the largest regional market for Epoxy Curing Agents, primarily due to rapid industrialization, expanded infrastructure development and strong growth in construction, automotive, electronics and marine industries. The region’s large manufacturing base, rising investments in industrial coatings and increasing demand for high-performance materials further strengthen its dominant market position.

In the Epoxy Curing Agents Market, paints and coatings represent the leading application segment. This dominance is driven by the widespread use of epoxy-based coatings in construction, automotive, marine and industrial sectors due to their superior adhesion, corrosion resistance, chemical durability and long-term performance across diverse environmental conditions.

The global Epoxy Curing Agents Market is witnessing growing adoption of eco-friendly, low-VOC and bio-based curing agents as industries shift toward sustainable and regulatory-compliant materials. Advancements in high-performance formulations—such as rapid-curing, hybrid and nano-enhanced agents—are also gaining traction to meet demand from electronics, automotive and aerospace sectors. Additionally, the rise in renewable energy and infrastructure projects is driving the need for durable, high-strength epoxy systems worldwide.

Loading Table Of Content...

Loading Research Methodology...