Equipment Finance Services Market Research, 2032

The global equipment finance services market was valued at $1.2 trillion in 2022, and is projected to reach $3.1 trillion by 2032, growing at a CAGR of 9.7% from 2023 to 2032.

Equipment financing is a financing method that provides funds to business owners to purchase new machinery or modify existing machinery. Both small and large businesses can benefit from equipment financing. Business owners and enterprises availing equipment loans also enjoy tax benefits. The interest rate, loan amount, and loan period may vary from bank to bank. Financing leases, hire-purchase agreements, operational leases, and others offer more alternatives related to equipment leasing.

Key Takeaways

Key Takeaways

- By service type, the equipment loan segment held the largest share in the equipment finance services market in 2022.

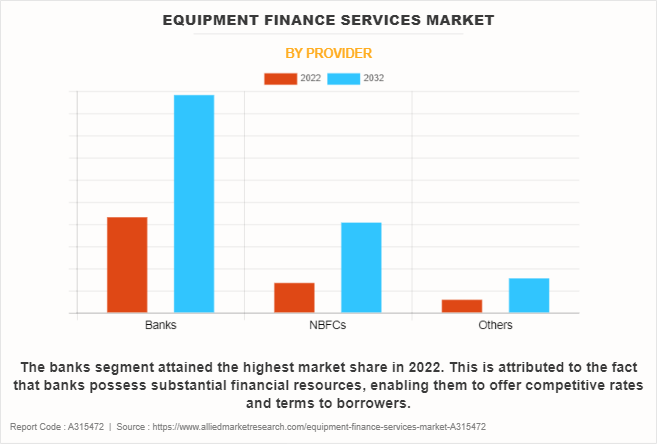

- By provider, the banks segment held the largest market share in 2022.

- By application, the healthcare segment is expected to witness the fastest growth during the forecast period.

- Region-wise, North America held the largest equipment finance services market share in 2022. However, Asia-Pacific is expected to witness the highest CAGR during the forecast period.

The equipment finance services market size is influenced by technological advancements that play an important role in shaping this landscape, with innovations such as AI, blockchain, and IoT revolutionizing asset management and financing processes. These technologies enhance efficiency, reduce operational costs, and facilitate better risk management, thereby attracting both providers and consumers towards equipment finance solutions. Furthermore, economic conditions such as interest rates, GDP growth, and business confidence influence investment decisions and demand for equipment financing. In addition, evolving customer preferences and demands for flexible financing options and value-added services drive providers to adapt their offerings to meet changing market needs, fostering competition and innovation.

However, regulatory compliance poses a significant challenge, with complex and evolving legal frameworks governing lending practices, risk management, and customer protection hindering the growth of equipment finance services market. The economic uncertainties such as geopolitical tensions and trade disputes, create volatility in financial markets, impacting investment decisions and overall market stability.

On the contrary, the growing equipment finance services market trend towards sustainability and environmental consciousness presents an avenue for equipment finance providers to offer green financing solutions, leading to the rising demand for eco-friendly equipment and practices. Moreover, partnerships and collaborations across industries enable equipment finance companies to leverage complementary expertise and resources, expanding their market reach and enhancing their service offerings to meet diverse customer needs in the upcoming years.

The report focuses on growth prospects, restraints, and trends of the equipment finance services market forecast. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the equipment finance services market outlook.

Segment Review

The equipment finance services market is segmented into type, provider, application, and region. On the basis of type, the market is categorized into equipment loan, equipment lease, and others. On the basis of provider, the market is segmented into banks, NBFCs, and others. On the basis of application, the equipment finance services market is differentiated into transportation, aviation, it and telecom, manufacturing, healthcare, construction, and others. On the basis of region, the equipment finance services market is analyzed across North America (the U.S., and Canada), Europe (the UK, Germany, France, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, and rest of Asia-Pacific), Latin America (Brazil, Argentina, and rest of Latin America), and Middle East and Africa (GCC Countries, South Africa, and rest of Middle East and Africa).

By provider, the banks segment acquired a major share in the equipment finance services market in 2022. This is attributed to the fact that banks possess substantial financial resources, enabling them to offer competitive rates and terms to borrowers. Furthermore, their established reputation and credibility inspire trust among customers, attracting businesses seeking reliable financing partners. Bank’s extensive networks and distribution channels allow them to reach a broader customer base, including small and medium-sized enterprises (SMEs) and large corporations alike. However, the NBFCs segment is anticipated to be the fastest growing segment during the forecast period, owing to their agile decision-making processes and streamlined operations enabling quicker loan approvals and disbursements, appealing to customers seeking expedited financing.

Region-wise, North America dominated the equipment finance services market in 2022. This is attributed to the technological advancements that are driving demand for updated equipment across various industries, necessitating flexible financing options to facilitate equipment acquisition in the region. However, Asia-Pacific is considered to be the fastest-growing region during the forecast period. This is attributed to the rapid industrialization and urbanization in countries such as China, India, and Southeast Asian nations, fueling demand for modern equipment across various sectors, including manufacturing, construction, and infrastructure development.

Competition Analysis

Competitive analysis and profiles of the major players in the equipment finance services market include The PNC Financial Services Group, Inc., Keystone Equipment Finance Corp., JPMorgan Chase & Co., Crest Capital, First-Citizens Bank & Trust Company, OnDeck, Bank of America Corporation, Wells Fargo, Balboa Capital, and Smarter Finance USA. These players have adopted various strategies to increase their market penetration and strengthen their position in the equipment finance services industry.

Recent Developments in the Equipment Finance Services Market

- In February 2023, First-Citizens Bank & Trust Company (First Citizens Bank) announced that its vendor equipment financing business will now be known as First Citizens Bank Equipment Finance to better communicate its core mission to vendors, customers, and prospects.

- In April 2022, MidCap Business Credit increased its senior credit facility with Wells Fargo Capital Finance to $200 million. This upsize enables MidCap to support the growth of its existing asset-based lending business and support the launch of its equipment finance vertical, MidCap Equipment Finance, which focuses on providing equipment leases and loans between $2 million and $20 million to middle-market customers in the U.S. and Canada.

- In May 2022, OnDeck, part of Enova, announced a growing list of strategic partnerships, including SoFi Technologies, Inc. and LendingTree, specifically aimed at helping small businesses around the country. These partnerships bring together best-in-class digital lending products and FinTech offerings with OnDeck's Artificial Intelligence (AI) and Machine Learning (ML) expertise, giving small businesses more options for obtaining effortless access to working capital that supports their growth.

- In January 2022, Commercial Credit, Inc. (CCI), a Charlotte-based equipment and accounts receivable finance company and the parent company of Commercial Credit Group Inc. (CCG) and Commercial Funding Inc., acquired Keystone Equipment Finance Corp. that provides small-ticket equipment financing specializing in the transportation and construction related industries.

Market Landscape and Trends

According to the 2023 survey of the Equipment Leasing and Finance Association (ELFA), which records economic activity from 25 companies, overall new business volume in the equipment finance industry increased 11% year on year in September 2022 and 16% from August 2021. Furthermore, ELFA discovered that the rate of late or delayed payments in September 2022 was lower than 2021. These trends show that, despite the chances of a recession, businesses are continuing to engage in new capital expenditures. They might not have insufficient cash flow to increase payments that remain on new equipment or software.

In November 2021, the Infrastructure Investment and Jobs Act bipartisan bill was passed to improve infrastructure in the U.S. The funds allocated toward these investments have the potential to result in tremendous increase in equipment leasing for trucks, construction equipment, and freight and passenger rail equipment.

Top Impacting Factors

Customer Preferences and Demands for Flexible Financing Options

Evolving customer preferences and demands for flexible financing methods and value-added services are driving the equipment finance services market growth by reshaping the industry landscape to better meet the diverse needs of businesses. Increasingly, customers seek tailored financing solutions that align with their specific requirements, whether it's leasing, asset-based lending, or other alternative financing models.

Moreover, customers prioritize flexibility in terms of repayment schedules, lease durations, and end-of-term options to accommodate fluctuations in business cycles and cash flows. Furthermore, there is a growing demand for value-added services such as equipment maintenance, insurance, and asset tracking, which enhance the overall value proposition of equipment financing solutions, driving sustained growth in the equipment finance services market.

Economic Uncertainties

Economic uncertainties, such as geopolitical tensions and trade disputes, introduce volatility into financial markets, thereby impacting investment decisions and overall stability within the equipment finance services market. Geopolitical tensions and trade disputes can lead to shifts in global trade patterns, imposition of tariffs, and disruptions to supply chains, all of which can adversely affect business confidence and economic growth. Heightened uncertainty prompts businesses to adopt a more cautious approach towards investment, delaying or scaling back equipment procurement plans. Moreover, fluctuating currency values and interest rates stemming from geopolitical uncertainties can increase borrowing costs and alter financing terms, further deterring businesses from making capital investments, and ultimately impacting market stability and growth.

Technological Advancements

Technological advancements are significantly driving the growth of the equipment finance services market by revolutionizing the way equipment is acquired, managed, and financed. Innovations such as artificial intelligence, machine learning, and blockchain are streamlining processes, enhancing efficiency, and reducing operational costs for both lenders and borrowers. For instance, AI-powered algorithms can analyze vast amounts of data to assess creditworthiness quickly and accurately, expediting loan approval processes. In addition, digital platforms and mobile applications enable seamless communication and transaction management between lenders and borrowers, improving customer experience and accessibility.

Moreover, technologies such as IoT and telematics enable real-time monitoring of equipment performance and usage, reducing risks for lenders and providing valuable insights for borrowers. Therefore, these technological advancements optimize operational efficiency as well as foster innovation, expanding the scope and reach of equipment finance services in today's digital era.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the equipment finance services market analysis from 2022 to 2032 to identify the prevailing equipment finance services market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- The Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the equipment finance services market segmentation assists to determine the prevailing equipment finance services market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as equipment finance services market trends, key players, market segments, application areas, and market growth strategies.

Equipment Finance Services Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 3.1 trillion |

| Growth Rate | CAGR of 9.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 287 |

| By Type |

|

| By Provider |

|

| By Application |

|

| By Region |

|

| Key Market Players | Crest Capital, The PNC Financial Services Group, Inc., Bank of America Corporation, Keystone Equipment Finance Corp., Wells Fargo, Smarter Finance USA, Balboa Capital, JPMorgan Chase & Co., First-Citizens Bank & Trust Company, OnDeck |

Analyst Review

There are infrastructure-related bills that could drive equipment demand, hence, fueling the growth of the equipment finance services market in the coming years. For instance, in November 2021, the Infrastructure Investment and Jobs Act bipartisan bill was passed to improve infrastructure in the U.S. The funds allocated toward these investments have the potential to result in tremendous increase in equipment leasing for trucks, construction equipment, and freight and passenger rail equipment.

Key players in the equipment finance services market adopt partnership, acquisition, and product launch, as their key development strategies to sustain their growth in the market. For instance, in January 2022, Commercial Credit, Inc. (CCI), a Charlotte-based equipment and accounts receivable finance company and the parent company of Commercial Credit Group Inc. (CCG) and Commercial Funding Inc., acquired Keystone Equipment Finance Corp., which provides small-ticket equipment financing specializing in the transportation and construction related industries. Therefore, such strategies adopted by key players propel the growth of the equipment finance services market.

According to the 2022 Equipment Leasing & Finance Industry Horizon Report, 79.3% of survey respondents who acquired equipment or software in 2021 used at least one form of financing to do so (i.e., lease, secured loan, or line of credit). The most common payment method used by businesses to acquire equipment and software in 2021 was leasing (26%), followed by secured loans (19%), and lines of credit (17%).

The key players in the equipment finance services market include The PNC Financial Services Group, Inc., Keystone Equipment Finance Corp., JPMorgan Chase & Co., Crest Capital, First-Citizens Bank & Trust Company, OnDeck, Bank of America Corporation, Wells Fargo, Balboa Capital, and Smarter Finance USA. These players have adopted numerous strategies to increase their marketplace penetration and strengthen their position in the equipment finance services market.

Partnership and acquisition are the key strategies opted by the operating companies in this market.

The key players operating in the global equipment finance services market include The PNC Financial Services Group, Inc., Keystone Equipment Finance Corp., JPMorgan Chase & Co., Crest Capital, First-Citizens Bank & Trust Company, OnDeck, Bank of America Corporation, Wells Fargo, Balboa Capital, and Smarter Finance USA.

North America is the largest regional market for equipment finance services.

The size of the global equipment finance services market was valued at $293.64 billion in 2022 and is projected to reach $790.22 billion by 2032.

Loading Table Of Content...

Loading Research Methodology...