Equity Management Software Market Overview

The global equity management software market was valued at USD 517.8 million in 2022, and is projected to reach USD 1,900 million by 2032, growing at a CAGR of 14.3% from 2023 to 2032. Rising demand for efficient equity processes, regulatory compliance, stakeholder transparency, and increased adoption of equity-based compensation schemes by corporations are contributing to the growth of the market.

Market Dynamics & Insights

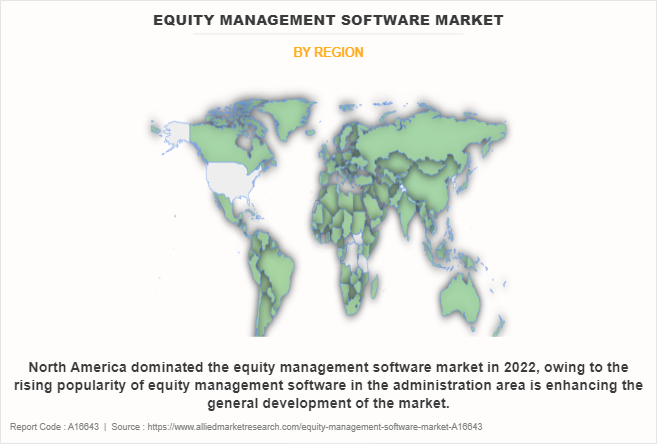

- The equity management software industry in North America held a significant share of 35% in 2022.

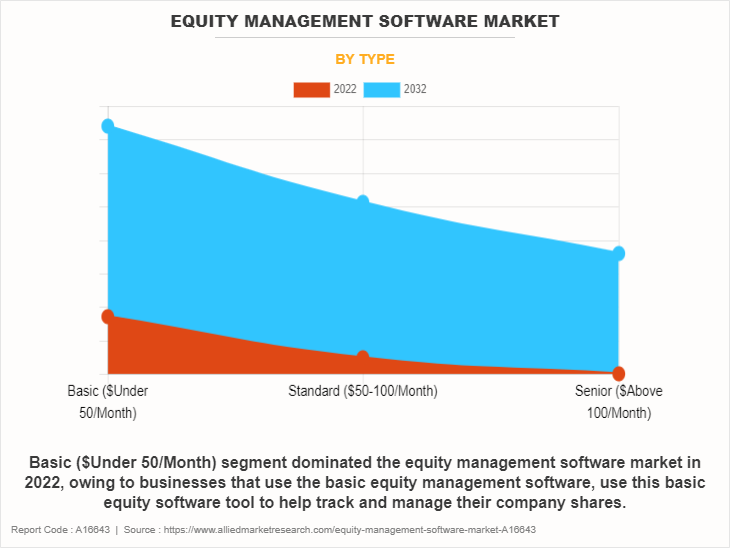

- By type, the basic ($under 50/month) segment accounted for the largest equity management software market share in 2022, accounting for the revenue share of 53%

- By application, the private corporation segment is one of the dominating segment in the market, accounting for the revenue share of 32% in 2022.

- By enterprise size, the large enterprise segment dominated the industry in 2022 and accounted for the largest revenue share of 71%.

Market Size & Future Outlook

- 2022 Market Size: USD 517.75 Million

- 2032 Projected Market Size: USD 1,900 Million

- CAGR (2023-2032): 14.3%

- North America: Dominated the market in 2022

- Asia Pacific: Fastest growing market

What is Meant by Equity Management Software

Equity management is the process of creating and managing owners in a company. A variety of features and functionalities offered by these software programs let customers monitor, assess, and manage their stock holdings. Software for equities management has developed and grown as a result of various trends and factors. Initially, having strong tools to manage equity holdings has become important to investors due to the growing complexity of financial markets and the abundance of investment possibilities. To assist users in making wise decisions, equity management software offers a centralized platform for tracking and evaluating investments. In addition, the landscape of equity management is now significantly changed due to the development of technology and the accessibility of real-time data. With the ability to interact with several data sources, software solutions may now give customers access to the most recent financial reports, news, and market data.

Surge in growing necessity of real-time analytics, increased usage of equity management software in large & medium-sized enterprises, computerized procedure helps organizations to stay organized and backed up by professional advisors. Moreover, growing trend of digitization and technological innovation and developing software that can provide more customizable features are expected to provide lucrative opportunities for the growth of the market during the forecast period. On the contrary, potential system crashes and reduced physical audits limit the growth of the equity management software market.

Key Takeaways

- By type, the basic ($under 50/month) segment accounted for the largest equity management software market share in 2022.

- By enterprise size, the large enterpses segment accounted for the largest equity management software market share share in 2022.

- By application, the private corporation segment accounted for the largest equity management software market share in 2022.

- Region wise, North America generated the highest revenue in 2022.

Equity Management Software Market Segment Review

The equity management software market is segmented on the basis of type, enterprise size, application, and region. By type, it is segmented into basic (under $50/month), standard ($50-100/month), and senior (above $100/month). Based on enterprise size, it is segregated into large enterprises and small & medium-sized enterprises. By application, the market is divided into private corporation, start-ups, listed company, and others. By region, it is analyzed across Asia-Pacific, Europe, North America, and LAMEA.

The report focuses on growth prospects, restraints, and analysis of the equity management software trend. The study provides Porter‐™s five forces analysis to understand the impact of numerous factors, such as the bargaining power of suppliers, the competitive intensity of competitors, the threat of new entrants, the threat of substitutes, and the bargaining power of buyers on the market share.

Based on type, the basic ($under 50/month) segment dominated the market share in 2022 and, is expected to maintain its dominance during the equity management software market forecast period, as businesses that use the basic equity management software, use this basic equity software tool to help track and manage their company shares, which is further expected to propel the segment growth in the global market. However, the senior ($above 100/month)segment is expected to exhibit the highest growth during the forecast period, as the senior (above $100/month) equity management software provides an all-in-one platform, which allows companies to easily manage shareholder communication, organize meetings, and generate reports..

Region-wise, North America attained the highest equity management software market growth in 2022. This is attributed to the rising popularity of equity management software in the administration area is enhancing the general development of the market in North America. It has been observed that the interest for the equity management software has been expanding from large-size organizations as equity management software builds effectiveness. However, Asia-Pacific is expected to exhibit the highest growth during the forecast period. This is attributed to the expansion of advanced technologies such as digital financial systems, cloud computing, and others, which further contribute to the growth of global equity management software market.

Competition Analysis

The key players operating in the equity management software industry include Carta, Certent, Capdesk, Altvia Solutions, LLC, Preqin Solutions, Gust, Ledgy, Eqvista, Euronext, and Deep Pool Financial Solutions Limited. The report highlights the strategies of the key players to improve the market share, equity management software market outlook and sustain competition.

What ar ethe recent developments in the Equity Management Software Industry

- In June 2023, beqom launched an innovative solution for managing pay equity in large organizations. With the rise of equal pay regulations worldwide and the growing importance of fair and competitive compensation to meet talent needs, beqom's new software aims to address pay inequities effectively. Similar strategies by the market players operating at a global and regional level are expected to help the market to witness significant of equity management software market growth during the forecast period.

- In November 2023, Lunate raised $50 billion of assets under management for developing a customized wealth management technology platform for wealth and asset managers in the Middle East and North Africa (MENA). The new financial technology company meet the growing demand of equity management platform in the Middle East from wealth and asset managers, private banks, and investment houses, for an end-to-end digital solution that delivers a range of services, including client onboarding, financial planning, portfolio construction, trading and rebalancing, risk management reporting, and analytics.

What are the Top Impacting Factors in Equity Management Software Market

Growing necessity of real-time analytics

The equity management software market is significantly growing, owing to rise in need for real-time analytics solutions. The ability to collect, process, and analyze data in real-time and deliver current, useful insights to organizations is known as real-time analytics. Real-time analytics helps businesses to manage equity by monitoring and analyzing equity plans, grants, and transactions in real-time. This facilitates better decision-making and management of equity-related activities. The capability of real-time tracking and monitoring of equities performance and valuation is one of the main advantages of real-time analytics in equity management software. As a result, businesses are able to see their stock holdings' current worth clearly and accurately. Organizations may use real-time analytics to make educated decisions about equity-based incentives and employee compensation by receiving fast information on the value of stock options and equity grants. This enables businesses to modify their equity plans in response to changing equity management software market conditions.

In addition, firms can quickly detect and handle any possible risks or problems related to their stock management procedures owing to real-time analytics. Companies promptly detect any inconsistencies, mistakes, or compliance problems by keeping an eye on equity-related operations in real-time and implementing prompt corrective measures. This aids businesses in maintaining the integrity and authenticity of their equity data while averting unfavorable outcomes such as fines for noncompliance or harm to their reputation. Furthermore, real-time analytics gives businesses important information into the effectiveness and outcomes of their grants and equity initiatives. Organizations may optimize their equity management strategies by identifying trends, patterns, and correlations through the analysis of real-time data.

Increased usage of equity management software in large and medium-sized enterprises

Equity management is the process of creating and managing proprietors for large & medium-sized organizations. Equity management software serves as an ideal tool to manage a company‐™s equity, and is increasingly adopted by large- & medium-sized organizations. It involves tracking and recording changes in the ownership, renewing reports, interacting with stakeholders, advising senior management team, and remaining compliant. Furthermore, it is intended to assist businesses in managing the revenues. It alleviates the difficulty faced in using spreadsheets to manage corporate capitalization tables as well as the time-consuming paperwork in enterprises. In addition, the equity management software market has developed tremendously due to quickly changing requirements of businesses throughout the globe. Thus, increase in usage of equity management software in large & medium-size corporations is supporting the market growth, globally.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the equity management software market size, segments, current trends, estimations, and dynamics of the equity management software market analysis from 2022 to 2032 to identify the prevailing equity management software market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the equity management software market segmentation assists to determine the prevailing equity management software market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global equity management software market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the equity management software market players.

- The report includes the analysis of the regional as well as global equity management software market trends, key players, market segments, application areas, and market growth strategies.

Equity Management Software Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 1.9 billion |

| Growth Rate | CAGR of 14.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 248 |

| By Type |

|

| By Enterprise Size |

|

| By Application |

|

| By Region |

|

| Key Market Players | DEEP POOL Financial Solutions Limited, Eqvista, Carta, Preqin Solutions, Euronext, Certent, ALTVIA SOLUTIONS, LLC, Ledgy, Capdesk, Gust |

Analyst Review

The market for equity management software is expanding significantly primarily owing to the growing need for streamlined and effective equity management procedures. Organizations may ensure regulatory compliance and stakeholder transparency by using equity management software to handle equity plans, grants, and transactions in an efficient and transparent approach. The increasing adoption of equity-based compensation schemes by corporations is one of the main factors propelling the market expansion. Equity compensation is an important part of every company's overall compensation plan as it helps to motivate and maintain large numbers of people. With the use of equity management software, businesses may effectively oversee and manage equity awards, guaranteeing that employee shares are distributed in a timely and accurate manner.

This encourages workers to contribute to the success of the company and helps organizations match employee interests with business performance. Moreover, the growing demand for regulatory compliance is another factor propelling the market expansion. Companies are able to guarantee compliance with a range of regulations, including tax laws, accounting standards, and Securities and Exchange Commission (SEC) rules and regulations, by utilizing equity management software. By automating intricate computations and reporting procedures, the program lowers the possibility of mistakes and non-compliance. For publicly traded organizations in particular, this is very important since non-compliance may result in serious penalties and harm their brand. In addition, technological developments such as cloud computing and mobile applications drive the market growth. Cloud-based equity management software has many benefits, such as affordability, scalability, and is simple to use. Collaboration and process simplification are made possible by its ability to securely store and retrieve equity-related data for organizations at any time and from any location.

With the use of mobile applications, employees are capable of tracking and handling their stock holdings on their cellphones, improving convenience and user experience. For instance, in September 2023, Euronext launched a series of strategic ESG initiatives aimed at accelerating the transition towards sustainable finance. These innovative ESG services were unveiled during the inaugural Euronext Sustainability Week, further delivering on their Fit For 1.5 objectives and growth strategy.

The equity management software market was valued for $517.75 million in 2022 and is estimated to reach $1,911.75 million by 2032, exhibiting a CAGR of 14.3% from 2023 to 2032.

Growing necessity of real-time analytics and increased usage of equity management software in large and medium-sized enterprises the upcoming trends of Equity Management Software Market in the world.

Growing digitization and technological innovation is the leading application of Equity Management Software Market.

North America is the largest regional market for Equity Management Software

Carta, Certent, Capdesk, Altvia Solutions, LLC, Preqin Solutions, Gust, Ledgy, Eqvista, Euronext, and Deep Pool Financial Solutions Limited.are the top companies to hold the market share in Equity Management Software

Loading Table Of Content...

Loading Research Methodology...