Ethiopia And Djibouti Heavy Equipment Market Outlook - 2026

The Ethiopia and Djibouti heavy equipment market size was $323.9 million in 2018, and is projected to reach $496.1 million in 2026, growing at a CAGR of 5.6%.

Heavy equipment includes earthmoving machinery, material handling machinery, roadway machinery, and others. Earthmoving equipment is used to move large amounts of earth or to dig foundations and landscape areas; material handling equipment is used to move raw, waste material from one place to another; and roadway machinery such as graders, road rollers, and pavers, are used in the proper construction of roads.

Increased focus on workplace safety, large adoption in the manufacturing sector for material handling, and increase in mining activities fuel the demand for heavy construction equipment used in material handling. In addition, major companies such as Caterpillar and others, are offering high quality and heavy-duty earth moving machinery in this market. For instance, Caterpillar through its authorized dealer Ries Engineering S. Co. (RESCO) deals in a variety of products such as excavators, backhoe loaders, and others.

High capital investment followed by sale of used and rental equipment sale in Ethiopia and Djibouti acts as a major restraint for the Ethiopia and Djibouti heavy equipment market. However, rise in air pollution and huge carbon emissions make way for energy-efficient and environmentally friendly heavy equipment, which in turn reduce environmental degradation. Further, introduction of telematics and integrated grade control systems has witnessed high demand as it aims to decrease cost and reduce risk of damage or theft of the equipment.

Companies are introducing new technology roadway machineries that are equipped with the ACERT engine technology and provide excellent fuel economy and durability, which helps to significantly reduce operating costs. Technological advancements and innovation such as IOT and others, have led to the development of more intelligent and powerful construction equipment, which acts as a major driving factor. Moreover, huge investments in the infrastructure sector drives the growth of graders and pavers. The Addis Ababa–Djibouti Railway project was constructed with a total investment of $4 billion, out of which 70% investment was provided by China Exim Bank and 30% by the Ethiopian government.

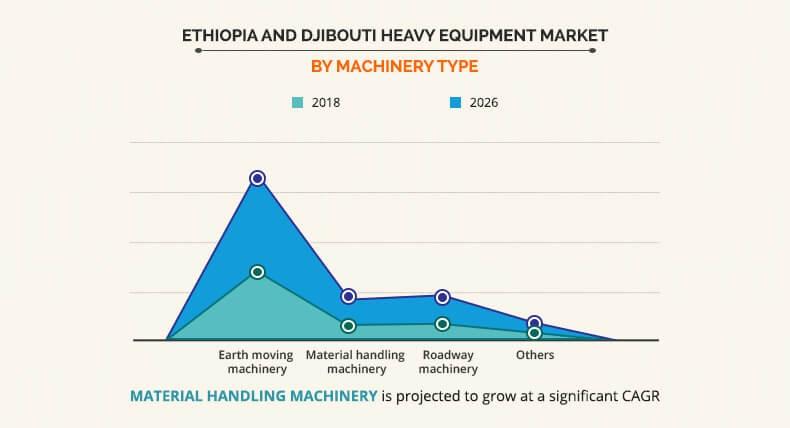

The Ethiopia and Djibouti heavy equipment market is segmented based on machinery type, business type, function, end-user industry, and country. Based on machinery type, the market is divided into earth moving machinery, material handling machinery, roadway machinery, and others. The earth moving machinery segment is projected to dominate the Ethiopia and Djibouti heavy equipment market throughout the study period in terms of value. Based on business type, the market is bifurcated into original equipment and aftermarket. The original equipment segment is anticipated to dominate the Ethiopia and Djibouti heavy equipment market throughout the analysis period.

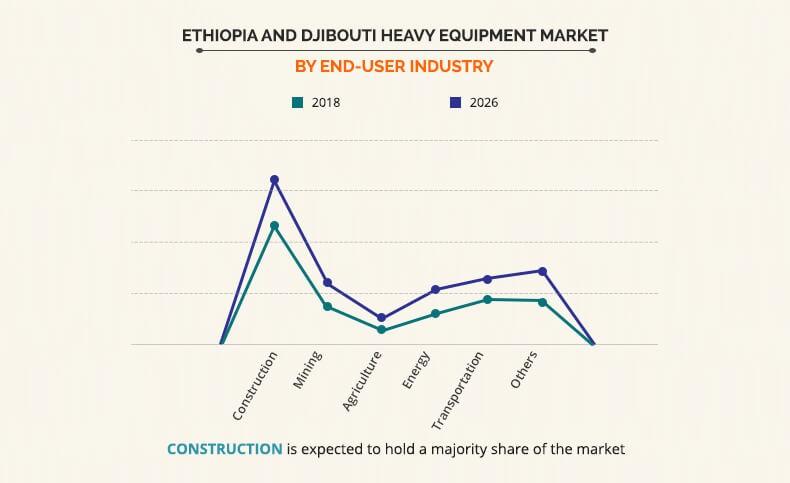

Based on function, the market is divided into hauling, drilling, excavating, paving & grading, and others. In terms of value, the excavating type is estimated to account for a major Ethiopia and Djibouti heavy equipment market share throughout the study period. On the basis of end-user industry, the market is categorized into construction, mining, agriculture, energy, transportation, and others. The construction segment is expected to dominate the market during the forecast period. By country, the market is analyzed across Ethiopia and Djibouti.

The key players profiled in this report include AB Volvo, Caterpillar Inc., Deere & Company, Doosan Infracore, Hitachi, Ltd., J C Bamford Excavators Ltd, Kobelco Construction Machinery Co., Ltd., Komatsu Ltd., SANY Group, and Xuzhou Construction Machinery Group Co., Ltd. (XCMG).

TOP INVESTMENT POCKET

The following graph exhibits the growth potential of various types of machinery in the Ethiopia and Djibouti heavy equipment market. The machineries considered are earth moving machinery, material handling machinery, roadway machinery, and others. Among these, the earthmoving machinery segment is the top investment pocket. This segment accounted for a significant share in 2018, and is projected to register a substantial CAGR during the forecast period. Rise in the construction industry in the region is expected to supplement the Ethiopia and Djibouti heavy equipment market growth.

BY MACHINERY TYPE

By machinery type, the Ethiopia and Djibouti heavy equipment industry is segmented into earth moving machinery, material handling machinery, roadway machinery, and others. Among these, the earth moving machinery segment holds a dominant position in 2018, and is expected to grow at a significant growth rate during the forecast period. This is attributed to large applications of earthmoving equipment that includes repairing, constructing, elevating, mining, agriculture, and demolition among others.

BY FUNCTION

By function, the market is segmented into hauling, drilling, excavating, paving and grading, and others. Among these, the excavating segment held the dominant position in 2018, and is expected to grow at a suitable growth rate during the Ethiopia and Djibouti heavy equipment market forecast period.

BY COUNTRY

The market is analyzed across Ethiopia and Djibouti. Among these, Ethiopia holds a significant share in the Ethiopia and Djibouti heavy equipment market, and is projected to grow at a substantial CAGR during the forecast period.

Key Benefits for Ethiopia And Djibouti Heavy Equipment Market:

- The study provides an in-depth analysis of the Ethiopia and Djibouti heavy equipment market and current as well as future trends to elucidate the imminent investment pockets.

- Information about key drivers and restraints and their impact analysis on the market size is provided.

- Porter’s five forces analysis illustrates the potency of buyers and suppliers operating in the industry.

- The quantitative analysis from 2014 to 2026 is provided to determine the market potential.

- The study also provides an in-depth value chain analysis of the Ethiopia and Djibouti heavy equipment market.

Ethiopia and Djibouti Heavy Equipment Key Market Segments:

By Machinery Type

- Earth Moving Machinery

- Material Handling Machinery

- Roadway Machinery

- Others

By Function

- Hauling

- Drilling

- Excavating

- Paving and Grading

- Others

By Business Type

- Original equipment

- Aftermarket

By End-User Industry

- Construction

- Mining

- Agriculture

- Energy

- Transportation

- Others

By Country

- Ethiopia

- Djibouti

Key Market Players Profiled In The Report:

- AB Volvo

- Caterpillar Inc.

- Deere & Company

- Doosan Infracore

- Hitachi Ltd.

- J. C. Bamford Excavators Ltd.

- Kobelco Construction Machinery Co., Ltd.

- Komatsu Ltd.

- SANY Group

- Xuzhou Construction Machinery Group Co., Ltd. (XCMG)

Ethiopia and Djibouti Heavy Equipment Market Report Highlights

| Aspects | Details |

| By Machinery Type |

|

| By Function |

|

| By Business Type |

|

| By End-User Industry |

|

| By Country |

|

| Key Market Players | J. C. Bamford Excavators Ltd., KOBE STEEL LTD., Komatsu Ltd., Xuzhou Construction Machinery Group Co., Ltd. (XCMG), AB Volvo, SANY Group, Caterpillar Inc., Hitachi Ltd., Deere & Company, Doosan Infracore Co. Ltd |

Analyst Review

The demand for heavy equipment has increased due to rise in construction as well as mining activities in the region. Leading companies, such as Caterpillar, Case IH, Kobelco, and others, have witnessed significant growth and expansion of their overall consumer base, as they have offered numerous types of heavy equipment in different sizes, capacities, and functions in the past few years. Moreover, innovative marketing and positioning strategies have influenced the expansion of the Ethiopia and Djibouti heavy equipment market size.

There are various types of heavy equipment available in the Ethiopia and Djibouti heavy equipment market. Thus, it is imperative to select the right type of heavy machinery. While selecting heavy equipment, industries need to focus on parameters that include the complication of the project, quality, time, material, cost, and safety. In addition, factors such as growth in demand from the construction industry and increased investments in the real estate sector, are expected to drive the Ethiopia and Djibouti heavy equipment market in the coming years. Further, the major market players are focusing on growth and introduction of high-quality machines to meet the consumer needs and preferences and thereby, boost their businesses in the Ethiopia and Djibouti heavy equipment market. However, high capital investment hampers the growth of this market. The construction industry segment accounted for the largest share in the heavy equipment market. Rise in focus on energy efficiency as well as energy savings and the demographic shift toward urbanization, increase the utilization of heavy equipment systems.

The demand for heavy equipment has increased due to rise in construction as well as mining activities in the region. Leading companies, such as Caterpillar, Case IH, Kobelco, and others, have witnessed significant growth and expansion of their overall consumer base, as they have offered numerous types of heavy equipment in different sizes, capacities, and functions in the past few years. Moreover, innovative marketing and positioning strategies have influenced the expansion of the Ethiopia and Djibouti heavy equipment market size.

There are various types of heavy equipment available in the Ethiopia and Djibouti heavy equipment market. Thus, it is imperative to select the right type of heavy machinery. While selecting heavy equipment, industries need to focus on parameters that include the complication of the project, quality, time, material, cost, and safety. In addition, factors such as growth in demand from the construction industry and increased investments in the real estate sector, are expected to drive the Ethiopia and Djibouti heavy equipment market in the coming years. Further, the major market players are focusing on growth and introduction of high-quality machines to meet the consumer needs and preferences and thereby, boost their businesses in the Ethiopia and Djibouti heavy equipment market. However, high capital investment hampers the growth of this market. The construction industry segment accounted for the largest share in the heavy equipment market. Rise in focus on energy efficiency as well as energy savings and the demographic shift toward urbanization, increase the utilization of heavy equipment systems.

Loading Table Of Content...