Etomidate Market, 2033

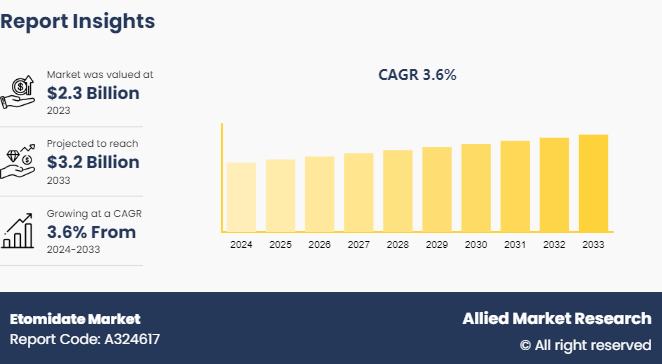

The global etomidate market was valued at $2.3 billion in 2023 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 3.6% from 2024 to 2033. The etomidate market is driven by its widespread use as an anesthetic agent in emergency settings, particularly for rapid sequence intubation due to its quick onset and short duration of action. The growing prevalence of surgeries and critical care procedures, along with the increasing demand for safe and effective sedatives in hospitals and surgical centers, further propels the market.

Market Introduction and Definition

Etomidate is a short-acting intravenous anesthetic drug used to induce general anesthesia and drowsiness for brief procedures such as joint reduction, tracheal intubation, cardioversion, and electroconvulsive therapy. Etomidate can be used as a sedative and hypnotic drug in emergency situations. It is used for conscious sedation as well as to induce anesthesia through rapid sequence induction. It is used as an anesthetic because it has short duration of action and a low cardiovascular risk profile, making it less likely to cause a large drop in blood pressure than other induce drugs.

In addition, etomidate is commonly used due to its simple dosing profile, limited ventilation suppression, lack of histamine liberation, and protection against myocardial and cerebral ischemia. Thus, etomidate is an effective induction drug for persons with hemodynamic instability. Etomidate is also an attractive anesthetic medication for individuals with traumatic brain injury as it is one of the few drugs that can lower intracranial pressure while maintaining normal artery pressures.

Key Takeaways

- The etomidate market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period from 2024 to 2033.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major energy storage system industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach intends to provide a balanced view of global markets and assist stakeholders in making informed decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The etomidate market growth is significantly driven by the increasing number of surgical procedures performed globally. According to the Johnson & Johnson 2022 Health for Humanity Report, approximately 313 million surgical procedures are undertaken worldwide each year. This surge is largely attributed to rising prevalence of chronic diseases and increasing aging population, both of which necessitate a higher frequency of surgical interventions. The rising demand for anesthesia in these procedures boosts the adoption of etomidate, preferred for its rapid onset and short duration of action, making it an ideal choice for various surgeries, particularly in emergency and short-term cases. As the healthcare sector continues to advance and the global population ages, the demand for effective and reliable anesthesia like etomidate is expected to rise, driving market growth.

While etomidate presents several advantages, its potential side effects pose notable concerns. One of the primary issues is its link to adrenal suppression. Etomidate inhibits the synthesis of cortisol, an essential hormone produced by the adrenal glands. This inhibition can be substantial and prolonged, potentially leading to adrenal insufficiency, particularly in critically ill patients. Therefore, careful attention must be given to the dosage and duration of etomidate administration. These side effects can limit its usage and adoption, acting as a restraining factor for the etomidate market growth.

The expanding healthcare infrastructure and increasing investment in healthcare within emerging markets present significant growth opportunities for the etomidate market players. As governments and private sectors prioritize the enhancement of medical facilities and accessibility, there is a rising demand for effective anesthetics. Etomidate, known for its stability and minimal cardiovascular effects, is gaining traction as a preferred choice in these regions. In addition, the rising prevalence of surgeries and emergency medical procedures in these markets highlights the necessity for reliable and efficient anesthetic agents. Consequently, the etomidate market is projected to capitalize on these developments, driving its growth and establishing a stronger presence in the global healthcare landscape.

Healthcare Expenditure

According to OECD Health Statistics 2023, the average health expenditure to GDP ratio among OECD countries declined from its pandemic peak of 9.7% in 2021 to 9.2% in 2022. Despite this reduction, the share of GDP allocated to health remains above the pre-pandemic level of 8.8%. However, in 11 OECD countries, the ratio in 2022 is anticipated to have fallen below the 2019 pre-pandemic levels. Examining country-specific data, the U.S. continued to lead with the highest health expenditure to GDP ratio at 16.6% in 2022, followed by Germany at 12.7% and France at 12.1%. In addition, 14 other high-income countries, including Canada and Japan, dedicated over 10% of their GDP to healthcare in 2022, reflecting a sustained commitment toward health investment in many developed nations.

OECD Health Spending as a Share of GDP, 2015 to 2022

OECD Health Spending as a share of GDP, 2015 to 2022 | % Share of GDP |

2015 | 8.70% |

2016 | 8.80% |

2017 | 8.70% |

2018 | 8.70% |

2019 | 8.80% |

2020 | 9.60% |

2021 | 9.70% |

2022 | 9.20% |

Market Segmentation

The etomidate market is segmented into product type, end user, and region. On the basis of product type, the market is divided into induction agent and fat emulsion. On the basis of end user, the market is classified into hospitals, ambulatory surgical centers, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

The etomidate market in North America is expected to develop significantly, owing to factors such as the region's advanced healthcare infrastructure, an increase in the prevalence of surgical operations, and a high incidence of chronic conditions that require anesthesia. The U.S., in particular, plays an important role in this market due to its high healthcare spending and well-established medical facilities. Furthermore, the rising geriatric population, which often necessitates more frequent medical interventions, leads to an increase in demand for etomidate. The presence of large pharmaceutical companies, as well as ongoing R&D in anesthetic medications, is expected to drive the regional market growth.

- On March 05, 2024, Fresenius Kabi Canada announced the launch of Etomidate Injection, USP 2 mg/mL Single Use Vial 10 ml. The product features bar-coding, is preservative-free, and includes a latex-free stopper.

- In December 2020, Caplin Steriles Limited, a subsidiary of Caplin Point Laboratories Limited, has gained final FDA approval for Etomidate injection USP, 20 mg/10 mL (2 mg/mL) and 40 mg/20 mL (2 mg/mL) .

Competitive Landscape

The major players operating in the etomidate market include Teva, Johnson & Johnson, Esteve Pharma, Krka, AbbVie, Abbott, Mylan, Luitpold, Par Sterile Products, and Zydus.

Other players in etomidate market include Chengdu Suncadia, Zhejiang Jiuxu, Merck, Braun, Jiangsu Hengrui Pharmaceutical, and Jiangsu Nhwa Pharmaceutical.

Recent Key Strategies and Developments

- In August 2023, Mindray announced upgrades to its A7 and A5 anesthetic devices in the A Series. The most recent modifications feature breakthrough technology that enables anesthesiologists to give precise anesthesia, resulting in increased patient safety and efficiency throughout the perioperative period.

- In August 2023, PAION AG, a specialty pharmaceutical company that develops innovative compounds for use in outpatient and in-hospital sedation, anesthesia, and intensive care, announced that the UK Medicines and Healthcare Products Regulatory Agency (MHRA) has approved Byfavo for the induction and maintenance of general anesthesia in adults.

- In January 2022, Drägerwerk AG (Lübeck, Germany) showcased new products at Arab Health 2020 in Dubai, UAE, including ICU ventilators and anesthetic workstations.

Industry Trends

- In May 2023, Harrow officially introduced Iheezo (chloroprocaine hydrochloride ophthalmic gel) 3%. Iheezo is a sterile, single-use, physician-administered, preservative-free low-viscosity ophthalmic gel indicated for ocular surface anesthetic.

- In January 2023, Milestone Scientific Inc., a leading developer of computerized drug delivery instruments for painless and precise injections, announced that it has signed a distribution agreement with TEKMIKA Health Technologies to market Milestone's STA Single Tooth Anesthesia System (STA) in Brazil. TEKMIKA Health Technologies is a major distributor in Brazil that specializes in the import, promotion, marketing, and distribution of high-tech medical equipment and gadgets.

Key Sources Referred

- National Library of Medicine

- Medscape

- WHO

- Drugs.com

- American Society of Anesthesiologists

- Companies Annual Reports

- WebMD LLC

- Cleveland Clinic

- National Institute for Health and Care Excellence

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the etomidate market analysis from 2023 to 2033 to identify the prevailing etomidate market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the etomidate market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

Apart from the points mentioned above, the report includes the analysis of the regional as well as global etomidate market trends, key players, market segments, application areas, and market growth strategies.

Etomidate Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 3.2 Billion |

| Growth Rate | CAGR of 3.6% |

| Forecast period | 2024 - 2033 |

| Report Pages | 320 |

| By Product Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Zydus, Esteve Pharma, Luitpold pharmaceuticals, Teva, Abbott, Mylan, Par Sterile Products, Krka, AbbVie, Johnson and Johson |

The upcoming trends in the global etomidate market include increasing demand in emergency and surgical procedures, growing adoption of etomidate for its favorable hemodynamic profile, and ongoing research into new formulations and delivery methods.

The leading application of the etomidate market is in general anesthesia induction.

Asia-Pacific is the largest regional market for etomidate.

The etomidate market was valued at $2.3 billion in 2023 and is estimated to reach $3.2 billion by 2033, exhibiting a CAGR of 3.6% from 2024 to 2033.

The major players operating in the etomidate market include Teva, Johnson & Johnson, Esteve Pharma, Krka, AbbVie, Abbott, Mylan, Luitpold, Par Sterile Products, and Zydus.

Loading Table Of Content...