Europe 900 Series Cooking Equipment Market Outlook - 2025

Europe 900 series cooking equipment market size was $51.34 million in 2017, and is projected to reach $59.15 million by 2025, registering a CAGR of 1.7% from 2018 to 2025. The 900 series cooking equipment are used in commercial kitchens of full-service restaurants, luxury hotels & restaurants, and institutional caterers for cooking food. These equipment are the basic requirements for any big commercial involved into cooking and catering business. These equipment are also widely used in hotels, full service restaurants, commercial institutes, popular QSRs, and budgetary hotels. These equipment reduce labor cost, improve food safety, and minimize operational cost.

With changes in lifestyle and more influence toward outside food, restaurants are gaining increased popularity among consumers. Moreover, rise in popularity of creative cooking and baking among consumers results in variety of dine out options for consumers. Thus, restaurants invest in different types of cooking equipment, to offer best services to customer, which further fuel the growth of Europe 900 series cooking equipment market. Increase in trend for bigger, open kitchen spaces has been witnessed in the fast food chains to show consumers how the food is prepared, thus showing off the fancy equipment being used by them. Furthermore, increase in investments in cooking equipment and replacements are expected to boost Europe 900 series cooking equipment market growth. However, high installation cost and integration capabilities required for the initial setup are anticipated to hamper growth of Europe 900 series cooking equipment market. Favorable government regulations and increase in demand for energy-efficient equipment are further anticipated to open new avenues for the manufacturers, thereby driving the market growth.

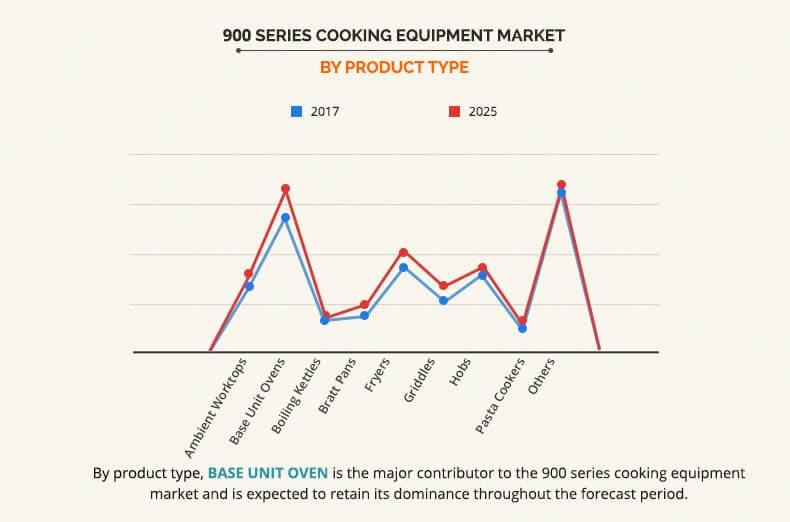

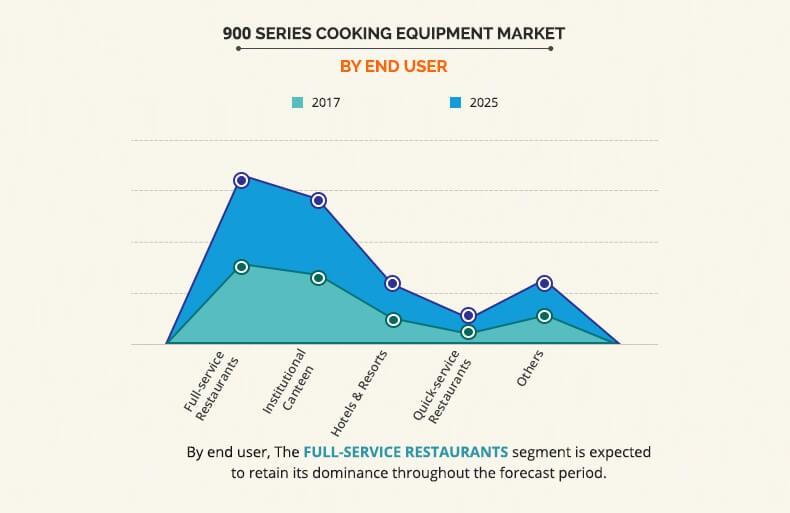

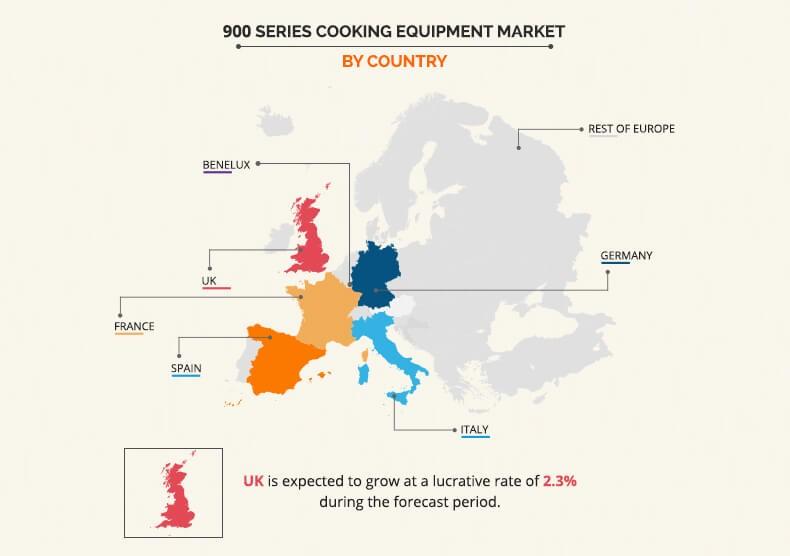

Europe 900 series cooking equipment market is segmented based on product type, end use, and country. Based on product type, the market is divided into ambient worktops, base unit ovens, boiling kettles, bratt pans, fryers, griddles, hobs, pasta cookers, and others. Based on end use, the market is categorized into full-service restaurants, institutional canteen, hotel & resorts, quick service restaurants and others. Country wise, the Europe 900 series cooking equipment market is analyzed across Spain, Italy, Benelux, UK, Germany, France, and rest of Europe.

In 2017, the base unit oven segment accounted for the highest Europe 900 series cooking equipment market share growing at a CAGR of 2.5% from 2018 to 2025. Commercial ovens include convection ovens, commercial microwave ovens, combi ovens, pizza, and bakery ovens. These ovens are used for roasting, baking, and heating food & bakery items. Convection microwave ovens are equipped with heating element and a fan, hence are used for both cooking and baking purposes. The 900 series base unit ovens are majorly adopted by large FFCs such as McDonald’s, Domino's, and KFC to cater to large consumer base efficiently and thus gain momentum during the forecast period. In addition, 900 series pasta cookers and bratt pans are the two potential markets, expected to witness higher growth rates during Europe 900 series cooking equipment market forecast period.

Based on end user, full-service restaurants accounted for the highest share of Europe 900 series cooking equipment market in 2017 and is expected to grow at the considerable CAGR of 1.2%. Improvement in economic scenario after recession and rise in standard of living have increased the number of people dinning out in luxurious hotels in Europe. These full-service restaurants offer a wide variety of food & beverages along with other facilities such as accommodation and luxury amenities. Luxury dining is also popular among high-income tourists and affluent customers. Ongoing trends of luxury dining and tourism are expected to drive the growth of Europe 900 series cooking equipment market for full-service restaurants. However, quick service restaurants segment is projected to positively impact the 900 series cooking equipment market during the forecast period. This is majorly due to the rise in trend of international QSR outlets and the opening of new QSR brands.

Based on country, UK accounted for the highest market share in 2017 and is anticipated to grow at a CAGR of 2.3%. UK and Germany, together accounted for about 41.6% of Europe 900 series cooking equipment market in 2017, with the former constituting around 22.3%. From a growth perspective, UK and Germany are the two potential markets, expected to witness higher growth rates during the forecast period. Installation of 900 series cooking equipment in commercial kitchens improve work quality, increase efficiency, and reduce costs. Easy affordability and increase in application areas for 900 series cooking equipment across various verticals drive the market growth in these countries.

The leading players in Europe 900 series cooking equipment industry focus on providing customized solution to consumers as their key strategies to gain a significant market share. Strategies such as product launch and acquisition have also helped the key players to gain a significant share in the market. The key players of Europe 900 series cooking equipment market profiled in the report include Charvet, Rosinox, Capic, Ali Group, AB Electrolux, ATA Srl, Fagor Industrial, Illinois Tool Works Inc., MKN, Modular Professional Srl, and The Middleby Corporation.

Key Benefits for Europe 900 Series Cooking Equipment Market:

- This report provides a quantitative analysis of Europe 900 series cooking equipment market trends, estimations, and dynamics of market from 2018 to 2025 to identify the prevailing market opportunities.

- The key countries in the Europe region are mapped based on their market share.

- Porter’s five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier–buyer network.

- In-depth Europe 900 series cooking equipment market analysis assists in determining the prevailing market opportunities.

- Major countries are mapped according to their revenue contribution to the industry. Market player positioning segment facilitates benchmarking and provides a clear understanding of the present position of market players.

- Key market players and their strategies are analyzed to understand the competitive outlook of the market.

Europe 900 Series Cooking Equipment Market Report Highlights

| Aspects | Details |

| By Product Type |

|

| By End User |

|

| By Country |

|

| Key Market Players | Base Unit Ovens, Griddles, Ambient Worktops, Pasta Cookers, Fryers, Bratt Pans, Hobs, Boiling Kettles, Others |

Analyst Review

Based on the interviews of various top-level CXOs of the leading companies, Europe 900 series cooking equipment market is dependent on the development of the hospitality industry and increase in investment in hotels, restaurants, and full-service restaurants.

Presently, the demand for processed fast food has reduced, due to increase in demand for readymade food, healthy menus, change in lifestyle, and increase in disposable income. Thus, these factors have led to the adoption of automated food service solutions, replacing the traditional cooking equipment in big kitchens. As per the CXOs, continuous developments in food industry and the introduction of advanced and energy-efficient solutions to the hotel and restaurant industry are responsible for driving the 900 series cooking equipment market growth in Europe.

Consumer preference has shifted from for high-end luxurious hotels to budgetary and quick-service restaurants, owing to increase in demand for value-for-money food products. This has led to higher adoption of 900 series cooking equipment mainly cooking equipment in popular QSRs such as McDonald’s, Domino's, and KFC. Moreover, changes in trends of food consumption and rise in need to reduce food wastage have created new opportunities for 900 series cooking equipment manufacturers impacting 900 series cooking equipment market directly. Favorable government regulations and increase in demand for energy-efficient equipment are further anticipated to open new avenues for the manufacturers, thereby driving the market growth. However, as per the CXOs, high installation cost and integration capabilities required for the initial setup are anticipated to hamper the market growth.

Loading Table Of Content...