Europe Early Toxicity Testing Market Outlook - 2025

The Europe early toxicity testing market accounted for $265 million in 2017, and is expected to reach $460 million by 2025, registering a CAGR of 7.1% from 2018 to 2025.

Toxicity is the degree of threat posed by a substance to the living organism. The effects of chemical substance on the body are studied to choose a potential drug candidate during the development of newer molecules. Early toxicity testing is carried out at pre-clinical stages of a drug development process and is essential as toxicity serves as the major reason for the failure of potential drug candidates in the later stages of drug development leading to huge financial loss to companies. Moreover, companies perform early toxicity testing to comply with the government standards to market the drug. These testing are necessary as it can prevent financial losses that occur during the failure of drugs in further late stages of drug development.

It is estimated that Europe early toxicity testing market is expected to witness significant growth over the forecast period, owing to increase in the R&D activities and rise in stringent regulatory authorities concerning public healthcare welfare. In addition, technological advancements in in vitro technique, rise in adoption of in vitro models in the Europe early toxicity testing industry, and surge in adoption of early toxicity testing in the various industries further fuel the market growth. However, limitations associated with preclinical testing hamper the market growth. Furthermore, the technological advancements related to early toxicity testing provide opportunities for the growth of Europe early toxicity testing market during the forecast period.

Europe Early Toxicity Testing Market Segmentation

The Europe early toxicity testing market is segmented based on technique, application, end users, and country to provide a detailed assessment of the market. Based on technique, the market is divided into in vivo, in vitro, and in silico. The market on the basis of in vitro is further divided into in vitro toxicity testing market by assays and in vitro toxicity testing market by toxicity endpoints. The in vitro toxicity testing market by assays is further segmented into enzyme toxicity assays, bacterial toxicity assays, cell-based ELISA & western blots, receptor binding assays, and other assays. The in vitro toxicity testing market by toxicity endpoints is further divided into dermal toxicity, systemic toxicity, carcinogenicity, ocular toxicity, skin sensitization and irritation, neurotoxicity, organ toxicity, and other toxicity endpoints. Depending on end user, it is categorized into pharmaceutical industry, food industry, chemicals industry, cosmetics industry, and other industry. Based on region, the Europe early toxicity testing market size is analyzed across Germany, France, the UK, and rest of Europe.

Segment review

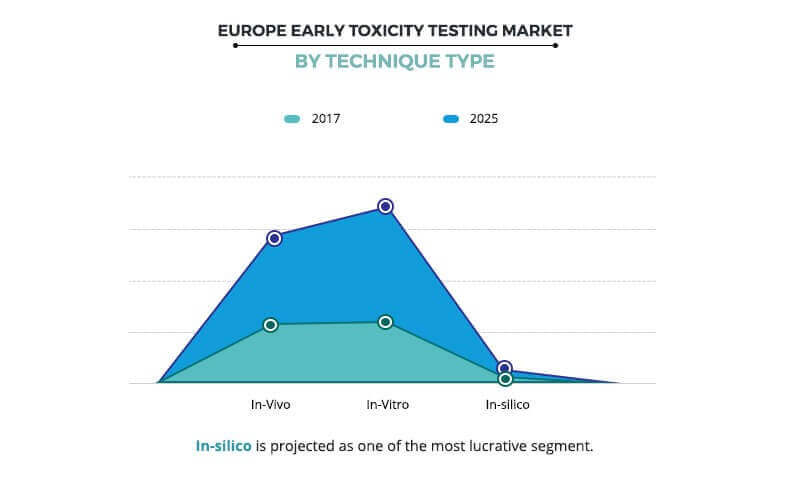

Based on product type market is divided into in vivo, in vitro, and in silico. In vitro segment is largest contributor to the Europe early toxicity testing market in 2017 and is expected to maintain its dominant position throughout the analysis period. In vitro toxicity methods use different laboratory techniques and cell lines to assess the possible adverse effects of different drugs and chemicals on the human health. Cost-effective nature of this technique, technological advancement, and stringent regulation for animal usage during diagnostic procedures are majorly driving the Europe early toxicity testing market growth of this segment. On the other side in silico segment is the fastest growing segment during the forecast period, owing to the rise in its adoption due to advantages offered by the technique. In silico techniques have revolutionized the drug discovery process as these techniques are not only applied to find the new targets and new molecule with high affinity to those targets but also used to determine the metabolic pathways of those active molecules. In addition, these techniques are computer-based that eliminate animal sacrifice, which is another factor that contributes to the growth of Europe Early Toxicity Testing market.

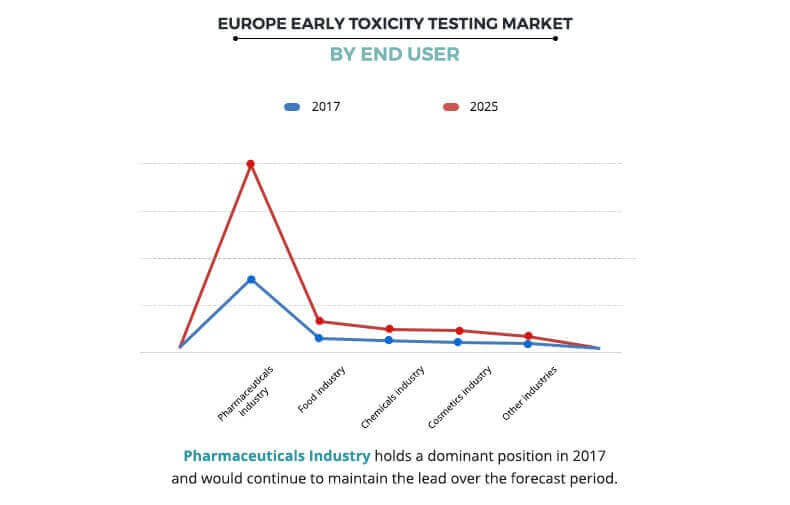

According to Europe early toxicity testing market analysis, the end users segment is classified into pharmaceutical industry, food industry, chemicals industry, cosmetics industry, and other industries. The pharmaceutical segment is expected to be the fastest growing segment throughout the forecast period. It also accounted for the highest Europe early toxicity testing market share in 2017, and is anticipated to maintain this trend over the forecast period, owing to rise in number of clinical trials for drug development. During drug development, early toxicity testing can help reduce the risk of later stage failure for drug development, which predominantly fuels the growth of the pharmaceutical industry market.

The report provides an extensive competitive analysis and profiles of the key market players such as Agilent Technologies, Inc., General Electric Company (GE Healthcare), Danaher Corporation (Beckman Coulter, Inc.), Evotec AG (Cyprotex), Bioanalytical Systems, Inc., Bruker Corporation, Thermo Fisher Scientific, Inc., PerkinElmer Inc., Enzo Biochem, Inc. (Enzo Clinical Labs, Inc.), The Jackson Laboratory.

Key Benefits for Europe Early Toxicity Testing Market:

- This report entails a detailed quantitative analysis along with the current Europe early toxicity testing market trends of the market from 2017 to 2025 to identify the prevailing opportunities along with the strategic assessment of the Europe market.

- The Europe early toxicity testing market forecast is studied from 2018 to 2025.

- The early toxicity testing market size and estimations are based on a comprehensive analysis of key developments in the early toxicity testing industry.

- A qualitative analysis based on innovative products facilitates strategic business planning.

- The development strategies adopted by the key market players are enlisted to understand the competitive scenario of the Europe early toxicity testing market.

Europe Early Toxicity Testing Market Report Highlights

| Aspects | Details |

| By TECHNIQUE |

|

| By APPLICATION |

|

| By END USER |

|

| By COUNTRY |

|

| Key Market Players | The Jackson Laboratory, Agilent Technologies, Inc, PerkinElmer Inc, Enzo Biochem, Inc. (Enzo Clinical Labs, Inc.), BRUKER CORPORATION, General Electric Company (GE Healthcare), Danaher Corporation (Beckman Coulter, Inc.), Bioanalytical Systems, Inc, Evotec AG (Cyprotex), Thermo Fisher Scientific, Inc |

Analyst Review

Early toxicity testing is the analysis of chemical entities in the pre-clinical phases to check their compatibility for the clinical trial to be performed in humans. In accordance to several interviews conducted, the adoption of early toxicity testing in Europe is expected to witness significant growth with rise in research conducted toward the development of new drugs. Moreover, there have been remarkable technological advancements to improve the process of drug development. The increase in stringent regulations concerning public welfare and replacement of in vivo models by in vitro models are some the factors that boost the growth of the Europe early toxicity testing market.In addition, surge in healthcare investments in Europe is another major factor that drives the market growth. However, limitations of preclinical testing are expected to restrain the market growth. A rapid advancement in in silico platforms serves as an opportunity to Europe early toxicity testing market. Countries such as Germany garnered the largest share of this market due to rise in research activities related to drug development whereas the UK is expected to grow at the fastest pace, owing to surge in healthcare investments in the country.

Loading Table Of Content...