Europe Electrolyzer Market Research, 2032

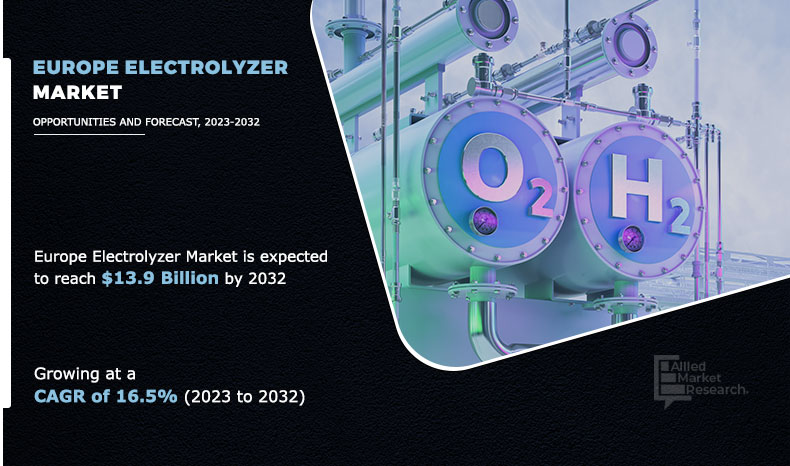

The Europe electrolyzer market was valued at $3.1 billion in 2022 and is estimated to reach $13.9 billion by 2032, exhibiting a CAGR of 16.5% from 2023 to 2032. Governments across Europe are implementing ambitious carbon reduction targets and investing heavily in renewable energy infrastructure. Electrolyzers play a crucial role in this transition by enabling the production of green hydrogen using renewable electricity from sources such as wind, solar, and hydro power. In addition to transportation, industries are exploring ways to decarbonize their operations using green hydrogen. Electrolyzers offer a scalable and versatile solution to meet the growing demand for clean hydrogen across diverse sectors, driving innovation and economic growth in Europe.

Introduction

An electrolyzer is a device that utilizes an electrochemical process known as electrolysis to split water (H2O) into its constituent elements, hydrogen (H2) and oxygen (O2). Electrolyzers typically consist of two electrodes immersed in an electrolyte solution, with an electrical current passed through them. Electrolyzers are crucial components in the production of hydrogen as a clean and renewable energy carrier. They are powered by various sources of electricity such as renewable energy such as wind or solar power, making the hydrogen produced through electrolysis an environmentally friendly and sustainable alternative to fossil fuels. Electrolyzers are used in a wide range of applications such as energy storage, transportation, industrial processes, and power generation.

Key Takeaways

- The Europe electrolyzer market has been analyzed in terms of value ($million). The analysis in the report is provided on the basis of capacity, product, application, and country.

- The Europe electrolyzer market report includes a detailed study covering underlying factors influencing the industry opportunities and trends.

- The key players in the Europe electrolyzer market are Air Liquide, Cummins Inc., Enapter S.r.l., Green Hydrogen Systems, H-TEC SYSTEMS GmbH, INEOS, ITM Power PLC, John Cockerill, Linde PLC, McPhy Energy S.A., Nel ASA, Plug Power Inc., Siemens AG, Sunfire GmbH, thyssenkrupp nucera AG & Co. KGaA, and Topsoe A/S.

- The report facilitates strategy planning and industry dynamics to enhance decision making for existing market players and new entrants entering the electrolyzer industry.

- Countries such as Germany, UK, France, Italy, and Spain hold a significant share in the global turbo generator market.

Market Dynamics

Electrolyzers play a pivotal role in supporting carbon reduction initiatives by facilitating the widespread adoption of hydrogen as a clean energy carrier. Hydrogen holds immense potential as a versatile and zero-emission fuel that is used across various sectors such as transportation, industry, and power generation. According to International Energy Agency (IEA), Europe is expected to deploy 7 GW of dedicated renewable capacity for hydrogen production during 2022-2027, encouraged by decarbonization goals and, more recently, the need to strengthen energy security by displacing Russian gas. By utilizing electrolyzers to produce green hydrogen, Europe significantly decreases its reliance on fossil fuels and accelerates the transition towards a more sustainable energy landscape. All these factors are expected to drive the demand for the Europe electrolyzer market during the forecast period.

However, policy inconsistencies across different European countries and regions exacerbate the challenges faced by electrolyzer manufacturers and developers. Varying regulations, incentives, and support mechanisms for hydrogen and electrolyzer projects create barriers to entry, increase compliance costs, and create inefficiencies in the market. According to the International Energy Agency (IEA), the European Union is considering three different proposals for binding targets for renewables in existing hydrogen use in industry (ranging from 35% to 50%) and renewables of non-biological origin in transport (2.6% to 5.7%), but a final decision has yet to be taken. Inconsistent policies also undermine investor confidence and hinder the scaling-up of electrolyzer deployment at the regional and national levels. All these factors hamper the Europe electrolyzer market growth.

The integration of electrolyzers enables the production of green hydrogen, which holds immense potential as a clean energy carrier across various sectors. Green hydrogen is used as a zero-emission fuel for transportation, as a feedstock for industrial processes, and as a means of energy storage and grid balancing. By harnessing the scalability and flexibility of electrolyzer technology, Europe accelerates the adoption of green hydrogen and reduces its dependence on fossil fuels, thereby advancing its energy transition goals while promoting environmental sustainability. All these factors are anticipated to offer new opportunities for the Europe electrolyzer market during the forecast period.

Segments Overview

The Europe electrolyzer market is segmented into capacity, application, product, and country. On the basis of capacity, the market is classified as less than 500 KW, 500 KW to 2 MW, and above 2 MW. On the basis of application, the market is categorized into power generation, transportation, industry energy, industry feedstock, building heat and power, and others. By product, the market is segmented into alkaline electrolyzer, proton exchange membrane electrolyzer, solid oxide (SOE) electrolyzer, anion exchange membrane (AEM) electrolyzer. Country wise, the market is analyzed across Germany, the UK, France, Italy, Spain, Norway, Sweden, Denmark, and rest of Europe.

By Capacity

Less than 500 KW is projected as the most lucrative segment.

On the basis of capacity, the market is classified as less than 500 KW, 500 KW to 2 MW, above 2 MW. The 500 KW to 2 MW segment accounted for less than half of Europe electrolyzer market share in 2022 and is expected to maintain its dominance during the forecast period. Technological advancements and economies are contributed to the growing adoption of 500 KW to 2 MW electrolyzers in Europe. Continuous innovation in electrolysis technology has led to improvements in efficiency, durability, and cost-effectiveness that makes larger systems more economically viable. In addition, the scaling up of electrolyzer manufacturing processes has resulted in cost reductions through mass production, lowering the capital expenditure associated with larger units.

By Application

Power generation is projected as the most lucrative segment.

On the basis of application, the market is categorized into power generation, transportation, industry energy, industry feedstock, building heat and power, and others. The power generation segment accounted for less than one-third of Europe electrolyzer market share in 2022 and is expected to maintain its dominance during the forecast period. Electrolyzers are becoming increasingly prominent in power generation applications across Europe, driven by growing emphasis on decarbonization and the transition towards renewable energy sources. According to the European Commission, European climate law sets the intermediate target of reducing net greenhouse gas emissions by at least 55% by 2030, compared to 1990 levels. As countries commit to reducing greenhouse gas emissions and achieving carbon neutrality targets, electrolyzers offer a viable solution for storing excess renewable energy and producing green hydrogen. This hydrogen is used as a clean fuel for power generation, particularly in sectors such as transportation and industry, where electrification is not feasible.

By Product

Proton exchange membrane electrolyzer is projected as the most lucrative segment.

Based on product the market is segmented into alkaline electrolyzer, proton exchange membrane electrolyzer, solid oxide (SOE) electrolyzer, anion exchange membrane (AEM) electrolyzer. The alkaline electrolyzer segment accounted for less than three-fifths of Europe electrolyzer market share in 2022 and is expected to maintain its dominance during the forecast period. The declining costs of renewable energy technologies, particularly solar and wind power, have made electrolytic hydrogen production more economically viable. According to the Internation Energy Agency (IEA), cost of producing hydrogen from renewable electricity is expected to fall 30% by 2030. The falling prices of renewable electricity contribute to lower operating costs for alkaline electrolyzers that enhance their competitiveness compared to hydrogen produced from fossil fuels. Moreover, advancements in electrolyzer technology and manufacturing processes have led to improved efficiency and scalability, further driving down costs and increasing the attractiveness of alkaline electrolysis. All these factors drive the demand for alkaline electrolyzer in Europe electrolyzer market.

By Country

Rest of Europe is projected as the most lucrative.

Country wise, the market is analyzed across Germany, the UK, France, Italy, Spain, Norway, Sweden, Denmark, and rest of Europe. Germany accounted for more than one-fifth of the Europe electrolyzer market share in 2022 and is expected to maintain its dominance during the forecast period. German companies and research institutions are at the forefront of electrolyzer development, driving advancements in efficiency, scalability, and cost-effectiveness. The presence of leading electrolyzer manufacturers, coupled with government support for research and development initiatives. For instance, in 2021 Germany launched the H2Global initiative, which uses a mechanism analogous to the CCfD approach, compensating the difference between supply and demand prices with grant funding from the German government. All these factors are expected to drive the demand for electrolyzers in Germany.

Competitive Analysis

Key players in the Europe electrolyzer market include Air Liquide, Cummins Inc., Enapter S.r.l., Green Hydrogen Systems, H-TEC SYSTEMS GmbH, INEOS, ITM Power PLC, John Cockerill, Linde PLC, McPhy Energy S.A., Nel ASA, Plug Power Inc., Siemens AG, Sunfire GmbH, thyssenkrupp nucera AG & Co. KGaA, and Topsoe A/S.

In the Europe electrolyzer market, companies have adopted joint venture and product launch to expand the market or develop new products. For instance, in November 2023, Air Liquide and Siemens Energy officially inaugurated their joint venture gigawatt electrolyzer factory in Berlin. The mass production of electrolyzer components helps in the manufacturing of low-carbon hydrogen at industrial scale and competitive cost and foster an innovative European ecosystem. Moreover, in March 2023, Cummins Inc. announced the launch of Accelera by Cummins, a new brand for its New Power business unit. It provides a diverse portfolio of zero-emissions solutions such as electric battery and fuel cell electric solutions across commercial and industrial applications with hundreds of electrolyzers that generate hydrogen for industries empowering customers to accelerate their transition to a sustainable future.

Historical Trends of Electrolyzers in Europe

- In the 1960s, Europe saw the initial development and commercialization of electrolyzers, marking the beginning of their adoption across various industries such as chemical processing, energy storage, and hydrogen production. Companies like Siemens, ABB, and Nel emerged as key players, introducing electrolysis technologies to meet the growing demand for sustainable energy solutions.

- Significant advancements in electrolyzer technology were witnessed in the 1970s and 1980s, characterized by improvements in efficiency, scalability, and cost-effectiveness. This era saw the expansion of electrolyzers into new applications such as water treatment, metallurgy, and electronics manufacturing, driven by increasing awareness of environmental issues and the need for clean energy alternatives.

- The 1990s marked a period of rapid growth and innovation in the European electrolyzer market. Manufacturers introduced innovations such as alkaline electrolyzers, proton exchange membrane (PEM) electrolyzers, and solid oxide electrolyzers, catering to diverse industrial and commercial needs for hydrogen production, grid stabilization, and renewable energy integration.

- In the 2010s, the European electrolyzer market underwent further transformation with a focus on renewable hydrogen production and grid-scale energy storage. Companies embraced advancements in electrolyzer stack design, catalyst materials, and system integration, aligning with European Union initiatives for decarbonization and the transition to a hydrogen economy.

- The European electrolyzer market continued to evolve in the 2020s, driven by technological innovations and policy support for green hydrogen. Manufacturers invested in electrolyzer technologies capable of electrolyzing water using renewable energy sources such as wind and solar power, enabling carbon-neutral hydrogen production. In addition, advancements in electrolyzer efficiency, durability, and modularity enhanced their competitiveness and scalability in various sectors such as transportation, industry, and residential energy systems.

Key Benefits of Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the Europe electrolyzer market analysis from 2022 to 2032 to identify the prevailing Europe electrolyzer market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the Europe electrolyzer market statistics and segmentation assists to determine the prevailing market opportunities.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the Europe electrolyzer market trends, key players, market segments, application areas, and market growth strategies.

Europe Electrolyzer Market Report Highlights

| Aspects | Details |

| By Capacity |

|

| By Application |

|

| By Product |

|

| By Country |

|

| Key Market Players | Plug Power Inc., Nel ASA, Linde PLC, H-TEC SYSTEMS GmbH, thyssenkrupp nucera AG & Co. KGaA, Cummins Inc., Enapter S.r.l., INEOS, John Cockerill, McPhy Energy S.A., Sunfire GmbH, ITM Power PLC, Topsoe A/S, Air Liquide, Green Hydrogen Systems, Siemens AG |

Analyst Review

According to the opinions of various CXOs of leading companies, the Europe electrolyzer market is expected to witness an increase in demand during the forecast period. A surge in green hydrogen economy and environmental sustainability and carbon reduction initiatives increased the demand for Europe electrolyzer market during the forecast period.

The surge in the green hydrogen economy is driving remarkable growth in the demand for electrolyzers across Europe. As the world intensifies its focus on combating climate change, green hydrogen has emerged as a promising solution for decarbonizing various sectors of the economy. With renewable energy sources such as wind and solar power becoming increasingly prevalent, electrolyzers play a pivotal role in harnessing this clean energy to produce hydrogen through electrolysis.

Moreover, environmental sustainability and carbon reduction initiatives are gaining momentum across Europe. Governments, industries, and stakeholders are committed to reducing greenhouse gas emissions and transitioning toward a more sustainable future. In this initiative, electrolyzers offer a versatile and scalable solution for producing clean hydrogen, which is utilized as a zero-emission fuel for transportation, industrial processes, and energy storage.

Environmental sustainability and carbon reduction initiatives and development of green hydrogen economy are the key factors boosting the Europe electrolyzer market growth.

The Europe electrolyzer market was valued at $3,115.50 million in 2022 and is estimated to reach $13,854.46 million by 2032, exhibiting a CAGR of 16.5% from 2023 to 2032.

Key players in the Europe electrolyzer market include Air Liquide, Cummins Inc., Enapter S.r.l., Green Hydrogen Systems, H-TEC SYSTEMS GmbH, INEOS, ITM Power PLC, John Cockerill, Linde PLC, McPhy Energy S.A., Nel ASA, Plug Power Inc., Siemens AG, Sunfire GmbH, thyssenkrupp nucera AG & Co. KGaA, and Topsoe A/S.

Integration of electrolyzers in European renewable energy infrastructure is the opportunity to the Europe electrolyzer market growth.

The Europe electrolyzer market is segmented into capacity, application, product, and country. On the basis of capacity, the market is classified as less than 500 KW, 500 KW to 2 MW, above 2 MW. On the basis of application, the market is categorized into power generation, transportation, industry energy, industry feedstock, building heat and power, and others. By product, the market is segmented into alkaline electrolyzer, proton exchange membrane electrolyzer, solid oxide (SOE) electrolyzer, anion exchange membrane (AEM) electrolyzer. Country wise, the market is analyzed across Germany, the UK, France, Italy, Spain, Norway, Sweden, Denmark, and rest of Europe.

Regulatory uncertainty and policy inconsistencies hamper the growth of Europe electrolyzer market growth.

Which is the fasting growing segment on the basis of application in Europe electrolyzer market?

Loading Table Of Content...