Europe Fiber Cement Market Overview:

The Europe Fiber Cement Market generated revenue of $3,305 million in 2016, and is expected to garner $4,411 million by 2023, registering a CAGR of 4.6% from 2018 to 2023.

The Europe fiber cement market is driven by factors such as rapid urbanization and industrialization in the developing countries of the continent. Moreover, rapid growth in the construction industry due to renovation of historical structures in countries such as Rome, Italy, and Spain also augment the demand for fiber cement in the region. Also, the high efficiency of fiber cement products, and ban on asbestos cement products supports the growth of the market. However, lack of skilled labor in the developing countries of Europe along with high cost of products hamper the growth of the fiber cement industry in the region. Nevertheless, increase in investments in the infrastructure sector in countries such as the UK, France, and Germany offer growth opportunities for fiber cement manufacturers in the region.

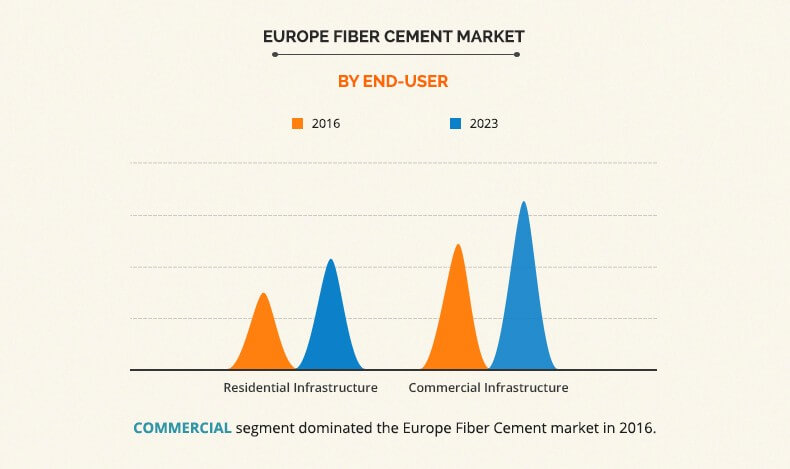

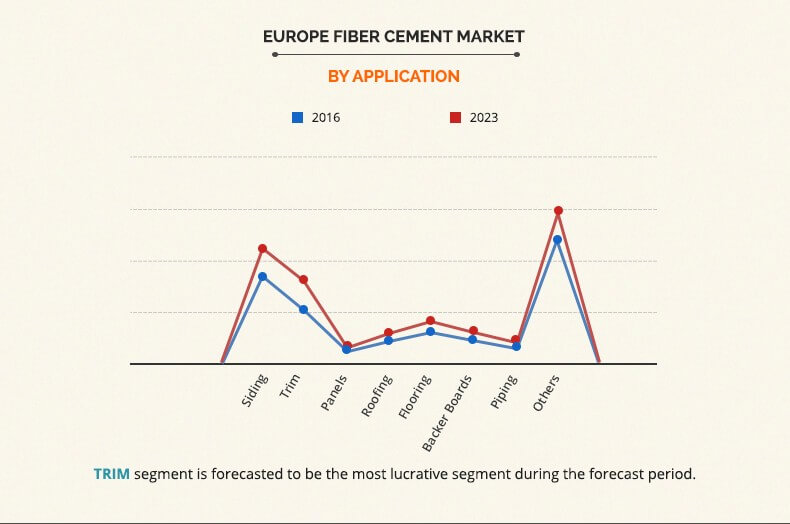

The Europe fiber cement market is segmented based on its application, end use, and region. The application areas of the fiber cement market are broadly classified into siding, trim, panel, roofing, flooring, backer board, piping, and others. The end user of the market is categorized into residential and non-residential sectors. The commercial sector accounted for the highest market share, owing to increase in installation of fiber cement products in non-residential infrastructure projects.

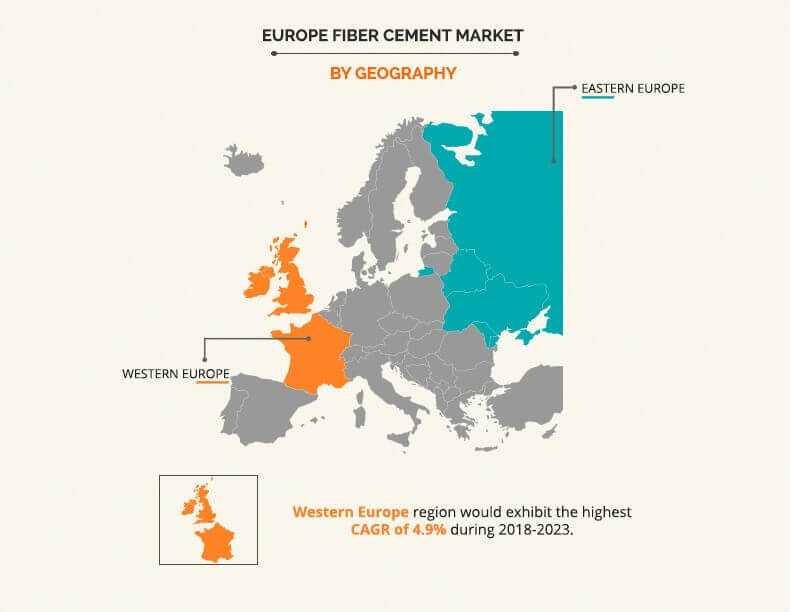

The Europe fiber cement market has been regionally classified as Western Europe, Eastern Europe, and Rest of Europe. Western Europe was the leading region in terms of demand for fiber cement and is expected to maintain its dominance during the forecast period.

The key players profiled in the report include Evonik Industries AG, GIP GmbH, MASTERTEC GmbH & Co. KG, Briarwood Products Ltd, RILCO UK, VIVALDA Limited, BRICQ SAS, PLAKA Group France SAS, Compagnie de Saint-Gobain S.A., Amiantec 3000, S.L., Grupo LOHE F.S., S.A., Tubex SA, Bernardelli Group, and LANDINI S.p.A. di Landini Cav. Mirco.

Segment Overview

There is an increase in the adoption of fiber cement products in construction of commercial buildings owing to the increase in production of fiber cement products, such as corrugated sheets, slates, tiles, and others by developers & contractors. Some of the leading suppliers of these products include James Hardie, Nichicha Corporation, and Etex Group. It is estimated that the construction of commercial infrastructure that includes railways, roads, bridges, airport runways, and dams accounted for 23% of the total construction in Europe in 2013.

Top Investment Pocket

Trim is the most prominent segment by application and is preferred by builders and landholders, owing to its anti-warping and anti-rotting properties. The market for trim application is also projected to witness a significant growth rate due to increased installation in housing projects. Rise in the expansion of construction activities in the developing countries of Europe, has led to a surge in demand of trim boards as it offers the property to withstands harsh weather conditions.

Key Benefits

- The report includes an in-depth analysis of the Europe fiber cement market along with the current trends, drivers, restraints, and growth opportunities.

- Porter’s five forces model of the market illustrates the potency of buyers and sellers to formulate effective growth strategies.

- Value chain analysis of the fiber cement industry provides a clear understanding of the key intermediaries involved, and their respective roles at every stage of the value chain.

- Key market players are profiled in the report to understand the strategies adopted by them.

- The current trends have been quantitatively analyzed and estimated for the period of 2013–2023 to highlight the financial competency of the market.

Europe Fiber Cement Market Key Segmentation:

By Application

- Siding

- Trim

- Panel

- Roofing

- Flooring

- Backer Board

- Piping

- Others

By End Use

- Residential Sector

- Commercial Sector

By Region

- Western Europe

- Eastern Europe

- Rest of Europe

Key Players

- Evonik Industries AG

- GIP GmbH

- Mastertec GmbH & Co.KG

- Briarwood Products Ltd

- Rilco UK

- Vivalda Limited

- Bricq SAS

- CRH plc (PLAKA Group France SAS)

- Compagnie De Saint Gobain SA

- Amiantec 3000, S.L.

Other Players in the Industry

- Grupo LOHE F.S., S.A.

- Tubex SA

- Bernardelli Group

- LANDINI S.p.A. di Landini Cav. Mirco

- Società Italiana Lastre S.p.A.

- Etex Group SA

- Solix Group AB (Cembrit Holding A/S)

- James Hardie Industries PLC

- Open Joint Stock Company LATO

- Nichiha Corporation (NITIHA)

Europe Fiber Cement Market Report Highlights

| Aspects | Details |

| By Application |

|

| By End-use Industry |

|

| By Country |

|

| Key Market Players | ETEX GROUP, JAMES HARDIE INDUSTRIES PLC, BRIARWOOD PRODUCTS LTD, EVONIK INDUSTRIES, TORAY INDUSTRIES, CEMBRIT GROUP A/S, NICHIHA CORPORATION, COMPAGNIE DE SAINT GOBAIN SA, GIP GMBH, TUBEX SA |

Analyst Review

The demand for fiber cement is on the rise in the Europe market, owing to the ban on asbestos cement. Fiber cement ensures durability and provides better efficiency unlike conventional counterparts. It is preferred by professional builders, contractors, and homeowners over vinyl siding.

Countries, such as the UK, Germany, Italy, Spain, and others have opted for fiber cement in interior and exterior cladding to obtain a wood-like texture, and ensure resistance to weather, fire, and termite. Homeowners in the UK have focused on covering their decks with fiber cement. Therefore, fiber cement decking materials gain popularity, particularly in some areas of the UK, to accentuate the aesthetics of their houses.

The Europe fiber cement market is segmented, based on application, into siding, trim, panels, roofing, flooring, backer board, piping, and others. The trim segment is projected to be the fastest growing application during the forecast period, as fiber cement trim boards are adopted by builders and homeowners due to their resistance to rotting and warping. Moreover, a fiber cement panel trim offered by Fry Reglet adds an attractive look to the building, ensures ease of installation, has ecofriendly properties, and is made of 60% recycled aluminum.

Loading Table Of Content...