Europe Industrial Plugs & Sockets Market Overview:

Europe industrial plugs & sockets market was valued at $2,463.6 million in 2017 and is projected to reach $3,614.4 million by 2025, registering a CAGR of 4.7% from 2018 to 2025. North America accounted for the highest revenue share in 2017, and is projected to grow at a CAGR of 22.3% during the forecast period.

Industrial plugs & sockets are power devices, which allow electric equipment to be connected to the power source. These industrial plugs & sockets prevent accidental or deliberate mismatching of plugs. Moreover, they avoid electrical connections that are not compatible in terms of current, polarity, voltage frequency, and type of use. Products, such as plugs, connectors, interlocked socket outlets, switch disconnectors, distribution board equipped with IEC sockets, and other types of products including phase inverter plugs, phase inverter surface inlets, and auxiliary contacts, are covered in this report.

Industrial plugs and sockets are robust, reliable, easy to install, chemical-resistant, and weatherproof. Safety features of such products such as dust-proof, water-proof, and fire-proof make them suitable for use in industrial applications; thereby, providing safe and secured operation even in the most adverse environmental conditions. Moreover, industrial plugs & sockets differ in voltage & current rating, shape, size, and type of connectors, and are used in various industries such as automotive, power & gas, power generation, pharmaceutical, entertainment, construction, and others. Hence, the growth of the industrial production in European Union drives the growth of industrial plugs & sockets in the European market. Europe continues to be the leading consumer of the industry since the inception of the industrial revolution in the region.

Increasing need for establishing secured connections between high voltage and high current electrical circuits in industries drives the growth of the industrial plugs and sockets market in Europe. Moreover, there is increase in demand for dust-proof & splash-proof plugs & sockets due to increased awareness and government regulations about safer work environment. In addition, low cost of raw materials, easy installation of sockets, and use of advanced production technologies are some of the factors that boost the market growth. However, downshift in mining industry in Europe, which employs massive use of industrial plugs and sockets, is expected to restrain the growth of the European market.

On the other hand, rapid development of automotive industries in Europe is expected to provide lucrative opportunities for the growth of the industrial plugs and sockets market. Although Europe is considered as the cradle of innovation in the automotive industry, Germany majorly drives innovation in design and manufacturing of automotive. The advanced technologies used in the production of the automotive vehicles is expected to deploy the use of industrial plugs and sockets in Europe, thereby providing attractive opportunities for the growth of the market.

The key players operating in the European plugs and sockets market are Mennekes Elektrotechnik GmbH & CO. KG , PC Electric GmbH, Bals Elektrotechnik GmbH & Co. KG Scame Group, Palazzoli Group, Marechal Electric Group, Schneider Electric SE, ABB Group, Eaton Corporation plc, Legrand SA, KATKO, and Lovato Electric S.p.A These key players have adopted strategies, such as product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations to enhance their market penetration.

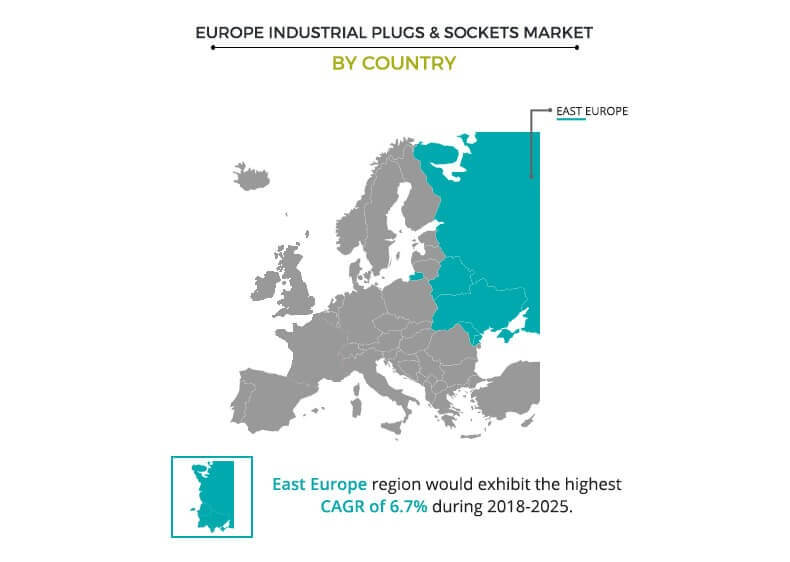

Europe industrial plugs and sockets market is segmented based on product, end user, and country. On the basis of product, the market is categorized into plugs, connectors, interlocked socket outlets, switch disconnectors, distribution board equipped with IEC sockets, and others. Based on end user, the market is segmented into automotive, oil & gas, power generation, chemical & pharmaceutical, marine, entertainment, construction, food & beverages, manufacturing, and aerospace & defense. Based on country, the market is analyzed across Italy, Spain, France, UK, Dach, Benelux, North Europe, East Europe, and Others.

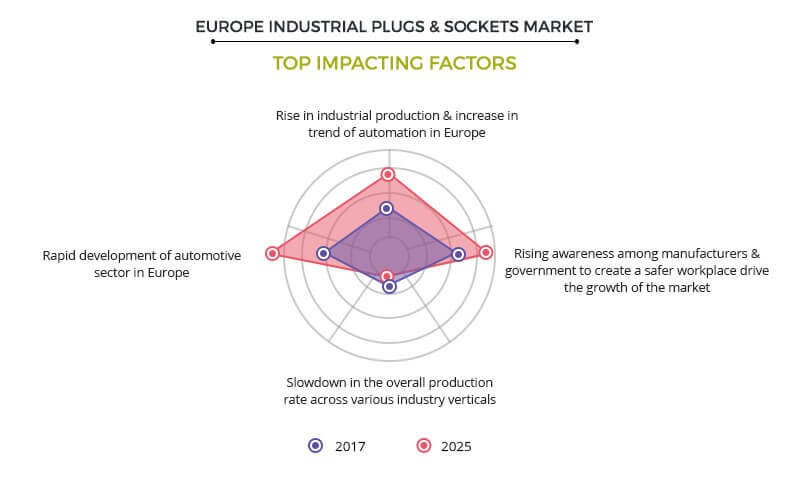

Spiraling increase in industrial production, growing trend of automation in Europe, and rising awareness among manufacturers & government to create a safer workplace drive the growth of the market. However, downshift in the overall production rate across various industry verticals restrains the market growth. Moreover, rapid development of automotive sector in Europe is expected to provide lucrative opportunities for the Europe industrial plugs & sockets market in the upcoming years.

Rise in industrial production and increase in trend of automation in Europe

Industrial plugs & sockets provide a safe and secure connection between electric circuits and prevent accidents such as experiencing electric shocks due to touching energized conductors. The increase in innovation and competitiveness in the European industries boosts the growth of industrial automation to enhance the production capacity and efficiency. Modern industries in Europe incorporate various types of machineries that require huge power supply. Therefore, rise in industrial production and industrial automation trend fuel the demand for the industrial plugs and sockets market in Europe.

Rising awareness among manufacturers & government to create a safer workplace

In any manufacturing industry, secure plugs & sockets help monitor and control the flow of electricity, which can otherwise be harmful for workers. This has obligated key electric plugs & sockets manufacturers to introduce advanced products such as dust-proof and shock-proof plugs & sockets that deliver improved shock resistance and provide better safety. Hence, there is a need for increasing awareness regarding better workplace and safe work environment for the employees. For instance, a wide variety of community measures in the field of safety at work are adopted based on Article 153 of the Treaty on the Functioning of the European Union, which prevents industries to expose their workers to hazardous environment.

Industrial plugs & sockets play a crucial role in establishing safety from severe electric shocks from highly energized conductors to its employees. Hence, there is an increase in demand for dust-proof and splash-proof plugs & sockets, which drives the growth of the European plugs & sockets market.

Downshift in the overall production rate across various industry verticals

Mining and construction are two prominent end-user industries of the electric plugs and sockets market. Earlier, Europe faced a serious decline in the mining and construction equipment market owing to economic meltdown, which in turn has hampered the installation rate of electric plugs & sockets. Mining and metal companies in Europe are in recovery mode due to sluggish mineral prices, increased imposition of environmental regulations, and development of renewable energy sources. For instance, the industrial production of coal and lignite reduced by 36%, from 2010 to 2016, according to the Eurostat. However, the construction industry in Europe is relatively weak but has revived at a notable pace.

Thus, the overall economic slowdown in European countries leads to the decline of various end-user industries such as mining and impedes the installation of industrial plugs & cables in Europe.

Key Benefits for Europe Industrial Plugs & Sockets Market:

- This study presents an analytical depiction of the Europe industrial plugs & sockets market along with the current trends and future estimations to depict the imminent investment pockets.

- The overall market potential is determined to understand the lucrative trends to gain a stronger foothold in the Europe industrial plugs & sockets industry.

- The report includes information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The current market is quantitatively analyzed for the period of 20172025 to highlight the financial competency of the Europe industrial plugs & sockets market.

- Porters five forces analysis illustrates the potency of the buyers and suppliers in the market.

Europe Industrial Plugs & Sockets Market Report Highlights

| Aspects | Details |

| By Product |

|

| By End User |

|

| By Country |

|

| Key Market Players | LEGRAND SA, SCAME PARRE S.P.A. (SCAME GROUP), MENNEKES ELEKTROTECHNIK GMBH & CO. KG, LOVATO ELECTRIC, PC ELECTRIC GMBH, MARECHAL ELECTRIC GROUP, SCHNEIDER ELECTRIC S.E., PALAZZOLI GROUP, ASEA BROWN BOVERI LTD., BALS, EATON CORPORATION PLC., KATKO |

Analyst Review

Industrial plugs & sockets are utilized for establishing a secured connection between machines and equipment, which work on different frequencies and voltages with a compatible power source. They are designed as a system to meet standards for safety and reliability. These plugs & sockets prevent exposure to bare energized contacts and reduce the risk of users accidentally touching the energized conductors. Moreover, features such as large connection area, superior conductivity, and compact design fuel the growth of the industrial plugs & sockets market.

Europe has been anticipated to be the fastest growing market in terms of adoption of industrial plugs & sockets. Massive industrialization and growing trend of automation in industries in Europe drive the industrial plugs & sockets market. The scope of this report includes the analysis of various countries namely, Italy, Spain, France, the UK, Germany, Austria, Switzerland, Belgium, Luxembourg, Holland, Sweden, Finland, Norway, Denmark, Baltics, Poland, Romania, Hungary, Czech Republic, Balkans, Greece, Albania, and Turkey.

The industrial plugs & sockets market is powered by various factors such as surge in industrial production, ongoing trend of automation in Europe, and rise in awareness among manufacturers & government to create a safer workplace. However, downshift in the overall production rate across various industry verticals restrains the market growth. Moreover, rapid development of automotive sector in Europe is expected to provide lucrative opportunities for the Europe industrial plugs & sockets market in the upcoming years.

The major players operating in the Europe industrial plugs & sockets market are Mennekes Elektrotechnik GmbH & Co. KG, PC Electric GmbH, Bals Elektrotechnik GmbH & Co. KG, Scame Group, Palazzoli Group, Marechal Electric Group, Schneider Electric S.E., ABB Group, Eaton Corporation PLC, Legrand SA, KATKO, and Lovato Electric S.p.A.

Loading Table Of Content...