The Europe Polyurea Coatings Market is expected to register a CAGR of 4.5% during the forecast period.

Polyurea coatings are created when amines and isocyanates are combined. These coatings find their application across many industries due to their features such as high tensile strength, flexibility, resistance to chemicals & environmental conditions, short cure periods, and enhanced abrasion resistance. Polyurea coatings, renowned for their adaptability and toughness, have become essential for meeting a wide range of protective coating requirements in various industries. They offer enduring solutions under difficult conditions. These coatings, which are widely used in the oil & gas, automotive, transportation, and construction sectors, are essential for industrial flooring, corrosion prevention, and waterproofing.

The surge in construction activities is poised to drive significant expansion in the Europe polyurea coatings market.

The market for Europe polyurea coating is expanding at a substantial rate owing to increase in construction activities. The need for high-performance protective coatings, such as polyurea, has increased significantly due to strong boom of the construction industry with increased infrastructure development, urbanization, and refurbishment projects. Polyurea coatings are ideal for various kinds of construction substrates due to their flexibility, which allows for substrate movement without breaking or weakening the protective layer. This characteristic is important in dynamic construction settings where structures might be subjected to mechanical stress and temperature changes.

Furthermore, the need to protect surfaces such as steel, concrete, and other materials from corrosive elements is increasing as new buildings and rehabilitation projects take shape. This is attributed to the fact that these coatings offer a smooth, robust protective layer, which is highly resistant to corrosion and adds to the overall lifetime of the structure. Thus, surge in construction activities is expected to drive the growth of the polyurea coating market in Europe.

The rise in usage of sustainable products is poised to drive significant expansion in the Europe polyurea coatings market.

Furthermore, rise in usage of sustainable products such as polyurea coatings drives the growth of the polyurea coating market in Europe. Polyurea coatings are considered sustainable due to their low volatile organic compound (VOC) composition, quick cure times, resilience, and adaptability. High concentrations of VOCs are frequently found in traditional coatings, which may damage human health and contribute to air pollution. Low-VOC polyurea formulations, on the other hand, reduce the amount of toxic compounds released during application and curing, complying with strict environmental standards and enhancing both indoor and outdoor air quality.

Moreover, a key factor in polyurea coatings' sustainability is their quick cure time. When coatings with shorter drying times are used, the amount of pollutants released into the atmosphere is reduced considerably. By doing this, coating application efficiency is increased overall, and the environmental impact of using energy-intensive buildings and equipment is reduced. Hence, polyurea coatings are considered a more environmentally friendly choice, particularly for projects where timeliness and resource efficiency are crucial factors. Thus, surge in environmentally friendly products is expected to foster the growth of the Europe polyurea coating market.

However, the market for polyurea coatings in Europe is significantly hampered by the health risks associated with the toxic gases emitted during the application and curing processes. Isocyanate, a crucial component of polyurea coatings, is widely known for releasing toxic vapors that—if appropriate workplace safety precautions are not taken—could endanger both workers and tourists. Permissible exposure limits (PELs) for isocyanates are established by regulatory agencies such as the Occupational Safety and Health Administration (OSHA), which highlights the necessity of strict safety precautions to reduce inhalation exposure and safeguard the health of workers.

Companies must enforce thorough safety procedures to comply with these regulations. These procedures must include the use of personal protective equipment (PPE), the installation of suitable ventilation systems, and development of training programs that inform staff members about potential risks and preventive measures. However, following these safety guidelines makes the application process more difficult and raises related costs significantly. Therefore, companies thinking about implementing polyurea coatings might find it difficult to navigate the complex web of health and safety laws, which might limit the expansion of the polyurea coating market in Europe. Thus, rise in health hazards from toxic fumes is expected to restrain the growth of the Europe polyurea coating market.

Technological advancements in polyurea coatings are expected to create potential growth opportunities for the expansion of the Europe polyurea coating market. The development of low-VOC and solvent-free polyurea coatings has been the focus of study to meet environmental regulations and address health concerns surrounding toxic emissions during application and curing. These developments provide a more sustainable coating option while simultaneously meeting the increasing need for environmentally friendly solutions.

The polyurea coatings market has benefited from advancements in application technology. The most advanced plural-component spray equipment provides optimal curing and coating performance through precise mixing ratios and improved temperature control. Polyurea coatings may be applied more easily in a variety of environments, including those with high humidity and extreme temperatures, owing to this technology.

Autonomous spray systems have further enhanced the application process and lowered error margin, thus boosting efficiency. The introduction of smart application equipment with real-time monitoring capabilities has improved the quality and uniformity of polyurea coatings and given users greater control over the coating process. Thus, advancements in technology are anticipated to create lucrative growth opportunity for the Europe polyurea coating market during the forecast period.

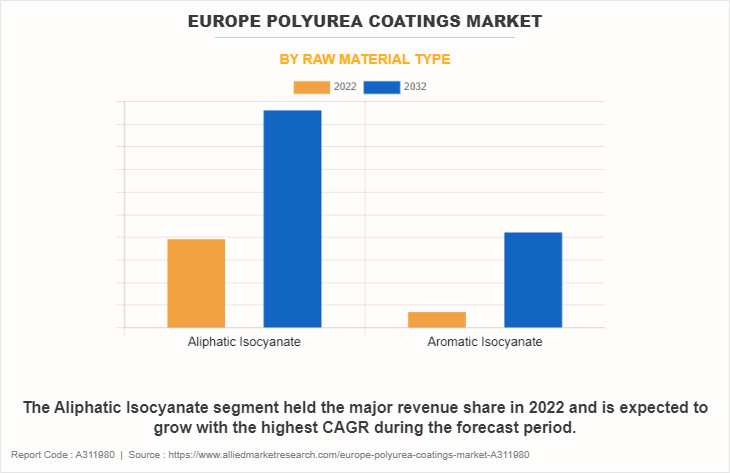

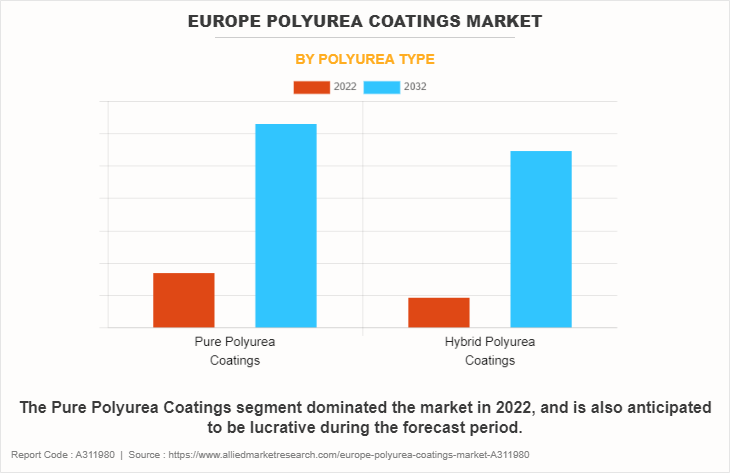

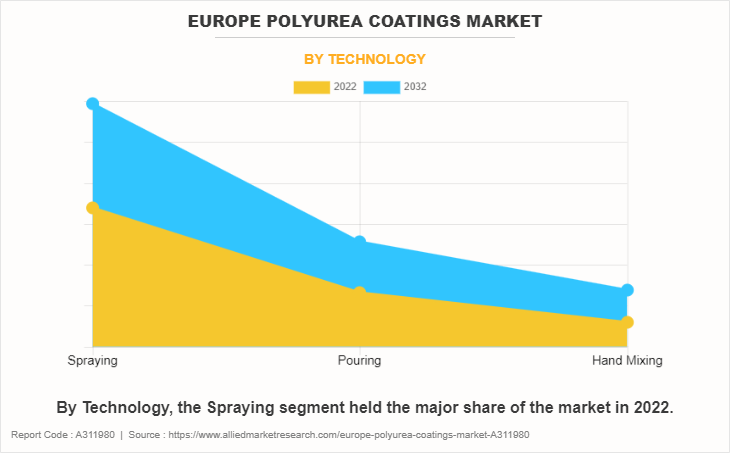

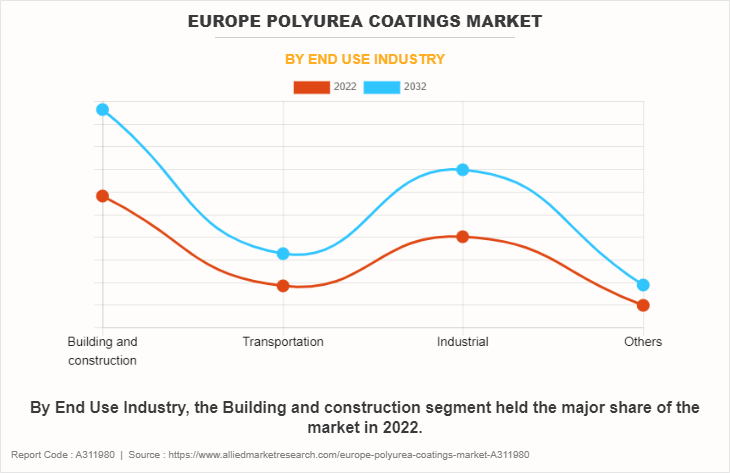

The Europe polyurea coating market is segmented into raw material type, polyurea type, technology, end-use industry, and country. By raw material type, the market is bifurcated into aliphatic isocyanate and aromatic isocyanate. On the basis of the polyurea type, it is categorized into pure polyurea coatings and hybrid polyurea coatings. Depending on technology, the market is divided into spraying, pouring, and hand mixing. By end-use industry, it is categorized into building & construction, transportation, industrial, and others. Country wise, the market is studied across Germany, UK, France, Italy, Spain, and the rest of Europe.

The aliphatic isocyanate segment accounted for the largest share in 2022 and is expected to register the highest CAGR of 4.7%. This can be attributed to its remarkable UV stability, weather resistance, and color retention properties. These attributes make it highly suitable for outdoor applications, offering long-lasting protection against environmental elements. Industries such as construction, automotive, and infrastructure benefit from its versatile and reliable performance.

The pure polyurea coatings segment accounted for the largest share in 2022 owing to its unparalleled versatility, rapid curing, and seamless application. It forms a durable, elastic, and chemical-resistant protective layer, making it a preferred choice for various applications across industries. Its effectiveness in providing long-lasting protection contributes to its market dominance.

The hybrid polyurea coatings segment is expected to register the highest CAGR of 4.7% due to its unique combination of polyurea and polyurethane properties. This results in enhanced flexibility, abrasion resistance, and prolonged durability, making it a preferred choice for diverse applications and contributing to its dominance in the market.

The spraying segment accounted for the largest share in 2022 and is expected to register the highest CAGR of 4.7%. This can be attributed to its efficiency and versatility. This method enables quick and uniform application over various surfaces, facilitating seamless protection. Its ease of use supports large-scale projects, making it the preferred choice in industries like construction, infrastructure, and manufacturing for its cost-effective and time-saving benefits.

The building and construction segment accounted for the largest share in 2022 due to the coatings' exceptional protective properties. Polyurea coatings provide durability, chemical resistance, and waterproofing, making them vital for applications like roofing, flooring, and infrastructure. The construction industry relies on polyurea coatings for long-lasting and reliable protection against environmental factors.

The industrial segment is expected to register the highest CAGR of 4.8% due to rising demand for robust protective solutions. Polyurea coatings offer superior resistance to chemicals, abrasion, and corrosion, making them crucial for industrial applications, including pipelines, tanks, and machinery, driving their increased adoption and growth in this sector.

Rest of Europe garnered the largest share in 2022 driven by robust industrial activities, infrastructure development, and widespread adoption across various sectors. The region's diverse economies, including emerging markets, contribute to the dominant position, reflecting the growing demand for polyurea coatings in this geographic segment.

The major players operating in the Europe polyurea coating market are Corroless Eastern, Elastopol S.r.l., ISOMAT, mpm S.r.l., Teknos Group, Tikkurila, Valpolymer S.r.l., and VIP Coatings Intl GmbH & Co.KG.

Strategic Developments Undertaken By Key Players:

In December 2021, Teknos Group introduced TEKNOPUR 400, a two-component elastomeric coating that is an affordable solution for waterproofing and producing long-lasting concrete and roofing surfaces. It was developed using modified polyurea technology. TEKNOPUR 400-800 exhibits strong mechanical qualities and is able to withstand severe abrasion, offering it a long-lasting surface with excellent wear resistance. It works particularly well not only for making sturdy concrete and roofing surfaces but it may also be applied to wood, geotextile, and foam substrates. This product launch will increase the demand for the polyurea coating in Europe.

Historic Trends:

- The Europe polyurea coating market has grown steadily over the years. This growth has been attributed to the increasing demand for high-performance coatings across various industries, including construction, automotive, industrial, and oil & gas.

- The construction sector has been a major driver of the polyurea coating market in Europe. The coatings are widely used for waterproofing, protecting concrete structures, and providing corrosion resistance, contributing to the durability and longevity of buildings and infrastructure.

- The market has witnessed continuous innovations in polyurea coating formulations and applications. Manufacturers have focused on developing coatings with enhanced properties, such as faster curing times, improved adhesion, and increased chemical resistance, expanding the range of potential applications.

- There has been a growing emphasis on environmentally friendly coatings. Manufacturers have been working on formulations with lower volatile organic compounds (VOCs) to align with stringent environmental regulations and address concerns related to air quality and health.

- While construction remains a key application area, the use of polyurea coatings has diversified into other industries such as automotive, oil & gas, and manufacturing. This diversification has contributed to a more resilient market, reducing dependence on a single sector.

- Customers have increasingly sought customized polyurea coating solutions to meet specific project requirements. This trend reflects the industry's responsiveness to diverse needs of end users in different sectors.

- Some companies in the Europe polyurea coating market have been engaged in strategic partnerships and acquisitions to strengthen their market presence, expand their product portfolios, and enhance their technological capabilities.

Key Benefits For Stakeholders

- The report provides a comprehensive analysis of the current market estimations through 2022-2032, which would enable the stakeholders to capitalize on prevailing market opportunities.

- Major countries are mapped according to their revenue contribution to the europe polyurea coatings market.

- In-depth analysis of the europe polyurea coatings market segmentation assists to determine the prevailing market opportunities.

- Identify key players and their strategic moves in europe polyurea coatings market.

- Assess and rank the top factors that are expected to affect the growth of europe polyurea coatings market.

- Analyze the market factors in various countries and understand business opportunities.

- Player positioning provides a clear understanding of the present position of key market players.

Europe Polyurea Coatings Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 257.6 million |

| Growth Rate | CAGR of 4.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 122 |

| By Raw Material Type |

|

| By Polyurea Type |

|

| By Technology |

|

| By End Use Industry |

|

| By Country |

|

| Key Market Players | PPG Industries Inc., Covestro AG, Wacker Chemie AG, Axalta Coatings Systems LLC, Sherwin-Williams Company, BASF SE, Akzo Nobel N.V., Huntsman Corporation, Dow Chemical Company, RPM International Inc. |

The Europe Polyurea Coatings Market is projected to grow at a CAGR of 4.5% from 2022 to 2032

BASF SE, Covestro AG, Huntsman Corporation, Dow Chemical Company, PPG Industries Inc., Akzo Nobel N.V., Axalta Coatings Systems LLC, RPM International Inc., Sherwin-Williams Company, Wacker Chemie AG are the leading players in Europe Polyurea Coatings Market

1. The report provides a comprehensive analysis of the current market estimations through 2022-2032, which would enable the stakeholders to capitalize on prevailing market opportunities. 2. Major countries are mapped according to their revenue contribution to the europe polyurea coatings market. 3. In-depth analysis of the europe polyurea coatings market segmentation assists to determine the prevailing market opportunities. 4. Identify key players and their strategic moves in europe polyurea coatings market. 5. Assess and rank the top factors that are expected to affect the growth of europe polyurea coatings market. 6. Analyze the market factors in various countries and understand business opportunities. 7. Player positioning provides a clear understanding of the present position of key market players.

Europe Polyurea Coatings Market is classified as by raw material type, by polyurea type, by technology, by end use industry

Loading Table Of Content...

Loading Research Methodology...