EV Insurance Market Research, 2031

The global ev insurance market was valued at $51.4 billion in 2021, and is projected to reach $210.4 billion by 2031, growing at a CAGR of 15.5% from 2022 to 2031.

Electric car insurance is a type of motor insurance which is there to protect electric cars from a number of potential damages and losses, such as those that might happen in the case of accidents, natural calamities, or fire. Electronic Vehicle Insurance (EV insurance) is a new type of motorized vehicle insurance for cars and other electric vehicles. It covers bills and expenses during vehicle breakdowns and insures the vehicle against damage, theft, etc. The growing availability of electric vehicles (EVs) has created new opportunities for insurers to develop products tailored to the policies of EVs. Electronic Vehicle Insurance (EV insurance) is one example of this concept, providing motorists with vehicle coverage.

The spread of internet access to every corner of the globe has resulted in a surge in the online segment which has facilitated a rapid growth prospect for the EV insurance. In the twenty-first century, smartphones have also become an indispensable part of many people's lives. The increasing use of devices such as smartphones and tablets, as well as access to the internet via 4G, 5G, and other technologies, has accelerated the adoption of digital technology.

Moreover, Surge in demand for EV vehicle insurance and several instances of electric bikes and cars catching fire have come to light in recent months but there is no stopping this vehicle segment from picking up speed. Though it is still at a nascent stage therefore, general insurance companies are turning their attention to the segment, recognizing its growing potential. Therefore, these are some of the factors that propel the growth of EV insurance market.

However, enforcement of strong rules by banks and financial institutions for providing vehicle finance has put up a strong restriction. This restriction has been implemented by a number of banks and financial service providers to offer car finance services, which restricts the growth of the market across the globe. On the contrary, there has been a significant increase in the awareness about the importance of insurance policies among the customers. Many banks and financial institutions, can leverage on this opportunity by offering various types of EV vehicle insurance policies to the customers.

The report focuses on growth prospects, restraints, and trends of the EV insurance market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the EV insurance market.

Segment Review

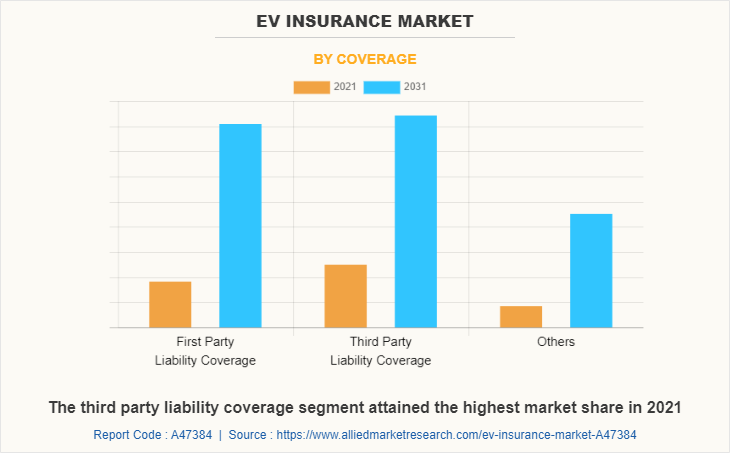

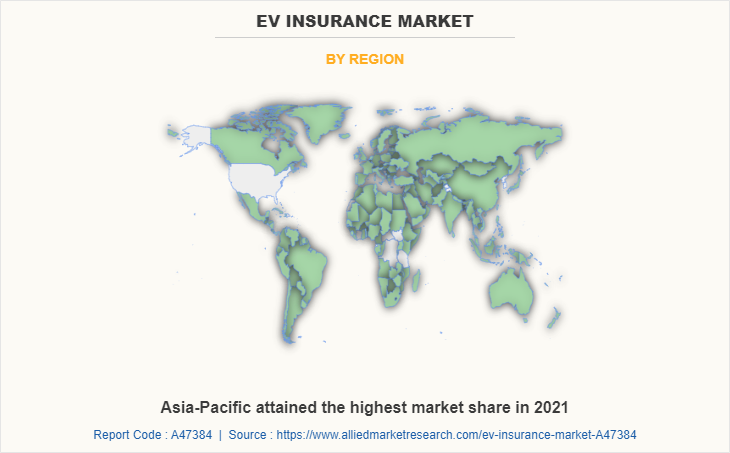

The EV insurance market is segmented on the basis of coverage, distribution channel, vehicle age, application, and region. By coverage, it is segmented into first party liability coverage, third party liability coverage, and others. By distribution channel, it is bifurcated into, insurance companies, banks, insurance agents/ brokers, and others. On the basis of vehicle age, the EV insurance market is segmented into new vehicle and used vehicle. By application, it is segmented into personal and commercial. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By coverage, the third-party liability coverage segment attained the highest growth in 2021. This is attributed to the fact that third-party liability coverage is a statutory requirement under the Motor Vehicles Act. It is compulsory to buy for both new and old vehicle owners at the time of registration of vehicles, which acts as a key factor driving the growth of the global EV insurance market. Moreover, this factor significantly contributes toward the growth of the market. As the third-party insurance cover is mandatory, all non-life insurance companies have an obligation to provide this cover, which propels the market growth, globally.

By region, Asia Pacific attained the highest growth in 2021. This is attributed to the fact that EV insurance market possesses highest potential growth owing to rise in usage of EV vehicles. Moreover, the growth of the market is attributed to supportive government policies and regulations, increasing investments by leading automotive OEMs, and decreasing prices of batteries. Increasing adoption of electric mobility in emerging economies and increasing EV and battery manufacturing capabilities in Southeast Asia provide lucrative growth opportunities for the EV insurance market.

The report analyzes the profiles of key players operating in the EV insurance market such as ACKO General Insurance Limited, Allianz SE, Allstate Insurance Company, AXA, Bajaj Allianz General Insurance Company, Beinsure Digital Media, Esure, HDFC ERGO, Lemonade, Inc., Progressive Casualty Insurance Company. These players have adopted various strategies to increase their market penetration and strengthen their position in the EV insurance market.

Market Landscape and Trends

Over the past two years, the coronavirus epidemic has moderately affected the insurance sector. With the aid of latest technology, insurers can use data from IoT devices such as the various components of smart homes, automobile sensors, and wearable technologies to better determine rates, mitigate risk, and even prevent losses in the first place. Moreover, with an increasing focus on personalized premiums and usage-based coverage, insurers are leveraging Internet of Things, advanced analytics and machine learning to develop more granular individual risk profiles. In addition, collaboration between traditional insurance and InsurTech firms will give rise to newer models and revenue streams, higher profitability and reduced operational costs for EV insurance industry.

Furthermore, digitalized workplaces and simplified operations along with accelerated performance are expected to drive the growth of the global EV insurance market over the forecasted period. In addition, companies' companies who are providing EV insurance services are continuously attempting to reduce their capital expenditures and operational costs. Because of the current competitive environment and global economic crisis, the adoption of cost-effective strategies for restructuring existing business models has increased. Therefore, these are the major market trends of EV insurance market.

Top Impacting Factors

Rise in Penetration of Internet & Mobile Devices Across the World

The spread of internet access to every corner of the globe has resulted in a surge in the online segment which has facilitated a rapid growth prospect for the EV insurance. In the twenty-first century, smartphones have also become an indispensable part of many people's lives. The increase in use of devices such as smartphones and tablets, as well as access to the internet via 4G, 5G, and other technologies, has accelerated the adoption of digital technology.

Moreover, banking firms and financial institutions are turning to cloud oriented software, as the software keeps businesses up to date on transactions automatically, to streamline daily operations and gain access to data from anywhere. According to the article published by InsurTech, in January 2022, there are many different ways insurers can use the cloud to improve their business which is platform hosting, data storage and backup, marketing campaign and ERP. Therefore, rise in penetration of the internet and mobile devices across the world is expected to drive the growth of the EV insurance market during the forecast period.

Surge in Demand for EV Vehicle Insurance

Several instances of electric bikes and cars catching fire have come to light in recent months but there is no stopping this vehicle segment from picking up speed. Though it is still at a nascent stage therefore, general insurance companies are turning their attention to the segment, recognizing its growing potential. Moreover, large insurers, such as Bajaj Allianz General and HDFC ERGO, have set up dedicated portals that offer specialized services for electric cars as also information to prospective electric car buyers. Moreover, in response to an increase in the amount of EV purchases, EV vehicles insurance in developing nations like Japan, India, Hong Kong, and others is experiencing rapid growth, which is opportunistic for the growth of the EV insurance market demand.

Furthermore, it is no surprise that they are quickly becoming the new-age modes of transportation, with perks like noiseless driving, pollution-less commuting, and added savings from cutting out petrol and diesel use. Nevertheless, the perks come at an additional cost to the vehicle owner. For instance, as these vehicles are built with advanced technology, their repair also necessitates hiring specialists and an increase in repair costs in case of damage. Similarly, the batteries of these cars or bikes and other specialized parts are expensive, implying a high replacement cost. Therefore, in that case, having an EV vehicle insurance policy in place can save the consumer from hefty charges. if there is any damage or depreciation. Thus, this factor helps to drive the global EV insurance market.

Enforcement of Strong Rules by Banks and Financial Institutions for Providing Car Finance

Strong restrictions have been implemented by a number of banks and financial service providers to offer car insurance for electric cars, which restricts the growth of the market across the globe. Vehicle finance providers have been demanding several documents to deliver lending services, which include owner’s bank account statement, credit score document, historical information of property, and no criminal cases document. Thus, this factor hampers the EV insurance market growth.

Prices of EV Vehicles are Expensive

The electric car insurance cost is high as it is made up of advance technology and also helps reduce the pollution in the globe. There come difficulties for the individuals to buy such EV cars, which leads to less sales of the EV insurance with such advent function in EV vehicles. Moreover, in most of the countries there is no proper facility of the charging stations which indeed leads to less purchasing of the EV vehicles; thus, this factor hampers the market growth. In addition, the maintenance of such vehicles which requires huge investment amount and such huge cost cannot be afforded by most of the individuals. Therefore, these factors limit the growth of the EV insurance market size.

Growth in Demand for EV Insurance Policies

There has been a significant increase in the awareness about the importance of insurance policies among the customers. Many banks and financial institutions, can leverage on this opportunity by offering various types of EV vehicle insurance policies to the customers. Furthermore, banks are partnering with insurance companies to provide EV insurance policies to increase their customer satisfaction and with the rise in demand for insurance policies, insurance companies are approaching banks to sell their products to the customers. Therefore, the demand for EV insurance services will also increase in the upcoming years, with the growing demand for EV vehicles policies among customers. Thus, this is projected to provide major lucrative opportunities for the growth of the EV insurance market share.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the EV insurance market forecast from 2022 to 2031 to identify the prevailing EV insurance market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the EV insurance market outlook assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global EV insurance market trends, key players, market segments, application areas, and market growth strategies.

EV Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 210.4 billion |

| Growth Rate | CAGR of 15.5% |

| Forecast period | 2021 - 2031 |

| Report Pages | 396 |

| By Coverage |

|

| By Distribution Channel |

|

| By Vehicle Age |

|

| By Application |

|

| By Region |

|

| Key Market Players | Lemonade, Inc., Esure Group plc, Allianz SE, Beinsure Digital Media, ACKO GENERAL INSURANCE LIMITED, AXA, Progressive Casualty Insurance Company, Allstate Insurance Company, HDFC ERGO, Bajaj Allianz General Insurance Company |

Analyst Review

Insurance is a contract in which an insurer indemnifies another against losses from specific contingencies or perils. It helps to protect the insured person or their family against financial loss. There are many types of insurance policies. Life, health, homeowners, and auto are the most common forms of insurance. In addition, electric car insurance is a type of motor insurance that is there to protect electric cars from a number of potential damages and losses, such as those that might happen in the case of accidents, natural calamities, or fire. Such EV insurance offers electric vehicles insurance, also called automotive insurance, it is a contract by which the insurer assumes the risk of any loss the owner or operator of a car may incur through damage to property or persons as the result of an accident.

Furthermore, market players are adopting partnership strategies for enhancing their services in the market and improving customer satisfaction. For instance, in November 2021, Zurich North America has announced the launch of an enhanced suite of vehicle protection products designed for electric vehicle (EV) owners. This product provide coverage for electric vehicles from the repair or replacement of rechargeable batteries to roadside assistance for recharging EV batteries that run out of power mid-trip. The product suite covers nearly all EV manufacturers, including Tesla, Rivian and Polestar. Therefore, such strategy helps to grow the EV insurance market.

Moreover, some of the key players profiled in the report include are ACKO General Insurance Limited, Allianz SE, Allstate Insurance Company, AXA, Bajaj Allianz General Insurance Company, Beinsure Digital Media, Esure, HDFC ERGO, Lemonade, Inc., and Progressive Casualty Insurance Company. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Some upcoming trends in the EV insurance market include a shift towards usage-based insurance, increased focus on cybersecurity for connected vehicles, and a rise in the number of electric vehicle-specific insurance products. Additionally, there may be changes in liability laws as EVs become more prevalent, and insurance companies may also begin to take into account the unique maintenance needs of electric vehicles.

Asia-Pacific is the largest regional market for EV Insurance

The global EV insurance market was valued at $51,436.50 million in 2021, and is projected to reach $210,394.92 million by 2031, growing at a CAGR of 15.5% from 2022 to 2031.

ACKO General Insurance Limited, Allianz SE, Allstate Insurance Company, AXA, Bajaj Allianz General Insurance Company, Beinsure Digital Media, Esure, HDFC ERGO, Lemonade, Inc., Progressive Casualty Insurance Company

Loading Table Of Content...