EVA Solar Films Market Research, 2032

The global EVA solar films market size was valued at $3.2 billion in 2022, and is projected to reach $7.8 billion by 2032, growing at a CAGR of 9.5% from 2023 to 2032. ethylene vinyl acetate (EVA) solar films play a pivotal role in transforming the photovoltaic industry, it is an important component in solar cell encapsulation. Derived from the copolymerization of ethylene and vinyl acetate, these polymer sheets offer transparency, flexibility, and exceptional adhesion properties, making them indispensable for lamination in solar panel production. In addition, the introduction of EVA solar films has transformed the solar energy sector, elevating the durability & performance of solar modules. The blend of ethylene and vinyl acetate imparts distinctive qualities to EVA solar films.

Their flexibility facilitates integration into the solar panel manufacturing process, accommodating various shapes and sizes. Simultaneously, the films adhesion properties contribute to the overall structural integrity of solar modules, further enhancing their reliability and performance in harnessing solar energy. Furthermore, the transparent nature of EVA solar films is instrumental in optimizing light transmission, a major factor for maximizing energy conversion efficiency. As encapsulants, these films serve as protective barriers for solar cells, shielding them from environmental elements such as moisture and UV radiation. This dual functionality prolongs the lifespan of solar panels and preserves optical clarity, ensuring efficient sunlight capture for energy conversion.

Moreover, upsurge in adoption of solar panels is poised to catalyze a substantial increase in the demand for EVA solar films. With a heightened global emphasis on sustainable and renewable energy sources, solar power has emerged as a pivotal player in addressing these imperatives. In addition, the installation of solar panels has experienced progressive growth, driven by a dual stimulus of environmental awareness and government initiatives promoting clean energy. Furthermore, EVA solar films, integral components within photovoltaic modules, are a crucial part of elevating the efficiency and lifespan of solar panels. Functioning as encapsulants, EVA solar films play a pivotal role in shielding the delicate photovoltaic cells within solar panels from environmental elements such as moisture, dust, and mechanical stress. Their distinctive properties, encompassing light transmittance and robust adhesion, significantly contribute to the resilient performance of solar modules. These films effectively bind the different layers of a solar panel, ensuring durability & reliability in diverse weather conditions. The escalating demand for EVA solar films is further propelled by the burgeoning solar energy market, marked by increased investments and technological advancements. These films establish a protective barrier and enhance the overall performance of solar panels by facilitating crucial light transmission for optimized energy conversion.

However, the EVA solar films market growth is projected to experience several challenges due to the escalating costs associated with this crucial component in photovoltaic module manufacturing. In addition, EVA solar films, integral to the encapsulation of solar modules, have experienced a surge in prices, posing a potential impediment to the broader expansion of the solar film market. As a key element ensuring the durability and performance of solar panels, the soaring prices of EVA films present challenges for manufacturers and stakeholders in the solar energy sector. In markets such as solar energy, where cost-effectiveness is pivotal for widespread adoption, the high price of EVA solar films becomes a barrier to achieving ambitious renewable energy targets. Stakeholders, encompassing solar panel manufacturers and project developers, grapple with the challenge of maintaining competitive pricing and achieving desirable returns on investment. Addressing the issue necessitates a multifaceted approach, encompassing innovations in manufacturing processes, cost-effective raw material sourcing, and technological advancements. These measures could collectively contribute to mitigating the cost challenges faced by the EVA solar films market, fostering a more sustainable and accessible landscape for the solar energy sector growth and development.

On the other hand, surge in popularity of EVA solar films is notably evident in architectural applications and the automotive industry, marking a substantial growth trajectory for the EVA solar films market. Particularly in architectural structure, these films play a crucial role within solar photovoltaic (PV) modules, contributing significantly to the utilization of solar energy for sustainable power generation. Their application lies in their versatility, seamlessly integrating into various architectural elements such as glass facades and windows. This integration allows for the effective harnessing of solar energy without impacting the aesthetic and design aspects of buildings. EVA solar films emerge as a preferred choice in sustainable architecture, offering dual functionality of energy generation and design flexibility. Simultaneously, the automotive sector is increasingly acknowledging the potential of EVA solar films, especially in applications like solar roofs for electric and hybrid vehicles. Beyond contributing to carbon emissions reduction, these films enhance vehicle energy efficiency by leveraging solar power as a supplementary source for traditional charging systems. The lightweight & flexible characteristics of EVA solar films align seamlessly with the automotive industry's ongoing initiatives to improve fuel efficiency and minimize the environmental footprint of vehicles, further solidifying their role in the pursuit of sustainable transportation solutions.

Moreover, the key players profiled in this report are Hangzhou First Applied, Str Holdings, Inc., Hanwha Solutions, Mitsui Chemicals, KENGO, Bridgestone Corporation, 3M, Astenik Solar, Guangzhou Lushan New Materials Co., Ltd., and Celanese Corporation. Acquisition and strategic partnership are common strategies followed by major market players. For instance, in September 2022, Hanwha Solutions, a prominent player in South Korea's chemical and energy sector, is making a strategic investment of $549 million to reinforce its solar cell material business, responding to the formidable competition from Chinese companies in the solar energy domain. The focal point of this substantial infusion is to enhance the production capacity of EVA, a crucial component serving as an encapsulating agent in solar modules. The investment is set to elevate Hanwha Group's cumulative EVA production capacity to 9,20,000 tons, surpassing Exxon Mobil's capacity of 7,90,000 tons. EVA is known for its attributes such as excellent radiation transmission and resistance to sunlight degradation, playing a pivotal role in bolstering the durability and efficiency of solar modules. In a strategic collaboration, Hanwha Solutions has joined forces with GS Energy, a comprehensive energy solutions provider in South Korea, to establish an EVA joint venture named H&G Chemical. This venture, supported by a total investment of 590 billion won, aims to achieve an annual production capacity of 300,000 tons, commencing from September 2025. This partnership underscores Hanwha's commitment to fortifying its position in the solar energy market through technological advancements and robust production capabilities.

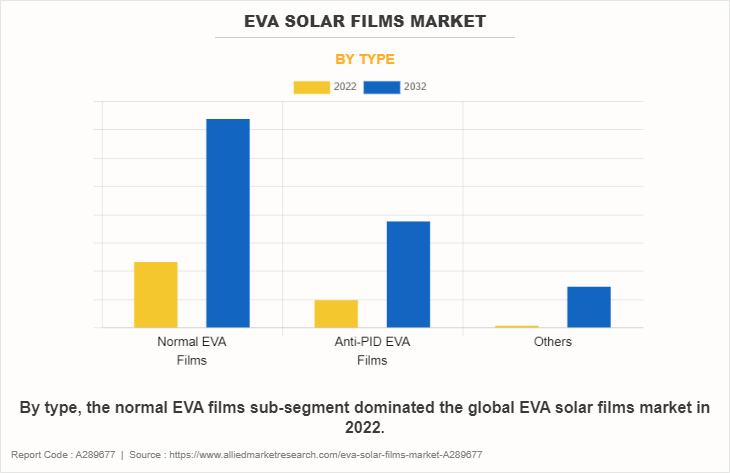

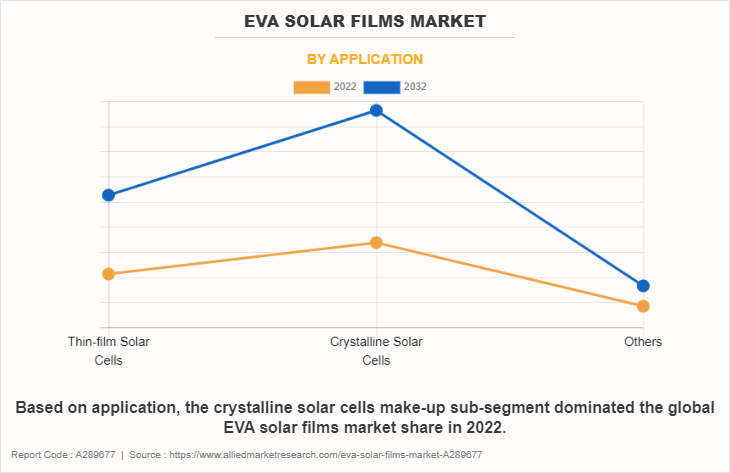

Moreover, the EVA solar films market is segmented on the basis of type, application, and region. By type, the market is divided into normal EVA films, anti-PID EVA films, and others. Based on application, the market is classified into thin-film solar cells, crystalline solar cells, and others. According to region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The eva solar films market is segmented into Type and Application.

By type, the normal EVA films sub-segment dominated the global EVA solar films market in 2022. The durability inherent in normal EVA films stands as a paramount advantage, showcasing robust resistance to environmental factors and wear. This resilience ensures the prolonged longevity of solar panels, proving crucial in the face of varied weather conditions and external elements to which solar installations are exposed. Particularly noteworthy is the cost-effectiveness embedded in normal EVA films, positioning them as a pragmatic choice for manufacturers. Widely accessible and economically viable, these films offer a harmonious balance between performance and affordability, allowing manufacturers to optimize production costs without compromising the quality or enduring capability of their solar panels. The advantageous properties of normal EVA films extend their impact on the efficiency of the manufacturing process. These films contribute to streamlined production workflows by facilitating easy lamination processes during the creation of solar modules. The seamless integration of EVA films enhances overall production efficiency, providing manufacturers with a smoother and more cost-effective manufacturing experience. As a result, the utilization of normal EVA films emerges not only as a testament to their intrinsic durability but also as a strategic choice in bolstering the economic feasibility and manufacturing efficacy of solar panel production.

Based on application, the crystalline solar cells make-up sub-segment dominated the global EVA solar films market share in 2022. Crystalline solar cells held a dominant share in the EVA solar films market, owing to their inherent advantages and widespread adoption in the solar energy sector. Renowned for their efficiency and durability, these cells have emerged as the preferred choice for capturing solar energy. The utilization of crystalline silicon in these cells contributes to their high conversion efficiency, a crucial factor in maximizing electricity output from sunlight. This efficiency has propelled crystalline solar cells to the forefront of the EVA solar films market. These cells find application across a spectrum of settings, from residential rooftop installations to large-scale solar farms, showcasing their versatility. Their integration into different environments meets the diverse needs of the solar energy landscape. The adaptability of crystalline solar cells positions them as a solution for both established and emerging solar projects, maintaining their dominating share in the EVA solar films market. With their efficiency, durability, and applicability to various scales of solar installations, crystalline solar cells continue to play a pivotal role in advancing the effectiveness and sustainability of solar energy systems.

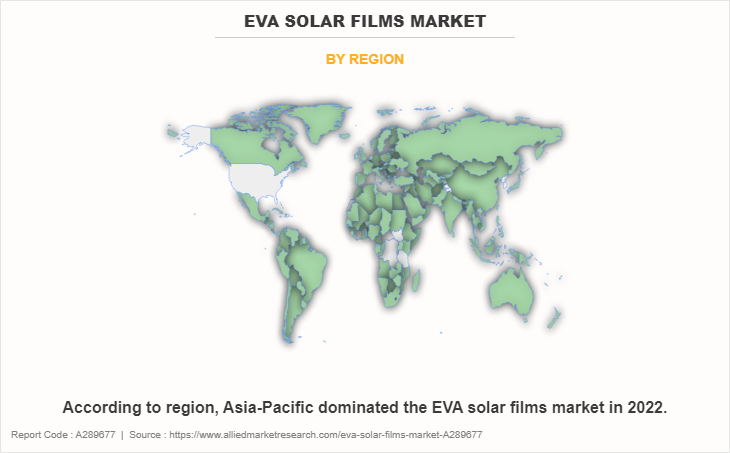

According to region, Asia-Pacific dominated the EVA solar films market in 2022. The Asia Pacific region commands a prominent position in the EVA solar films market, establishing dominance within this dynamic sector. This is driven by the region’s surging demand for sustainable energy solutions, particularly in the solar industry, which has experienced substantial growth. The Asia Pacific nations, united by a shared commitment to renewable energy and environmental sustainability, have made significant investments in solar power infrastructure. This strategic emphasis has resulted in the widespread deployment of solar modules, with EVA solar films playing a pivotal role in enhancing the longevity and performance of photovoltaic panels. The proactive adoption of solar energy technologies by countries in the Asia Pacific region addresses escalating energy needs while concurrently mitigating environmental impact. This approach has solidified the region's supremacy in the EVA solar films market forecast. As the demand for sustainable and eco-friendly solutions continues to rise.

Impact of COVID-19 on the Global EVA Solar Films Industry

- EVA solar film production faced challenges due to COVID-19-related disruptions in the supply chain, affecting the availability of raw materials.

- Implementation of solar projects using EVA solar films experienced delays as lockdowns and restrictions hampered construction activities.

- Remote working conditions in the industry have slowed down decision-making processes and project planning, affecting the overall adoption of EVA solar films.

- As economies recover from the pandemic, there have a gradual resurgence in the demand for EVA solar films, aligning with renewed investments in renewable energy projects.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the eva solar films market analysis from 2022 to 2032 to identify the prevailing eva solar films market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the eva solar films market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global eva solar films market trends, key players, market segments, application areas, and market growth strategies.

EVA Solar Films Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 7.8 billion |

| Growth Rate | CAGR of 9.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 310 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Mitsui Chemicals, Hangzhou First Applied, 3M, Astenik Solar, Hanwha solutions, Guangzhou Lushan New Materials Co. Ltd., Celanese Corporation, Bridgestone Corporation, Str Holdings, Inc., KENGO Industrial Co., Ltd. |

The normal EVA films sub-segment of the type acquired the maximum share of the global EVA solar films market in 2022.

Solar panel companies are the major customers in the global EVA solar films market.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global EVA solar films market from 2022 to 2032 to determine the prevailing opportunities.

Crystalline solar cells held a dominant share in the ethylene vinyl acetate (EVA) solar films market, owing to their inherent advantages and widespread adoption in the solar energy sector.

The surge in popularity of ethylene vinyl acetate (EVA) solar films is notably evident in architectural applications and the automotive industry, marking a substantial growth trajectory for the EVA solar films market.

The EVA solar films market size is expected to grow due to an escalating adoption in architectural and automotive applications.

The major growth strategies adopted by the EVA solar films market players are product launches and partnership agreements.

Asia-Pacific will provide more business opportunities for the global EVA solar films market in the future.

Hangzhou First Applied, Str Holdings, Inc., Hanwha Solutions, Mitsui Chemicals, KENGO, Bridgestone Corporation, 3M, Astenik Solar, Guangzhou Lushan New Materials Co., Ltd., and Celanese Corporation are the major players in the EVA solar films market.

Loading Table Of Content...

Loading Research Methodology...