Event Insurance Market Research, 2032

The global event insurance market was valued at $726.9 million in 2022, and is projected to reach $2.3 billion by 2032, growing at a CAGR of 12.7% from 2023 to 2032.

Event insurance is a type of insurance that compensates the policyholder in the event of direct physical loss due to fire & allied perils, including earthquake, burglary, and theft, occurring during events such as corporate conferences, seminars, live concerts, award ceremonies, school & college annual functions, wedding ceremonies, sports events, and others. There is an increase in the demand for events insurance in the market to cover the policyholder from unforeseen property damage & losses. Premium rates are determined by location as well as the duration of the event. Furthermore, the event insurance market size is expected to grow in the near future, to protect against unforeseen monetary losses or damage.

The increase in demand for event insurance is a key driver for the growth of event insurance market. There is a surge in need for all-inclusive insurance coverage that takes a wide variety of risks into account as events continue to expand in size and complexity. The possibility exists for insurance companies to create and supply specialized coverage choices that are tailored to particular event types, risk profiles, and coverage requirements. In addition, the growing awareness of potential risks associated with events and the risk mitigation and financial protection provided by event insurance are the major driving factors for the market.

However, the high cost of event insurance policies is a major factor hampering the growth of the market. Event insurance can be expensive, especially for large-scale events or events with high-risk factors. In addition, premiums can vary based on the size, location, type, and risk profile of the event. Further, event insurance policies can be complex and involve various terms, conditions, and exclusions. Understanding the coverage options and tailoring them to specific event requirements can be challenging for customers. Contrarily, the increasing demand for comprehensive coverage presents a significant opportunity for the event insurance industry. International events, such as conferences, sporting events, and music festivals, have increased as a result of the event industry's globalization. This offers chances for insurance companies to provide coverage for cross-border occurrences, assuring adherence to local laws and managing the particular risks connected with foreign occurrences.

The report focuses on growth prospects, restraints, and trends of the event insurance market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the event insurance market.

Segment Review

The event insurance market is segmented into Coverage, Type and End User.

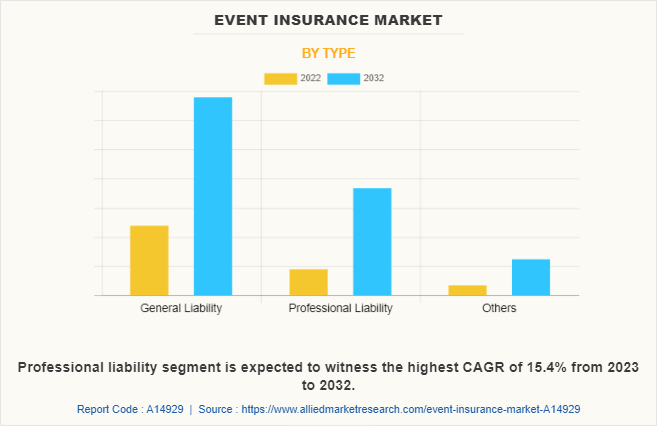

The event insurance market is segmented on the basis of type, coverage, end user, and region. On the basis of type, it is categorized into general liability, professional liability, and others. By coverage, it is divided into bodily injury, property damage, and others. On the basis of end user, it is bifurcated into individual and enterprises. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of type, the general liability segment attained the highest event insurance market size in 2022. This is attributed to the fact that event organizers are seeking more flexible and tailored general liability insurance solutions to meet their specific needs. In response to increasing demand, insurers are offering customizable coverage choices, allowing event organizers to select the specific types and quantities of coverage that are most suitable for their events.

On the basis of region, North America held the highest event insurance market share in 2022. The event insurance market in North America is witnessing increased adoption of technology-driven solutions. Insurance providers are leveraging advanced technologies such as data analytics, digital platforms, and automated underwriting processes to streamline operations, enhance customer experience, and improve risk assessment. Further, insurance providers are adapting their offerings to cater to the changing landscape of events and ensure comprehensive coverage for hybrid and virtual formats.

The report analyzes the profiles of key players operating in the event insurance market such as Aon plc, Allstate Insurance Company, American International Group, Inc., Chubb, Hiscox Ltd, GEICO, InEvexco, MARSH LLC, R.V. Nuccio & Associates Insurance Brokers, Inc., and The Hartford. These players have adopted various strategies to increase their market penetration and strengthen their position in the event insurance market.

Market Landscape and Trends

The event insurance market is gradually adopting technology to streamline processes and enhance customer experience. Online platforms and digital tools are being utilized for policy purchasing, claims processing, and risk assessment. This integration of technology helps simplify the insurance application process, improve efficiency, and provide real-time information to event organizers.

Moreover, event organizers are increasingly focusing on risk management strategies to mitigate potential hazards and minimize the occurrence of incidents. Insurers offer risk assessment services, safety training programs and risk management consulting to help event organizers identify and address potential risks before they materialize. By adopting proactive risk management measures, event organizers may be able to reduce insurance premiums. In addition, with the rise of virtual and hybrid events, there is a growing need for insurance coverage tailored to these formats. Insurance providers are developing policies that address unique risks associated with online events, such as technical issues, cyber liability, and intellectual property infringements. This trend reflects the evolving nature of events in response to changing circumstances and advances in technology.

Furthermore, as sustainability becomes more important, event organizers are looking for insurance to cover environmental risks and sustainable event practices. Insurers are integrating insurance options for green initiatives, waste management and carbon footprint reduction. This trend is consistent with a broader shift towards more sustainable event planning and management. Therefore, the event insurance industry is constantly evolving, with new trends emerging as technology advances.

Top Impacting Factors

Risk Mitigation and Financial Protection

Event organizers and stakeholders seek insurance coverage to mitigate potential risks and protect themselves financially. These risks include adverse weather conditions, natural disasters, accidents, property damage, cancellation or postponement, liability claims, and terrorism. Event insurance helps to manage these risks and provides financial protection against unforeseen circumstances. Further, many jurisdictions, venues, and event organizers have specific insurance requirements for events. They mandate liability coverage, worker's compensation insurance, or property insurance as a condition for obtaining permits or licenses. Compliance with these regulations drives the demand for event insurance.

Furthermore, event organizers are increasingly recognizing the importance of comprehensive coverage that protects against various risks. The trend is moving away from basic coverage toward policies that comprise a wider range of perils, including fire, theft, and allied perils. Moreover, the key players in the market are increasingly developing enhanced insurance products to strengthen the market position. For instance, in October 2021, APOLLO Insurance, Canada’s leading online insurance provider, partnered with Wedding Planners Institute of Canada to offer access to immediate digital insurance specifically tailored to weddings and events. The partnership helped customers to obtain an estimate and purchase insurance with APOLLO in five minutes, from any device. Thus, the risk mitigation and financial protection provided by event insurance is fueling the event insurance market growth.

Increase in Demand for Event Insurance

There is an increase in need for all-inclusive insurance coverage that takes a wide variety of risks into account as events continue to expand in size and complexity. The possibility exists for insurance companies to create and supply specialized coverage choices that are tailored to particular event types, risk profiles, and coverage requirements. Further, the COVID-19 pandemic has accelerated the adoption of hybrid and virtual events. Insurance providers are responding to this trend by developing coverage options specifically tailored for these types of events. The focus is on addressing unique risks associated with online platforms, data breaches, technical failures, and virtual event cancellations. This trend reflects the changing landscape of events and the need for innovative insurance solutions.

Furthermore, insurance providers are recognizing the importance of efficient claims management and customer support in the event insurance market. The trend involves investing in streamlined claims processes, providing dedicated claims handling services, and offering prompt and responsive customer support. Thus, the increase in demand for event insurance propels the growth of the market.

Increased Awareness of Risks

The growing awareness of potential risks associated with events has led to a greater focus on risk management and insurance. Event organizers are proactive in protecting themselves and their investments, recognizing that well-planned events can face unexpected challenges. In addition, the increase in occurrence of event cancellations or postponements due to unforeseen circumstances, such as public health emergencies, extreme weather events, or travel disruptions, has highlighted the importance of event insurance. Organizers and sponsors want to safeguard their financial investments in case of such situations.

Moreover, venues often require event organizers to carry insurance coverage as a part of their rental agreements to safeguard against potential damage to the property and liability claims resulting from the event. Event organizers need to fulfill these requirements to secure venues, which drives the demand for event insurance. Thus, the increased awareness of risks among event organizers is boosting the growth of the market.

High Cost of Event Insurance Policies and lack of Awareness

Event insurance can be expensive, especially for large-scale events or events with high-risk factors. In addition, premiums can vary based on the size, location, type, and risk profile of the event. Further, event insurance policies can be complex and involve various terms, conditions, and exclusions. Understanding the coverage options and tailoring them to specific event requirements can be challenging for customers. The complexity of coverage can create confusion and reluctance among organizers, impacting market penetration. Furthermore, limited awareness and understanding the importance and benefits of event insurance is restraining the growth of the market.

Technological Advancements

Insurance providers are leveraging technology to streamline policy issuance, claims management, and risk assessment processes. Risk assessment, underwriting procedures, and claims administration can be improved by technologies such data analytics, the internet of things (IoT), and artificial intelligence. Insurance companies can improve client satisfaction, offer specialized coverage, and streamline operations using these developments. Further, the risk of cyber threats and data breaches has grown significantly, with increasing reliance on technology and digital platforms in event management. Insurance providers are responding to this trend by offering cyber insurance coverage as part of event insurance policies. This coverage protects against financial losses resulting from cyberattacks, data breaches, and unauthorized access to sensitive information during events.

Furthermore, key players in the market are leveraging advanced technologies to boost their product offerings and acquire more customers. For instance, in December 2021, Thimble, an insurtech startup, announced the launch of its new event liability insurance offering. The policy will be available to customers through a modern, thoughtfully designed app and web product. The coverage is appropriate for both individuals and small businesses interested in organizing events. This covers a wide range of events, such as marriages, concerts, conventions, baby showers, business gatherings, and parties. Thus, technological advancements are expected to create lucrative opportunities for the market growth in the upcoming years.

Increase in Demand for Comprehensive Coverage

International events, such as conferences, sporting events, and music festivals, have increased as a result of the event industry's globalization. This offers chances for insurance companies to provide coverage for cross-border occurrences, assuring adherence to local laws and managing the particular risks connected with foreign occurrences. Furthermore, there is a growing need for all-encompassing insurance coverage that considers a variety of risks as events continue to expand in size and complexity. Specialized coverage alternatives that address certain event types, risk profiles, and coverage requirements can be developed and offered by insurance carriers.

Furthermore, the event sector is expanding significantly in emerging countries, particularly in continents like Asia, Latin America, and Africa. These markets offer untapped opportunities for insurance providers to cater to the increasing demand for event insurance and establish a presence in emerging event markets. Thus, the increasing demand for comprehensive coverage is expected to boost the growth of the market in upcoming years.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the event insurance market forecast from 2022 to 2032 to identify the prevailing market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities of event insurance market outlook.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the event insurance market segmentation assists in determining the prevailing event insurance market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global event insurance market trends, key players, market segments, application areas, and market growth strategies.

Event Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 2.3 billion |

| Growth Rate | CAGR of 12.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 248 |

| By Coverage |

|

| By Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Hiscox Ltd, R.V. Nuccio & Associates Insurance Brokers, Inc., Allstate Insurance Company, InEvexco Ltd., Chubb, MARSH LLC, American International Group, Inc., The Hartford, Aon plc, GEICO |

Analyst Review

Event insurance is a type of insurance that compensates the policyholder in the event of direct physical loss due to fire & allied perils, including earthquake, burglary, and theft, occurring during events such as corporate conferences, seminars, live concerts, award ceremonies, school & college annual functions, wedding ceremonies, sports events, and others. To indemnify the policyholder from unforeseen property damage & losses, the demand for events insurance has risen tremendously in the market. Premium rates are determined by location as well as the duration of the event. Furthermore, to protect against unforeseen monetary losses or damage, the event insurance market size is expected to grow in the near future.

Furthermore, market players are adopting strategies like partnership for enhancing their services in the market and improving customer satisfaction. For instance, in October 2021, APOLLO Insurance, Canada’s leading online insurance provider, partnered with Wedding Planners Institute of Canada to offer access to immediate digital insurance specifically tailored to weddings and events. The partnership enables customers to obtain an estimate and purchase insurance with APOLLO in five minutes, from any device. Therefore, such strategies are expected to boost the growth of the event insurance market in the upcoming years.

Moreover, some of the key players profiled in the report are Aon plc, Allstate Insurance Company, American International Group, Inc., Chubb, Hiscox Ltd, GEICO, InEvexco, MARSH LLC, R.V. Nuccio & Associates Insurance Brokers, Inc., and The Hartford. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

The event insurance market is estimated to grow at a CAGR of 12.7% from 2023 to 2032.

The event insurance market is projected to reach $2.34 billion by 2032.

Risk mitigation and financial protection, increase in demand for event insurance and increased awareness of risks majorly contribute toward the growth of the market.

The key players profiled in the report include event insurance market analysis includes top companies operating in the market such as Aon plc, Allstate Insurance Company, American International Group, Inc., Chubb, Hiscox Ltd, GEICO, InEvexco, MARSH LLC, R.V. Nuccio & Associates Insurance Brokers, Inc., and The Hartford.

The key growth strategies of event insurance players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...