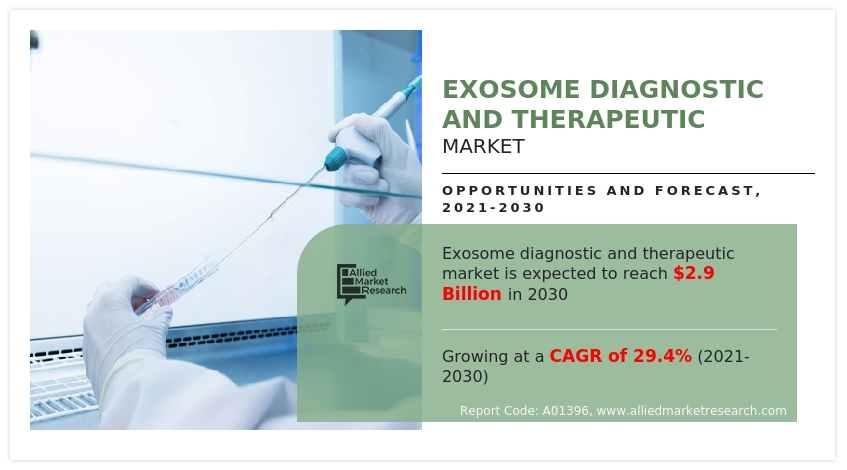

The global exosome diagnostic and therapeutic market size was valued at $224.34 million in 2020, and is projected to reach $2.9 billion by 2030, growing at a CAGR of 29.4% from 2021 to 2030. The exosome diagnostic and therapeutic market growth is driven by an increase in global incidence of cancer and advancements in exosome diagnostic & therapeutic technology. For instance, the American Cancer Society estimated that 2.0 million new cancer cases were diagnosed in the U.S. in 2024. In addition, the World Health Organization (WHO) estimated that over 35 million new cancer cases are expected to be diagnosed in 2050, a 77% increase from 20 million cases in 2022. Thus, the increase in the number of cancer cases accelerates investments in exosome diagnostic and therapeutic technology, spurring market growth.

Exosome diagnostics and therapeutics involve the use of exosomes, which are small extracellular vesicles secreted by cells, to detect and treat various diseases. Exosomes contain biomolecules such as RNA, DNA, proteins, and lipids that reflect the state of their parent cells. In diagnostics, exosomes serve as non-invasive biomarkers for early detection and monitoring of conditions such as cancer, cardiovascular diseases, and neurodegenerative disorders due to their presence in body fluids. Therapeutically, exosomes are engineered as targeted delivery vehicles for drugs, genes, and therapeutic molecules, leveraging their natural biocompatibility and ability to cross biological barriers. This dual application positions exosomes as valuable tools in precision medicine and innovative healthcare solutions.

Key Takeaways

- By application, the diagnostic segment was the highest revenue contributor to the market in 2020.

- By product, the instrument segment was the highest revenue contributor to the market in 2020.

- By end user, the cancer institute segment dominated the market in 2020, and is expected to continue this trend during the forecast period.

- By region, North America garnered the largest revenue share in 2020, whereas Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period.

Market Dynamics

The exosome diagnostic and therapeutic market is poised for significant growth driven by a combination of aging population, increase in incidences of cancer, and technological advancements in precision medicine. Exosomes, nanosized extracellular vesicles, have garnered attention in the medical field due to their role in cell communication and their potential as biomarkers for diagnostics and therapeutic agents. These vesicles offer an innovative approach to diagnosing diseases and developing targeted therapies, contributing to a rapidly expanding market.

One of the primary drivers of the exosome market is the rise in geriatric population. According to the World Health Organization (WHO), by 2030, 1 in 6 people worldwide are expected to be aged 60 or over. This demographic shift results in an increased prevalence of age-related diseases, including cancer, neurodegenerative disorders, and cardiovascular diseases. The demand for effective diagnostic and therapeutic solutions has escalated, positioning exosomes as a potential tool in managing these diseases. Exosome-based diagnostics, such as blood-based liquid biopsies, hold promise for detecting diseases at early stages, facilitating more timely and effective interventions.

In addition, the rise in incidence of cancer globally is a major factor that fosters the growth of the exosome diagnostic and therapeutic market. WHO statistics reveal that lung cancer is the most commonly occurring cancer worldwide, with 2.5 million new cases accounting for 12.4% of total new cases in 2022. This is followed by female breast cancer (2.3 million cases, 11.6%), colorectal cancer (1.9 million cases, 9.6%), and other cancer types. As cancer remains one of the leading causes of morbidity and mortality, early detection and personalized treatment options are critical. Exosomes, due to their involvement in tumorigenesis and metastasis, are increasingly explored as liquid biopsy markers, enabling non-invasive detection of cancer and real-time monitoring of tumor progression. Moreover, exosome-based therapies are developed to deliver targeted drugs or RNA therapies directly to cancer cells, improving treatment outcomes and reducing side effects.

However, despite their promising potential, several challenges hinder the growth of the exosome diagnostic and therapeutic market. A key restraint is the complexity of isolating and characterizing exosomes. Current methods for exosome isolation, such as ultracentrifugation, are time-consuming, labor-intensive, and result in contamination with other extracellular vesicles or proteins, affecting the quality and reproducibility of results. This complexity limits the widespread clinical adoption of exosome-based diagnostics and therapeutics.

Regulatory hurdles also pose a significant challenge. The exosome-based therapeutic products are still in the early stages of development and face stringent regulations for approval. The lack of standardized guidelines for exosome-based therapies and diagnostics delays product development and increased costs, slowing down market adoption of exosome products. Furthermore, the safety and efficacy of exosome-based therapies must be thoroughly validated in clinical trials before they are commercialized, and the long-term effects of exosome therapies are still not fully understood.

Moreover, the exosome diagnostic and therapeutic market is anticipated to grow during the forecast period owing to surge in demand for personalized medicine. Exosome-based diagnostics are increasingly used for non-invasive cancer screening, monitoring of disease progression, and detection of minimal residual disease. This offers significant advantages over traditional biopsy methods, which are often invasive and provide limited information. As precision medicine continues to evolve, the use of exosomes as diagnostic tools for a wide range of diseases presents an opportunity for improved patient outcomes.

Furthermore, the ability of exosomes to cross biological barriers, such as the blood-brain barrier, opens new avenues for therapeutic applications in treating neurodegenerative diseases such as Alzheimer's and Parkinson's. Researchers are exploring the use of exosomes for drug delivery, gene therapy, and immune modulation, offering exciting opportunities in the treatment of conditions that are difficult to treat with conventional methods. The development of exosome-based therapies could revolutionize the way diseases like cancer, autoimmune disorders, and neurodegenerative diseases are treated, offering a more targeted and effective approach.

Segments Overview

The exosome diagnostic and therapeutic market is segmented into application, product, end user, and region. By application, the market is bifurcated into diagnostic and therapeutic. By product, it is classified into instrument, reagent, and software. By end user, the market is categorized into cancer institute, hospital, diagnostic center, diagnostic center, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Application

The diagnostic segment dominated the market share in 2020. This trend is driven by the growing number of diagnostic tests for cancer and the rising adoption of exosome diagnostic tests, which provide non-invasive and precise detection methods, contributing to enhanced early diagnosis and monitoring of cancer and other diseases.

By Product

The reagents segment held the largest exosome diagnostic and therapeutic market share in 2020. This was attributed to the growing demand for molecular diagnostics, which require high-quality reagents for accurate results. In addition, the surge in research and development activities aimed at improving diagnostic capabilities further fueled the need for advanced reagents, enhancing their market dominance during that period.

However, the instrument segment is expected to register the highest CAGR during the forecast period, owing to advancements in research and development activities within the healthcare sector, leading to enhanced diagnostic and therapeutic capabilities. In addition, the rise in the number of key manufacturers investing in innovative exosome-related technologies is contributing to improved instrument availability and performance, supporting robust market expansion in this segment.

By end user

The cancer institute segment held the largest exosome diagnostic and therapeutic market share in 2020, owing to the high prevalence of cancer, which spurred the need for advanced diagnostic and therapeutic solutions. Exosome-based technologies provided valuable tools for early detection, monitoring, and targeted treatments, making them integral to research and clinical practices in specialized cancer institutes.

However, the diagnostic center segment is expected to register the highest CAGR during the forecast period. This is attributed to the increasing demand for non-invasive, precise diagnostic solutions and the widespread adoption of exosome-based tests. In addition, advancements in diagnostic technology and the expansion of diagnostic centers globally are contributing to enhanced accessibility and efficiency in exosome diagnostics, driving significant market growth.

By Region

The exosome diagnostic and therapeutic industry is analyzed across North America, Europe, Asia-Pacific, LAMEA. North America dominated the market share in 2020. This dominance is attributed to the region's advanced healthcare infrastructure and significant investment in R&D. The presence of key biotechnology and pharmaceutical companies, along with strong academic and clinical research institutions, further contributed to this leadership. In addition, rise in awareness of exosome-based diagnostics and therapeutics and the increasing prevalence of chronic diseases bolstered the region's market position.

However, the Asia-Pacific region is anticipated to register the highest CAGR during the forecast period. This is attributed to rapid advancements in healthcare infrastructure, increased R&D investments, and growing awareness of exosome-based diagnostics and therapeutics, especially in emerging economies such as China and India.

Competitive Analysis

Aethlon Medical, Inc., Bio-techne, NanoSomix Inc., and Thermo Fisher Scientific Inc have adopted product launch and collaboration as key developmental strategies to improve the product portfolio of the exosome diagnostic and therapeutic market. For instance, in August 2020, Aethlon Medical announced collaboration with University of Pittsburgh for the study of depleting exosome to enhance response to immune therapy in head and neck squamous cell carcinoma.

Recent Developments in the Exosome diagnostic and therapeutic Industry

- In April 2020, Bio-Techne Corporation announced the product launch of exosome diagnostics, an ExoDx for prostate cancer test at home.

- In June 2020, Bio-Techne Corporation announced that Exosome Diagnostics, a Bio-Techne brand, has established a new partnership with ZERO – The End of Prostate Cancer, the leading national nonprofit organization in the fight against prostate cancer. The ZERO company is engaged in advanced research to improve the lives of men and families.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the exosome diagnostic and therapeutic market analysis from 2020 to 2030 to identify the prevailing exosome diagnostic and therapeutic market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the exosome diagnostic and therapeutic market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional and global exosome diagnostic and therapeutic market trends, key players, market segments, application areas, and market growth strategies.

Exosome Diagnostic and Therapeutic Market Report Highlights

| Aspects | Details |

| Market Size By 2030 | USD 2.9 billion |

| Growth Rate | CAGR of 29.4% |

| Forecast period | 2020 - 2030 |

| Report Pages | 110 |

| By Application |

|

| By Product |

|

| By End User |

|

| By Region |

|

| Key Market Players | System Biosciences, Inc, Aethlon Medical, Inc., Exosome Diagnostic, Inc., Capricor Therapeutics, Inc., Sistemic Ltd, Exiqon A/S, Malvern Instruments Ltd, NanoSomix, Inc, Thermo Fisher Scientific, Inc., NX Pharmagen, Inc. |

Analyst Review

This section provides various opinions of the top-level CXOs in the clinical area of exosome-based research examination and studies. In accordance to several interviews conducted, utilization of exosome isolation instrument is expected to witness a significant rise with increase in focus on life science research, rise in diagnostic procedures for cancer, and surge in innovative and advanced applications of isolation kits.

Moreover, remarkable technological advancements in the exosome isolation kits and reagents to provide advanced extraction procedures from the body fluids surge the demand for molecular diagnosis drive the growth of the market. According to the CXOs of leading companies operating in this market, increase in prevalence of cancer, surge in technological advancements, and rise in emphasis on early diagnosis of cancer are some of the major factors driving market growth.

However, lack of awareness regarding the use of exosome therapeutics and stringent regulations for the approval of products used in exosome-based research hamper the growth of the market. Presently, the diagnostic application is the largest segment in the global exosome diagnostic and therapeutic market. According to the CXOs, rise in incidences of cancer, growth in geriatric population, and surge in initiatives by various government associations for screening of cancer boost the growth of the exosome diagnostic and therapeutic market.

According to the CXO’s, cancer institutes are the major end users in the exosome diagnostic and therapeutic market. This is due to the increase in focus of cancer prevention & treatment and rise in government supports in the form of funding to the cancer institutes. As per CXOs, North America is expected to dominate the global exosome diagnostic and therapeutic market during the forecast period, followed by Europe.

The total market value of exosome diagnostic and therapeutic market is $224.3 million in 2020.

The forecast period in the report is from 2021 to 2030

The market value of exosome diagnostic and therapeutic Market in 2021 was $288.3 million

The base year for the report is 2020.

Yes, exosome diagnostic and therapeutic companies are profiled in the report

The top companies that hold the market share in exosome diagnostic and therapeutic market are Aethlon Medical, Inc, Exosome Diagnostics Inc., NanoSomix Inc., Thermo Fisher Scientific Inc., Malvern Instruments Ltd., System Biosciences Inc, NX Pharmagen, Sistemic Inc., Capricor Therapeutics, and Exiqon A/S.

The key trends in the exosome diagnostic and therapeutic market are increase in prevalence of chronic disease, infectious disease, autoimmune disease and cancer and surge in demand for molecular diagnosis.

Loading Table Of Content...

Loading Research Methodology...