Extended Warranty Market Research, 2032

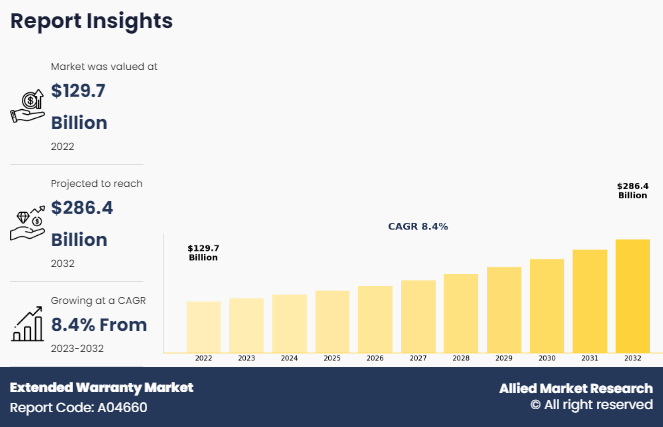

The global extended warranty market was valued at $129.7 billion in 2022, and is projected to reach $286.4 billion by 2032, growing at a CAGR of 8.4% from 2023 to 2032.

Extended warranty, also known as a service agreement, service contract, or maintenance agreement, refers to a policy that extends the warranty period of consumer durable goods beyond what is provided by manufacturers to consumers on the purchase of new items. If the damage is caused by manufacturing faults or low quality, it often covers the expenses of repair or replacement of the product. Extended warranty is generally provided for automobiles and electronic & electrical appliances, and is usually offered by the manufacturer, retailer, or third-party service provider. Increased awareness of extended warranty policies among consumers has led to the development of extended warranties in the insurance market. The rise in extended warranty usage is driven by the need to protect expensive items against unexpected repairs or replacements of parts. As more individuals invest in electronic devices and appliances, the demand for extended warranty services grows, contributing to the expansion of the extended warranty market.

Key Takeaways:

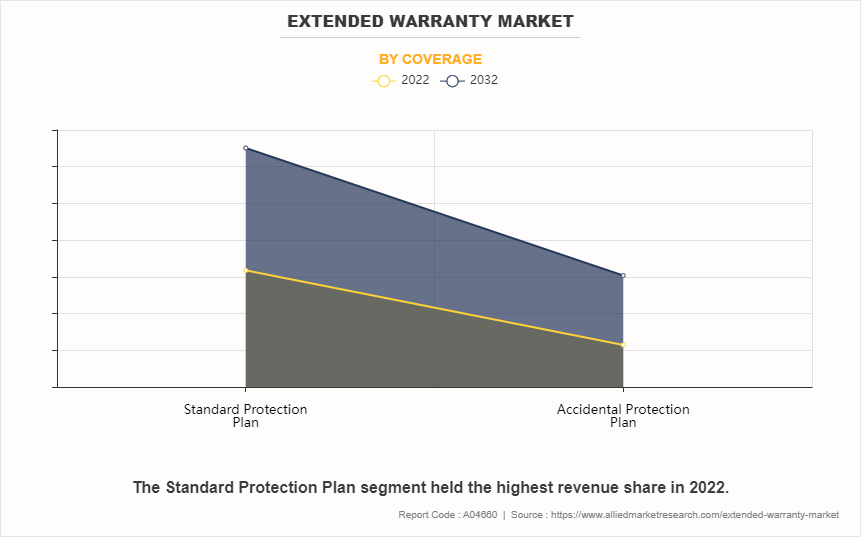

- By coverage, the accidental protection plan segment held the largest share in the extended warranty market for 2023.

- By distribution channel, the retailers held the largest share in the extended warranty market for 2023.

- By application, the home appliances segment is expected to show the fastest market growth during the forecast period.

- By end users, the business segment is expected to show the fastest market growth during the forecast period.

- By sales type, point of sale held the largest share in the extended warranty market for 2023.

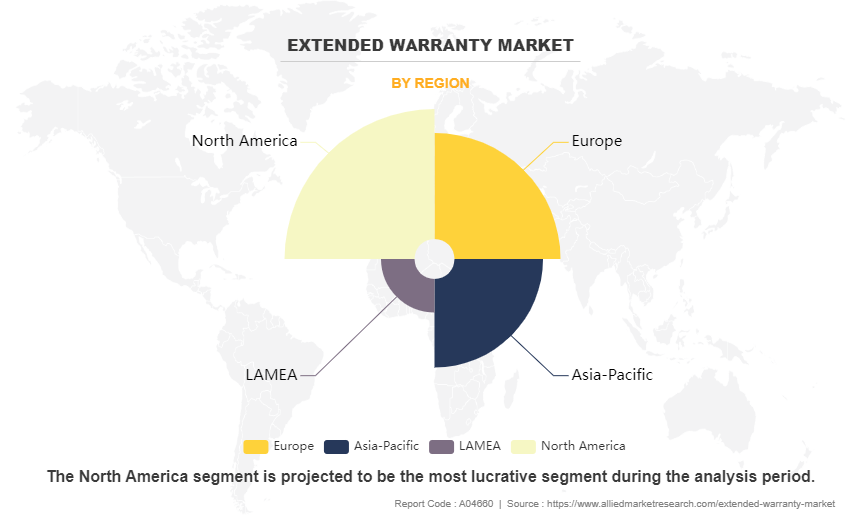

- Region-wise, North America held the largest extended warranty market share in 2023. However, Asia-Pacific is expected to witness the highest CAGR during the extended warranty market forecast.

In addition, the extended warranty market is expected to witness notable growth, owing to a surge in awareness for extended guarantee for cars, a rise in penetration of laptops, smartphones, and tablets, and rising product complexities. Moreover, the expansion of products and services, electrical vechicles and car warranty, and the untapped potential of emerging economies are expected to provide lucrative opportunities for the growth of the market during the forecast period. On the contrary, the decline in sales of PCs limits the growth of the extended warranty market.

Segment Review

The extended warranty market is segmented based on coverage, distribution channel, application, end-users, sales type, and region. By coverage, the market is bifurcated into standard protection plan and accidental protection plan. By distribution channel, the market is segregated into manufacturers, retailers, and others. By application, the market is divided into automobiles, consumer electronics, home appliances, mobile devices and PCs, and others. By end user, the market is divided into individuals and business. By sales type, the market is divided into point of sale and after sale. By region, it is analyzed across North America, Europe, Asia-Pacific and LAMEA.

The key players profiled in the extended warranty market analysis are Axiom Connected, Consumer Priority Services (CPS), Likewise, Assurant, Inc., American International Group Inc., Asurion, CARCHEX, Endurance Warranty Services, LLC, Edel Assurance, Amtrust Financial, Carshield, Squaretrade, Inc., Servify, Safeware Inc., Cover Genius, Fortegra, Extend, Onpoint Warranty Solutions, Llc, PROTECTALL USA, LLC, Guardsman, Mulberry, Centricity, Worth Ave. Group, and AXA. These players have adopted various strategies, including partnership, collaboration, product launch, and developments to increase their market penetration and strengthen their position in the extended warranty industry.

On the basis of coverage, the standard protection plan dominated the extended warranty market size in 2022, owing to the fact that a standard protection plan provides coverage for an additional two to three years of coverage against product failure. Furthermore, these extended warranty plans are mainly suitable for consumers looking for an uncomplicated usage experience and longer life for their devices. However, accidental protection plan is expected to witness the fastest growth, owing to an increase in accidental damages to consumer durable goods, along with the rise in the availability of affordable accidental plans.

Region-wise, the extended warranty market growth was dominated by North America in 2022 and is expected to retain its position during the forecast period, owing to increase in penetration of electronic production and the significant presence of extended warranty providers. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to the proliferation of complex and expensive consumer electronics and appliances, coupled with surge in per capita income of individuals in this region.

Competitive Analysis

Competitive analysis and profiles of the major players in the extended warranty industry include Axiom Connected, Consumer Priority Services (CPS), Likewise, Assurant, Inc., American International Group Inc., Asurion, CARCHEX, Endurance Warranty Services, LLC, Edel Assurance, Amtrust Financial, Carshield, Squaretrade, Inc., Servify, Safeware Inc., Cover Genius, Fortegra, Extend, Onpoint Warranty Solutions, Llc, PROTECTALL USA, LLC, Guardsman, Mulberry, Centricity, Worth Ave. Group, and AXA. Major players have adopted product launch, partnership, collaborations, and acquisition as key developmental strategies to improve the product portfolio and gain strong foothold in the extended warranty industry.

On October 2023, Shippo collaborated with Cover Genius to introduce an insurance solution for eCommerce merchants and ensure a positive shipping experience for their customers.

On August 2021, Axiom Connected partnered with RepairPal, by utilizing Axiom Connected's subscription-based connected warranty platform with RepairPal's extensive network of over 2,800 certified repair shops.

On November 2022, Assurant, Inc. launched enhancements to Assurant EV One Protection, the company's protection product created specifically for U.S. owners of Battery Electric Vehicles (BEVs) and Plug-in Hybrid Electric Vehicles (PHEVs). To meet the growing needs of EV owners, expanded benefits include more battery health transparency, more protection, and more value, making it the most consumer-friendly product in the market.

On July 2022, Rhino partnered with AmTrust Financial to provide an additional $60 million in premium-writing capacity for its core product offering. AmTrust Financial, an international property and casualty insurer, joined Rhino's existing panel of industry-leading insurance carriers and reinsurers, bringing Rhino's total premium-writing capacity to over $200 million.

On August 2022, Bumper.com partnered with CarShield to offer their members an amazing monthly discount on extended warranty coverage in order to avoid unforeseen expensive repairs.

Top Impacting Factors

Surge in Awareness for Extended Warranty

Extended warranty provides customers with an additional layer of protection against unexpected repair costs that may arise from product defects or accidental damage. This is likely to boost the awareness for extended warranties. In addition, consumers are often concerned about the safety of their products and services post-expiry of seller's warranty, which creates the need for insurance/warranty claim. Thus, coverage for extended warranties has surged among individuals and businesses, which is expected to drive the market growth. An increasing demand for insurance against unanticipated product failures, the incorporation of cutting-edge technologies like blockchain to improve operations, and the growing public awareness of extended warranties are the factors propelling the market for extended warranties.

Furthermore, the market for extended warranties is expanding due to the growing popularity of smartphones, laptops, household appliances, and other related devices. These products highlight the benefit of extended warranty services in giving customers peace of mind and additional value. Numerous products have a high price tag at the time of purchase, hence awareness for extended warranty for those products has increased tremendously. According to a survey conducted by AmTrust, 51% of the respondents are aware of the extended warranty contracts. In addition, consumers are often concerned about the safety of their electronic products post expiry of seller's warranty, which increases the coverage for extended warranty among the consumer electronics & mobile devices segment.

Rise in Penetration of Laptops, Smartphones, and Tablets

The increased penetration of laptops, smartphones, and tablets, coupled with the increased adoption of extended warranty plans, has notably transformed the consumer electronics industry. Nowadays, smart phones and gadgets have become an internal part of every individual̢۪s life, which is creating a need to protect these devices against damage and extending the lifetime value. Furthermore, consumers are more inclined to invest in extended warranty plans to ensure uninterrupted usage and to minimize potential disruptions caused by unexpected hardware or software issues. Therefore, provision of extended warranty for these goods has fostered market competition, which in turn drives the market growth.

Moreover, the rise in prices of raw materials continues to imply pressure on profit margins of manufacturers and retailers of consumer electronic products. This has induced the manufacturers and consumers to opt for warranty plans to protect their valuable assets and ensure a seamless user experience.Furthermore, extended warranty solutions for electronic items are continuously evolving and are expected to maintain their dominance during the forecast period. Thus, continuous rise in use and adoption of laptops, smartphones, tablets, and other brown goods fuel the growth of extended warranty in the market, as consumers continue to prioritize the longevity and reliability of their devices.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the extended warranty market analysis from 2022 to 2032 to identify the prevailing extended warranty market opportunity.

- The extended warranty market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the extended warranty market segmentation assists to determine the prevailing extended warranty market outlook.

- Major countries in each region are mapped according to their revenue contribution to the global extended warranty market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global extended warranty market trends, key players, market segments, application areas, and market growth strategies.

Extended Warranty Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 286.4 billion |

| Growth Rate | CAGR of 8.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 373 |

| By Sales Type |

|

| By Coverage |

|

| By Distribution Channel |

|

| By Application |

|

| By End-users |

|

| By Region |

|

| Key Market Players | CarShield, Cover Genius, Centricity, American International Group Inc., AXA, Mulberry, Extend, Assurant, Inc., Likewize, PROTECTALL USA, LLC, Guardsman, Safeware Inc., Fortegra, Servify, Worth Ave. Group, Asurion, Axiom Connected, Edel Assurance, AmTrust Financial, Endurance Warranty Services, LLC, CARCHEX, SquareTrade, Inc., OnPoint Warranty Solutions, LLC, Consumer Priority Services (CPS) |

Analyst Review

The adoption of extended warranty has increased in the last few years, due to the growing number of extended warranty providers that help consumers to acquire long-term product security. In addition, the proliferation of complex and expensive consumer electronics and appliances has increased the utility for extended warranty protection, which is expected to drive the growth of the market.

In addition to this, the supply side of the extended warranty market is driven by the expansion of e-commerce. The ease of online price comparison has compressed retail margins, creating a need for online and brick-and-mortar merchants to augment revenue and boost profitability by selling extended warranties.

Moreover, key players in the extended warranty market such as AmTrust Financial, Assurant, and AXA, account for a significant share of the market, followed by some other top vendors in the local and regional markets. With larger requirements for warranty services, companies introduced various strategies to strengthen their market position capabilities. For instance, in February 2021, AXA Affine General Insurance launched Business Advantage Plus (Enhanced), or BAPE, a business protection plan for SMEs. The policy covers fire and other insured perils, such as burglary, public liability, and workmen’s compensation. Such strategic initiatives by the market players are expected to contribute to significant growth of the extended warranty market across the globe.

Moreover, market players have expanded their business operations and geographical footprint by making strategic collaborations and partnerships. For instance, in February 2023, AmTrust Financial Services, Inc., a global specialty property-casualty insurer, expanded its international extended warranty and protection business in South Korea. AmTrust writes policies for leading automotive, electronics, equipment manufacturers, and retailers. In addition, the automobile and electronic vendors are providing a range of extended warranty services to their customers.

For instance, in June 2023, Honda Motorcycle and Scooter India unveiled a new program, Extended Warranty Plus (EW Plus), for its models up to 250cc that provides warranty coverage for up to 10 years, among other benefits. These strategic advancements propel the growth of the extended warranty market.

Surge in awareness for extended warranty, and rise in penetration of laptops, smartphones, and tablets are the upcoming trends of Extended Warranty Market in the world.

The Extended Warranty Market was valued at $129.65 billion in 2022 and is estimated to reach $286.37 billion by 2032, exhibiting a CAGR of 8.4% from 2023 to 2032.

The key players profiled in the extended warranty market analysis are Axiom Connected, Consumer Priority Services (CPS), Likewize, Assurant, Inc., American International Group Inc., Asurion, CARCHEX, Endurance Warranty Services, LLC, Edel Assurance, Amtrust Financial, Carshield, Squaretrade, Inc., Servify, Safeware Inc., Cover Genius, Fortegra, Extend, Onpoint Warranty Solutions, Llc, PROTECTALL USA, LLC, Guardsman, Mulberry, Centricity, Worth Ave. Group, and AXA. These players have adopted various strategies, including partnership, collaboration, product launch, and developments to increase their market penetration and strengthen their position in the industry.

North America is the largest regional market for Extended Warranty.

Expansion of products and services and untapped potential of emerging economies are the leading application of Extended Warranty Market.

Loading Table Of Content...

Loading Research Methodology...