Extremity Reconstruction Market Research, 2030

The global extremity reconstruction market was valued at $3.6 billion in 2020, and is projected to reach $6.5 billion by 2030, growing at a CAGR of 6.3% from 2021 to 2030. Extremity reconstruction devices are used to treat, repair, replace, or heal extremity injuries, such as fractures or damage. The extremity reconstruction market size covers implant devices for the shoulder, elbow, wrist, digits, foot, and ankle joints.

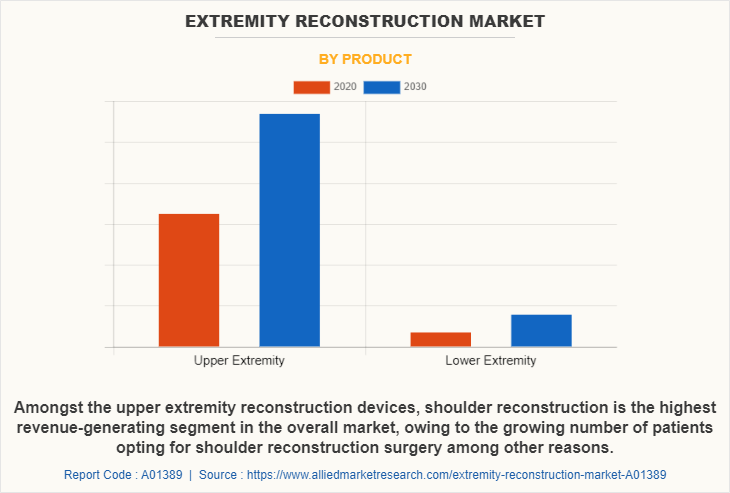

The etremity reconstruction market share is segmented based on the product type into upper extremity reconstruction devices and lower extremity reconstruction devices. The upper extremity surgery segment holds a small share in the extremity reconstruction market but it is expected to grow at the fastest rate during the forecast period. Hence, leading companies have increased their focus on the upper extremity segments to overcome the sluggish market growth.

The increase in incidences of accidents, abnormalities, and congenital defects in the upper and lower extremities of the human body fuels the demand for reconstructive surgery. The extremity reconstruction market includes implant devices for the shoulder, wrist, ankle joints, digits, elbow, and foot. The rise in geriatric population is the key driver for the growth of the global extremity reconstruction market. According to the Centers for Disease Control and Prevention, the number of individuals affected by arthritis in the U.S. is predicted to climb to 78 million by 2040 due to increase in older population.

The global extremity reconstruction market size is rapidly changing. 3D implants are quickly gaining popularity among arthritis sufferers. Stryker's Triathlon Tritanium Cone Augments and Triathlon Tritanium Knee System, which are utilised in knee surgeries, have included 3D printed patellas and tibial baseplates. The company also intends to invest roughly $400 million in a 3D manufacturing facility. Shoulder arthroplasty is a rapidly developing area of orthopaedics that focuses on treating specific, painful gleno humeral articulation disorders.

The extremity reconstruction market analysis is segmented on the basis of product, material, and region.

By Product Segment Review

On the basis of product, the extremity reconstruction market opportunity is segmented into upper extremity reconstruction market and lower extremity reconstruction market. Upper extremity reconstruction devices are further segmented into shoulder reconstruction, elbow reconstruction, and hand & wrist reconstruction. Lower extremity reconstruction is further segmented into foot fusion, ankle fusion, and ankle reconstruction. Amongst the upper extremity reconstruction devices, shoulder reconstruction is the highest revenue-generating segment in the overall market, owing to the growing number of patients opting for shoulder reconstruction surgery, technological advancements in the shoulder implants, and positive clinical outcomes of shoulder reconstruction surgeries. Stemless shoulder replacement is associated with lesser pain and blood loss and faster recovery. Hence, the extremity reconstruction forecast is expected to grow at a CAGR of more than 6.0% during the forecast period.

By Material Segment Review

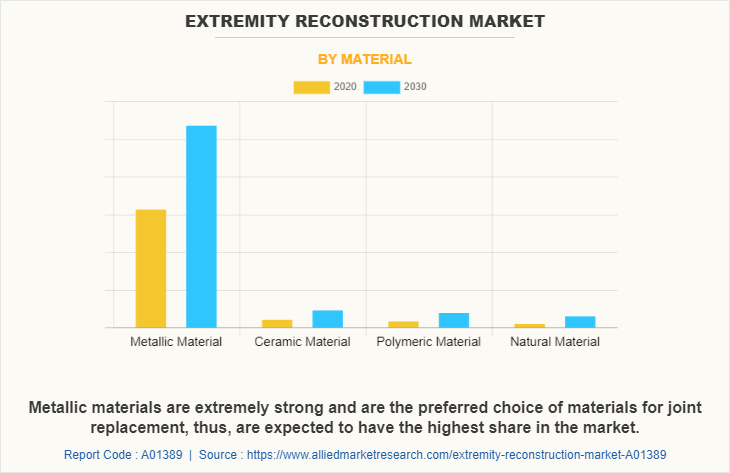

Based on material, the market is segmented into metallic, ceramic, polymer, and natural materials. Metallic materials are extremely strong and are the preferred choice of materials for joint replacement, thus, are expected to have the highest share in the market. The global extremity reconstruction market for metallic materials was worth $3,123.91 million in 2020, and is expected to garner $5,355.87 million by 2030, at an estimated CAGR of 5.7% from 2021 to 2030.

By Region Segment Review

Region-wise, the market is analysed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major share in the global extremity reconstruction market forecast in 2020 and is expected to maintain this trend during the forecast period. This is attributed to rise in the prevalence of joint disorders coupled with rise in elderly population. North America generated revenue of $ 1,314.87 million in 2020 and is expected to reach $ 2,008.56 million by 2030, registering a CAGR 4.5 % from 2021 to 2030. Asia-Pacific is expected to be the fastest growing region by 2040. Asia's elderly population is expected to reach approximately 923 million people. As a result, the region is on track to become one of the oldest region in the coming decades, Asia-Pacific generated revenue of $ 1,115.09 million in 2020 and is expected to reach $ 2,364.92 million by 2030, registering a CAGR of 8.0% from 2021 to 2030. As a result, the region is on track in the next few decades to become one of the oldest in the world owing to presence of ample growth opportunities in terms of unmet medical needs for the treatment of small joint disorders, increasing awareness and the rising acceptance of advanced technologies in this region.

Key players in this extremity reconstruction market growth include, DePuy Synthes (a wholly-owned subsidiary of Johnson & Johnson), Stryker Corporation, Smith & Nephew plc., Integra Lifesciences Holdings Corporation, Exatech, Isto Biologics, Acumed, Inc., Arthrex, Inc., CONMED Corporation, and Skeletal Dynamics LLC.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the extremity reconstruction market share, segments, current trends, estimations, and dynamics of the extremity reconstruction market analysis from 2020 to 2030 to identify the prevailing extremity reconstruction market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the extremity reconstruction industry segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the extremity reconstruction industry.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global extremity reconstruction market trends, key players, market segments, application areas, and market growth strategies.

Extremity Reconstruction Market Report Highlights

| Aspects | Details |

| By Product |

|

| By Material |

|

| By Region |

|

| Key Market Players | Zimmer Biomet Holdings, Inc., CONMED Corp., depuy synthes, Smith & Nephew plc, Stryker Corporation, Integra LifeSciences Holdings Corporation, Arthrex, Inc, Skeletal Dynamics LLC., Acumed, Inc., Wright Medical Group N.V. |

Analyst Review

The use of extremity reconstruction devices is anticipated to witness a major rise with increase in diagnosis of joint disorders. The extremity reconstruction market has piqued the interest of healthcare providers because of several benefits offered by these devices to treat joint disorders and improve the standard of lifetime of the patients. There are remarkable technological advancements in these devices to produce advanced treatment options. While the market grows at a gentle rate in developed nations, the Asia-Pacific and LAMEA regions are expected to supply high growth opportunities to key players. The rise in incidence of joint related disorders, technological advancements, and increase in desire to own a much better quality of life, are factors that drive the growth of the market. However, lack of reimbursement and the need for revision of surgery and implants after few years hamper the market growth. Currently, shoulder replacement is the largest segment in the terms of value and volume, followed by ankle reconstruction. The rise in geriatric population, which is vulnerable to joint disabilities and the increase in prevalence of obesity and diabetes, drive the expansion of joint-related disorders. Emerging markets are gaining more importance from majority of the manufacturers and distributors within the extremity reconstruction market. The necessity for improved healthcare services in emerging nation’s results in significant growth in shipment of these devices, and this is often expected to offset the challenging conditions in mature markets of North America and Europe. As per the reports, North America is anticipated to dominate the market, followed by Europe.

Utilization of natural materials which helps in faster healing with minimal complications is one the major trends currently

One of the leading applications of Extremity Reconstruction is upper extremity surgery

North America accounted for a major share in the global extremity reconstruction market in 2020 and is expected to maintain this trend during the forecast period. This is attributed to rise in the prevalence of joint disorders coupled with rise in elderly population.

The extremity reconstruction market was valued at $3,574.0 million in 2020, and is expected to reach $6,479.22 million by 2030, supported by a CAGR of 6.3 % during the forecast period 2021 to 2030.

Johnson & Johnson, Stryker Corporation, Smith & Nephew plc., Integra Lifesciences Holdings Corporation are few major players operating in the market

Loading Table Of Content...