Eye Testing Equipment Market Overview:

The global eye testing equipment market was valued at $2,638 million in 2017 and is expected to reach $3,914 million by 2025, registering a CAGR of 5.0% from 2018 to 2025. A variety of eye tests are performed by optometrists and ophthalmologists to examine eye health. These range from simple tests that use simple eye charts or complex eye examination wherein devices that can visualize the tiny structures inside an individuals eyes. Combination of several tests can be performed for a complete eye evaluation. Increase in the focus on eye care among people has propelled the need for comprehensive eye examinations.

Increase in prevalence of eye associated disorders among the developed as well as developing countries has majorly contributed to the growth of the eye testing equipment market. In addition, introduction of technologically advanced eye testing devices in the market along with the activities initiated by the government to manage the burden of eye disorders across the globe have supplemented the market growth. However, lack of skilled professionals who are fully aware of the latest eye testing equipment technologies hampers the growth of the market. Conversely, rise in demand for comprehensive eye examinations across the developing economies offers profitable opportunities for the expansion of the market.

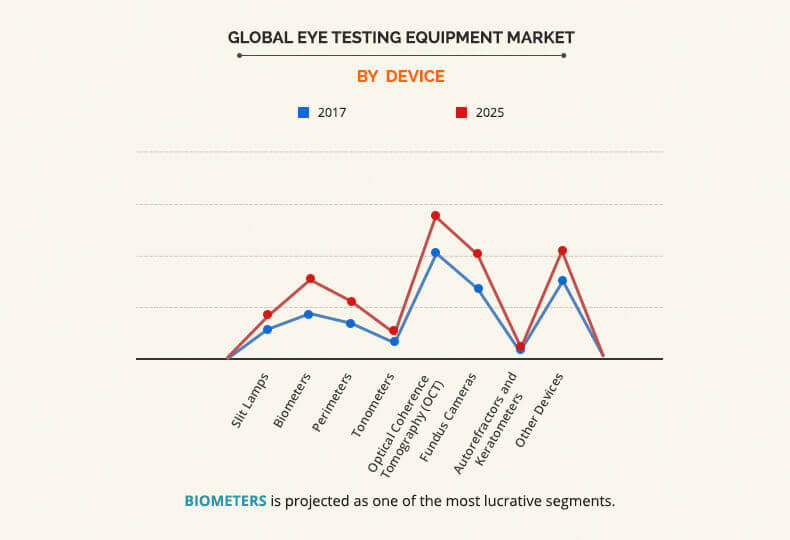

Device Segment Review

Eye testing equipment market is categorized into eight segments based on devices. The eye testing equipment constitute of slit lamp, biometer, perimeter, tonometer, optical coherence tomography (OCT) scanner, fundus camera, autorefractor & keratometer, and other devices. The other devices commonly utilized for eye examination include lensmeters, chart projectors/visual acuity accessories/computerized visual acuity systems, and ophthalmoscopes among others. The optical coherence tomography (OCT) scanner segment generated the highest revenue in 2017 and is expected to maintain its dominance throughout the forecast period. Whereas, the biometer segment is expected to witness highest growth rate from 2018 to 2025. Incorporating optical coherence tomography enables an ophthalmologist to view each of the retinas distinctive layers, which offers effective guidelines for the treatment of patients suffering from glaucoma. This has contributed to the dominant position of this segment in the global eye testing equipment market throughout the forecast period.

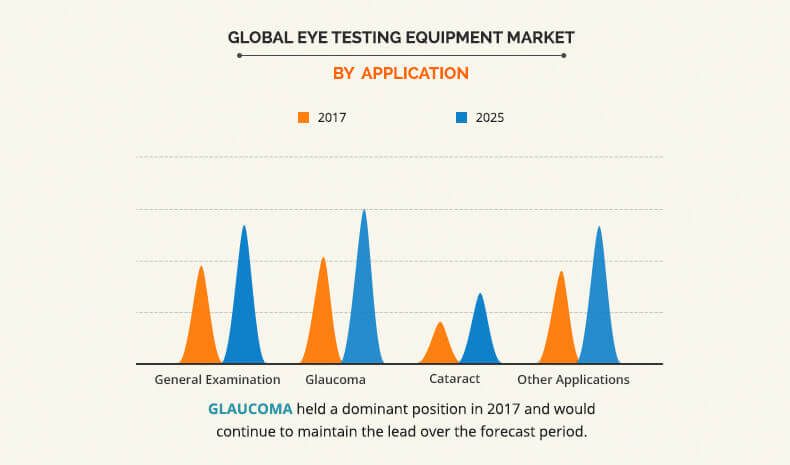

Application Segment Review

Based on the applications, the global eye testing equipment market is divided into four segments namely, general examination, glaucoma, cataract, and other applications. The other applications include diagnosis of other diseases including diabetic retinopathy, age-related macular degeneration, bulging eyes, CMV retinitis, color blindness, and diabetic macular edema among others. The glaucoma application segment generated the highest revenue in 2017 and is anticipated to maintain this trend throughout the forecast period. However, the cataract application segment is anticipated to register the highest growth rate during the forecast period. Approximately two million of the U.S. residents suffer from glaucoma as of 2018, and the incidence of glaucoma is expected to increase further across the globe. Glaucoma symptoms are more evident as compared to cataract, however rise in the awareness regarding effective diagnosis and treatment of cataract has contributed to the highest CAGR recorded in the global market throughout the forecast period.

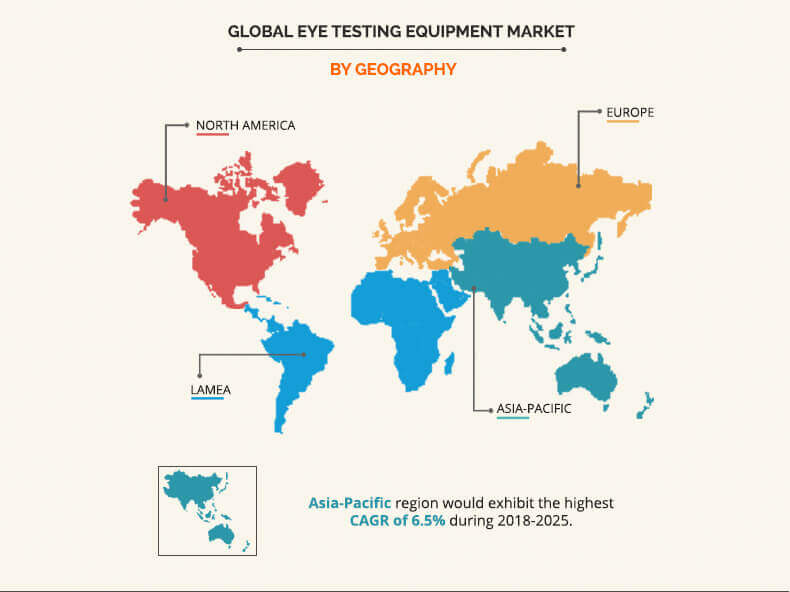

Geography Segment Review

Region wise, the eye testing equipment market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America dominated the market in 2017, accounting for the highest share, and is anticipated to maintain this trend throughout the forecast period. This is attributed to the early adoption of novel eye testing equipment systems and increase in prevalence of glaucoma, cataract, and diabetic retinopathy in this region. However, Asia-Pacific is projected to register the highest growth rate from 2018 to 2025 due to presence of a high population base and increase in geriatric population (more susceptible to eye ailments).

The report provides a comprehensive analysis of the key players operating in the global eye testing equipment market such as Carl Zeiss, Metall Zug AG (Haag Streit), Topcon Corporation, Nidek Co., Ltd., BON Optic, Novartis (Alcon), Canon, Essilor, Heine Optotechnik, and Luneau Technology. Other players operating in the eye equipment market include Heidelberg Engineering GmBH, Huvitz, Reichert Technologies, Potec, Visionix, Tomey Corporation, Escalon, and LuxVision.

Key Benefits for Stakeholders

- The study provides an in-depth analysis with the current trends and future estimations of the global eye testing equipment market to elucidate the imminent investment pockets.

- Comprehensive analysis of the factors that drive and restrict the market growth is provided.

- The quantitative analysis of the industry from 2017 to 2025 is provided to enable the stakeholders to capitalize on the prevailing market opportunities.

- Extensive analysis of key segments of the industry is provided to understand the devices of eye testing equipment used globally.

- Key players and their strategies are analyzed to understand the competitive outlook of the market.

Eye Testing Equipment Market Report Highlights

| Aspects | Details |

| By Device |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Heine Optotechnik, Carl Zeiss, Nidek Co., Ltd, Luneau Technology, Canon, Topcon Corporation, BON Optic, Metall Zug AG (Haag-Streit), Novartis (Alcon), Essilor |

Analyst Review

Eye testing equipment is largely utilized across various eye examinations including visual acuity tests, color blindness test, cover test, ocular motility (eye movements) testing, stereopsis (depth perception) test, retinoscopy, refraction, slit lamp exam, glaucoma test, pupil dilation test, visual field tests, and others. This has propelled the utilization of eye testing devices such as slit lamp, biometer, perimeter, tonometer, optical coherence tomography (OCT), fundus camera, autorefractor and keratometer, and other devices over the years. In addition, significant opportunities offered by the optometry academic institutes boost the demand for the eye testing devices, and are expected to propel the market growth in future.

Factors like rise in prevalence of eye diseases along with the technological advancements in ophthalmic devices are the key contributors to the market growth. In addition, increase in government initiatives to control visual impairment are anticipated to increase awareness regarding the latest available eye testing technologies in the patients suffering from eye-associated disorders. Conversely, less accessibility to eye care in low income countries poses a restrain to the market. Whereas, development of advanced portable eye testing devices by the key manufacturers is expected to open new avenues for the expansion of the eye testing equipment market.

Loading Table Of Content...