Facility Management Services Market Research, 2030

The global facility management services market was valued at $1,253.30 billion in 2020, and is projected to reach $2,525.10 billion by 2030, growing at a CAGR of 7.1% from 2021 to 2030. Facility management services increases the value of the building by offering maintenance support solutions. In addition, these services offer greater returns over the real estate investments to property owners through management and value-added solutions. Facility management services support the operational and financial motives of owners. The services include applications, such as security, plumbing, landscaping, electrical solutions and cleaning for various tasks.

The global facility management services market size experiences growth due to increase in industrialization and urbanization. Rise in urbanization leads to rise in commercialization, which leads to increase in demand for greater productivity in lower maintenance in different corporate offices, thus driving the growth of the market. In addition, surge in demand of the residential and non-residential building increase the demand for greater spending over construction including different mega projects. These projects require huge investments, which in turn uses the maintenance services for longer life of construction structures. Thus, driving the facility management services market growth. Moreover, awareness by different organizations to drive the assets and properties is growing, owing to high investment required for purchasing these assets. Thereby, boosting the growth of the market.

Facility Management Services Market Dynamics

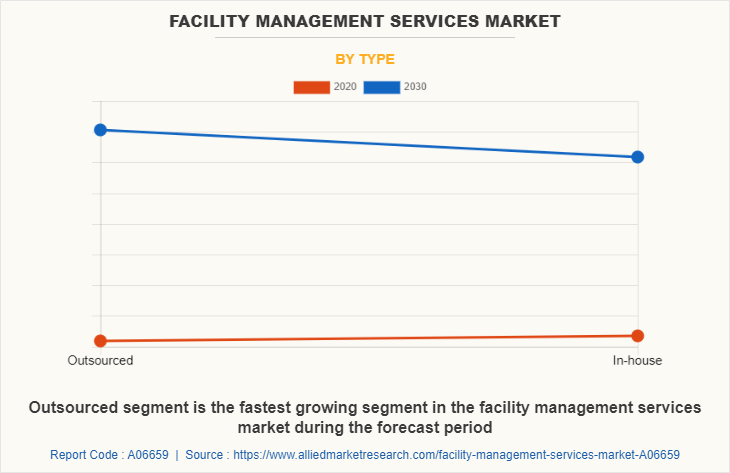

However, in developing countries, such as Africa and Chile, there is lack of educated workforce as compared to other developing countries. This in turn leads to limited awareness about benefits of facility management services, which hinders the growth of the facility management services market. In addition, different organizations are adopting outsourced facility management over in-house facility management, owing to low maintenance and operational cost, which restrains the growth of the facility management services industry.

However, in developing countries, such as Africa and Chile, there is lack of educated workforce as compared to other developing countries. This in turn leads to limited awareness about benefits of facility management services, which hinders the growth of the market. In addition, different organizations are adopting outsourced facility management over in-house facility management, owing to low maintenance and operational cost, which restrains the growth of the facility management services market.

Furthermore, during the outbreak of the COVID-19 pandemic, construction, manufacturing, hotel, and tourism industries were majorly affected. Manufacturing activities were halted or restricted. Construction and transportation activities, along with their supply chains, were hampered on a global level. This led to decline in manufacturing of facility management services as well as their demand in the market, thereby restraining the growth of the market. Conversely, industries are gradually resuming their regular manufacturing and services. This led to re-initiation of facility management services companies at their full-scale capacities, which helped the facility management services market to recover by mid of 2021.

On the contrary, governments globally are launching different initiatives for smart infrastructure construction. These initiatives lead to greater investment over different projects. These projects include commercial, railways and infrastructure. This is leading to surge in demand of the maintenance services. In addition, the technology is growing over years. The growing technology leads to smarter solutions for providing security services. Hence, the use of technology and rise in government investments are expected is offer facility management services market opportunity.

Facility Management Services Market Segment Overview

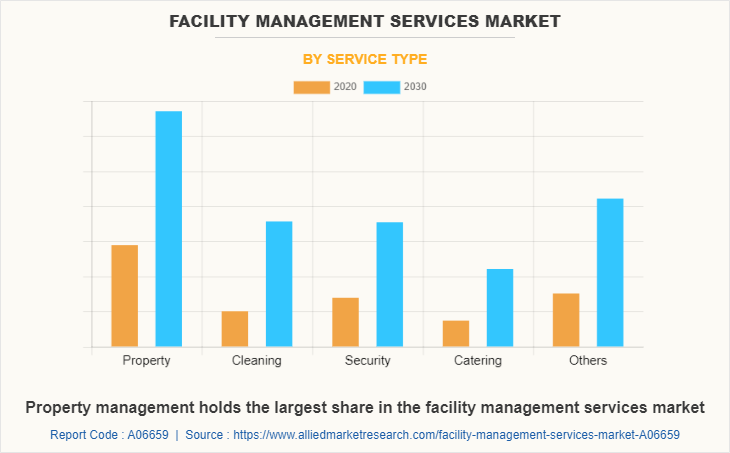

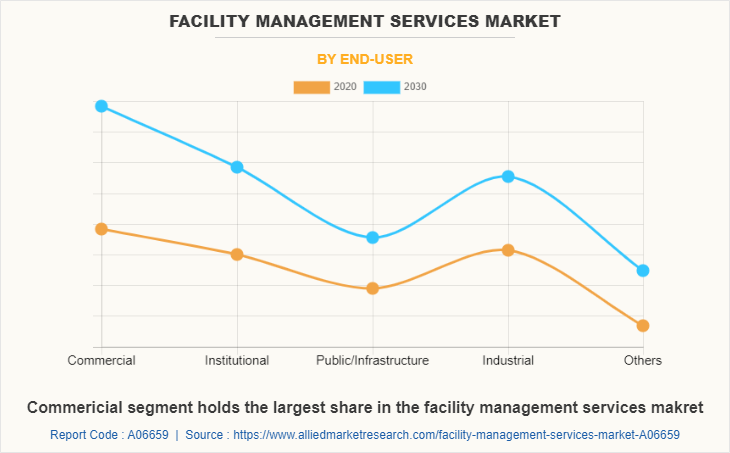

The market is segmented on the basis of service type, type, end user and region. By service type, the market is bifurcated into a property, cleaning, security, catering, and others. By type, the market is segmented into outsourced and in-house. By end user, the market is divided into end user, the market is divided into commercial, institutional, public/ infrastructure, industrial, and others.

Region-wise, the facility management services market analysis is conducted across North America (the U.S., Canada, and Mexico), Europe (the UK, France, Germany, Italy, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa). In 2020, Asia-Pacific was the highest contributor to the global facility management services market share, and LAMEA is anticipated to secure a leading position during the forecast period.

On the basis of service type, the property segment dominated the market in 2020, in terms of revenue, whereas the others segment is expected to witness growth at the highest CAGR during the forecast period. As per type, the in-house segment led the facility management services market in 2020. However, the outsourced segment is expected to exhibit highest CAGR in the near future. By end-user, the commercial segment led the market in 2020, in terms of revenue; however, the others segment is anticipated to register highest CAGR during the forecast period. Region-wise, Asia-Pacific garnered the highest revenue in 2020. However, LAMEA is anticipated to register highest CAGR during the forecast period.

Competition Analysis

The major players profiled in the facility management services industry include, Group Atalian (Arthur McKay & Co Ltd.), BVG India Ltd., CBRE Group, Inc., EMCOR Group, Inc., ISS World Services A/S, Knight Facilities Management, Quess Corp Ltd., Sodexo, Inc., Downer Group (Spotless Group), and Tenon Group. Major companies in the market have adopted acquisition, partnership and agreement as their key developmental strategies to offer better products and services to customers in the market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the market analysis from 2020 to 2030 to identify the prevailing facility management services market forecast.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global facility management services market trends, key players, market segments, application areas, and market growth strategies.

Facility Management Services Market Report Highlights

| Aspects | Details |

| By Service Type |

|

| By Type |

|

| By End-user |

|

| By Region |

|

| Key Market Players | BVG India, Sodexo, Inc., EMCOR Group, Inc., CBRE Group, Inc., Downer Group (Spotless Group), Group Atalian (Arthur McKay & Co Ltd.), ISS World Services A/S, Knight Facilities Management, Quess Corp Ltd, Tenon Group |

Analyst Review

The global facility management services market witnessed a huge demand in Asia-Pacific followed by North America & Europe owing to increase in industrialization and urbanization, surge in residential and non-residential construction, and rise in awareness towards the protection of assets.

However, dearth of skilled staffs and capital in developing countries, lack of managerial awareness, and dependency on the in-house facility management team act as major restraints of the facility management services market. On the contrary, government investments in the building infrastructure sector and technological advancements are expected to create opportunities for growth of the facility management services market during the forecast period.

Major companies in the market have adopted strategies, such as acquisition, partnership, and agreement to offer better services to customers in the facility management services market.

The facility management services market was valued at $1,253.3 million in 2020, and is expected to reach $2,525.1 million by 2030, registering a CAGR of 7.1% from 2021 to 2030.

To get latest version of global facility management services market report can be obtained on demand from the website.

The forecast period considered for the global facility management services market is 2021 to 2030, wherein, 2020 is the base year, 2021 is the estimated year, and 2030 is the forecast year.

The top ten market players are selected based on two key attributes - competitive strength and market positioning

The base year considered in the global facility management services market report is 2020.

The report contains an exclusive company profile section, where leading 10 companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

Loading Table Of Content...