Family Car Market Overview

The global family car market size was valued at USD 1.3 trillion in 2022, and is projected to reach USD 2.3 trillion by 2032, growing at a CAGR of 6.4% from 2023 to 2032. Families today increasingly prefer cars with advanced infotainment and connectivity features for a seamless and enjoyable driving experience. Automakers investing in technologies like smartphone integration, rear-seat entertainment, and in-car Wi-Fi are witnessing strong sales growth.

Key Market Trend & Insights

- Rising EV adoption is reshaping the family car market with eco-consciousness, savings, and incentives.

- Lower running and maintenance costs make EVs ideal for budget-conscious families.

- Expanding charging networks and better battery range reduce range anxiety.

- Government policies and incentives accelerate EV penetration in the family car segment.

- Technological innovations in EVs such as infotainment and ADAS features enhance family appeal.

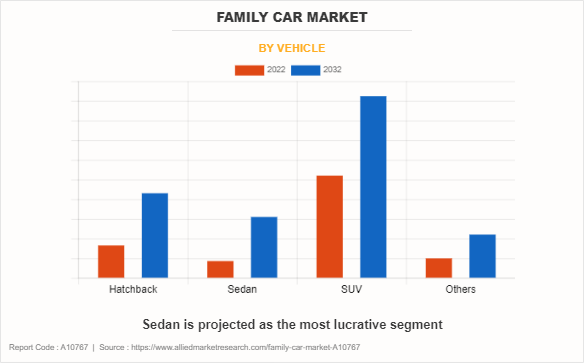

- Sedan segment is expected to exhibit notable growth in the coming years.

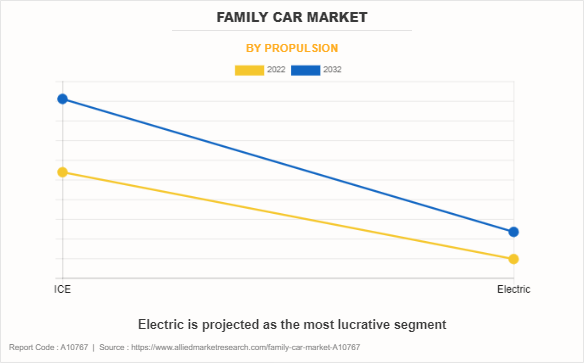

- Electric propulsion segment is projected to grow significantly in the family car market.

- Europe region is anticipated to record the highest CAGR during the forecast period.

Market Size & Forecast

- 2032 Projected Market Size: USD 2.3 trillion

- 2022 Market Size: USD 1.3 trillion

- Compound Annual Growth Rate (CAGR) (2023-2032): 6.4%

Report Key Highlighters:

- The family car market study covers 20 countries. The research includes regional and segment analysis of each country in terms of value ($billion) for the projected period 2023-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

Introduction

A family car is described as an automobile precisely tailored to meet the transportation needs of a typical family unit. These vehicles are renowned for their thoughtful inclusion of features & specifications that prioritize passenger well-being, convenience, and adaptability. Within the capacious confines of a family car's interior, provisions are made to comfortably house parents, children, and even extended family members, ensuring a sense of inclusiveness. In addition to a spacious interior, family cars are thoughtfully engineered to prioritize passenger safety, boasting an array of protective features. These encompass the presence of multiple airbags, child safety seat provisions, and driver assistance systems aimed at safeguarding all occupants.

Market Dynamics

The family car market share is highly competitive in nature influenced by various factors that impact sales and consumer choices, among which, safety innovations are paramount. The assurance of a secure & protective driving environment for families significantly impacts buying decisions. Manufacturers continuously integrate advanced safety features such as adaptive cruise control, collision avoidance systems, and lane-keeping assistance to not only attract buyers but also increase the car sales. Similarly, vehicles equipped with safety suites tend to witness greater market traction, boosting overall sales. According to Forbes, in 2021, 91.7% of households in the U.S. had at least one vehicle.

Fuel efficiency acts as a critical market driver that bears a direct impact on family car sales. Amid the ever-shifting landscape of fuel costs, consumers are on the lookout for pragmatic choices that present a financially astute answer to their mobility requirements. Family vehicles that boast fuel-savvy engines, harness the potential of hybrid innovations, or embrace electric propulsion have garnered favor, drawing attention not only for their eco-conscious credentials but also for the substantial, wallet-friendly benefits they bring over the long haul. This directly correlates with increased sales as cost-conscious families opt for vehicles that promise better mileage and reduced fuel expenses.

In today's fast-paced technological arena, families are progressively relying on sophisticated connectivity features and advanced infotainment systems to craft a truly immersive and comfortable driving experience. Manufacturers who invest in new technologies for family cars not only strengthen their appeal to tech-savvy consumers but also see a tangible increase in their sales performance. In particular, vehicles offering seamless smartphone integration, rear-seat entertainment systems, and in-car Wi-Fi connectivity are sought after, driving up the market growth.

Interior space and versatility are key factors that strongly influence family car sales. Families have diverse needs, ranging from accommodating passengers to transporting cargo, and vehicles that can flexibly adapt to these requirements tend to perform well in the market. Models with adjustable seating configurations, spacious cargo areas, and innovative storage solutions are better equipped to meet the demands of various family sizes & lifestyles, ultimately resulting in increased sales. Moreover, affordability remains a central consideration for families when making a vehicle purchase. Competitive pricing and attractive financing options can be the tipping point for many prospective buyers. Manufacturers offering value for money in terms of purchase price, maintenance costs, and long-term ownership expenses stand to attract budget-conscious consumers, leading to higher sales volumes.

Market Segmentation

The global family car market is segmented by vehicle, by propulsion, and by region. On the basis of vehicle, the market is divided into hatchbacks, sedan, SUV, and others. By propulsion, it is bifurcated into ICE and electric. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The North America family car market sales is undergoing a transformation marked by distinct trends that are intricately connected to the sales of family vehicles. According to OICA, North America had total sales of 3.6 million passenger cars in 2022. A striking trend is the growing preference for SUVs, valued for their versatility and spacious interiors, particularly in the context of a region where most car manufacturers maintain a significant presence. Safety features have gained paramount importance, enhancing family car appeal for security-conscious consumers.

Moreover, increase in adoption of electric and hybrid family cars aligns with the environmentally conscious outlook of North American families, encouraged by government incentives. Families' tech-savvy inclinations have fueled the demand for advanced connectivity & infotainment systems. The availability of diverse body styles, from SUVs to crossovers and minivans, accommodates the varying needs of families. Collectively, these factors drive the sales of family vehicles in a market where most major automakers have established a strong foothold, ensuring a wide array of options for North American families seeking a car that suits their specific requirements and lifestyles.

The Europe family car market manufacturers embodies a solid landscape marked by pivotal market dynamics, expansion catalysts, and a few prospects. Compact SUVs have emerged as a salient trend, resonating with families across the continent due to their versatility and pragmatic cargo space, aligning with the evolving preferences of European families. In 2022, Europe witnessed a 9.82% decrease in the sales of passenger cars compared to the 2021, with a total of 12.6 million units sold.

An escalating shift toward eco-conscious mobility takes center stage, with the prominence of electric and hybrid family cars, driven by stringent emissions standards and an eco-aware populace, thereby presenting an expansive growth horizon. Simultaneously, surge in technology-savvy European households is propelling the demand for cutting-edge connectivity and entertainment systems, augmenting the attractiveness of modern family vehicles. An assorted range of vehicle options, encompassing hatchbacks, sedans, SUVs, and other variants, adeptly accommodates diverse family dimensions and lifestyles, thereby presenting a surge in prospects for both car manufacturers and families alike.

The Europe family car market price is marked by these evolving dynamics, which, together with stringent regulations and heightened environmental consciousness, collectively foster the burgeoning sales of family vehicles while presenting numerous prospects for both industry players and families seeking efficient, reliable, and eco-conscious family cars.

What are the Recent Developments in the Family Car Market

The leading family car market manufacturers are adopting strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

In October 2023, Suzuki Motor Corporation signed a contract with SkyDrive Inc. for the manufacturing of flying cars. SkyDrive Inc. utilize a plant owned by the Suzuki Group in Iwata City, Shizuoka Prefecture to start the manufacturing of SKYDRIVE.

In July 2023, Hyundai Motor Group revealed its radically transformed all-new Santa Fe. It is boxy shape and distinctive silhouette are derived from its long wheelbase and wide tailgate area. The front of the vehicle creates a sense of grandeur with its high hood, H-shaped headlamps and bold, sharp fenders.

In May 2023, Kia Corporation, through its Indian subsidiary Kia India, launched Sonet with a special Aurochs edition with petrol andamp; diesel engines. The new edition comes with 6 exterior design iteration that include a wilder look with a robust front skid plate with tangerine accents on the signature tiger nose grille.

In June 2022, Toyota Motor Corporation collaborated with Suzuki Motor Corporation to start production of a new SUV model developed by Suzuki at Toyota Kirloskar Motor Pvt. Ltd. This strategy helps to strengthen electrification technologies andamp; increases the production of electrified vehicle in India.

Which are the Top Family Car companies

The following are the leading companies in the market. These players have adopted various strategies to increase their market penetration and strengthen their position in the family car industry.

- Ford Motor Company

- General Motors

- Honda Motor Co., Ltd.

- Hyundai Motor Group

- Kia Corporation

- Nissan Motor Co. Ltd

- Suzuki Motor Corporation

- Tata Motors

- Toyota Motor Corporation

- Volkswagen Group

What are the Top Impacting Factors

Key Market Driver

Rise in Sales of EV to positively impact the Market

The burgeoning sales of electric vehicles (EVs) are poised to create a significant positive impact on the family car market. This shift toward electric mobility represents a transformative trend that extends far beyond environmental consciousness. According to International Energy Agency, the rising wave of electric cars leads to hold a market share of 14.8% in 2022. Moreover, owing to climate change repercussions, families are actively pursuing greener mobility solutions. EVs, with much fewer emissions and a smaller impact on the environment, fit well with the growing awareness of being eco-friendly.. Families are now more inclined to embrace EVs, not solely to shrink their environmental impact but also as a channel to impart essential environmentally responsible values to the next generation.

However, the positive impact goes beyond the environment. Rise in sales of EVs simultaneously have practical implications for families. These vehicles typically come with lower ongoing expenses compared to traditional internal combustion engine (ICE) vehicles. They exhibit superior energy efficiency, and the cost of electricity often falls below that of gasoline or diesel fuel. Consequently, families can revel in enduring financial benefits, a pivotal factor for households that are mindful of their budget constraints. Lower maintenance costs are another advantage, as EVs typically have fewer moving parts and require less frequent servicing than ICE vehicles.

Charging infrastructure is rapidly expanding, further enhancing the appeal of EVs for families. The convenience of home charging coupled with the increasing availability of public charging stations, makes EVs a viable choice for families who previously had concerns about range and refueling. This expanded infrastructure reduces one of the main barriers to entry for potential EV buyers, thus contributing to the positive impact on sales. Furthermore, advancements in battery technology are extending the range of EVs, making them suitable for family travel. Families are now considering EVs for road trips and longer journeys, as range anxiety becomes less of an issue. In addition, manufacturers are introducing a variety of EV models, including SUVs and crossovers, which cater to the preferences of families seeking spacious and versatile vehicles.

Government incentives & regulations play a vital role in driving EV sales. Many governments globally offer incentives such as tax credits, rebates, and access to carpool lanes for EV owners. These incentives reduce the upfront cost of EVs and further sweeten the deal for families considering a switch to electric. In addition, governments are increasingly imposing emissions standards and regulations that encourage automakers to invest in electric and hybrid technologies, which, in turn, leads to a broader range of electric family car options in the market.

The positive impact of rising EV sales on the family car market extends to the technological front. EVs are at the forefront of innovation, often featuring infotainment systems, and advanced driver-assistance technologies. Families seeking the latest in technology and safety features are finding EVs to be an attractive proposition, further boosting their sales.

SUV and Crossover Craze is Shaping the Family Car Landscape

The SUV and crossover segment has sparked an undeniable craze that is profoundly shaping the family car landscape. This surge in popularity goes beyond mere trends, as it held 42% of market share in 2022 by volume in Indian market. It has fundamentally altered the automotive preferences of families, and its implications reverberate through various facets of the market. At its core, this craze reflects a significant shift in what family’s desire from their vehicles. They are increasingly drawn to the imposing stature and rugged aesthetics of SUVs and crossovers.

Families aspire to align themselves with this image, and automakers wisely acknowledge & harness this aspiration to drive sales. One of the primary ways in which the SUV and crossover phenomenon is impacting family car sales is through diversification. Manufacturers are broadening their product offerings, introducing a myriad of SUVs and crossover models tailored to cater to different family sizes, lifestyles, and preferences. From compact crossovers suited for urban living to full-size SUVs capable of accommodating large families and all their cargo, there is an SUV or crossover to meet virtually every need. This extensive variety not only captures a broader consumer base but also fosters an environment where buyers can find a vehicle that perfectly aligns with their family dynamics, ultimately translating into increased sales.

Safety stands as a paramount factor within the realm of SUVs and crossovers. The well-being of family members takes precedence, and the sturdy construction of these vehicles naturally imparts a profound sense of assurance. Manufacturers have proactively incorporated modern safety technologies, including driver-assistance systems and crash safety benchmarks within these automobiles. This heightened commitment to safety substantially enhances the appeal of SUVs and crossovers for families prioritizing security, ultimately increasing sales.

Furthermore, the driving experience offered by SUVs and crossovers has evolved to align with family needs. These vehicles come equipped with features such as sunroof that enhance family journeys. This enhancement of the overall driving experience not only attracts more buyers but also shores up the brand loyalty, resulting in increased sales.

Restraints

Rise in Fuel Prices Pose a Challenge for Affordable Family Cars

The family car landscape, once dominated by spacious SUVs and minivans, is undergoing a notable transformation. As fuel costs ascend, families are rethinking the need for massive, fuel-thirsty vehicles. This metamorphosis, while driven by fuel prices, paradoxically contributes to declining sales of traditional family cars. Smaller, more fuel-efficient models are gaining popularity, signaling a deviation from excess and a movement toward practicality & sustainability. The demand for bigger, less efficient vehicles is declining, leading to a drop in sales figures for these traditional giants.

Simultaneously, as fuel prices continue their upward trajectory, the idea of carpooling and ridesharing becomes an attractive alternative to individual family car ownership. Instead of viewing a car as a necessity, families are exploring new ways to share resources and cut down on fuel expenses. This paradigm shift further impedes the sales of traditional family cars, as fewer vehicles are deemed essential. The family car is gradually shifting from a symbol of individual status to a shared asset, contributing to the decline in sales.

Opportunity

Highly Advanced Safety Features

In the competitive market, staying ahead of the curve requires innovation that resonates with consumers. Highly advanced safety features offer a unique opportunity to not only meet but exceed the expectations of family car owners, potentially leading to increased sales.

Families are a distinct demographic within the automotive market, and safety is their top priority. While traditional safety features like airbags and anti-lock brakes are essential, today's families seek more. The inclusion of sophisticated technologies such as adaptive cruise control, lane-keeping assist, and automatic emergency braking provides an extra layer of reassurance. These advanced safety features offer several distinct advantages that can directly impact sales figures.

In addition, the integration of advanced safety features can lead to reduced insurance costs. Insurers often provide discounts for vehicles equipped with such technology due to the reduced risk of accidents. Modern consumers are tech-savvy and prioritize security. By embracing advanced safety features, family cars align with these factors. Moreover, this improves the overall driving experience, making it less stressful and more enjoyable for families. Ultimately, integrating safety features not only elevates the family car's role but also has the potential to increase sales.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the family car market analysis from 2022 to 2032 to identify the prevailing family car market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the family car market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global family car market trends, key players, market segments, application areas, and market growth strategies.

Family Car Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 2.3 trillion |

| Growth Rate | CAGR of 6.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 305 |

| By Vehicle |

|

| By Propulsion |

|

| By Region |

|

| Key Market Players | Hyundai Motor Group, Volkswagen Group, Suzuki Motor Corporation, NISSAN MOTOR CO., LTD., Kia Corporation, Ford Motor Company, General Motors, Tata Motors, Toyota Motor Corporation, Honda Motor Co., Ltd. |

highly advanced safety features and aging population and increase in dual-income households are the upcoming trends of family car market in the world

safety, comfort, fuel efficiency, technological features are the leading application of family car market

Asia-Pacific is the largest regional market for family car.

The estimated industry size of family car is $ 2,284.9 billion by 2032.

The current market size of family car market is $ 1,266.2 billion in 2022

Loading Table Of Content...

Loading Research Methodology...