Family Office Market Research, 2032

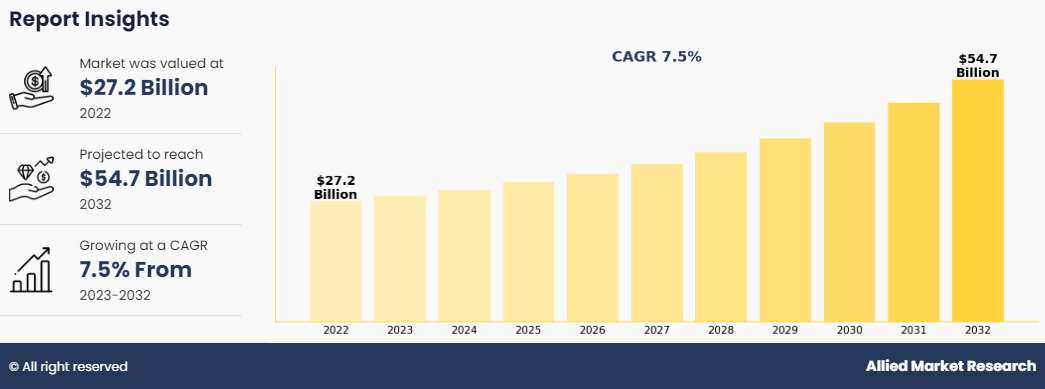

The family office market size was valued at $27.2 billion in 2022 and is projected to reach $54.7 billion by 2032, growing at a CAGR of 7.5% from 2023 to 2032.

A family office is kind of wealth management and advisory organization that services wealth clients. The organization is generally established by important wealthy families to manage their wealth and provide a range of services, including investment management, financial planning, tax management, estate planning, philanthropic activities, and other personalized services. The offices are basically formed to address the complex financial requirements and goals of wealthy families. The family office might operate as a single-family office, multiple family office or even as a virtual family office. The main aim of family office is to provide financial support and guidance to family members.

The report focuses on growth prospects, restraints, and trends of the family office market forecast. The study provides Porters five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the family office market outlook.

Key Takeaways

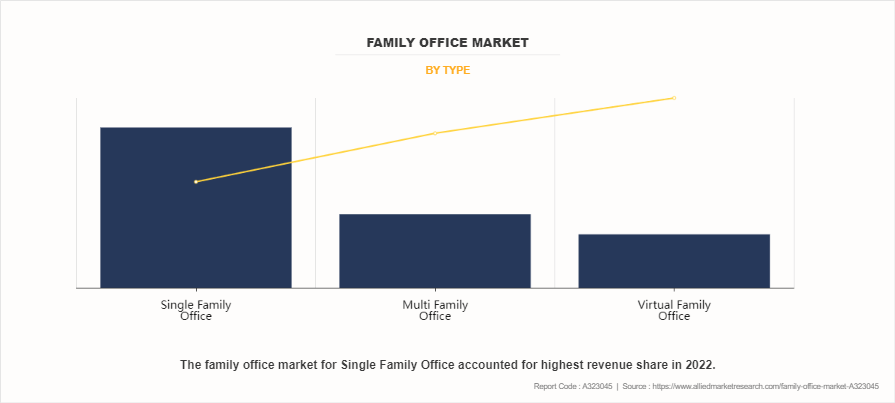

- Based on type, the single-family office segment held the largest market share in 2022

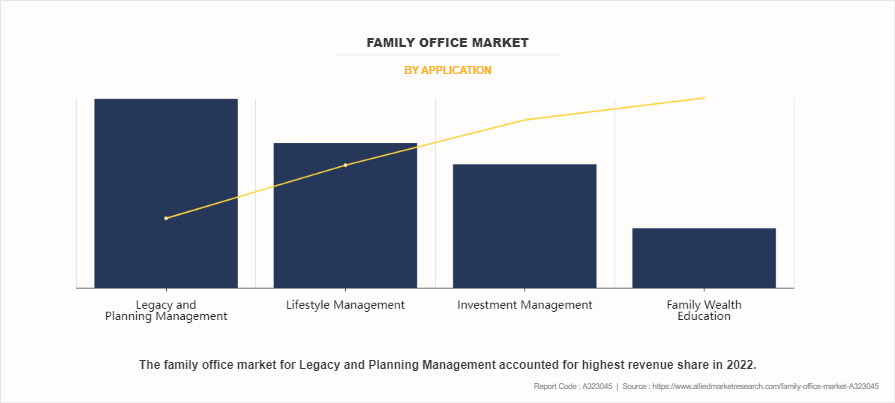

- Based on application, the legacy and planning management segment held the largest market share in 2022.

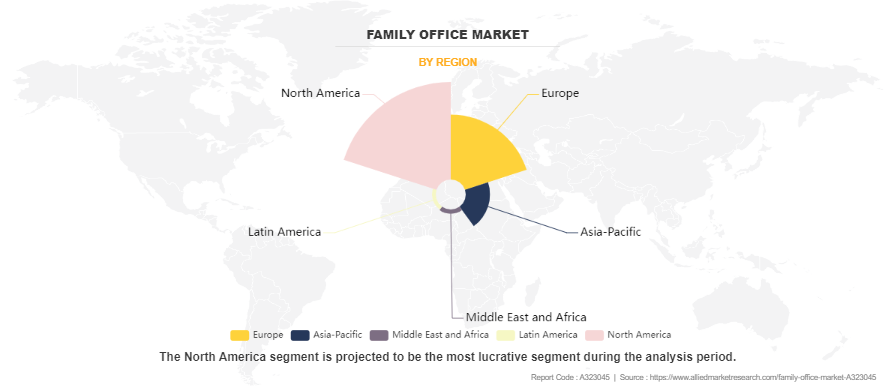

- Based on region, the North America segment held the largest market share in 2022.

Family Office Market Segment Review

The global family office market share is segmented into type, application and region. By type, the market is divided into single family office, multiple family office and virtual family office. By application, the market is divided into legacy and planning management, lifestyle management, investment management, and family wealth education. Region-wise, the family office market growth is studied across North America, Europe, Asia-Pacific, Latin America, Middle East and Africa.

Based on type, the single-family office segment held the largest family office market share in the market in 2022. This is due to the fact that single family office solutions are tailor made solutions that provide larger degree of control for making investment decisions, implementing wealth management strategies, and planning family legacy.

Based on application, the legacy and planning management segment held the largest market share in the family office market in 2022. This is due to the increasing demand to expand family legacy and secondly the increasing obstacles in relation to estate laws, estate taxes, family issues and business issues.

Based on region, the North America segment held the largest market share in the market in 2022.This is due to the high presence of high net-worth individuals and families in the region that necessarily require wealth management solutions to deal with their wealth related problems.

Competition Analysis

Competitive analysis and profiles of the major players in the family office market include Walton Enterprises LLC, Cascade Investment LLC, Bexos Expeditions, Mousse Partners, Ballmer Group, Citi Private Bank, Atlantic Trust, Pictet, BNY Melon Wealth Management, Stonehage Family & Fleming Partners, Abbot Downing, UBS Global Family Office Group, Bessemer Trust, Wilmington Trust, U.S Trust Family Office, Northern Trust, Hawthorn, Glemede Trust Company, Rockfeller Capital Management, BMO Harris Bank, and HSBC Private Bank. These players have adopted product launch, partnership, collaboration, acquisition and agreement strategies to increase their market penetration and strengthen their position in the industry.

Recent Product Launch in the Family Office Market

- In May 2023, Ballmer Group collaborated with Echoing Green and New Profit and granted 40 million dollars in seed funding to address funding gap for black led organization, to spur innovation and to improve economic mobility. The grant will fund a five-year initiative to build leadership and sustainability of Black-led organizations focused on economic mobility. Due to this move around 100 black-led organizations will receive both capital and operational support to assist in developing innovative solutions and providing black leaders with tools to meet long-term goals.

- In September 2021, Four Seasons Hotels and Resorts the world's leading luxury hospitality company has entered into a definitive agreement to acquire a controlling interest in the Cascade Investment, L.L.C. In the all-cash deal, Cascade will increase its existing 47.5 percent stake to 71.25 percent by purchasing half of the existing 47.5 percent stake owned by an affiliate of its long-term investment partner Kingdom Holding Company for $2.21 billion, valuing Four Seasons at a $10 billion enterprise value.

- In September 2022, Wilmington Trust launched boarding pass solution, a solution that helps in automating and simplifying and onboarding process for collective investment trusts. Boarding pass is type of solution that provides digital help for managing retirement plan onboarding process and for creating simple experience for sponsors, advisors and recordkeepers to manage participation agreements and enable accessibility and transparency in the collective investment fund to U.S. workforce.

Family Office Market Landscape and Trends

The wealth concentration is rising on a global scale. Increasing wealthy individuals are looking for advanced wealth management solutions. Furthermore, family offices are increasingly becoming important in order to full fill the requirement of wealthy families. In addition, family offices are becoming more mature in in their investment strategies and services, as clients seek tailored solutions that go beyond traditional wealth management offerings. The offering includes alternative investments, impact investing, philanthropy services, and family governance. In addition, technology is playing a crucial role in transforming the family office market landscape. Family offices are increasingly adopting advanced financial technology solutions for portfolio management, risk assessment, reporting and communication thus improving efficiency and transparency.

Moreover, there is a growing curiosity between family offices thus impacting investing, environmental, social, and governance (ESG) principles. Different wealth families are aligning their investment objectives with their values thus searching for both financial returns and social impact. Family office companies are focusing more on succession planning due to change in ownership of wealth between generations. Moreover, importance for education, and mentorship is growing in the family office industry. Hence all the above trends are expected to propel the growth of family office market during the forecast period.

Top Impacting Factors

Growing Wealth and Wealth Management Complexities in Family Office Market

Increasing wealth between wealthy individuals and families is leading to rise in the number of family office market. Individuals and families are gathering large assets and searching for matured financial management and customized services provided by family offices. Furthermore, according to Zipto, average rate of return for global family offices was around 5.4% in 2020. Furthermore, managing large fortunes is becoming increasingly complex, especially with diverse investment portfolios, multiple asset classes, and global investments. Family offices are offering specialized expertise and tailored solutions to navigate this complexity effectively.

Moreover, due to globalization, wealth is increasingly spreading across multiple jurisdictions and asset classes. High-net-worth individuals offer investments and business interests in various countries, leading to complex cross-border financial planning and tax considerations. Family offices specializes in navigating the intricacies of international wealth management and providing comprehensive solutions tailored to client global needs.Therefore, all the above factors are expected to drive the growth of family office markeuring the forecast period.

Challenges in Relation to Comply with Regulatory Requirements, Cost Complexities and Talent Management

Complexities in rules and regulations and strict laws are making it difficult and challenging for family office market to grow. In addition, running and setting up a family office is becoming very expensive and complex especially in case of small wealthy families. Furthermore, costs associated with staffing, technology and operations are restrictive in nature. Moreover, hiring and selecting skillful professionals such as investment managers, tax specialists and legal advisors is becoming difficult. Competition for talented people in the financial services industry is driving costs and limiting access to top talent. In addition, according to European family office report 62% of European family offices consider investment strategy and asset allocation as their primary concern in the current economic landscape. Therefore, all the above factors are expected to hamper the growth of family office industry during the forecast period.

Growing Drive for Creation of Wealth, Succession Planning and Customized Solutions

The demand for family office market service is increasing because the global wealth among rich families is growing. Family office solutions are able to provide tailormade remedies for wealthy families. They also provide tailormade solutions in relation to investment management, tax planning, estate planning and philanthropic initiatives. In addition, family office solution is increasingly focusing on succession planning due to increasing wealth transfers. For instance, a UBS report stated that the primary goals of most family offices is to support the transfer of wealth from one generation to another (63%) and provide income for family members (55%). Furthermore, family office plays an important role in the preservation and transfer of wealth to future generations by simultaneously dealing with the complexities of family dynamics and government structures. Moreover, family office provides highly personalized and customized services thus providing unique services to each family. The customization ability of family office solution sets them apart from traditional financial solutions. Therefore, all these factors are expected to provide family office market opportunity during the forecast period.

Report Coverage & Deliverables

Type Insights

Family office services include wealth management, investment advisory, estate planning, and tax services, all tailored to the needs of high-net-worth individuals and families. As the demand for specialized financial services grows, family offices are expanding their scope to include philanthropy management and succession planning. The family office market is increasingly adopting technology-driven solutions to improve efficiency and transparency in managing assets.

Application Insights

Family offices is driven by increased wealth accumulation, intergenerational wealth transfer, and rising demand for tailored financial services. As families look to protect and grow their wealth, they are increasingly adopting family office structures to ensure long-term sustainability and personalized service offerings these factors drive the family office growth.

Region Insights

Regionally, North America dominates the family office market due to its large concentration of wealth. Europe and Asia-Pacific are also experiencing significant growth, driven by rising numbers of wealthy individuals and a growing interest in bespoke wealth management services. Middle Eastern family offices are also growing rapidly, leveraging the region’s wealth from oil and diversified investments which increases the family office value.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the family office market analysis from 2022 to 2032 to identify the prevailing family office market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the family office market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global family office market trends, key players, market segments, application areas, and market growth strategies.

Family Office Market Report Highlights

| Aspects | Details |

| Forecast period | 2022 - 2032 |

| Report Pages | 300 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Wilmington Trust, Bezos Expeditions, Walton Enterprises LLC, Cascade Investment LLC, Atlantic Trust, Pictet, abbot downing, Citi Private Bank, ballmer group, mousse partners limited |

Analyst Review

Family office is an organization that manages and monitors wealthy family assets and finances. The main objective of family office is to collect and protect finance throughout several generations by providing services such as estate planning, investment management and legal counselling services.

Furthermore, family office provides a range of services such as investment management, estate and succession planning, legal and tax assistance. These solutions are tailormade to meet the specific demand for each family. Investment management helps in managing risk and maximizing returns. Family offices strive to diversify their portfolios and choose assets wisely. In order to minimize tax effects and ensure an efficient transfer of wealth across generations, estate and succession planning develops solutions. Legal and tax advice offers direction on matters pertaining to the law and taxes, ensuring adherence to regulations and maximizing the financial structure.

Key players in the family office market adopted different strategies to sustain their growth in the market. For instance, in April 2023, Northern Trust launched market risk monitor solution. This new risk solution leverages confluence technologies and includes analytics dashboard integration to support clients risk management and regulatory reporting. The service provides institutional investor clients such as pension funds with an extensive library of key risk indicators including stress tests, sensitivity shocks and value-at-risk measures, all available via radartm, Northern Trust’s digital dashboard for investment analytics. These can be used by clients for purposes ranging from monitoring the risk targets and limits of their external fund managers to reporting on their adherence to regulations and accounting standards. In July 2023, JP Morgan Private Bank launched U.S. family office practice, a new effort that will support the Private Bank's largest clients and their family enterprises, and expand its suite of family office services. The practice will bring together the experience of more than 150 professionals, including 40 formerly practicing partner level estate and tax attorneys, offering guidance on estate planning, life insurance and strategic wealth transfer techniques, along with the Private Bank's Advice Lab, Global Investment Opportunities (GIO) and Outsourced Chief Investment Officer (OCIO) teams. These players have adopted different strategies to increase their market penetration and strengthen their position in the family office industry.

The Family Office Market was valued at $27.2 billion in 2022 and is projected to reach $54.7 billion by 2032, growing at a CAGR of 7.5% from 2023 to 2032.

A family office is a wealth management and advisory organization established by wealthy families to manage their wealth and provide services such as investment management, financial planning, tax management, estate planning, philanthropic activities, and other personalized services.

Key players in the Family Office Market include single-family offices, multiple-family offices, and virtual family offices, each offering tailored solutions to meet the complex financial needs of wealthy families.

In 2022, North America accounted for the largest share of the Family Office Market, driven by the presence of numerous high-net-worth families seeking comprehensive wealth management services.

Factors driving the Family Office Market include the increasing demand for personalized wealth management solutions, the need for effective estate and legacy planning, and the growing complexity of financial landscapes requiring specialized advisory services.

Challenges facing the Family Office Market encompass navigating complex estate laws and taxes, addressing family dynamics and conflicts, and adapting to evolving regulatory environments that impact wealth management strategies.

Loading Table Of Content...

Loading Research Methodology...