Fast Charge Battery Market Research, 2033

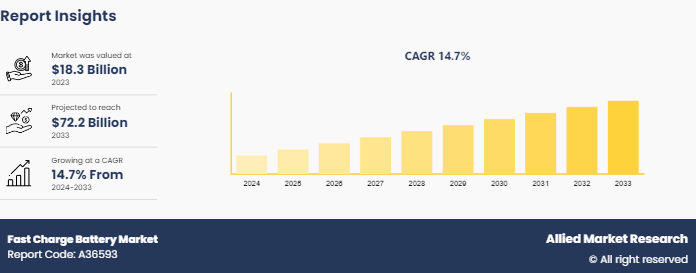

The global fast charge battery market size was valued at $18.3 billion in 2023, and is projected to reach $72.2 billion by 2033, growing at a CAGR of 14.7% from 2024 to 2033.

Market Introduction and Definition

Fast charge batteries, also known as quick charge batteries, are designed to reduce the time it takes to charge the battery to a usable level. These batteries are typically used in smartphones, electric vehicles (EVs) , laptops, and other portable electronic devices. The fast-charging technology involves both the battery's chemistry and the charging protocol. Fast charge batteries are revolutionizing a wide range of applications by significantly reducing charging times and enhancing convenience. In consumer electronics, they enable quick top-ups for smartphones, tablets, laptops, and wearables, ensuring devices are ready for use with minimal downtime.

In electric vehicles (EVs) , fast charge batteries reduce charging times at stations, making long-distance travel more feasible and increasing the practicality of EVs for daily use. Public transport and commercial vehicles also benefit from reduced idle times and operational cost savings. Residential and commercial energy storage systems utilize fast charge batteries to efficiently store and quickly access renewable energy, improving grid stability and offering reliable emergency backup power. Medical devices, including portable equipment, rely on fast charging to remain operational in critical situations. In construction and DIY settings, fast charge batteries in power tools minimize downtime and boost productivity.

Key Takeaways:

Over 1, 500 product literatures, industry releases, annual reports, and various documents from major fast charge battery market participants, along with credible industry journals, trade association releases, and government websites, have been reviewed to generate valuable industry insights.

The fast charge battery market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

The study integrated high-quality data, expert opinions and analysis, and crucial independent perspectives. This research approach aims to provide a balanced view of global markets and fast charge battery market overview, assisting stakeholders in making informed decisions to achieve their most ambitious growth objectives.

Fast charge battery market news and key industry trends are also included in the report.

Market Dynamics?

The fast charge battery market growth is primarily driven by the increasing demand for electric vehicles (EVs) . As consumer awareness of environmental issues grows and governments worldwide implement policies and incentives to promote EV adoption, the need for efficient and quick-charging batteries becomes critical. This demand is further amplified by advancements in battery technology, where innovations in battery chemistry and charging protocols are leading to significant improvements in battery performance and reduced charging times.

Nevertheless, technological advancements and innovation are expected to offer lucrative growth opportunities for market growth. To lower charging times, researchers are concentrating on a variety of fast-charging technologies, including advances in power electronic converters, heat management systems, and wireless charging technologies. Advancements in these areas are critical to make EVs more practical and appealing by substantially lowering charging times and improving overall system efficiency. Furthermore, advanced converter designs are being designed to handle the high power levels crucial?for rapid charging while reducing heat generation and energy loss. For example, in a 2023 study, researchers presented a novel method for improving the extreme rapid charging performance of commercial lithium-ion batteries without changing their materials or designs.

They used active thermal switching to manage the battery's self-generated heat and found that keeping heat during charging and then dispersing it considerably improves charging efficiency and lowers negative responses.?This approach charges batteries to 80% in 15 minutes, meeting the US Department of Energy's XFC objectives. This technology can be incorporated into current battery temperature management systems, making it a viable alternative for the?fast charging of electric vehicles.

Market Segmentation?

The fast charge battery market is segmented on the basis of type, application, and region. By type, the market is classified into lithium-ion batteries, solid-state batteries, lithium polymer batteries, and others. By application, the market is classified into electric vehicles, consumer electronics, medical devices and others. Region-wise, the fast charge battery market share is studied across areas such as North America, Europe, Asia-Pacific, and LAMEA.?

Regional/Country Market Outlook

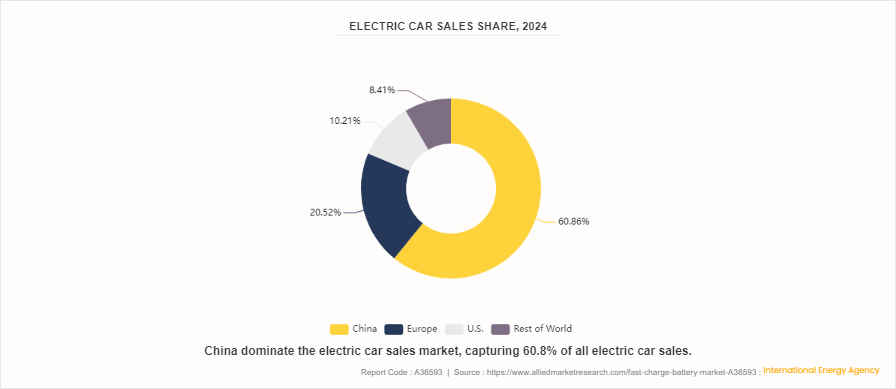

The Asia-Pacific region is expected to experience the fastest growth in the fast charge battery market. This rapid expansion is primarily driven by the region's status as a major global hub for electric vehicle (EV) manufacturing. Countries such as China and others in the region are leading the way in the production and sales of electric vehicles, significantly boosting the demand for fast charge batteries. Furthermore, the rising usage of electric vehicles in the region is driving up demand for fast charge batteries. For example, the International Energy Agency forecasts that new electric vehicle registrations in China will reach 8.1 million in 2023, up 35% from 2022. Increasing electric vehicle sales were the key driver of growth in the global auto market, which fell by 8% for conventional (internal combustion engine) automobiles but increased by 5% for electric vehicles, indicating that electric car sales will continue to expand as the sector matures.

Competitive Landscape

Key players in the fast charge battery industry include Tesla, Inc., Panasonic Holdings Corporation, CATL (Contemporary Amperex Technology Co. Limited) , BYD (Build Your Dreams) , LG Energy Solution Ltd, Samsung SDI Co., Ltd., Solid Power Inc., QuantumScape, A123 Systems, LLC, StoreDot and others.

Key Developments

In June 2024, BYD announced its plans to launch the Blade Battery 2.0, a lithium iron phosphate (LFP) battery supporting a 6C charge rate, in the second half of the year. Similarly, CATL plans to release the Qilin Battery 2.0, also featuring LFP chemistry and 6C fast charging, by the year's end. This follows CATL's recent introduction of 5C charging batteries a few months ago. On February 27, 2024, the Zeekr 001 was introduced to the Chinese market, equipped with CATL’s new Shenxing battery, which supports 5C charging. This new Zeekr 001 can charge from 10 to 80% in 11.5 minutes, adding a range of 472 km based on CLTC standards. The Shenxing battery is also an LFP type, and in April, CATL launched the Shenxing Plus, which boasts an energy density of 205 Wh/kg, allowing for an EV range of up to 1000 km. Notably, the Shenxing Plus supports only 4C charging.??

In March 2024, CATL, a Chinese power battery giant, announced its plans to collaborate?with Tesla (NASDAQ: TSLA) to create faster-charging batteries, as charging speed?becomes an important determinant of the experience of an electric vehicle (EV) model.

In March 2023, Samsung SDI exhibited BMW i7 and Volvo FM Electric cars at InterBattery 2023, as well as its innovative battery technology, which includes all-solid-state batteries and high-efficiency rapid charging. The firm aims to convey its technological expertise and commitment to a sustainable battery sector future. In addition to presenting Samsung SDI's existing solid-state battery pilot line, the booth showcased a range of battery applications.

Electric Cars Industry Facts

In 2022, over 800, 000 light-duty EVs were purchased in the U.S., representing a 65% increase from 2021 levels. According to Cox Automotive, the light-duty market in the U.S. reached?one million EVs in 2023.?In 2022, the EV market share reached 5.8%, up from 3.2% in 2021. In the first quarter of 2023, EV sales increased by about 45%?year on year to more than 258, 000 units, accounting for 7.2% of total new-vehicle sales. In addition, electric vehicle model availability in the medium- and heavy-duty markets is also growing extensively.

According to CALSTART, the global market for zero-emission trucks and buses increased by about 33% from 2021 to the end of 2022, from 609 to 808 units.?Between 2021 and 2022, the zero-emission cargo van (91 models available, up from 58 models) and heavy-duty truck (107 models available, up from 57 models) categories witnessed the most rise, increasing by 56% and 87%, respectively. Thus, growing demand for EVs is predicted to bolster the fast charge battery market growing during the forecast period. However, the fast charge battery market faces several restraints. One of the main challenges is the high cost associated with the development and production of advanced fast charge batteries. These costs can be a barrier to widespread adoption, especially in price-sensitive markets. Additionally, the fast charging process generates significant heat, which can impact battery longevity and safety, necessitating advanced thermal management solutions. This requirement can complicate the battery design and add to the overall cost.

Key Industry Trends

In February 2024, Ampcera, a Tucson-based battery innovator, ?announced that the performance of their all-solid-state battery (ASSB) technology surpassed the U.S. Department of Energy's (DoE) ambitious fast-charging benchmark of achieving an 80 percent charge in under 15 minutes, which is considered "an extreme fast-charging goal for lithium batteries" by the United States Advanced Battery Consortium (USABC) and the DoE.?The business claims that the breakthrough proves ASSB's fast-charging capabilities, which is a critical necessity for the broad adoption of electric cars.

In December 2023, Chinese automaker Geely's premium electric vehicle brand, Zeekr, introduced a groundbreaking electric vehicle charging solution that delivers a 500 km range after just 15 minutes of charging. This innovative technology was unveiled at a battery plant owned by Geely Holding Group in Zhejiang province. The fast-charging capability is attributed to Zeekr's lithium iron phosphate (LFP) batteries. By incorporating these batteries, Zeekr aims to reduce its dependency on external suppliers for critical electric vehicle components in a highly competitive market. The upcoming 007 sedan from Zeekr will be the first model to feature these advanced batteries, offering a rapid-charging capability that allows for a 500 km (300 miles) driving range within 15 minutes. This impressive system operates at an 800-volt level, setting a new standard in the electric vehicle industry.

Key Sources Referred

National Renewable Energy Laboratory (NREL)

Institution of Mechanical Engineers

Electric Drive Transportation Association (EDTA)

Battery Council International (BCI)

European Battery Alliance (EBA)

Advanced Automotive Battery Conference (AABC)

International Battery Materials Association (IBA)

National Alliance for Advanced Transportation Batteries (NAATBatt)

Global Battery Alliance (GBA)

China Battery Industry Association (CBIA)

Key Benefits For Stakeholders

- This fast charge battery market report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the fast charge battery market analysis to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the fast charge battery market forecast assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global fast charge battery market trends, key players, market segments, fast charge battery market statistics, application areas, and market growth strategies.

Fast Charge Battery Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 72.2 Billion |

| Growth Rate | CAGR of 14.7% |

| Forecast period | 2024 - 2033 |

| Report Pages | 280 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | QuantumScape Corporation, Solid Power Inc., BYD (Build Your Dreams), CATL (Contemporary Amperex Technology Co. Limited), LG Energy Solution Ltd, StoreDot Ltd., Panasonic Holdings Corporation, Samsung SDI Co., Ltd., Tesla, Inc., A123 Systems, LLC |

Loading Table Of Content...