Faucet Market Research, 2035

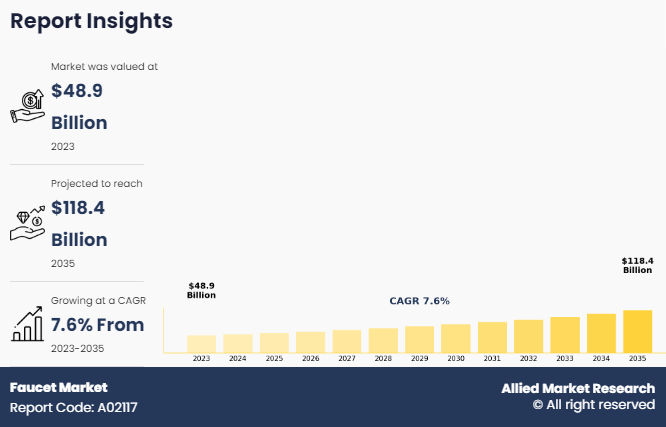

The global faucet market size was valued at $48.9 billion in 2023, and is projected to reach $118.4 billion by 2035, growing at a CAGR of 7.6% from 2023 to 2035. The growth of the faucet market is driven by increasing urbanization, rising disposable incomes, technological advancements in smart and water-saving features, and a growing emphasis on home aesthetics and hygiene.

Faucet is a plumbing fixture used to control the flow of water in various settings such as kitchen, bathrooms, and outdoor spaces. There are several types of faucets, including single-handle faucets, double-handle faucets, wall-mounted faucets, and touchless faucets, each offering different functionalities and aesthetics. Faucets serve multiple purposes such as providing access to clean water for drinking, cooking, and hygiene, as well as for filling containers and washing dishes or hands. They are made up of durable materials such as brass, stainless steel, or chrome-plated brass for the body, with components such as ceramic discs or rubber washers for regulating water flow and preventing leaks.

Key Takeaways of Faucet Market Report

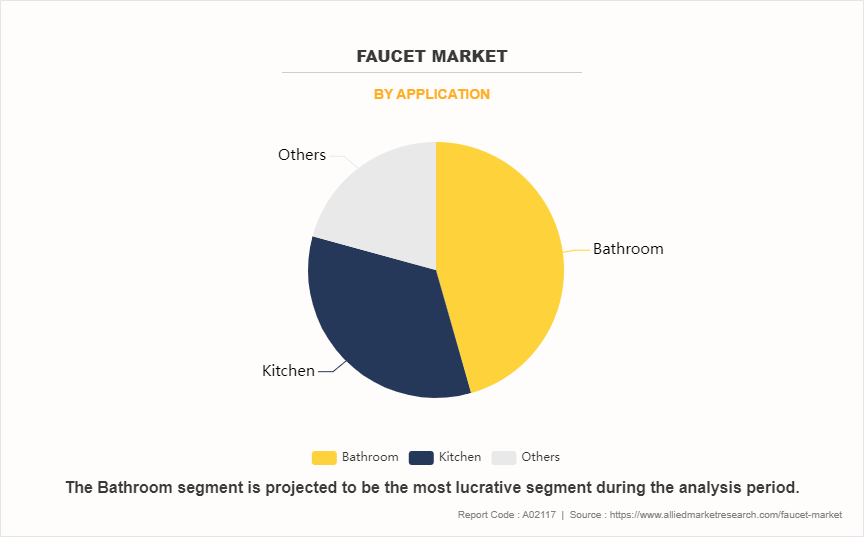

- By application, the bathroom segment was the highest revenue contributor to the faucet market in 2023.

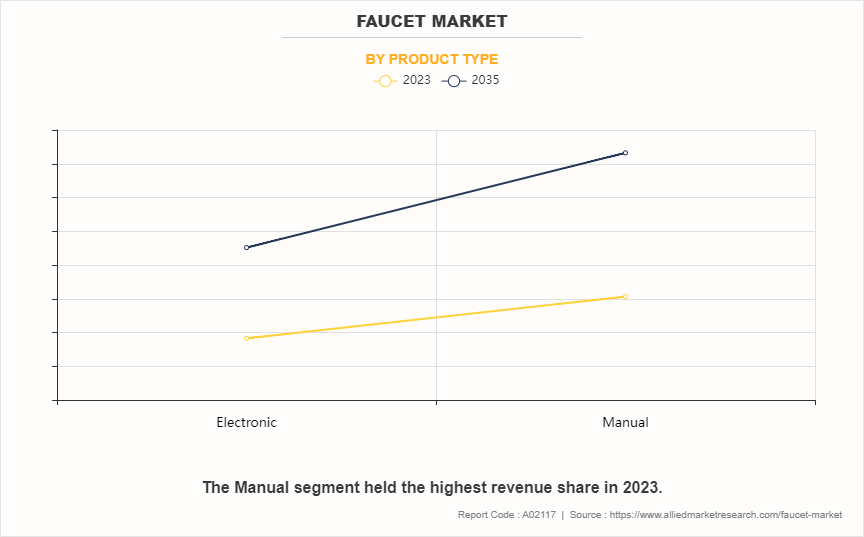

- As per type, manual segment was the largest segment in the global faucet market during the forecast period.

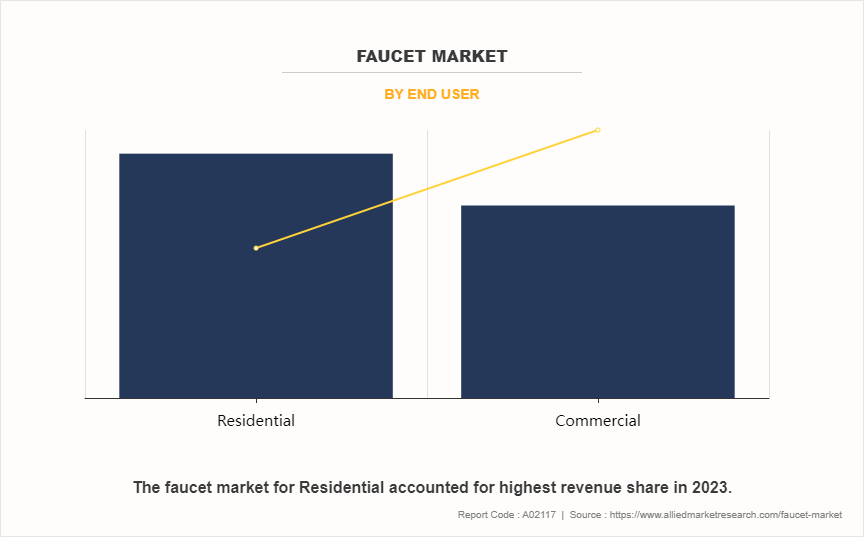

- Depending on end user, residential segment was the largest segment in 2023.

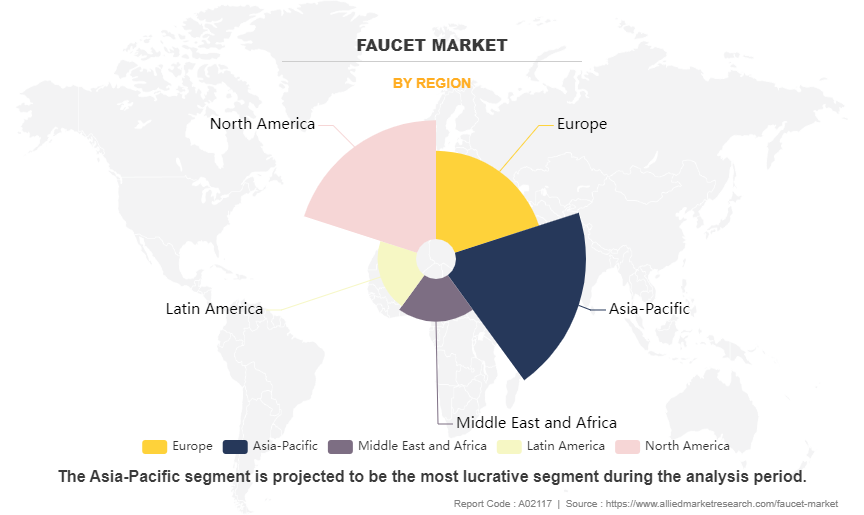

- Region-wise, Asia-Pacific was the highest revenue contributor in 2023.

Market Dynamics

Consumer preferences for interior aesthetics and functionality drive the selection of faucet styles, finishes, and features. As design trends evolve, manufacturers introduce innovative faucet designs that align with contemporary preferences. For instance, the popularity of minimalist and modern interior design has prompted demand for sleek and streamlined faucet designs characterized by clean lines and minimalist aesthetics. Similarly, trends favoring industrial or vintage-inspired decor have led to increased interest in faucets with unique finishes such as matte black or brushed nickel, as well as vintage-style handles and spouts.

Moreover, design trends reflect aesthetic preferences, encompass functionality and technology. Consumers increasingly seek faucets with advanced features that enhance convenience and efficiency in the kitchen and bathroom. This includes touchless or motion-sensor faucets that offer hands-free operation, as well as integrated water-saving technologies that contribute to sustainability efforts. Furthermore, the integration of smart technologies into faucet systems, such as temperature control and voice-activated commands, attracts to tech-savvy consumers looking to upgrade their homes with connected devices and contributes to the faucet market growth.

Technological innovations drive the demand for faucets by offering consumers enhanced convenience, efficiency, and sustainability. Advancements such as touchless or motion-sensor faucets have gained popularity due to their hands-free operation, which provides convenience and promotes hygiene, a particularly important consideration in today's health-conscious environment. These innovations cater to consumers seeking modern, high-tech solutions for their kitchens and bathrooms, drives the faucet market demand with such features. Water-saving technologies are another key driver of market demand within the faucet industry. With increasing concerns about water scarcity and environmental sustainability, consumers are actively seeking faucets equipped with water-saving features such as aerators and flow restrictors.

In addition, water-saving technologies have become more advanced and widespread, they contribute to the growth of the faucet market by addressing consumer concerns about resource usage and environmental impact, thus drive demand for eco-friendly faucet options. Smart faucet systems integrated with IoT capabilities further enhance market demand by offering consumers advanced functionalities such as voice-activated commands, customized settings, and remote monitoring and control options which cater to the growing preference for connected and smart home solutions. Thus, all these factors drive the demand for faucet market.

Economic downturns present significant restraints on the faucet market by reducing consumer assurance and discretionary spending on home improvement projects. Consumers often prioritize essential expenses over non-essential purchases during recessions or periods of economic uncertainty, which lead to a decrease in demand for faucets. Consumers delay or postpone renovation plans, including faucet replacements or upgrades, as they tighten their budgets and adopt a more cautious approach to spending. This reluctance to invest in home improvement projects during economic downturns directly impacts faucet manufacturers and retailers, who experience lower sales volumes and decreased revenue.

Furthermore, economic downturns lead to decreased activity in the housing market which further constrain the demand for faucets. During periods of economic instability, fewer individuals may be in a position to buy or sell homes, resulting in a slowdown in new construction and renovation activities. As a result, demand for faucets as essential fixtures in kitchens and bathrooms decreases and there is a negative impact of economic downturns on the faucet market.

Supply chain disruptions negatively affect the demand for the faucet market, impacting production and distribution channels. Disruptions such as raw material shortages, transportation delays, or manufacturing facility closures, faucet manufacturers face constraints in sourcing essential components and fulfilling orders. This led to production delays, reduced inventory levels, and, in some cases, product shortages, all of which negatively affect the availability of faucets in the market. As a result, consumers experience longer lead times for faucet purchases or encounter limited options which leads to a decline in demand as they defer purchases or seek alternative solutions.

Moreover, supply chain disruptions also result in increased costs for faucet manufacturers, which may be passed on to consumers in the form of higher prices. Fluctuations in raw material prices, expedited shipping costs to overcome delays, or investments in alternative sourcing strategies all contribute to rising production costs. As a result, consumers perceive faucets as more expensive or may be deterred from making purchases altogether, especially during periods of economic uncertainty. Furthermore, the combination of reduced availability and higher prices due to supply chain disruptions restrain market demand for faucets as consumers become more cautious with their spending and explore alternative options or postpone purchases. Thus, all these factors limit the growth of the faucet market.

Water-saving features present several opportunities in the faucet market by addressing consumer concerns about water conservation and sustainability while complying with regulatory standards. As governments and environmental agencies worldwide implement stricter regulations to mitigate water scarcity and promote efficient water usage, there is a growing demand for faucets equipped with advanced water-saving technologies. Manufacturers have the opportunity to develop innovative products that integrate features such as aerators, flow restrictors, and smart sensors to minimize water wastage without sacrificing performance. By offering faucets with enhanced water efficiency, manufacturers may position themselves as industry leaders in sustainability and cater to environmentally conscious consumers seeking eco-friendly solutions for their homes.

Moreover, the emphasis on water-saving features creates opportunities for faucet manufacturers to differentiate their products and capture market share in a competitive landscape. By leveraging water-saving technologies as key selling points, manufacturers attract consumers who prioritize sustainability and are willing to invest in products that align with their values. Furthermore, marketing campaigns highlighting the benefits of water-efficient faucets, such as cost savings on utility bills and contributions to environmental conservation efforts further drive consumer demand and promote brand loyalty. Thus, all these factors present numerous opportunities for faucet market.

Segmental Overview

The faucet market is segmented into application, type, end user, and region. By application, the market is classified into bathroom, kitchen, and others. By type, the market is classified into electric and manual. By end user, the market is classified into residential and commercial. Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, the UK, France, Italy, Spain, Russia, and the Rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea and the rest of Asia-Pacific), and Latin America (Brazil, Argentina, Colombia and Rest of Latin America) Middle East and Africa (GCC, South Africa, and Rest of MEA).

By Application

By application, the bathroom segment dominated the global faucet market in 2023 and is anticipated to maintain its dominance during the forecast period. Bathrooms are essential spaces in every household, requiring multiple faucets for sinks, showers, bathtubs, and bidets, thus drives the higher demand. Moreover, the increasing trend of bathroom renovations and upgrades contributes significantly to this dominance. Homeowners prioritize modern, stylish, and functional bathroom fixtures which leads to a surge in demand for innovative and aesthetically pleasing faucets. Furthermore, the rising focus on hygiene and convenience has spurred the adoption of advanced technologies such as touchless and sensor-activated faucets in bathrooms and further boost the market growth.

By Type

By type, the manual segment dominated the global faucet market in 2023 and is anticipated to maintain its dominance during the forecast period. Manual faucets are typically less expensive to produce, and purchase compared to advanced, technology-integrated options, making them accessible to a broad range of consumers. Their straightforward design and operation appeal to both residential and commercial users, ensuring their popularity across various settings. Moreover, manual faucets are versatile and reliable, with a long-established presence in the market that builds consumer trust. They are easier to install and maintain, requiring no specialized knowledge or additional infrastructure, unlike smart or touchless faucets. Furthermore, this simplicity and reliability make manual faucets a preferred choice for many consumers and businesses.

By End User

By end user, the residential segment dominated the global faucet market in 2023 and is anticipated to maintain its dominance during the faucet market forecast period. Homeowners frequently invest in modernizing their kitchens and bathrooms, which are the primary areas for faucet installations. This consistent demand for new and replacement faucets in residential properties drives significant market growth. In addition, the rising trend of home improvement, spurred by increased disposable incomes and the popularity of home renovation shows and further boosts the demand for stylish and functional faucets. Residential consumers are also more likely to adopt innovative designs and advanced technologies, such as touchless and water-saving faucets, to enhance their living spaces. Furthermore, the broad range of needs in residential settings, from basic utility to high-end aesthetics, ensures a steady and substantial market for faucets which makes the residential segment the most dominant in the faucet market.

By Region

Region-wise, Asia-Pacific is anticipated to dominate the market with the largest share during the forecast period. Rise in rapid urbanization, significant population growth, and increasing residential and commercial construction activities. Countries like China and India are experiencing a surge in infrastructure development and housing projects which drives the demand for faucets. Moreover, rising disposable incomes in these emerging economies enable consumers to invest in home improvements and modern plumbing fixtures and further boost the market demand in the region. The region's expanding middle class and changing lifestyle preferences contribute to the growing demand for aesthetically pleasing and technologically advanced faucets. Furthermore, the strong manufacturing base in Asia-Pacific also supports the production of a wide range of faucet products and offers a competitive pricing and drives the market growth.

Competitive Analysis

Players operating in the global faucet market have adopted various developmental strategies to expand their faucet market share, increase profitability, and remain competitive in the market. Key players profiled in this report include LIXIL Group Corporation, Sloan Valve Company, MASCO corporation, Paini (UK) Ltd, Fortune Brands Home & Security, Inc., Roca Sanitario S.A, TOTO Ltd., Spectrum Brands, Danze, Inc., and Rohl LLC.

Several upcoming brands are vying for market dominance in the expanding faucet industry. Smaller, niche firms are more well-known for catering to consumer demands and tastes. Private label brands created by merchants and e-commerce platforms are another aspect of the competitive market. While they provide more affordable options, they have different recognition or range of products than well-known companies. An important competition component is innovation in faucet products, sourcing, and sustainability policies. Brands that are able to change the tastes of their target market and align with their ethical & environmental values have an advantage over rivals.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the faucet market analysis from 2023 to 2035 to identify the prevailing faucet market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the faucet market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global faucet market trends, key players, market segments, application areas, and market growth strategies.

Faucet Market Report Highlights

| Aspects | Details |

| Market Size By 2035 | USD 118.4 billion |

| Growth Rate | CAGR of 7.6% |

| Forecast period | 2023 - 2035 |

| Report Pages | 294 |

| By End User |

|

| By Product Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | MASCO corporation, LIXIL Group Corporation, Sloan Valve Company, Roca Sanitario S.A, Danze, Inc., Fortune Brands Home & Security, Inc., Spectrum Brands, TOTO Ltd, Rohl LLC, Paini (UK) Ltd |

Analyst Review

According to CXOs of leading companies, the faucet market is an industry with huge scope for growth in near future. Increase in urbanization paired with rise in disposable income has increased the spending power of consumer to spend on luxury items, in turn positively affecting the global faucet market. Rise in the hospitality industry in developing economies including the U.S., France, Japan, Germany, and others, is expected to have a positive impact on the market growth.

Moreover, according to the U.S. Department of Commerce, and International Trade Administration, the foreign travel in the U.S. is expected to witness a compound annual growth rate of 3.01% from 2020 to 2024. The substantial growth in the travel and tourism industry will propel the growth of the hotel industry in the U.S., which in turn is expected to contribute toward the electronic faucet market growth. Over the past few years, adoption of internet of things (IoT) in the U.S. has fueled the smart home technologies. Major manufacturers are adopting various strategies including product innovation and expansion of distribution channels, to increase their market share and contribute to the growing demand for faucet market.

The global faucet market was valued at $48.9 billion in 2023 and is projected to reach $118.4 billion by 2035, registering a CAGR of 7.6%.

The forecast period in the faucet market report is 2024 to 2035.

The base year calculated in the faucet market report is 2023.

The top companies analyzed for global faucet market report are LIXIL Group Corporation, Sloan Valve Company, MASCO corporation, Paini (UK) Ltd, Fortune Brands Home & Security, Inc., Roca Sanitario S.A, TOTO Ltd., Spectrum Brands, Danze, Inc., and Rohl LLC.

The bathroom segment is the most influential segment in the faucet market report.

Asia-Pacific holds the maximum market share of the faucet market

The company profile has been selected on the basis of revenue, product offerings, and market penetration.

The market value of the faucet market in 2023 was $48.9 billion.

Loading Table Of Content...

Loading Research Methodology...