Feed Grade Valine Market Research, 2033

Market Introduction and Definition

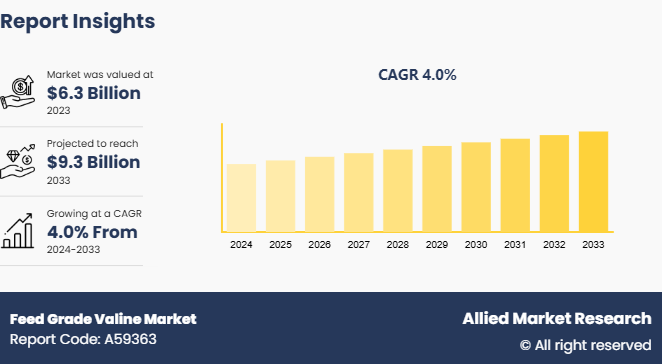

The global feed grade valine market size was valued at $6.3 billion in 2023, and is projected to reach $9.3 billion by 2033, growing at a CAGR of 4% from 2024 to 2033. Feed grade valine is an essential amino acid used in animal nutrition to improve protein synthesis, enhance growth, boost immune response, and optimize overall performance in livestock, poultry, and aquaculture feed formulations. In livestock, especially pigs, poultry, and aquaculture, valine is necessary for protein synthesis, energy production, and general growth. It is added to feed formulations to maintain appropriate growth performance and productivity as animals are unable to manufacture it on their own. The livestock industry's use of feed grade valine is fueled by surge in demand for premium animal protein and the move toward maximized feed efficiency. In addition, valine helps lower nitrogen excretion, which is consistent with the increased emphasis on ecologically friendly agricultural methods.

Key Takeaways

- The feed grade valine market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literature, industry releases, annual reports, and other such documents of major feed grade valine industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key market dynamics

The surge in need for high-performance animal feed to enhance livestock production and health drives the growth of the market for feed-grade valine, which is expanding significantly. Since it aids in tissue repair, protein synthesis, and growth stimulation, valine, a crucial branched-chain amino acid, is widely utilized in animal nutrition, especially in the diets of pigs and poultry. Market expansion has been further fueled by the rise in demand for effective feed solutions brought on by the world's growing population and rising meat consumption.

The availability of feed-grade valine for livestock farmers has increased due to technological developments in fermentation and amino acid synthesis processes, which have improved production efficiency and decreased costs. Moreover, the implementation of precision feeding techniques, where balanced amino acid supplementation, including valine, is essential for lowering nitrogen emissions, has been prompted by the increased awareness of the environmental effects of cattle farming.

However, the feed grade valine market is confronted with obstacles such as volatile raw material prices and a restricted supply of specific feed-grade ingredients, which impact production costs and supply reliability. Furthermore, manufacturers face compliance issues due to regional variations in regulatory frameworks and quality standards for animal feed additives.

Key market participants concentrate on capacity expansions, product innovation, and strategic partnerships to improve their competitive standing. For example, the development of customized feed solutions is being improved by collaborations with feed producers and R&D expenditures. With its vast livestock population and rising demand for meat and dairy products, Asia-Pacific has become a valuable market, while North America and Europe continue to grow steadily due to sophisticated animal husbandry techniques. The feed grade valine industry is therefore expected to rise steadily due to the growing demand for high-quality animal protein, technical improvements, and the move toward sustainable livestock farming practices.

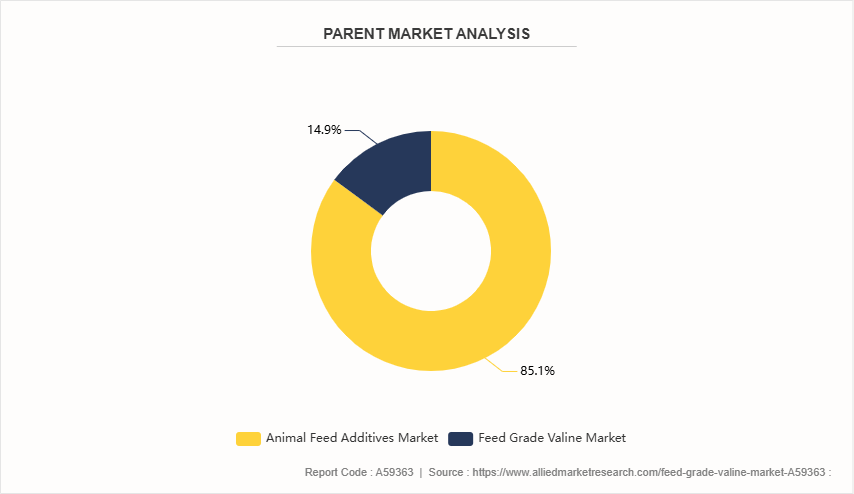

Parent Market Overview of the Global Feed Grade Valine Market

The global feed grade valine market is a part of the broader animal feed additives industry, which is concerned with improving the health, productivity, and nutrition of livestock. The parent market includes a broad range of feed additives, such as vitamins, minerals, probiotics, enzymes, and amino acids to serve a variety of livestock, including pigs, poultry, cattle, and aquaculture. The parent market has grown significantly due to the increased demand for premium animal protein on a global scale. The use of functional additives such as valine has been further stimulated by strict feed safety requirements and growing awareness of balanced nutrition. Valine is an essential branched-chain amino acid that promotes immune system function, muscular growth, and general animal performance, making it a crucial ingredient in the market for animal feed additives.

Market Segmentation

The feed grade valine market is segmented into type, application, and region. On the basis of type, the market is divided into pigs, poultry, and others. On the basis of application, the market is segregated into L type, D type, and DL type. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The surge in demand for premium animal nutrition drives several growth trends in the feed grade valine market across different geographies. Large-scale swine and poultry farming, as well as the rise in use of sophisticated animal husbandry techniques, are the main drivers of the market's consistent expansion in North America. Leading the region in awareness of balanced feed options to maximize cattle productivity is the U.S.

The feed-grade valine market in Europe is dominated by nations such as Germany, France, and the Netherlands due to the strict laws governing the sustainability and quality of livestock feed in the region. Further driving feed grade valine market demand is the growing trend toward precision feeding to improve animal efficiency. Valine and other amino acid-based alternatives are being promoted by the European Union's efforts to decrease the usage of antibiotics in feed supplements.

The Asia-Pacific market is growing at the highest rate, especially in nations such as China, India, and Japan. The market is driven by the growing swine and poultry industries in China, which is the world's largest producer and consumer of livestock products. Valine's use in animal feed formulations is also boosted by India's rising demand for diets high in protein and farmers' increased understanding of livestock health.

Brazil and Argentina are major market contributors in Latin America, mainly because of their flourishing swine and poultry production sectors. The great-quality feed additives such as valine are in great demand, which is further supported by the region's export-focused meat sector.

South Africa and the GCC nations are major contributors to the market's slow growth in the Middle East and Africa. The growing emphasis on raising cattle output and adjusting to contemporary farming methods is the main factor driving demand. Therefore, regional livestock trends, regulatory frameworks, and growing recognition of the significance of amino acids in animal nutrition all influence the global feed-grade valine market.

Industry Trends:

- Archer Daniels Midland Company (ADM) increased its feed-grade valine production capacity in July 2024 to satisfy the rising demand in the U.S. livestock industry.

- A new range of feed-grade valine products designed specifically for the Chinese aquaculture sector was introduced by Meihua Group in June 2024, improving fish health and feed efficiency.

- The consumption of feed-grade valine has increased significantly in the Asia-Pacific region, especially China, in May 2024 as a result of increased production of meat and dairy products.

- Evonik Industries purchased a feed-grade valine factory in the U.S. in April 2024 to improve its market standing and diversify its product line in North America.

- The Chinese company Ningxia Eppen Biotech Co., Ltd. increased its capacity to produce feed-grade valine in March 2024 to meet the growing demand at home.

- Increased demand and supply chain restrictions caused feed-grade valine prices in Asia-Pacific to rise significantly in February 2024.

Competitive Landscape

The major players operating in the feed grade valine market forecast include CJ CheilJedang (South Korea) , Evonik (Germany) , Ajinomoto (Japan) , Daesang (South Korea) , ADM (U.S.) , NB Group (China) , Meihua Group (China) , Ningxia Eppen (China) , Star Lake Bioscience (China) , and Polifar Group (China) .

Recent Key Strategies and Developments

- In January 2024, ADM and Evonik established a strategic alliance to utilize one another's production and distribution capabilities to jointly develop and commercialize feed-grade valine products in the U.S.

- In December 2023, local farmers began using feed-grade valine more frequently after China introduced new regulations encouraging its usage to enhance the quality of livestock feed.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the feed grade valine market size, segments, current trends, estimations, and dynamics of the feed grade valine market analysis from 2024 to 2033 to identify the prevailing feed grade valine market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the feed grade valine market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global feed grade valine market share.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global feed grade valine market trends, key players, feed grade valine market share, segments, application areas, and feed grade valine market growth strategies.

Feed Grade Valine Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 9.3 Billion |

| Growth Rate | CAGR of 4% |

| Forecast period | 2024 - 2033 |

| Report Pages | 250 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Ningxia Eppen (China), Star Lake Bioscience (China), Ajinomoto (Japan), CJ CheilJedang (South Korea), Polifar Group (China), NB Group (China), ADM (U.S.), Meihua Group (China), Daesang (South Korea), Evonik (Germany) |

The global Feed Grade Valine market is expected to see trends such as increasing demand for animal nutrition, sustainable production methods, and growth in livestock farming, particularly in Asia and North America.

The leading application of the Feed Grade Valine Market is in animal nutrition, primarily for poultry, swine, and livestock feed, enhancing protein synthesis, growth, and overall feed efficiency for better productivity.

The largest regional market for Feed Grade Valine is Asia-Pacific, driven by the high demand for animal feed in countries like China and India, coupled with rapid livestock and aquaculture industries growth.

The global feed grade valine market was valued at $6.3 billion in 2023, and is projected to reach $9.3 billion by 2033, growing at a CAGR of 4% from 2024 to 2033.

The major players operating in the feed grade valine market include CJ CheilJedang (South Korea), Evonik (Germany), Ajinomoto (Japan), Daesang (South Korea), ADM (U.S.), NB Group (China), Meihua Group (China), Ningxia Eppen (China), Star Lake Bioscience (China), and Polifar Group (China).

Loading Table Of Content...