Fiber Laser Market Size & Growth:

The global fiber laser market was valued at $3.3 billion in 2022, and is projected to reach $9.2 billion by 2032, growing at a CAGR of 11% from 2023 to 2032.

Introduction

A fiber laser is a solid-state laser that generates a high-intensity laser beam through the process of stimulated emission. The laser utilizes an optical fiber as the gain medium or the source of laser light amplification. The core of a fiber laser consists of a specially designed optical fiber, often doped with rare-earth elements such as erbium, ytterbium, or neodymium. These dopants provide the necessary energy levels for the laser to operate. The fiber is surrounded by a cladding layer that helps confine and guide the light within the core.

Fiber lasers can cut through a wide range of materials, including stainless steel, aluminum, copper, and titanium. Their high precision and clean edge-cutting reduce the need for post-processing. Fiber lasers are ideal for engraving barcodes, serial numbers, and logos on metals and plastics. Unlike ink-based methods, laser marking is permanent and resistant to wear. Fiber lasers are used for cleaning rust, paint, or oxides from surfaces without using chemicals or abrasive materials, making them environmentally friendly and cost-effective.

Key Takeaways:

- The report outlines the current fiber laser market trends and future scenario of the market from 2022 to 2032 to understand the prevailing opportunities and potential investment pockets.

- The global fiber laser market has been analyzed in terms of value ($ Billion). The analysis in the report is provided on the basis of type, application, 4 major regions, and more than 15 countries.

- The fiber laser market is consolidated in nature with few players such as AMONICS LTD, TRUMPF, COHERENT CORP., QUANTEL GROUP, IPG PHOTONICS CORPORATION, NKT PHOTONICS A/S, TOPTICA PHOTONICS AG, CY LASER SRL, APOLLO INSTRUMENTS, INC, and JENOPTIK GROUP, which hold significant share of the market.

- The report proivdes strategy planning and industry dynamics to enhance decision making for existing market players and new entrants entering the fiber laser industry.

- Countries such as China, U.S., India, Germany, and Brazil hold a significant share in the global fiber laser market.

Market Dynamics

Rising automation in industrial processes is expected to drive the growth of the fiber laser market. One of the primary areas where fiber lasers are gaining traction is automated cutting, welding, and marking systems. These processes, which once relied heavily on manual labor or traditional laser systems, are now being revolutionized by fiber laser technology. Their ability to deliver consistent, high-quality results at faster speeds makes them ideal for integration into robotic and CNC systems. This not only enhances production throughput but also reduces error rates and material waste. In February 2022, Messer Cutting Systems acquired the US-American manufacturer of products in the oxyfuel sector, Flame Technologies, Inc. (Flame Tech) through an affiliate company. With Flame Tech, Messer Cutting Systems strengthens its position as an international solution provider of Oxyfuel, Steel Mill, and pre-heating solutions.

However, thermal management challenges in high-power applications are expected to restrain the growth of the fiber laser market. As fiber lasers are increasingly deployed in high-power industrial applications such as heavy-duty cutting, welding, and additive manufacturing, effective thermal management has emerged as a critical challenge. While fiber lasers are inherently more efficient than other laser types, high-power output levels generate significant heat that must be carefully controlled to maintain system performance and reliability. According to CEIC Data, rising disposable incomes in countries like India has fueled demand in key sectors using fiber lasers, such as automotive and electronics, further driving market growth. However, these gains are partly offset by the technical and financial challenges associated with implementing high-power fiber lasers, including the need for advanced thermal management systems.

Moreover, miniaturization and portable laser systems is expected to provide lucrative opportunities in the fiber laser market. The trend toward miniaturization and the development of portable fiber laser systems is opening up new avenues for the use of laser technology beyond traditional manufacturing environments. Advances in fiber optics, laser source integration, and cooling technologies have enabled the design of compact systems that retain the high performance and reliability of larger industrial units. These portable solutions are particularly valuable in scenarios where mobility, space constraints, or on-site access are critical factors. In August 2023, Northrop Grumman delivered a 10-kilowatt laser system named Phantom to a U.S. government agency. Weighing under 200 pounds and approximately the size of a mini-fridge, it is designed for rapid deployment in tactical situations. The system is ruggedized for field use and can be carried and installed by just two people.

Segments Overview:

The global fiber laser market is segmented into type, application, and region. On the basis of type, the market is categorized into infrared fiber laser, ultraviolet fiber laser, ultrafast fiber laser, and visible fiber laser. By application, it is segregated high-power, marking, fine processing, and micro processing. Region wise, it is studied across North America, Europe, Asia-Pacific, and LAMEA.

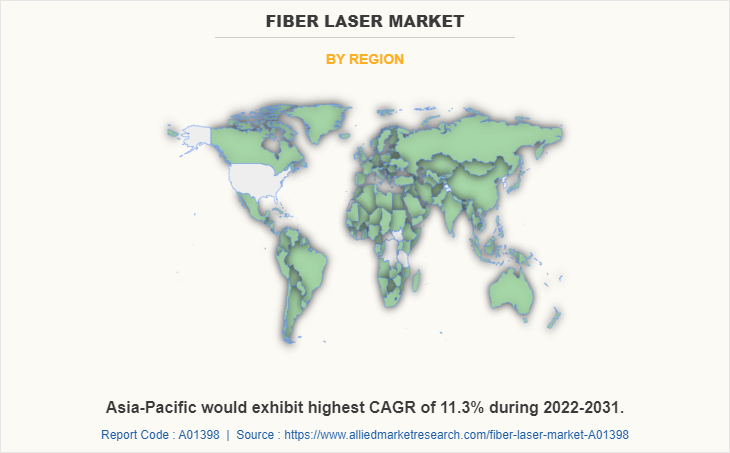

The Asia-Pacific fiber laser market size is projected to grow at the highest CAGR of 11.3% during the forecast period and account for 44% of fiber laser market share in 2022. China leads the Asia-Pacific fiber laser market both in terms of manufacturing and consumption. Its strong presence in industrial manufacturing, particularly in automotive, shipbuilding, and heavy machinery, has created an immense demand for laser-based cutting, welding, and marking solutions. The government’s support for advanced manufacturing through initiatives like "Made in China 2025" further accelerates adoption. China is also home to several key domestic players and facilities for global laser manufacturers, solidifying its central role in regional and global supply chains.

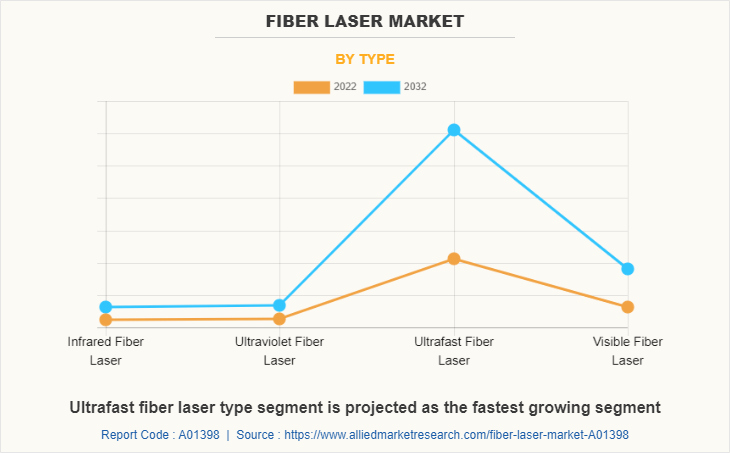

By type, the ultrafast fiber laser segment dominated the global market in 2022, and is anticipated to grow at a CAGR of 11.2% during forecast period. Ultrafast fiber lasers play a crucial role in semiconductor manufacturing processes. It is used in applications such as micromachining, wafer inspection, and defect analysis. Ultrafast lasers can accurately remove thin layers, create microstructures, and detect minute defects on semiconductor surfaces. Overall ultrafast fiber lasers are versatile tools with applications in scientific research, materials processing, biomedical imaging, optical communication, semiconductor manufacturing, metrology, and spectroscopy. Their unique capabilities in delivering ultrashort pulses of light make them invaluable for studying ultrafast phenomena and performing precision operations in various fields. In January 2024, IPG Photonics unveiled advanced fiber laser solutions at Photonics West, showcasing a range of laser sources and integrated systems. Earlier, in May 2023, they introduced a new series of high-power ultrafast fiber lasers with improved beam quality and power output, catering to advanced manufacturing needs.

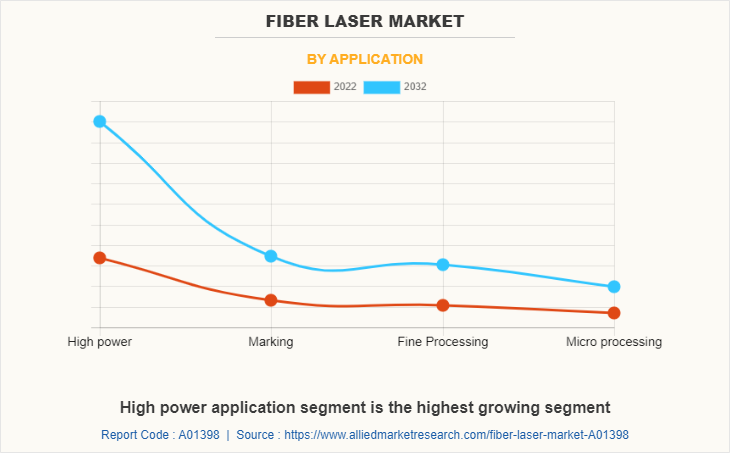

On the basis of application, the high power segment was the largest revenue generator, and is anticipated to grow at a CAGR of 11.5% during the forecast period. High-power fiber lasers excel in metal processing. Their ability to produce highly focused, intense beams makes them especially suited for cutting, welding, and drilling metals like steel, aluminum, and copper. In particular, the high beam quality enables narrow kerfs and deep penetration in welding, allowing for faster processing speeds and reduced heat-affected zones. Shenzhen Gongda Laser Co., Ltd. introduced a 1000W single-mode continuous green fiber laser, the highest power of its kind globally as of 2023. The company's portfolio also includes sub-nanosecond green lasers (50–500W) and ultraviolet nanosecond pulse fiber lasers (10–100W).

Competitive Analysis:

The global fiber laser market report profiles leading players that include Amonics Ltd, TRUMPF GmbH, Coherent, Inc., Quantel Group, IPG Photonics Corporation, NKT Photonics A/S, TOPTICA Photonics AG, Jenoptik Group, CY Laser SRL, and Apollo Instruments, Inc. The global fiber laser market report provides in-depth competitive analysis as well as profiles of these major players.

Key Recent Development:

In May 2024, IPG Photonics Corporation (US) launched the LightWELD 2000 XR, a 2 kW handheld laser welding and cleaning system that increases processing speeds and handles thicker materials. It enhances fabrication productivity and efficiency with improved presets and compatibility with the LightWELD Cobot System. In June 2023, Coherent Corp. (US) launched the HighLight FL-ARM fiber lasers, which features adjustable ring mode beams for improved welding process stability over large areas, which is ideal for electric vehicle battery manufacturing.

In January 2023, IPG Photonics launched three deep ultraviolet (Deep UV) lasers with its proprietary non-linear crystals providing more robust and flexible solutions over lasers using conventional frequency conversion materials for micromachining application. This strategic product launch is projected to increase IPG Photonics’ sales for fiber laser.

In May 2022, Yamazaki Mazak, leading machine tool builder, has launched “FG-400 NEO”, a 3D fiber laser cutting machine for steel products worldwide. The FG-400 NEO is equipped with an energy-efficient fiber laser oscillator that offers high productivity and energy conversion efficiency. This new product is also capable of cutting highly reflective materials such as aluminum, brass, and copper. This strategic product launch has enhanced the Mazak’s potential sales for fiber laser in Japan.

Bargaining Power of Buyers of Fiber Laser:

Governmental data from bodies such as the U.S. Department of Commerce and trade associations like the Laser Institute of America indicate that the fiber laser industry serves a wide range of sectors, including automotive, aerospace, electronics, and medical devices. These industries tend to be large, well-informed, and capable of exerting pressure on manufacturers for lower prices or customized solutions.

A key factor enhancing buyer power is the increasing commoditization of low to mid-power fiber lasers. According to data from the International Trade Centre (ITC) and manufacturers like IPG Photonics and Coherent, the proliferation of suppliers from low-cost manufacturing hubs like China has given buyers more options, enhancing their negotiating leverage. Distributors and system integrators in particular benefit from the price competition among suppliers, often sourcing components from multiple vendors to secure favorable terms.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the fiber laser market analysis from 2022 to 2032 to identify the prevailing fiber laser market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the fiber laser market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global fiber laser market trends, key players, market segments, application areas, and market growth strategies.

Fiber Laser Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 9.2 billion |

| Growth Rate | CAGR of 11% |

| Forecast period | 2022 - 2032 |

| Report Pages | 390 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | TRUMPF, IPG Photonics Corporation, Jenoptik Group, Apollo Instruments, Inc, Coherent Corp., Amonics Ltd, Toptica Photonics AG, NKT Photonics A/S, CY Laser SRL, Quantel Group |

Analyst Review

According to the insights of the CXOs of leading companies, fiber lasers are gaining high traction in biomedical, electronics, defense & aerospace, manufacturing, and industrial sectors. Fiber laser possesses various properties such as high efficiency, high-quality laser beam, fast processing speed, reliability, and longevity due to which it has been widely used in various end-use industries.

Fiber lasers are valuable tools in research and development laboratories. They are used for scientific investigations, material characterization, spectroscopy, and other research applications. The versatility, high beam quality, and reliability of fiber lasers make them suitable for various scientific and experimental purposes. Furthermore, fiber lasers can be used for microprocessing applications that require extremely high precision and small feature sizes. These applications include micro-drilling, micro-cutting, micro-machining, and micro structuring of materials. Fiber lasers enable the production of intricate patterns and microscale components used in electronics, medical devices, microfluidics, and other precision industries.

High power is the leading application of fiber laser market.

The global fiber laser market is segmented into type, application, and region. On the basis of type, the market is categorized into infrared fiber laser, ultraviolet fiber laser, ultrafast fiber laser, and visible fiber laser. By application, it is segregated high-power, marking, fine processing, and micro processing. Region wise, it is studied across North America, Europe, Asia-Pacific, and LAMEA.

Asia-Pacific is the largest regional market for fiber laser market.

Amonics Ltd, TRUMPF GmbH, Coherent, Inc., Quantel Group, IPG Photonics Corporation, NKT Photonics A/S, TOPTICA Photonics AG, Jenoptik Group, CY Laser SRL, and Apollo Instruments, Inc.

The demand for compact and portable fiber lasers is expected to grow. Industries such as automotive, aerospace, and defense often require mobility and flexibility in their manufacturing processes. Compact fiber lasers offer the advantage of portability and can be easily integrated into handheld or robotic systems.

The Fiber Laser Market was valued for $3.3 billion in 2022 and is estimated to reach $9.2 billion by 2032, exhibiting a CAGR of 11% from 2023 to 2032.

A fiber laser is a solid-state laser that generates a high-intensity laser beam through the process of stimulated emission. The laser utilizes an optical fiber as the gain medium or the source of laser light amplification. The core of a fiber laser consists of a specially designed optical fiber, often doped with rare-earth elements such as erbium, ytterbium, or neodymium. These dopants provide the necessary energy levels for the laser to operate. The fiber is surrounded by a cladding layer that helps confine and guide the light within the core.

Loading Table Of Content...

Loading Research Methodology...