Filtration And Separation Market Research, 2031

The global filtration and separation market size was valued at $98.13 billion in 2021, and is projected to reach $152.05 billion by 2031, growing at a CAGR of 4.4% from 2022 to 2031. The filtration & separation refers to the type of system that helps in elevation and removal of the waterborne and airborne pollutants. The operations and activities in different industries tend to produce allergens, dust, chemicals and different minute particles that pollute the water and the air. Due to this, the filtration & separation system is required in order to filter out the unrequired effluents with the help of the filter media. In addition, the industrial gases are required to be filtered from the impurities in order to improve the quality of manufactured commodities. Moreover, air filters are used for the biotechnology manufacturing and pharmaceutical industries. Therefore, the air filters are highly important for the biotechnology sectors, pharmaceutical industry and hospitals. Thus, the growth in the healthcare spending results in greater demand for air filters.

The quality of the water and air around the globe has reduced because of urbanization and industrialization. Thus, water and air pollution have become a health problem globally. According to the World Health Organization (WHO) report, more than 4 million people die every year owing to contaminated air. Hence, this is becoming a major concern for different countries; wherein countries such as China and India are major contributors to air pollution. Considering this, these countries are working on solutions in order to curb air pollution. For instance, in September 2021, the Indian Central Pollution Control Board announced the launch of a program named National Air Quality Monitoring Program (NAMP) focusing on identifying, preventing, controlling and reducing the air pollution that deals with monitoring of the air pollutants such as fine particulate matter, respirable suspended particulate matter, oxides of nitrogen and sulfur dioxide in different cities and as per their level working on solutions to control these pollutants. Therefore, high focus on curbing water and air pollution is expected to boost the demand for filters, which in turn drives the filtration and separation market.

In addition, various stringent government regulations considering the clean water in the developed countries is increasing the concern toward treatment of untreated water. Various acts such as Federal Water Pollution Control Act (FWPCA) and Clean Water Act (CWA) focuses on different regulations that deal with bringing laws in order to let different houses use septic systems and regulating industries with municipalities in order to limit disposing the liquid waste discharge into the surface water. Hence, such regulations enable use of filtration systems in order to treat the liquid waste discharge, which is driving the filtration and separation industry.

The higher initial and operating cost is limiting the use of air filters. The higher cost is because of the greater benefits and advantages these filters provide using different components. For instance, the heating, ventilation and air conditioning (HVAC) filters ensure filtering of the heavy particles, due to which it provides airflow resistance. Due to this, in order to solve this problem, it requires powerful fan consuming high energy and uses system for controlling the production of CO2 that leads to higher purchasing and running cost. In addition, the amount of coal power plants constructed per year decreased by more than 65% since 2015 till 2019 because of restrictions from different developing countries in order to limit the number of pollutants generated through the coal power plants and the filter membranes that are used in the coal power plants in order to improve the filtration process. Hence, limiting the use of coal power plants and greater cost is restricting the growth of the filtration and separation market.

Furthermore, during the outbreak of the COVID-19 pandemic, construction, manufacturing, hotel, and tourism industries were majorly affected. Manufacturing activities were halted or restricted. Construction and transportation activities, along with their supply chains, were hampered on a global level. This led to decline in manufacturing of filtration & separation as well as their demand in the market, thereby restraining the filtration and separation market growth. Conversely, industries are gradually resuming their regular manufacturing and services. This is expected to lead to re-initiation of filtration & separation companies at their full-scale capacities, which is expected to help the filtration and separation market share to recover by end of 2021.

On the contrary, focus on nanotechnology for the air filtration, which is a process in which matter gets manipulated near the atomic levels is on the rise. This technology is used for various air filtration applications in the form of performance layer for providing high energy saving benefits, high efficiency, lesser compressed air consumption, longer life, higher flexibility and providing complete purification of the water and owing to greater use of this in different industries is expected to offer new opportunities for the filtration and separation market.

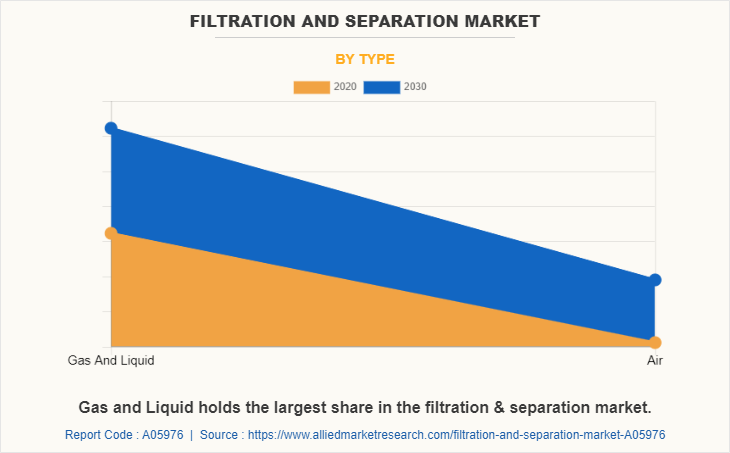

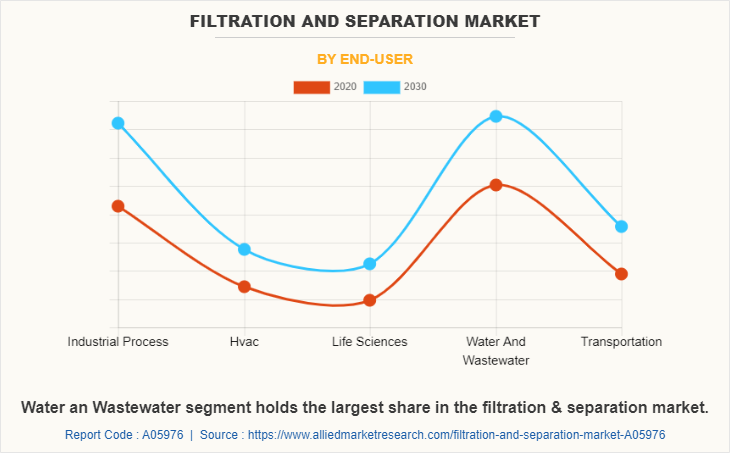

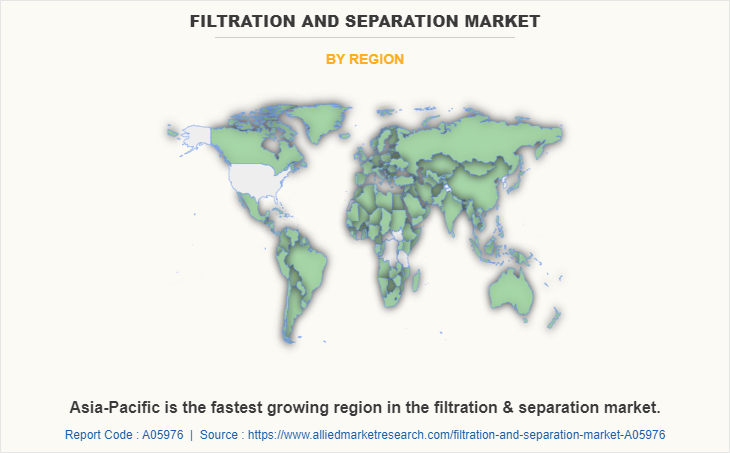

The filtration and separation market is segmented into type, end user, and region. Based on type, the market is divided into gas & liquid, and air. Based on end user, the market is divided industrial process, HVAC, life sciences, water & wastewater, and transportation. Region wise, the global market analysis is conducted across North America (the U.S., Canada, and Mexico), Europe (the UK, France, Germany, Italy, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

COMPETITION ANALYSIS

The major players profiled in the filtration and separation market analysis include Ahlstrom-Munksjö, ALFA LAVAL, Danaher (Pall Corporation), Donaldson Company, Inc., Eaton, Freudenberg Filtration Technologies SE & Co. KG, Lydall, Inc., MANN+HUMMEL, PARKER HANNIFIN CORP and Porvair Plc. Major companies in the market have adopted product launch, business expansion, agreement and acquisition as their key developmental strategies to offer better products and services to customers in the market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the filtration and separation market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the filtration and separation market forecast.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global filtration and separation market trends, key players, market segments, application areas, and market growth strategies.

Filtration and Separation Market Report Highlights

| Aspects | Details |

| By Type |

|

| By End-User |

|

| By Region |

|

| Key Market Players | Alfa Laval, Porvair Plc, MANN+HUMMEL, Ahlstrom-Munksjö, PARKER HANNIFIN CORP, Donaldson Company, Inc., Freudenberg Filtration Technologies SE & Co. KG, Danaher (Pall Corporation), Eaton Corporation, Lydall, Inc. |

Analyst Review

The filtration and separation market holds high growth potential in the life sciences industry owing to the growing pharmaceutical industry around the globe. Growth of the filtration and separation market is majorly driven by rise in awareness for controlling the pollution with different laws, regulation and programs conducted in order to restrict the generation of pollutants. The market has witnessed significant growth over the past decade, owing to increase in demand for filtration & separation due to rise in adoption of air filter in industries such as manufacture of LCD panels, pharmacy, nuclear power plants, and food processing facilities. Moreover, these filters are used for high temperature filtration in major industries such as cement, fertilizer, and carbon black, owing to its ability to achieve high efficiencies, nearly about 99.96% at elevated temperatures. Therefore, the expansion of cement and fertilizer factories around the globe offers lucrative growth opportunities for the manufacturer of filters for filtration & separation.

However, the high initial and operating cost with restriction over the manufacturing coal power plants acts as a major restraint for the filtration and separation market. On the contrary, growing adoption of nanotechnology is expected to create opportunities for growth of the filtration and separation market during the forecast period.

Major companies in the market have adopted strategies such as product launch, business expansion, agreement and acquisition to offer better services to customers in the filtration and separation market.

The global filtration and separation market was valued at $98,128.1 million in 2021, and is projected to reach $152,051.8 million by 2031, registering a CAGR of 4.4% from 2022 to 2031.

The forecast period considered for the global filtration and separation market is 2022 to 2031, wherein, 2021 is the base year, 2022 is the estimated year, and 2031 is the forecast year.

To get latest version of global filtration and separation market report can be obtained on demand from the website.

The base year considered in the global filtration and separation market report is 2021.

The top companies holding the market share in the global filtration and separation market report include Ahlstrom-Munksjö, ALFA LAVAL, Danaher (Pall Corporation), Donaldson Company, Inc., Eaton, Freudenberg Filtration Technologies SE & Co. KG, Lydall, Inc., MANN+HUMMEL, PARKER HANNIFIN CORP and Porvair Plc.

The top ten market players are selected based on two key attributes - competitive strength and market positioning.

The report contains an exclusive company profile section, where leading 10 companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

By type, the gas and liquid segment is the highest share holder of filtration and separation market.

Loading Table Of Content...