Financial Advisory Services Market Research, 2030

The global financial advisory services market was valued at $79.4 billion in 2020, and is projected to reach $135.6 billion by 2030, growing at a CAGR of 5.8% from 2021 to 2030.

Financial advisory services are consulting services that build on a strong financial-analytical fundamental. These service offerings span a wide variety of topics such as transaction services, risk management, tax advisory, real estate advisory, compliance and litigation services to name a few. Moreover, financial advisors offer clients global advisory services that entirely focus on the strategic direction of business success and advancement.

Growing demand for financial advisory services among SMEs and constant rise in global high-net-worth individual boost the financial advisory services market growth. In addition, factors such as increasing demand for alternative investments positively impacts the growth of the market. However, lack of awareness about financial risk advisory services and higher dependency on traditional methods are expected to hamper the market growth. On the contrary, rising innovations in the Fintech industry and untapped potential of emerging economies are expected to offer remunerative opportunities for expansion of the financial advisory services market forecast during the forecast period.

Segment review

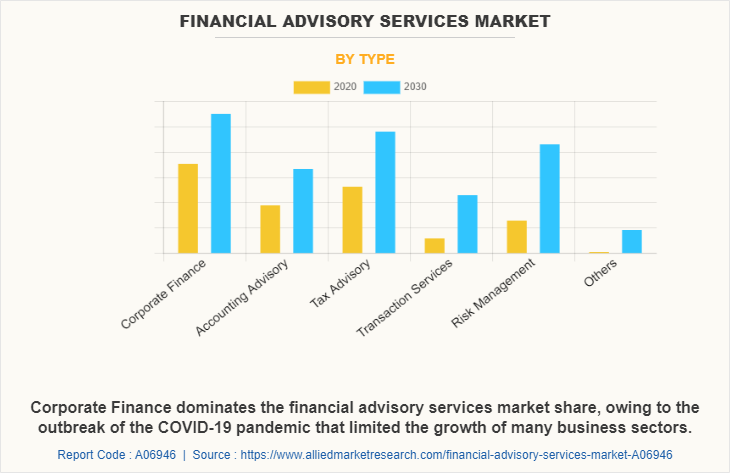

The global financial advisory services market is segmented on the basis of type, organization size, industry vertical, and region. In terms of type, the market is fragmented into corporate finance, accounting, advisory, tax advisory, transaction services, risk management, and others. Depending on organization size, it is bifurcated into large enterprises and small & medium-sized enterprises. In terms of industry vertical, it is segmented into BFSI, IT and telecom, manufacturing, retail and e-commerce, public sector, healthcare, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific and LAMEA.

Some of the key players operating in the global financial advisory services market include Accenture Inc., Bank of America Corporation, Citigroup Inc., CREDIT SUISSE GROUP AG, Goldman Sachs, JPMorgan Chase & Co., Morgan Stanley, Northern Trust Corporation, PwC, and Wells Fargo. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry

In terms of type, the corporate finance segment holds the largest global financial advisory services market share, owing to the outbreak of the COVID-19 pandemic that limited the growth of many business sectors. This in turn led to many firms employing corporate financing consultants to optimize their business operations and strategies during the period. However, the risk management segment is expected to grow at the highest rate during the forecast period, as organizations need to develop and enhance their risk management process and achieve balance in minimizing risk exposure for optimizing the profitability for the organization.

Region wise, the global financial advisory services market size was dominated by North America in 2020, and is expected to retain its position during the forecast period, due to rapidly growing due to evolving customer segments, rapid technological advances, and shifting competitive dynamics. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to continued growth in local wealth management products, distribution regimes, regulation, use of technology, and people skills.

The report focuses on growth prospects, restraints, and analysis of the global financial advisory services market trends. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the global financial advisory services market.

COVID-19 impact analysis

The COVID-19 pandemic has a detrimental influence on the financial advising services industry, due to the economic recession, instability in global financial sectors, and a highly unpredictable market. Investors and financial advice services organizations were both affected by the epidemic, and investors saw immediate effects on their current investments. As a result, amid the global health crisis, demand for financial advice services has plummeted. With the ongoing epidemic, financial advisory services providers have taken numerous steps to position themselves for the post-COVID future as they begin their recovery. As a result, financial advisors are focused on providing personalized offers and keeping timely communication with investors during times of increased volatility.

Top impacting factors

Growing demand for financial advisory services among SMEs

Financial advisory services are the best way to provide value for SMEs as it can maximize their pricing by the value they deliver to their small business clients. Moreover, according to a recent Accounting Today survey, 78% of small businesses want an accountant who’s a trusted advisor. In fact, this need ranked 10% higher than feeling that services were priced affordably. Furthermore, during the COVID-19 pandemic SMEs due to the lack of financial management, therefore some major banks collaborated to provide proper financial advisory services for SMEs. For instance, Gulf Bank collaborate with Balance Business Advisory, a Kuwaiti SME, to provide financial advisory services to entrepreneurs and SMEs as part of their continued commitment to their clients in this segment. This collaboration is rooted in the Bank’s strategy toward providing financial and advisory services to the SME’s sector. Thus, growing number of such advantages is driving the growth of the financial advisory services market size.

Constant rise in global high-net-worth individual (HNWI)

The number of HNWIs are increasing across the globe owing to better financial management and correct investments. Moreover, given their substantial assets, high-net-worth households require additional services from financial advisors and wealth managers. Financial services for HNWIs include investment management and tax advice as well as help with trusts and estates and access to hedge funds and private equity firms. Furthermore, around 13% of financial advisor clients fall under the category of high net worth. In addition, HNWIs are in high demand for financial advisory services as more money they have, more work is required to maintain and preserve those assets. These individuals generally demand personalized services in investment management, estate planning, tax planning, and so on. Therefore, driving the growth of the financial advisory services industry.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the financial advisory services market analysis from 2020 to 2030 to identify the prevailing financial advisory services market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the financial advisory services market outlook segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global financial advisory services market opportunity, key players, market segments, application areas, and market growth strategies.

Financial Advisory Services Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Organization Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | mckinsey & company, Pwc, JPMorgan Chase & Co. , KPMG, BCG Group, Deloitte, Bank of America Corporation, Wells Fargo & Co , Morgan Stanley , Goldman Sachs Group Inc. |

Analyst Review

According to insights of CXOs, the financial advisory services industry plays a major role in economic growth by providing financial protection to individuals, assets, and businesses against uncertain events. Hence, financial advisory services has become a massive contributor toward development of a country. Increase in economic strength of developing nations such as China and India is expected to provide lucrative opportunities for the market growth.

Key providers of the global financial advisory services market such as Sierra Wireless, ALLIANZ, and AXA account for a significant share in the market. With increasing requirement from financial advisory services, various companies are establishing partnerships to increase financial advisory services capabilities. For instance, in October 2021, Citi announced a strategic partnership with China Guangfa Bank (“CGB”) to offer cross-border wealth services to clients in the Greater Bay Area (“GBA”) under the Cross-boundary Wealth Management Connect Pilot Scheme (“WMC”). The partnership will combine Citi’s wealth management capabilities and advisory with CGB’s vast retail operations in the GBA, to provide unmatched cross-border wealth management experience and opportunities for retail investors in the GBA.

In addition, with increase in demand for financial advisory services, various companies are expanding their current services to meet the continuous rise in demand. For instance, in September 2021, Loop Capital Markets, a Black-led investment bank, brokerage and advisory firm, and Goldman Sachs announced a partnership to offer cash management solutions that will allow companies to advance racial equity by creating economic opportunity within diverse communities and providing funding for educational and career development for Black women in science, technology, engineering, mathematics (STEM) and related fields. Moreover, the partnership will ensure the products play a role in promoting racial equity in financial services and beyond as part of Goldman Sachs’ One Million Black Women initiative, a $10 billion investment strategy alongside $100 million in philanthropic support to help narrow opportunity gaps and positively impact the lives of at least one million Black women over the next decade.

Moreover, market players are expanding their business operations and customers by increasing their acquisition. For instance, in June 2021, J.P. Morgan has entered into an agreement to acquire OpenInvest, a leading financial technology company that helps financial professionals customize and report on values-based investments. The company is expected to retain its own brand and integrate into J.P. Morgan’s Private Bank and Wealth Management client offerings.

Increase in demand for financial advisory services among SMEs and constant rise in global high-net-worth individuals boost the growth of the financial advisory services market.

The global financial advisory services market size was dominated by North America in 2020, and is expected to retain its position during the forecast period, due to rapidly growing due to evolving customer segments, rapid technological advances, and shifting competitive dynamics.

The global financial advisory services market size was valued at $79.35 billion in 2020, and is projected to reach $135.56 billion by 2030, growing at a CAGR of 5.8% from 2021 to 2030.

The financial advisory services market will expand at a CAGR of 5.8% from 2020 - 2030

The global financial advisory services market is segmented on the basis of type, organization size, industry vertical, and Region.

Loading Table Of Content...