Financial Analytics Market Overview

The global financial analytics market size was valued at USD 7.6 billion in 2020, and is projected to reach USD 19.8 billion by 2030, growing at a CAGR of 10.3% from 2021 to 2030.

Increase in adoption of pervasive computing devices, rise in advanced storage capabilities, and growth in innovation of new analytic tools present new possibilities to market players, which, in turn, boost the global financial analytics market growth. In addition, increase in awareness among end users about the benefits of financial analytics solutions, especially for real-time data analysis and decision making positively impacts the growth of the market.

Key Market Insights

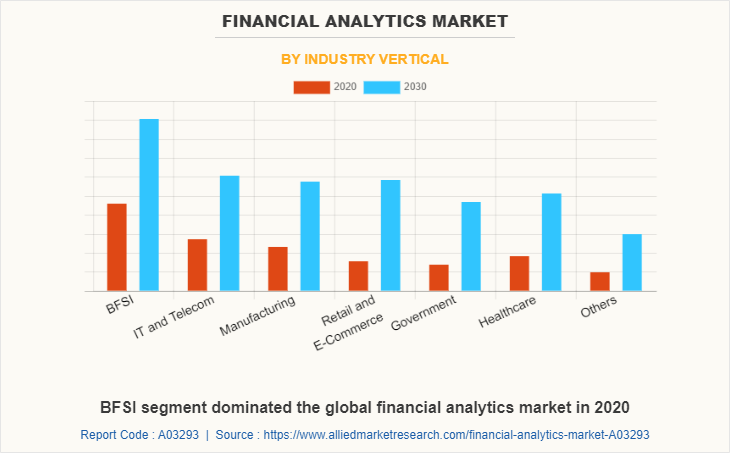

- By industry vertical, the retail and E-commerce segment is expected to grow at the highest rate during the financial analytics market forecast period.

- By region, Asia-Pacific is expected to witness significant growth in the coming years.

- By component, the solution segment accounted for the largest financial analytics market share in 2020.

Market Size & Forecast

- 2030 Projected Market Size: USD 19.8 Billion

- 2020 Market Size: USD 7.6 Billion

- Compound Annual Growth Rate (CAGR) (2021-2030): 10.3%

How to Describe Financial Analytics

Financial analytics is creation of ad hoc analysis to answer specific business questions and predict possible future financial scenarios. The goal of financial analytics is to shape the strategy for business through reliable and factual insight rather than intuition. It provides different perspectives on the financial data of a given business, giving insights that can facilitate strategic decisions and actions that improve the overall performance of the business.

However, constant increase in the number of cyber threats and data breaches indicate that critical business and customer information are potential targets of hackers and cyber-criminals, which hamper the financial analytics market growth. On the contrary, emerging markets, including Latin America, the Middle-East, and Africa, are expected to present significant growth opportunities for prominent players, owing to limited penetration of financial analytics solutions and infrastructure in the region during the forecast period.

Financial Analytics Market Segment Review

The financial analytics market is segmented on the basis of component, deployment mode, organization size, industry vertical, and region. Depending on the component, it is segmented into solution and service. The solution segment is further sub segmented into database management system (DBMS), data integration tools, query, reporting and analysis, analytics solutions, and others. According to deployment mode, it is segmented into on-premise and cloud. As per organization size, it is segmented into large enterprises and small-medium enterprises. By industry vertical, it is segmented into BFSI, IT and telecom, manufacturing, retail and E-commerce, government, healthcare, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Depending on industry vertical, the BFSI segment holds the largest market share of financial analytics market, owing to rapid adoption of financial analytics software by various fintech and banking institutions for providing personalized service and automated voice systems to the customer. However, the retail and E-commerce segment is expected to grow at the highest rate during the financial analytics market forecast period, owing to process and record financial & production data, manage plant-level strategies, and account for material, capacity, and labor constraints.

Region wise, the financial analytics market was dominated by North America in 2020, and is expected to retain its position during the forecast period, due to the early adoption of financial analytics and growing technological advancement in this region. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to rise in digitization and increase in data generated by internet of things (IoT) devices.

What are the Top Impacting Factors in Market

Improvement in Financial Performance

- Adoption of pervasive computing devices, advanced storage capabilities, and new analytic tools presents new possibilities to market players. Presently, end-user organizations can obtain real-time data from previously inaccessible areas at lower costs to improve their financial performance and efficiency. Moreover, financial analytics software reduces the chance of human error, which generally causes huge losses for the enterprises. Thus, this is a major driving factor for the financial analytics market growth.

Lack of Skilled Workforce

- Presently, the end-user industries face lack of skilled professionals, such as data scientists and analysts to operate and analyze the gathered data. This increases the need for end-user organizations to be more innovative in their approach toward talent acquisition, development, and deployment. Thus, lack of skilled workers to operate financial analytics software hampers the financial analytics market growth.

Which are the Leading Companies in Financial Analytics

The following are the leading companies in the market.

Deloitte LLP

Hitachi Vantara Corporation

International Business Machine Corporation

Microsoft Corporation

Oracle

Rosslyn Data Technologies

SAP SE

Symphony Teleca Services, Inc.

Teradata Corporation

TIBCO Software, Inc.

Financial Analytics Market Regional Insights

The financial analytics market is growing rapidly across regions due to the increasing need for data-driven decision-making and financial forecasting.

North America dominates the financial analytics market, with the U.S. being the largest contributor. This growth is driven by the widespread adoption of advanced technologies such as artificial intelligence (AI), machine learning (ML), and big data in the financial sector. Financial institutions, including banks, insurance companies, and investment firms, are increasingly leveraging analytics to optimize operations, reduce risks, and enhance customer experiences. The region’s strong regulatory framework and focus on risk management are also fueling demand for financial analytics solutions.

Europe is another key market, with countries like the U.K., Germany, and France leading the charge. The increasing need for compliance with stringent financial regulations, such as GDPR and MiFID II, has pushed organizations to adopt financial analytics tools. In addition, European financial institutions are focusing on enhancing operational efficiency and reducing costs through predictive analytics, which helps forecast market trends and improve decision-making.

Asia-Pacific is the fastest-growing region in the financial analytics market. The rise of digital banking, mobile payments, and fintech innovations in countries like China, India, Japan, and Singapore is driving the demand for advanced analytics. Financial institutions in the region are embracing digital transformation and big data analytics to enhance their services, manage risks, and improve customer satisfaction. The region’s growing e-commerce sector and increasing investment in financial technologies further contribute to market growth.

Latin America and the Middle East and Africa are also emerging markets. In Latin America, financial institutions in Brazil and Mexico are adopting analytics to improve fraud detection and regulatory compliance. Meanwhile, the Middle East and Africa are witnessing increased investments in financial technologies, particularly in the UAE and South Africa, as financial institutions aim to leverage analytics for improved financial planning and decision-making.

Key Industry Developments

February 2023: IBM partnered with Banco Santander in Spain to implement AI-driven financial analytics solutions to enhance risk management and fraud detection. This partnership aimed to improve operational efficiency by leveraging advanced analytics to monitor financial transactions in real time.

May 2023: Oracle Financial Services launched a new cloud-based financial analytics platform targeting SMEs in Europe. The platform integrates AI and ML technologies to provide real-time insights, helping businesses manage financial risks and optimize performance.

August 2023: SAS Institute announced the expansion of its financial analytics capabilities in Asia-Pacific by opening new data centers in Singapore and Australia. This move aimed to support growing demand in the region for cloud-based financial analytics solutions with enhanced security and compliance.

What are the Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the financial analytics market forecast analysis from 2021 to 2030 to identify the prevailing financial analytics market analysis.

The financial analytics market research is offered along with information related to key drivers, restraints, and opportunities.

In-depth analysis of the financial analytics market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global financial analytics market share.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global financial analytics market trends, key players, market segments, application areas, and market growth strategies.

Financial Analytics Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Deployment Mode |

|

| By Organization Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | International Business Machine Corporation, Symphony Teleca Services, Inc., Teradata Corporation, Rosslyn Data Technologies, SAP SE, Deloitte LLP, Hitachi Vantara Corporation, Oracle Corporation, TIBCO Software Inc., Microsoft Corporation |

Analyst Review

Financial analytics help end users to focus on financial function across organizations and provide better visibility into factors that drive costs, revenues, and shareholder values. Further, it enables end user to perform planned as well as ad-hoc analysis of financial data to find out efficient solutions for business problems.

Increase in awareness among end users about the benefits of financial analytics solutions, especially for real-time data analysis and decision making, has increased the penetration of financial analytics software in the industry. Moreover, the trend is projected to continue throughout the forecast period, thereby driving the market growth. However, constant increase in the number of cyber threats and data breaches indicate that critical business and customer information are potential targets of hackers and cyber-criminals. This, in turn, restricts end-user organizations to deploy digital solutions, such as financial analytics solutions; thereby, hampering the market growth. In addition, privacy and data security related issues are projected to hinder the market growth.

Business transformation and advancements in technology from big data, customer analytics software ,and data warehouses have made companies' to use financial analytics. In addition, the change in role of corporate finance department have an impact on the financial analytics market. Chief financial officers initially relied on historical data and trends to forecast future performance. However, they have changed their focus as they increasingly tap into technologies, such as advanced data analytics, machine learning, and automation. Moreover, availability of favorable financial analytics landscape and access to multilevel financial analytics policies accelerates the market growth in North America, particularly in the U.S.

The Financial Analytics Market is estimated to grow at a CAGR of 10.3% from 2021 to 2030.

The Financial Analytics Market is projected to reach $19.8 billion by 2030.

Increase in adoption of pervasive computing devices, rise in advanced storage capabilities, and growth in innovation of new analytic tools present new possibilities to market players, which, in turn, boost the growth of the global financial analytics market.

The key players that operate in the financial analytics market are Deloitte LLP, Hitachi Vantara Corporation, International Business Machine Corporation, Microsoft Corporation, Oracle, Rosslyn Data Technologies, SAP SE, Symphony Teleca Services, Inc., Teradata Corporation, and TIBCO Software, Inc.

The key growth strategies of Financial Analytics market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...