Financial Auditing Professional Services Market Research, 2032

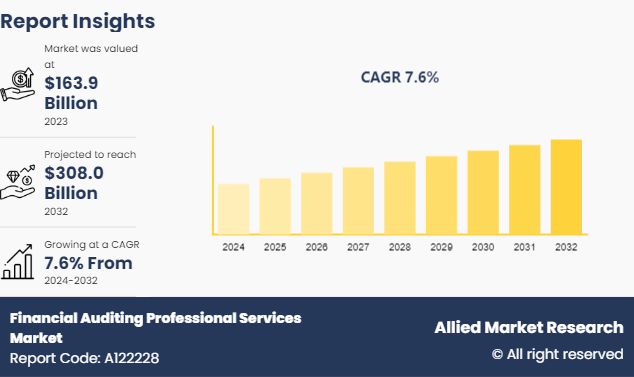

The global financial auditing professional services market was valued at $163.9 billion in 2023, and is projected to reach $308.0 billion by 2032, growing at a CAGR of 7.6% from 2024 to 2032.

Market Introduction and Definition :

Financial Auditing Professional Services Market refer to a range of activities that evaluate the reliability and credibility of financial records, including financial audits, accounting consultancy, and ensuring the legality of financial transactions. These services of financial auditing professional services market are used across various industries to review the accounts of companies and organizations.

The main services provided under financial auditing professional services market include employee benefit plan audits, service organization control (SOC) audits, financial statement audits, due diligence, and other accounting and consulting services related to financial management and compliance. The financial auditing professional service market has been growing in recent years due to factors such as regulatory compliance, globalization, corporate governance, and financial scandals.

Key Takeaways :

The financial auditing professional service market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($ billion) for the projected of financial auditing professional services market forecast and financial auditing professional services market outlook of 2023-2032.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major financial auditing professional services industry participants along with authentic financial auditing professional services industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious financial auditing professional services market growth objectives.

Key market dynamics:

The global financial auditing professional service market is experiencing growth to several factors such as increasing market complexity of auditing services and growing need for auditing services to ensure compliance and mitigate risks and regulatory requirements drive the demand for auditing services of financial auditing professional services market to ensure financial transparency and accountability. Further, rising incidences of banking fraud are expected to propel the growth of the financial auditing professional service market going forward. As businesses expand globally and engage in cross-border transactions, auditors play a crucial role in navigating the complexities of international trade and regulatory frameworks. The financial auditing professional services market is also driven by factors such as technological advancements, regulatory changes, and the need for financial transparency.

However, increased risk exposure, such as currency fluctuations and political instability to provide accurate assessments of financial information and operations constraints the financial auditing professional services market development. On the contrary, rise in integration of advanced technologies, such as data analytics and artificial intelligence, presents financial auditing professional services market opportunity for auditing firms to enhance efficiency and accuracy in audits of financial auditing professional services market .

Furthermore, the demand for specialized auditing services tailored to specific industries, such as healthcare, energy, and technology, underscores the need for auditors to stay abreast of industry trends and technological advancements. As businesses strive to align with international standards and improve financial reporting practices, auditing firms are essential in ensuring the accuracy of financial information, enhancing trust among stakeholders, and facilitating compliance with regulations. Therefore, the increasing financial auditing professional services market complexity and globalization underscores the critical role of auditing services in today's business environment of financial auditing professional services market .

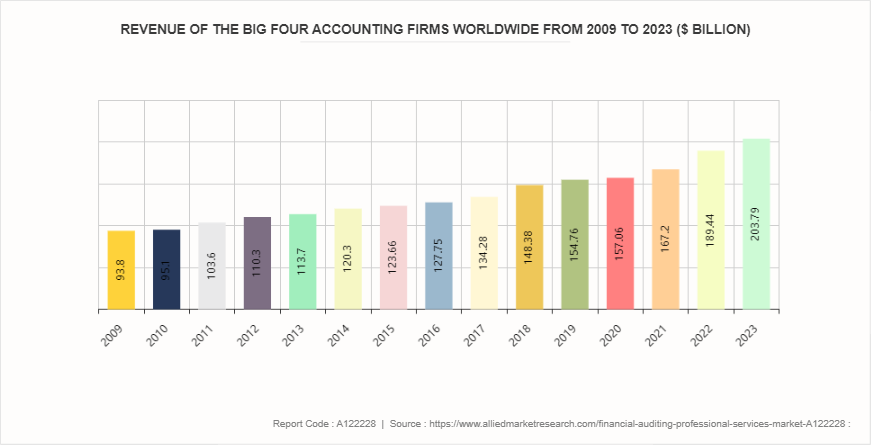

Deloitte Leads the Big Four in 2023 Revenues

The Big Four accounting firms are Deloitte, EY (Ernst & Young), PwC (PricewaterhouseCoopers), and KPMG (Klynveld Peat Marwick Goerdeler). These firms are the largest professional services networks in the world, measured by revenue, and are considered equal in their ability to provide a wide scope of professional services to their clients. They offer audit, assurance, taxation, management consulting, valuation, market research, actuarial, corporate finance, and legal services to their clients.

The largest of the Big 4 firms is PwC, with its headquarters in London and employing more than 208,000 people. It has revenues of well over financial auditing professional services market share $35 billion and is considered the most prestigious of the Big 4. Deloitte is not far behind, with its revenue only a couple of hundred million less than PwC’s. Its headquarters are in New York, and it employs over 225, 000 people. Although similar in revenue and employee numbers, one big difference between Deloitte and PwC is that the former has more of a focus on consulting while the latter’s main source of profit is financial auditing services. EY also employs well over 200,000 people but has a significantly lower revenue at just over $28 billion. This revenue comes from a balanced variety of services rather than any one particular focus. Its headquarters are also in London. KPMG is the smallest of the Big 4 and employs over 170,000 people. Its headquarters are in Amstelveen in the Netherlands, reflecting its more European-focused approach. Most of financial auditing professional services market size $24 billion revenue comes from auditing, consulting, and advising.

The development towards today’s Big 4 began in the late 1980s, when two mergers created a Big 6. Ernst & Whiney merged with Arthur Young to form Ernst & Young (later stylized as EY) , while Deloitte, Haskins and Sells merged with Touche Ross to form Deloitte and Touche. In the late 1990s, the Big 6 became the Big 5 when Price Waterhouse merged with Coopers and Lybrand to form PricewaterhouseCoopers (later stylized as PwC) . Five became four in 2001 after the insolvency of Arthur Andersen due to the firm’s involvement in the Enron scandal.

Market Segmentation :

The financial auditing professional services market is segmented into type, service, end user, and region. By type, the market is divided into external and internal audits. By service, the market is segregated into due diligence, employee benefit plan audit, financial statement audit, and others. By end use, the market is divided into BFSI, government, manufacturing, healthcare, retail & consumer, IT & telecom, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Financial Auditing Professional Services Market Outlook :

The growth is driven by a stable regulatory environment, the existence of numerous multinational corporations (MNCs), and the voluntary adoption of effective internal auditing and reporting procedures by local businesses. The markets in Europe and North America are comparatively developed. Companies in these areas are still committed to adhering to strict rules and are also among the first to use new technologies and best practices. However, Asia Pacific is expected to grow at the fastest rate during the forecast period, owing to the region's booming consumer market and urbanization trends

In April 2024, Deloitte Middle East launched Kiyadat, a center of excellence to empower national talent in the Gulf Cooperation Council (GCC). The center is expected to serve as a platform for Deloitte programs, including people development, mentoring, and sponsorship. The Deloitte Kiyadat Advisory Council, consisting of senior multi-disciplinary partners, will govern the center. The center will offer professional development programs, internships, onboarding, mentoring, alliances, and a dedicated portal for nationalization initiatives.

In May 2024, ZS, a Chicago-based management has launched a platform and products business unit to expand its software-as-a-service offerings. The new unit, led by chairman Jaideep Bajaj, will include the Zaidyn and Max AI platforms, which offer cloud-native analytics and generative AI solutions. ZS aims to help clients realize their digital operating models, drive business transformation, and respond to changing market needs using AI-powered technologies.

Industry Trends:

In June 2023, the Deloitte Center for Financial Services conducted a global study on women's progress in reaching financial services leadership, focusing on top jobs, and nurturing talent. The study includes over 68,000 financial services institutions across nearly 200 countries and territories. Results show mixed progress across regions, with most progress being incremental. If organizations continue to focus on achieving gender equity, progress will likely slow or stagnate by 2031. The number of women in financial services reaching the highest levels of leadership, including the C-suite and board, is rising. Over the past decade, more women have been added to FSI C-suite positions than men.

In October 2023, the global banking sector was reassessed due to early 2023 shocks, with U.S. banks focusing on proposed regulatory changes to enhance resilience. The global stress test revealed concerns about potential capital losses, particularly in advanced economies. The 2023 banking crisis highlighted the need for proactive measures to mitigate risks.

Competitive Landscape :

The major players operating in the financial auditing professional service market include Deloitte Touche Tohmatsu Limited, KPMG International, Ernst & Young (EY) , Grant Thornton International Ltd., Binder Dijker Otte (BDO) Global, RSMInternational Association, Mazars, Nexia International Limited, and Moore Stephens International Limited.

Other players in the financial auditing professional service market include PwC (U.K.) , Rodl & Partner, and others.

Key Strategies and Developments :

In April 2023, Ernst & Young scrapped its planned breakup of its consulting business and tax practice into a stand-alone public company, known as Project Everest. The plan, which required approval from over 13,000 partners in country-by-country votes, was a key sticking point over how to divide the tax practice. The partnership model, which defines most professional-services firms, is built on its culture and is based on the idea that partners' interests align with the firm's. The business rationale for the split remains valid, and the firm could pursue smaller-scale alternatives.

In April 2024, DataSnipper, an Intelligent Automation Platform, launched two new product suites for audit and finance professionals: the Advanced Extraction Suite and Cloud Collaboration Suite. The suites automate data extraction from unstructured documents using AI and facilitate cloud-based collaboration, boosting productivity and reducing risk. The suite includes features like invoice extraction, receipt extraction, and contract extraction. Customers report a 70% efficiency boost with the Advanced Extraction Suite. DataSnipper continues to be the trusted intelligent automation platform for audit and finance professionals.

Key Sources Referred :

PwC

U.S. Foreign portfolio investors (FPIs)

Deloitte Center for Financial Services

KPMG

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the financial auditing professional services market analysis from 2024 to 2032 to identify the prevailing financial auditing professional services market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the financial auditing professional services market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global financial auditing professional services market trends, key players, market segments, application areas, and market growth strategies.

Financial Auditing Professional Services Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 308.0 Billion |

| Growth Rate | CAGR of 7.6% |

| Forecast period | 2024 - 2032 |

| Report Pages | 345 |

| By Type |

|

| By Service |

|

| By End Use |

|

| By Region |

|

| Key Market Players | Nexia International Limited, Grant Thornton International Ltd., KPMG International, Deloitte Touche Tohmatsu Limited, Ernst & Young (EY), RSM International Association, Mazars, Binder Dijker Otte (BDO) Global, Moore Stephens International Limited |

Loading Table Of Content...