Financial Calculators Market Research, 2032

The global financial calculators market was valued at $224 million in 2022, and is projected to reach $615.8 million by 2032, growing at a CAGR of 10.8% from 2023 to 2032.

Financial calculators are used for financial accounting that regular calculators cannot do. Some of the features of financial calculators include cash flow, investment fees, debt-related expenses, interest rates, profit calculations, and more app to eliminate human error and inaccurate financial accounting. A financial calculator typically comes equipped with a set of basic financial functions, such as addition, subtraction, multiplication, and division, which are essential for performing various calculations. These basic operations allow users to modify calculations and perform numerical operations.

The key factors that drive the growth of the financial calculators market include increase in awareness about personal finance and rise in disposable income among individuals and businesses. Personal finance awareness encourages individuals to budget and track their expenses more diligently. Financial calculators help users create budgets, estimate expenses, and set savings goals boosting the growth of financial calculators market. They provide a tangible means of visualizing and managing financial plans.

Moreover, increased awareness about the consequences of debt has led individuals to seek ways to manage and reduce their debts effectively. Loan calculators help borrowers understand the impact of interest rates, loan terms, and repayment schedules on their debt obligations, enabling them to make strategic decisions. Thus, these factors notably contribute towards the growth of financial calculators market.

However, decline in demand for physical products is expected to hamper the growth of financial calculators market. The digital revolution has led to a shift in how people access and use information and tools. Many tasks that were traditionally performed using physical products, such as books, calculators, and maps, are now accomplished digitally through software applications and online platforms. On the contrary, AI-powered virtual assistants can contribute significantly to the growth of the financial calculators market. Virtual assistants assist users in setting and tracking financial goals related to EMI payments, savings, and investments. They provide guidance on how to achieve these goals and adjust plans as circumstances change.

Moreover, ensuring robust data security measures in AI-powered virtual assistants is critical to protect sensitive financial information. Trust in data privacy and security is essential to gaining user confidence. Thus, these factors are expected to provide lucrative opportunities for the growth of financial calculators market in upcoming years.

The report focuses on growth prospects, restraints, and trends of the financial calculators market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the financial calculators market.

Segment Review

The financial calculators market is segmented into Type and Application.

The financial calculators market is segmented on the basis of type, mode, application, and region. On the basis of type, the market is bifurcated into dual power source, and single power source. On the basis of application, it is divided into tax calculation, ROI calculation, loan calculation, investment calculation, and others. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

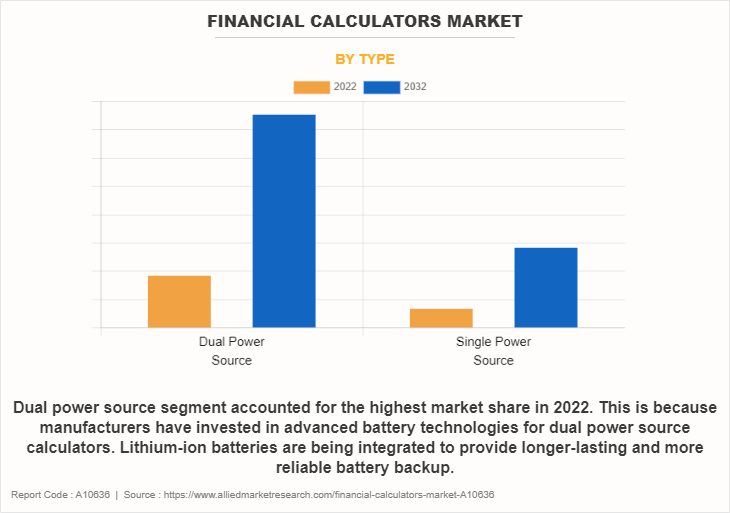

On the basis of type, the dual power source segment attained the highest financial calculators market size in 2022, because manufacturers have invested in advanced battery technologies for dual power source calculators. Lithium-ion batteries are being integrated to provide longer-lasting and more reliable battery backup.

On the basis of region, North America held the highest financial calculators market share in 2022. This growth can be attributed to factors such as the increase in use of smartphones, high internet penetration, and the growth in adoption of cloud-based applications among users.

The report analyzes the profiles of key players operating in the financial calculators market such as Texas Instruments Inc., Casio Computer Co. Ltd., HP Inc., Sharp Corporation., Canon Inc., Victor Technology LLC, Aurora, Oreva, Bombalio, and Ajanta Ltd. (Orpat Group). These players have adopted various strategies to increase their market penetration and strengthen their position in the financial calculators industry.

Market Landscape and Trends

The financial calculators market has experienced a digital transformation. Traditional standalone physical calculators are being complemented, and in some cases replaced, by digital applications and software. Mobile apps and web-based financial calculators have gained popularity due to their accessibility and convenience. Moreover, many financial calculator manufacturers now offer companion mobile apps that sync with their physical calculators or provide standalone calculator functionalities. These apps often include advanced features and interactive interfaces, making them appealing to a younger, tech-savvy audience. In addition, the educational sector remains a significant market for financial calculators. Students in mathematics, science, engineering, and finance rely on calculators for coursework and exams. As a result, manufacturers have actively marketed their products to schools and universities, often offering educational discounts and resources.

Furthermore, auto financing calculators are being integrated into digital courses and educational content with the growth of online learning and training platforms. This trend has driven the development of online calculator emulators and interactive tutorials, making it easier for learners to master financial calculations, which is expected to fuel the market growth during the forecast period.

Top Impacting Factors

Increased Financial Complexity

The finance industry has seen the introduction of more complex financial products, such as derivatives, structured products and new investments and these products require detailed calculations to assess potential risks and returns grade. Economists rely on specialized statistical equipment to accurately and thoroughly perform this complex analysis. Moreover, effective risk management is essential in financial landscape of the present time. Financial institutions and businesses need to assess and mitigate various types of risks, such as credit risk, market risk, and operational risk. Specialized calculators are crucial for modeling and quantifying these risks to make informed decisions. In addition, diversifying portfolios across asset classes and sectors is a common way to manage risk and increase returns. However, portfolio allocation requires complex calculations to optimize asset allocation and obtain desirable risk-return profiles. Financial calculators assist in these computations. Furthermore, as businesses and investors engage in international trade and investment, they require financial calculators to perform currency conversions, assess exchange rate risks, and calculate the impact of foreign exchange transactions. All these trends drive the growth of the financial calculators industry.

Increase in Awareness about Personal Finance

Personal finance awareness encourages individuals to budget and track their expenses more diligently. Financial calculators help users create budgets, estimate expenses, and set savings goals. They provide a tangible means of visualizing and managing financial plans. Moreover, increased awareness about the consequences of debt has led individuals to seek ways to manage and reduce their debts effectively. Loan calculators help borrowers understand the impact of interest rates, loan terms, and repayment schedules on their debt obligations, enabling them to make strategic decisions. In addition, awareness about the importance of long-term financial goals, such as retirement and wealth accumulation, has grown. Investment calculators assist individuals and investors in estimating returns, analyzing investment strategies, and determining the ideal investment amount to achieve their goals.

Furthermore, investors are increasingly interested in fixed deposits as a secure investment option. FD calculators assist in estimating returns, helping individuals make informed investment decisions and diversify their portfolios. The aforementioned strategies are projected to further boost the growth of the financial calculators industry.

Rise in Disposable Income

The growth of the financial calculators market is being driven by the rise in disposable income among individuals and businesses. People are increasingly inclined to invest in financial tools and services to optimize their financial decision-making processes as they have more financial resources at their disposal. Moreover, with higher disposable income, individuals and businesses have more funds available for investment. They use financial calculators to evaluate investment opportunities, and project returns, and assess the impact of different investment strategies on their wealth benefiting the growth of financial calculators market. In addition, increased income levels enable individuals and businesses to consider loans for various purposes, such as home purchases, business expansion, or education. Financial calculators help borrowers assess loan affordability, determine suitable repayment schedules, and make informed borrowing decisions.

Furthermore, increased disposable income often leads to a desire for portfolio diversification. Investors use FD calculators to model the impact of fixed deposits on their investment portfolios, analyze risk-return profiles, and optimize their asset allocation strategies. Thus, the rise in disposable income fuels the growth of financial calculators market.

Decline in Demand for Physical Products

The digital revolution has led to a shift in how people access and use information and tools. Many tasks that were traditionally performed using physical products, such as books, calculators, and maps, are now accomplished digitally through software applications and online platforms. Digital solutions often offer greater convenience and accessibility. Users are able to access digital products and services from their smartphones, tablets, or computers, eliminating the need to carry physical items. This convenience factor has driven the adoption of digital alternatives. In addition, economic instability, such as recessions or financial crises, are expected to lead to reduced borrowing and lending activity. Individuals and businesses are anticipated to delay or scale back their borrowing plans, resulting in decreased demand for financial calculators during uncertain economic times. These challenges are expected to hamper the growth of financial calculators market.

AI-powered Virtual Assistants

AI-powered virtual assistants provide a more interactive and user-friendly experience. Users can engage in natural language conversations with these virtual assistants, making it easier to input data and receive financial insights. This enhanced user experience can attract more users to financial calculators. In addition, AI can analyze user data and behavior to create personalized financial recommendations and solutions. Virtual assistants can offer tailored financial advice based on individual financial goals, risk tolerance, and financial history. This level of personalization is expected to significantly improve user engagement and satisfaction.

Furthermore, virtual assistants assist users in setting and tracking financial goals related to EMI payments, savings, and investments. They can provide guidance on how to achieve these goals and adjust plans as circumstances change. Moreover, ensuring robust data security measures in AI-powered virtual assistants is critical to protect sensitive financial information. Trust in data privacy and security is essential to gaining user confidence. Thus, the AI powered virtual assistants are expected to fuel the growth of financial calculators market in upcoming years.

Personalized Financial Planning

Personalized financial calculators allow users to input their specific financial data, including income, expenses, debts, and goals. The calculators then generate customized financial plans and strategies based on this information. This tailoring ensures that users receive recommendations aligned with their individual circumstances. In addition, personalized calculators consider risk tolerance of users when providing financial advice. They factor in comfort levels of users with different investment options and provide recommendations that align with their risk profiles, enhancing the likelihood of user acceptance and adherence to the plan.

Moreover, users with loans can benefit from personalized debt management plans that recommend repayment schedules and strategies to reduce debt efficiently. This can help users save on interest costs and achieve debt freedom sooner. Furthermore, for users with educational or retirement goals, personalized calculators can estimate the costs of education or retirement and provide savings and investment strategies. They can suggest investment options such as FDs to achieve these financial objectives. Therefore, these factors are anticipated to provide lucrative opportunities for financial calculators market growth.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the financial calculators market forecast from 2022 to 2032 to identify the prevailing market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities of financial calculators market outlook.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the financial calculators market segmentation assists in determining the prevailing financial calculators market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global financial calculators market trends, key players, market segments, application areas, and market growth strategies.

Financial Calculators Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 615.8 million |

| Growth Rate | CAGR of 10.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 329 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Ajanta Ltd.(Orpat Group), Aurora, Bambalio, Sharp Corporation., Texas Instruments Inc., Canon Inc., HP Inc., Oreva, Casio Computer Co. Ltd., Victor Technology LLC |

Analyst Review

The rise of mobile apps has had a significant impact on the financial calculators market. Many users now prefer to access financial calculator functionalities through smartphone apps. Financial institutions, banks, and fintech companies have responded by developing intuitive and feature-rich mobile apps that offer EMI, FD, investment, and loan calculators. In addition, alongside mobile apps, web-based financial calculators have gained popularity. These calculators can be accessed from any device with an internet connection, providing users with flexibility and convenience. They are often integrated into the websites of banks, financial advisory firms, and real estate agencies. Furthermore, many financial calculator providers now offer educational resources to promote financial literacy. These resources include tutorials, explanations of financial concepts, and links to articles or videos that help users understand how to use the calculators effectively. This trend aligns with the increase in emphasis on financial education.

The market players have adopted strategies such as product launch for enhancing their services in the market and improving customer satisfaction. For instance, in October 2022, Casio Computer Co. Ltd. launched two new Ergonomic Calculators, the JE-12E and DE-12E, both featuring keypad surfaces sloped 3° to the right and keys arranged in a step configuration to facilitate ease of key input using the right hand. The innovative JE-12E and DE-12E Ergonomic Calculators are the result of a special Casio vision, making the calculator fit the person, not the person fit the calculator. Casio used ergonomic experience to develop a novel new case and key design that offers a perfect fit in the hand and facilitates key input. Such strategies are anticipated to boost the growth of the financial calculators market.

Moreover, some of the key players profiled in the report are Texas Instruments Inc., Casio Computer Co. Ltd., HP Inc., Sharp Corporation., Canon Inc., Victor Technology LLC, Aurora, Oreva, Bombalio, and Ajanta Ltd. (Orpat Group). These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

The financial calculators market is estimated to grow at a CAGR of 10.8% from 2023 to 2032.

Increased financial complexity, increase in awareness about personal finance, and rise in disposable income contribute towards the growth of the market.

The financial calculators market is projected to reach $615.75 million by 2032.

The key growth strategies of financial calculators players include product portfolio expansion, mergers & acquisitions, agreements, business expansion, and collaborations.

The key players profiled in the report include financial calculators market analysis includes top companies operating in the market such as Texas Instruments Inc., Casio Computer Co. Ltd., HP Inc., Sharp Corporation., Canon Inc., Victor Technology LLC, Aurora, Oreva, Bombalio, and Ajanta Ltd. (Orpat Group).

Loading Table Of Content...

Loading Research Methodology...