Financial Fraud Detection Software Market Research, 2032

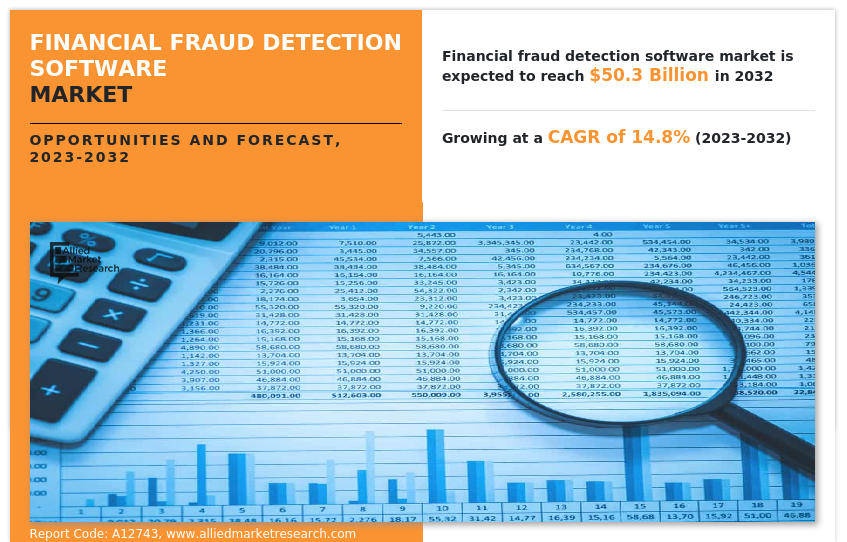

The global financial fraud detection software market was valued at $13 billion in 2022, and is projected to reach $50.3 billion by 2032, growing at a CAGR of 14.8% from 2023 to 2032.

Financial fraud detection software applications are used to provide analytical solutions for fraud incidents and help identify or prevent future occurrences. Currently, enterprises are more susceptible to incidents of fraud that may result in financial losses due to the generation of massive amounts of enterprise data and an increase in technological advancements.

The growing adoption of online banking applications and mobile banking services and increasing incidences of financial fraud are boosting the growth of the global financial fraud detection software market. in addition, the increase in the use of digital transformation technology the positively impacts growth of the financial fraud detection software market. However, growing incidents of false positive rates and high implementation costs are hampering the financial fraud detection software market growth. On the contrary, rising Innovations in the Fintech Industry are expected to offer remunerative opportunities for the expansion of the financial fraud detection software market during the forecast period.

Segment Review

The financial fraud detection software market is segmented on the basis of component, deployment mode, type, end user, and region. On the basis of component, the market is categorized into solution and service. On the basis of deployment mode, the market is fragmented into on-premise and cloud. On the basis of type, the market is bifurcated into core money laundering, identity theft, debit & credit card frauds, claim frauds, transfer frauds, and others. By end user, it is classified into banks, NBFCs, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

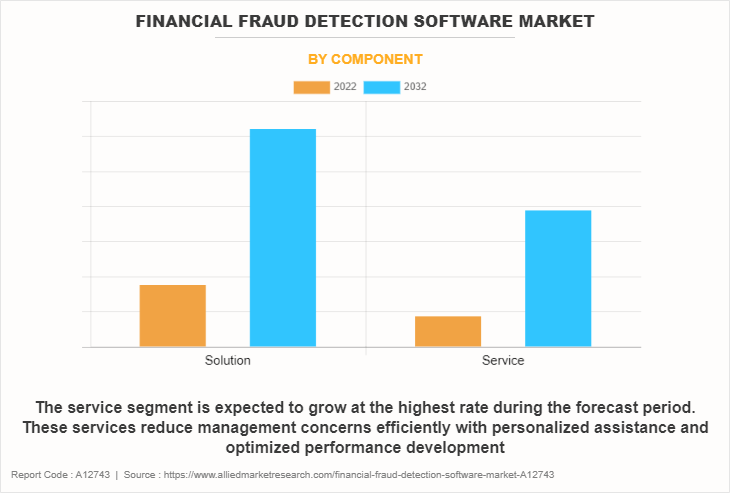

In terms of component, the solution segment holds the highest financial fraud detection software market share as it provides personalized services, accelerates throughput, and reduces operational costs. However, the service segment is expected to grow at the highest rate during the forecast period. These services reduce management concerns efficiently with personalized assistance and optimized performance development.

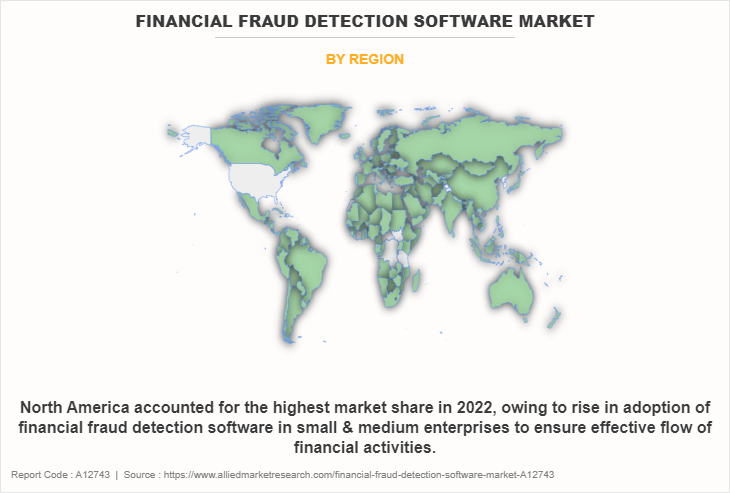

Region wise, the financial fraud detection software market size was dominated by North America in 2022, and is expected to retain its position during the forecast period, owing to rise in adoption of financial fraud detection software in small & medium enterprises to ensure effective flow of financial activities. However, Asia-Pacific is expected to witness significant growth during the forecast period, due to the growing adoption of web-based and mobile-based business applications in the sector of banking.

The key players that operate in the financial fraud detection software market are Feedzai, FiCO, Oracle Corporation, ThreatMetrix, SAS Institute Inc., SAP SE, Fiserv, Inc., IBM Corporation, Software AG, and Experian plc. These players have adopted various strategies to increase their market penetration and strengthen their position in the financial fraud detection software industry.

Competition Analysis

Recent Partnerships in the Financial Fraud Detection Software Market

June 28, 2023: Treasury Prime partnered Sardine to strengthen fraud detection capabilities for enterprises and banks on the platform. This collaboration will empower companies and financial institutions within Treasury Prime's multi-bank network to leverage Sardine's Sponsor Bank Operating System, offering turnkey fraud management and oversee BSA/AML compliance at 3rd parties.

Recent Product Launches in the Financial Fraud Detection Software Market

In January 11, 2021, NICE Actimize, a leading provider of financial crime software solutions, launched a new cloud-based fraud detection and prevention solution. The solution, called ActimizeWatch, is designed to help businesses of all sizes prevent fraud in real time by leveraging machine learning and artificial intelligence technologies. ActimizeWatch provides an integrated platform that can be used across multiple channels, including mobile and web, and offers advanced analytics to help detect even the most sophisticated fraud attempts.

Recent Collaboration in the Financial Fraud Detection Software Market

On August 09, 2023, PULSE, collaborated with FICO to deliver market-leading fraud-detection technology that reduces losses and risk exposure for financial institutions, merchants and consumers worldwide. This extension supports PULSE in continuing to enhance its DebitProtect® suite of advanced fraud-mitigation solutions, powered by the state-of-the-art FICO® Falcon® Fraud Manager.

Top Impacting Factors

Growing Adoption of Online Banking Applications and Mobile Banking Services

The increased use of online applications and mobile banking services has resulted in an increase in the number of illegitimate domains and mobile apps. Fake websites and online apps are on the rise in other industries, including retail and eCommerce, manufacturing, banking, and healthcare. These websites and apps imitate real retail stores and home delivery services, luring clients into making fraudulent online transactions. Customers in the banking industry are increasingly using mobile applications for a variety of purposes, including online payment, statement review, complaint registration, and feedback. According to the Boston Consulting Group (BCG), almost 70% of urbanites worldwide are digitally persuaded to buy financial products and services through online banking apps or mobile banking websites. In the current economic climate, many firms are integrating solutions across their business units to progress their business road maps. During the forecast period, the growing number of internet users, increasing acceptance of digital payment methods, and rising number of start-ups are likely to boost the global financial fraud detection software market.

Increasing Incidences of Financial Fraud

The increase in incidences of financial fraud drives the growth of the financial fraud detection software market, owing to rising awareness of financial frauds with advanced technology that keep up with evolving fraudulent techniques. In addition, the banking sector along with other units that deal in different types of monetary transactions has become highly prone to cyber-attacks and financial fraud. Factors like rapid digitization, lack of security awareness amongst consumers, insider threats, rising complexity, and economic instability are the leading causes of the increase in digital cyber-crimes including financial fraud. In addition, the rising rate of digital payment systems makes consumers more vulnerable to becoming victims to financial fraudsters causing a greater need to have fraud-detecting software programs in place, which in turn is driving the growth of the financial fraud detection software market.

Restraints

Growing Incidents of False Positive Rates

False positive rates are incidents in which the program concludes legitimate transactions as fraudulent activities. The growing rate of such incidents is a major challenge for global industry players to tackle. Moreover, false-positive rates occur due to multiple human or mechanical errors like the input of wrong data, along with lack of context and integration, and several other types of human error in understanding. Furthermore, software programs are also highly prone to collapse under certain situations hampering the growth of the financial fraud detection software market.

High Implementation Cost

Implementing financial fraud detection software solutions requires substantial investments in terms of hardware, software, and personnel. This is a major deterrent for small and medium-sized banks and financial institutions, thus hindering their adoption of financial fraud detection software solutions. Financial fraud detection software is complex in nature, as it requires high level functions and integrations, thus leading to prohibitive costs standing between $36,000 and $75,000 and sometimes even higher than $150,000, in the case of complex applications with high level features. Hence, this factor is expected to hamper market growth. The major factors that are leading to higher costs are the implementation of software technology, data migration, bank size, and tech debt associated with digital service technology. Architectural design requirements are challenging as software architects and developers must migrate into micro-services with individual databases. Furthermore, the creation of an application programming interface (API) for communication between banking services with client-side and load balancers adds up to the cost of implementing banking software, thus restraining the market growth. Moreover, to modernize software changes, a tech-stack is quired, as a result ensuring compatibility of legacy components, while mitigating application to the cloud for data storage leads to compatibility issues, and fixing compatibility issues leads to higher cost, thus hindering the financial financial fraud detection software market growth.

Opportunities

Rising Innovations in the Fintech Industry

BFSI companies are increasing investment in machine learning and AI solutions to transform financial institutes’ management for providing enhanced services to the end users and to automate the necessary solutions. In addition, with rising complexity and competition in the BFSI market, the demand for industry-specific solutions increased to meet the goals of the companies and AI-based financial solutions are helping Fintech and other industries to enhance their security and upsurge their revenue opportunity, which is driving the growth of the market. For instance, in March 2021, IBM announced that it had launched a new fraud detection and prevention solution for the financial services industry. The solution, called IBM Financial Crimes Insight, is built on IBM Cloud Pak for Data and leverages advanced analytics, artificial intelligence, and machine learning technologies. The solution is designed to help financial institutions detect and prevent fraud across a range of channels, including mobile, web, and call centers. IBM Financial Crimes Insight offers real-time monitoring and analytics, enabling businesses to quickly respond to potential fraud attempts.

Furthermore, AI and machine learning assist financial institutes at various stages of the risk management process ranging from identifying risk exposure, measuring, and estimating, to assessing its effects. Moreover, increasing investments in AI and machine learning offer the potential to transform the area of automation for time-consuming, mundane processes, and offer a far more streamlined and personalized customer experience, which is enhancing the growth of the market. In addition, major financial institutes such as Bank of America, JPMorgan, and Morgan Stanley, are investing heavily in ML technologies to develop automated investment advisors and train systems to detect flags such as money laundering techniques and for other fraud cases, which in turn is expected to provide lucrative opportunity for the growth of the financial fraud detection software market.ll

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the financial fraud detection software market analysis from 2023 to 2032 to identify the prevailing financial fraud detection software market opportunity.

- The financial fraud detection software market outlook research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the financial fraud detection software market segmentation assists to determine the prevailing market .

- Major countries in each region are mapped according to their revenue contribution to the global financial fraud detection software market forecast.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the financial fraud detection software market players.

- The report includes the analysis of the regional as well as global financial fraud detection software market trends, key players, market segments, application areas, and financial fraud detection software market growth strategies.

Financial Fraud Detection Software Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 50.3 billion |

| Growth Rate | CAGR of 14.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 250 |

| By Component |

|

| By Deployment Mode |

|

| By Fraud Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | SAS Institute Inc., Oracle Corporation, Software AG, SAP SE, Fiserv, Inc., IBM Corporation, FiCO, ThreatMetrix, Feedzai, Experian PLC |

Analyst Review

Financial fraud detection software is growing at an exceptional rate as the world moves toward digitizing every aspect of financial transactions that occur at the business or personal level. The software programs make use of different types of solutions like authentication solutions, fraud analytics, risk and compliance solutions governance, and solutions that monitor transactions across the consumer group of the financial unit using the software. These programs are essential in detecting any abnormal payment patterns and transactions and are useful in avoiding irreparable damage to the entity using the software.

Key providers in the financial fraud detection software market are Oracle Corporation, SAP SE, and IBM Corporation. With the growth in demand for financial fraud detection software solutions, various companies have established acquisition strategies to increase their solutions offerings in AI solutions. For instance, in November 2022, Mangopay acquired Nethone to develop and offer anti-fraud solutions designed specifically for marketplaces. Further, such strategies drive market growth.

In addition, with the surge in demand for financial fraud detection software, several companies have expanded their current product portfolio to continue with the rising demand in the market. For instance, in June 2022, eFraud Services launched eFraud Converter. eFraud Converter is an AI-driven, SaaS-based solution solving the problem of the time-consuming and labor-intensive process of analyzing bank statements.

For instance, in January 2022, PULSE partnered with FICO, to deliver market-leading fraud-detection technology that reduces losses and risk exposure for financial institutions, merchants and consumers worldwide. This extension supports PULSE in continuing to enhance its DebitProtect suite of advanced fraud-mitigation solutions

The financial fraud detection software market landscape is continually evolving to address the increasing sophistication of fraud threats and the changing needs of financial institutions. The financial fraud detection software market is highly competitive and includes a range of solution providers, from established players to innovative startups.

Money Laundering is the leading application of Financial Fraud Detection Software Market.

North America is the largest regional market for Financial Fraud Detection Software.

$50,327.02 million is the estimated industry size of Financial Fraud Detection Software.

The key players that operate in the financial fraud detection software market are Feedzai, FiCO, Oracle Corporation, ThreatMetrix, SAS Institute Inc., SAP SE, Fiserv, Inc., IBM Corporation, Software AG, and Experian plc. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Loading Table Of Content...

Loading Research Methodology...