Financial Leasing Services Market Research, 2032

The global financial leasing services market was valued at $214.9 billion in 2022, and is projected to reach $624.3 billion by 2032, growing at a CAGR of 11.5% from 2023 to 2032.

Financial leasing is defined as a way of financing the assets where they tend to remain the property of the lessor unless all lease payments have been accounted for. The lessor charges the lessee a fee for selecting the specific asset in exchange for the lease that is agreed upon. A finance lease substantially transfers the risks and rewards that are associated with the ownership of the lessee to the lessor.

One of the key drivers of the financial leasing services market is the capital efficiency offered by financial leasing services. Businesses today face the imperative of optimizing their use of capital to remain competitive and agile. When companies opt for financial leasing, they gain access to valuable assets without the burden of a substantial upfront capital outlay. Furthermore, the flexibility and customization offered by financial leasing are significant drivers behind the rapid growth of the financial leasing services market. In the current dynamic business landscape, companies increasingly demand tailored financial solutions that can adapt to their unique needs. Financial leasing offers the ability to craft lease agreements to suit specific requirements. In addition, tax benefits and favorable accounting treatment promote the growth of the financial leasing services market. Many regions offer tax advantages to businesses that opt for financial leasing over outright asset purchase. This can manifest as deductions on lease payments, effectively reducing the overall tax liability.

However, the various web of regulations and standards governing financial leasing, and economic uncertainty hamper the financial leasing services market growth. On the contrary, the increase in demand for digital transformation is expected to provide lucrative growth opportunities to the financial leasing services market size in the upcoming years. The integration of cutting-edge technologies such as the Internet of Things (IoT), artificial intelligence (AI), and blockchain is reshaping the landscape of financial leasing.

The report focuses on growth prospects, restraints, and trends of the financial leasing services market forecast. The study provides porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the financial leasing services market outlook.

Segment Review

The financial leasing services market is segmented into type, provider, application, and region. On the basis of type, the market is differentiated into capital lease, operating lease, and others. On the basis of provider, it is fragmented into banks and non-banks. On the basis of application, the market is divided into transportation, aviation, IT and telecom, manufacturing, healthcare, construction, and others. On the basis of region, the market is segmented into North America, Europe, Asia-Pacific, and LAMEA.

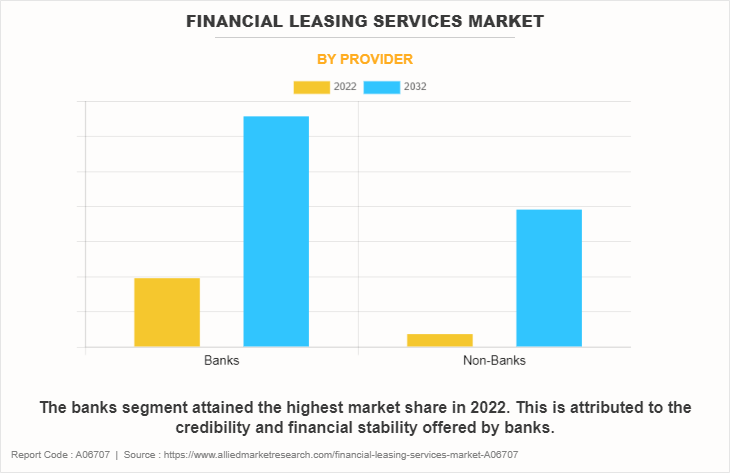

On the basis of provider, the banks segment acquired a major financial leasing services market share in 2022. This is attributed to the credibility and financial stability offered by banks. They leverage their vast resources to offer competitive leasing terms and options. Furthermore, banks provide one-stop financial solutions, making it convenient for businesses and individuals to handle both their banking and leasing needs at one place. However, the non-banks segment is expected to be the fastest-growing segment during the forecast period. The growth of the non-banks segment in the financial leasing services market is propelled by its specialization, flexibility, and innovative offerings. These providers focus on specific types of leases, catering to niche markets and unique customer needs.

On the basis of region, North America dominated the financial leasing services market in 2022. The stable economic environment of this region, characterized by strong consumer demand and a change in business landscape, has fueled the demand for financial leasing services in North America. Furthermore, the significant presence of the world's largest banks, financial institutions, and leasing companies in the region drives the market growth. However, Asia-Pacific is considered to be the fastest-growing region during the forecast period, owing to the economic expansion of this region, increase in asset demand, and supportive regulatory environments that have collectively fostered the adoption of leasing across diverse sectors.

Competition Analysis

Competitive analysis and profiles of the major players in the financial leasing services market include Bank of America Corporation, General Motors Financial Company, Inc., Fifth Third Bank, Crest Capital, Minsheng Financial Leasing, BNP Paribas Leasing Solutions, Wells Fargo, CMB Financial Leasing Co., Ltd., BOC Aviation, and Sumitomo Mitsui Finance and Leasing Co., Ltd. These players have adopted various strategies to increase their market penetration and strengthen their position in the financial leasing services industry.

Recent Partnerships in the Financial Leasing Services Market

In February 2023, BNP Paribas Leasing Solutions formed a partnership with Eaton, the intelligent power management company, to offer tailored finance solutions to help business owners accelerate their energy transition while preserving cashflow.

In July 2022, Ford Trucks and BNP Paribas Leasing Solutions joined forces to offer tailor-made financing solutions in Europe. Ford Trucks signed an agreement with BNP Paribas Leasing Solutions to offer finance solutions to their customers based in France, Germany, and Benelux. Customers have access to a range of leasing and financing solutions for all their requirements across the Ford Trucks Dealer Network through this cooperation.

Recent Product Launch in the Financial Leasing Services Market

In November 2021, Tesla launched a new financial product called “financial leasing” that enables customers to buy its cars with no down payment. Tesla updated its online configurator in China to add a new financing option when buying a vehicle online.

Recent Acquisition in the Financial Leasing Services Market

In September 2023, Air India announced the acquisition of its first Airbus A350-900 aircraft through a finance lease transaction with HSBC. Apart from being the first aircraft financing transaction from massive 470-plane order of Air India, it is also the first such transaction by a scheduled airline through first International Financial Services Centre (IFSC) of India in the Gujarat International Finance Tec-City (GIFT City).

Market Landscape and Trends

In the aviation industry, leasing aircraft by airlines is an alternative to them directly owning the planes. Leasing allows airlines to expand their fleets without incurring significant capital expenditure. Aircraft leasing allows them to operate on an asset-light model and helps keep debt levels in check apart from helping airlines protect liquidity. In addition, the Government of India has taken several initiatives to develop the aircraft leasing ecosystem at IFSC in India. IFSCA (IFSC Authority) has been working with the stakeholders to develop regulatory enablers for aircraft leasing and financing. The steps taken by Air India by establishing a finance company for the purpose of aircraft leasing and financing at IFSC is expected to develop IFSC as a preferred destination for aircraft leasing and financing in India as well as globally.

Top Impacting Factors

Capital Efficiency Offered by Financial Leasing

Capital efficiency plays a vital role in propelling the expansion of the financial leasing services market. Businesses today face the imperative of optimizing their use of capital to remain competitive & agile and gain access to valuable assets without the burden of a substantial upfront capital outlay when they opt for financial leasing. Furthermore, financial leasing offers businesses a means to diversify their financing options beyond traditional debt or equity financing. The flexibility in structuring lease agreements, such as lease duration and end-of-lease choices, empowers companies to tailor financing to their unique requirements. In addition to conserving capital, this adaptability augments financial planning and mitigates the risks associated with asset ownership, further fueling the growth of the financial leasing services market.

In addition, key players in the market adopted partnership as their key development strategy to offer tailored finance solutions to help business owners accelerate their energy transition while preserving cashflow. For instance, in February 2023, BNP Paribas Leasing Solutions announced a partnership with Eaton, the intelligent power management company, to provide tailored financing solutions to help business owners boost their energy transformation while protecting cashflow. The solution developed by Eaton and BNP Paribas Leasing Solutions offers cashflow-friendly payment plans for infrastructure and equipment and also integrates access to global service network of Eaton. Therefore, such factors drive the growth of the financial leasing services market.

Flexibility and Customization

Flexibility and customization are significant drivers behind the rapid growth of the financial leasing services market. In the current dynamic business landscape, companies increasingly demand tailored financial solutions that can adapt to their unique needs. Financial lease of operational lease offers the ability to craft lease agreements to suit specific requirements. Businesses negotiate lease terms, payment structures, and end-of-lease options, creating a bespoke arrangement that aligns with their financial and operational strategies. This high degree of customization empowers organizations to address evolving market conditions and changing business priorities effectively.

Moreover, flexibility in financial leasing facilitates risk mitigation. Businesses can acquire essential assets without committing to the long-term ownership risks associated with outright purchase. This conserves capital and provides an exit strategy if business demand changes. In an era of rapid technological advancements and shifting market demands, the capacity to adapt and optimize asset utilization is paramount. Consequently, businesses are increasingly drawn to the financial leasing services market as a means to attain the flexibility and customization necessary to thrive in a dynamic economic environment.

Increase in Demand for Digital Transformation

Technological advancements represent a vital role in the growth of the financial leasing services market. The integration of innovative technologies such as the Internet of Things (IoT), AI, and blockchain has reshaped the landscape of financial leasing. For instance, IoT enables real-time asset monitoring, enhancing the management and maintenance of leased equipment. This reduces operational costs as well as minimizes the risks associated with asset wear and tear, making leasing a more attractive option for businesses. Furthermore, AI-powered data analytics has improved the underwriting process by providing more accurate risk assessments. This results in more precise pricing and terms, increasing the overall efficiency and competitiveness of financial leasing firms.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the financial leasing services market analysis from 2022 to 2032 to identify the prevailing financial leasing services market opportunity.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- The porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the financial leasing services market segmentation assists to determine the prevailing financial leasing services market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as financial leasing services market trends, key players, market segments, application areas, and market growth strategies.

Financial Leasing Services Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 624.3 billion |

| Growth Rate | CAGR of 11.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 210 |

| By Type |

|

| By Provider |

|

| By Application |

|

| By Region |

|

| Key Market Players | Crest Capital, Wells Fargo, Bank of America Corporation, General Motors Financial Company, Inc., Fifth Third Bank, BOC Aviation, CMB Financial Leasing CO., LTD., Sumitomo Mitsui Finance and Leasing Co., Ltd, BNP Paribas Leasing Solutions, Minsheng Financial Leasing |

Analyst Review

The Government of India has taken several initiatives to develop the aircraft leasing ecosystem at IFSC in India. IFSCA (IFSC Authority) has been working with the stakeholders to develop regulatory enablers for aircraft leasing and financing. The steps taken by Air India by establishing a finance company for the purpose of aircraft leasing and financing at IFSC will go a long way in developing IFSC as a preferred destination for aircraft leasing and financing in India as well as globally. For instance, in September 2023, Air India acquired its first Airbus A350-900 aircraft through a finance lease transaction with HSBC. Moreover, it is the first such transaction by a scheduled airline through first International Financial Services Centre (IFSC) of India in the Gujarat International Finance Tec-City (GIFT City) apart from being the first aircraft financing transaction from the massive 470-plane order of Air India. Therefore, such government initiatives and strategies adopted in aviation industries propel the growth of the financial leasing services market.

The COVID-19 pandemic significantly disrupted the financial leasing services market, leading to a complex web of challenges and opportunities. Leasing companies faced high risks as economic uncertainty and lockdown measures impacted ability of borrowers to meet lease obligations. This resulted in increased failures and defaults, prompting lessors to reassess their risk management strategies and tighten underwriting standards. Furthermore, the decreased demand for certain types of assets, such as commercial real estate and transportation equipment, compelled leasing firms to diversify their portfolios to mitigate sector-specific vulnerabilities.

The key players in the financial leasing services market include Bank of America Corporation, General Motors Financial Company, Inc., Fifth Third Bank, Crest Capital, Minsheng Financial Leasing Co. Ltd., BNP Paribas Leasing Solutions, Wells Fargo, CMB Financial Leasing Co., Ltd., BOC Aviation, and Sumitomo Mitsui Finance and Leasing Co., Ltd. Major players operating in this market have witnessed significant adoption of strategies that include business expansion and partnership to reduce supply and demand gap. Major players have collaborated on their product portfolio to provide differentiated and innovative products with an increase in awareness & demand for financial leasing services across the globe.

The financial leasing services market is segmented into type, provider, application, and region. On the basis of type, the market is differentiated into capital lease, operating lease, and others. On the basis of provider, it is fragmented into banks and non-banks. On the basis of application, the market is divided into transportation, aviation, IT and telecom, manufacturing, healthcare, construction, and others.

North America is the largest regional market for Financial Leasing Services.

The financial leasing services market size was valued at $214,849.63 million in 2022 and is projected to reach $624,254.06 million by 2032, growing at a CAGR of 11.5% from 2023 to 2032.

The major players in the financial leasing services market include Bank of America Corporation, General Motors Financial Company, Inc., Fifth Third Bank, Crest Capital, Minsheng Financial Leasing, BNP Paribas Leasing Solutions, Wells Fargo, CMB Financial Leasing Co., Ltd., BOC Aviation, and Sumitomo Mitsui Finance and Leasing Co., Ltd.

Loading Table Of Content...

Loading Research Methodology...