Financial Planning Software Market Overview

The global financial planning software market was valued at $3.7 billion in 2021, and is projected to reach $16.9 billion by 2031, growing at a CAGR of 16.6% from 2022 to 2031. Growing demand to manage consumer income, rising mobile app usage, digital transformation in financial services, and increasing global base of internet users contribute to the growth of the market.

Market Dynamics & Insights

- The financial planning software market in North America held the largest market share in 2021.

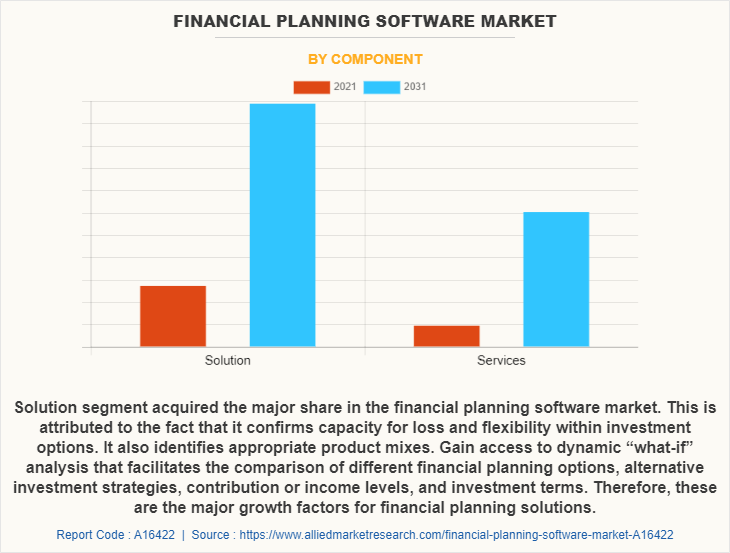

- By component, the solution segment held the largest market share in 2021.

- By application, the financial advice and management segment held the largest market share in 2021.

Market Size & Future Outlook

- 2021 Market Size: $3.7 Billion

- 2031 Projected Market Size: $16.9 Billion

- CAGR (2022-2031): 16.6%

- North America: dominated the market in 2021

- Asia-Pacific: Fastest growing market

What is Meant by Financial Planning Software

Financial planning software is a tool designed to integrate the financial data of a user and segregate this information to deliver a desired analytical output for improved financial planning. This software tool utilizes variety of financial data as input and can be implemented for various tasks such as financial transactions, bank records management, investment tracking, budget management, portfolio management, and others.

Rise in need to track & manage income of consumers and surge in mobile application across the globe are the major factors that drive the financial planning software market growth. In addition, increase in focus of organizations on digitalizing their financial services and upsurge in internet users across the globe fuel the growth of the market. However, security and compliance issues in financial planning software and availability of open source finance software hamper the growth of the market. Furthermore, increased adoption of finance software among developing economies and increasing number of high net worth individual is expected to provide lucrative financial planning software market opportunity.

The report focuses on growth prospects, restraints, and trends of the financial planning software market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the financial planning software market outlook.

Financial Planning Software Market Segment Review

The financial planning software market is segmented on the basis of component, deployment mode, application, end user, and region. By component, it is segmented into solution and service. By deployment mode, it is bifurcated into on-premises and cloud. By application, it is segregated into financial advice and management, portfolio, accounting and trading management, wealth management, personal banking, and others. By end user, the market is divided into large enterprises, small and medium-sized enterprises (SMEs), and individuals. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By on component, the solution segment attained the highest revenue in the financial planning software industry. This is attributed to the fact that financial planning solutions help assess investment suitability, illustrating potential loss and alignment of investment solutions with a client’s risk profile and financial objectives. It demonstrates how a chosen investment portfolio meets the client’s objectives, replaying the risk profile, downside risk, and sequence of returns risk.

By region, North America attained the highest share in 2021. This is attributed to factors such as increased internet dependence, increased usage of mobile apps, increased acceptance of personal finance software, and the availability of open-source solutions are driving the growth of the financial planning software industry in this region.

The report analyzes, the profiles of key players operating in the financial planning software market such as Advicent Solutions, eMoney Advisor, LLC, Moneytree Software, MoneyGuide, Inc., Miles Software, Orion Advisor Technology, Personal Capital Corporation, Quicken Inc., RightCapital Inc., and SAP. These players have adopted various strategies to increase their market penetration and strengthen their position in the financial planning software market.

COVID-19 Impact Analysis

In COVID-19 pandemic, businesses were coping with operational challenges. To cope with this situation, many banks & financial institutions are providing their customers with new digital tools & techniques, among which financial planning software has witnessed significant growth. In addition, rise in online and mobile banking in this pandemic among end-users provides growth potential for the financial planning software market. Furthermore, many banks and FinTech industries have introduced various attractive banking strategies to support the SMEs and consumers to adopt financial planning software, thereby creating numerous opportunities for the market growth.

What are the Top Impacting Factors in Financial Planning Software Market

Surge in Awareness of Financial Planning Software

Factors such as huge customized & personalized products & services, help in eliminating financial stress & creating financial plans, and massive incorporation of digitalized offerings are contributing toward the market growth. With combining investment and financial counseling, financial planning software providers help in forming strategies as per the personal requirements of an individual and offers a completely personalized service from the expert and ensures quality services. Moreover, financial planning services for retired consumers has increased tremendously, as individual holding huge pensions that can help pay for bills & day-to-day needs, and further plan for retirement portfolio. These major benefits provided by financial planning software is boosting the market growth.

Increased Usage of FinTech

Financial advisors are increasingly investing in new technologies such as robo-advisor, artificial intelligence (AI), robotic process automation, and digital identification (ID) technologies for improving customer experience, FinTech (Financial technology) have largely disrupted the financial planning industry. In addition, FinTech includes a wide range of new technologies used to improve and automate delivery of financial planning services. Moreover, robo-advisor technology is increasingly used among high net worth individual as it involves automated & algorithm-based systems to provide customized portfolio management advices to customers. Growth in FinTech enhances efficiency and transparency in financial advisor software, which, as a result is significantly fueling the market growth in the region.

Rising Number of High Net-Worth Individuals (HNWI)

Recently, there has been a huge spike in the number of HNWIs worldwide and thus, the need for financial planning for them has increased considerably. A majority of the HNWIs are retired and have a huge amount of money, and thus, require financial planning to invest the funds in order to get good returns on investment as well as to plan their retirement. Therefore, the need for financial management software will help the HNWIs to carefully invest their money and provide expertise as per the market conditions. Thus, the growing number of high net worth individuals globally will provide major financial planning software market opportunity in the upcoming years.

What are the Key Benefits for Stakeholders

- The study provides in-depth analysis of the global financial planning software market share along with current & future trends to illustrate the imminent investment pockets.

- Information about key drivers, restrains, & opportunities and their impact analysis on the global financial planning software market size are provided in the report.

- Porter’s five forces analysis illustrates the potency of buyers and suppliers operating in the financial planning software market.

- An extensive analysis of the key segments of the industry helps to understand the global financial planning software market trends.

- The quantitative analysis of the global financial planning software market forecast from 2021 to 2031 is provided to determine the market potential.

Financial Planning Software Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Deployment Mode |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | SAP, quicken inc., Moneytree Software, MoneyGuide, Inc. (Envestnet), Miles Software, RightCapital Inc., MoneyGuide, Inc., Personal Capital Corporation, eMoney Advisor, LLC., Advicent Solutions (NaviPlan) |

Analyst Review

A financial plan is most generally, a budget or plan for handling cash flow. Financial plans can allocate income to expenses and help to plan for savings. This can also involve borrowing cash, as through a loan. More specifically, a financial plan is a strategy which is personalized, given the client’s financial situation, to meet a client’s specific goals. In addition, accidents, business loss or illnesses cannot be predicted. These situations require individuals to prioritize health over finances. However, without a stable financial standing, getting the required support can become difficult or even impossible. This forces people to borrow money or take out an extra loan from banks. Therefore, having a financial planning software ensure that users are always aware of their current financial standing, where their money is invested or saved and how much of it is available to them. This allows them to be completely open-minded when they come across an opportunity or emergency. Furthermore, if they get any bonuses or raises, they have an acute understanding of where the money can go without requiring to consult several people.

Business owners or self-employed people do not have the financial security provided by a monthly salary. Instead, their monthly income depends entirely on their business income in the month. This can make it difficult to provide financial security to their family. Thus, a financial planning software can help them to secure their family’s finances and become independent of these constraints. With a good financial plan, users can save enough money to cover their monthly expenses. The financial planning software can help them manage their money when their business has extra sales. This invested, safe amount can then be used to fund family’s expenses in months when business does not break the profit margin. Some of the key players profiled in the report include Advicent Solutions, eMoney Advisor, LLC, Moneytree Software, MoneyGuide, Inc., Miles Software, Orion Advisor Technology, Personal Capital Corporation, Quicken Inc., RightCapital Inc., and SAP. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

With providing several benefits such as reduction in portfolio risk, diversification, low correlation with other assets, and less regulation, demand for alternative investment continue to rise in the market.

Financial advice and management segment accounted for the highest revenue in financial planning software market. Financial planning software solutions are designed by financial advisers for financial planners, and developed specifically to improve workflow efficiency, increase productivity and enhance client relationships.

North America accounted for the major share of financial planning software market. The increasing internet dependence in the North American region for various banking operations is boosting the growth for financial planning software market. In addition, the increased awareness among the people owing to advanced technological systems in the region is propelling the market.

The global financial planning software market size was valued at $3,680.23 million in 2021, and is projected to reach $16,914.08 million by 2031, growing at a CAGR of 16.6% from 2022 to 2031.

eMoney Advisor, LLC, RightCapital Inc., MoneyGuide, Inc., Orion Advisor Technology, and Quicken Inc. hold the market share in financial planning software market.

The global financial planning software market size is growing at a CAGR of 16.6% from 2022 to 2031.

The financial planning software market is segmented on the basis of component, deployment mode, application, end user, and region. By component, it is segmented into solution and service. By deployment mode, it is bifurcated into on-premises and cloud. By application, it is segregated into financial advice and management, portfolio, accounting and trading management, wealth management, personal banking, and others. By end user, the market is divided into large enterprises, small and medium-sized enterprises (SMEs), and individuals. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Loading Table Of Content...