Financial Risk Management Software Market Overview

The global financial risk management software market was valued at $2.5 billion in 2021, and is projected to reach $9.2 billion by 2031, growing at a CAGR of 14.4% from 2022 to 2031. The rising adoption of cloud-based security, increasing complexity of financial instruments, and stricter regulatory compliance requirements are contributing to the growth of the market.

Market Dynamics & Insights

- The financial risk management software industry in North America held the largest share of 39% in 2021.

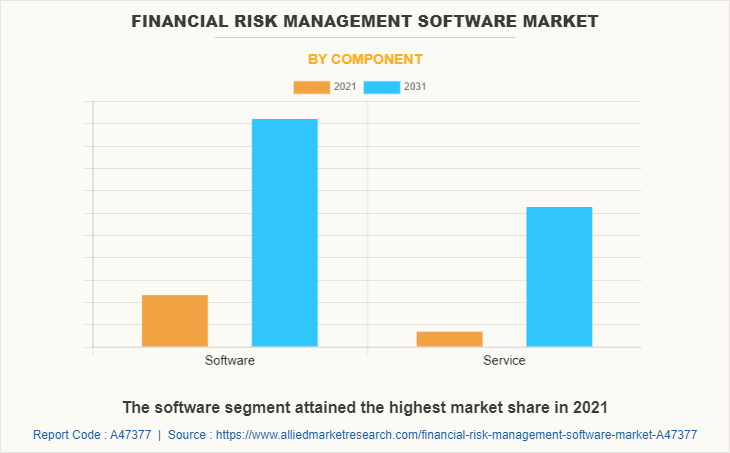

- By component, the software segment dominated the market, accounting for the revenue share of 66% in 2021.

- By deployment mode, the on-premise segment dominated the market, accounting for the revenue share of 61% in 2021.

- By end-user, the NBFCs segment is the fastest growing segment in the market, growing at a CAGR of 16.9% from 2022-2031.

Market Size & Future Outlook

- 2021 Market Size: $2.5 Billion

- 2031 Projected Market Size: $9.2 Billion

- CAGR (2022-2031): 14.4%

- North America: dominated the market in 2021

- Asia-Pacific: Fastest growing market

What is Meant by Financial Risk Management Software

Financial risk management software is a type of computer program that is designed to help organizations identify, assess, and manage various financial risks that they may face. These risks can include credit risk, market risk, liquidity risk, and operational risk. The software typically uses various tools and techniques to analyze data and generate reports that provide insights into the organization's financial risks. This information can then be used by decision-makers to make informed decisions about how to mitigate these risks. Some common features of financial risk management software may include risk modeling, stress testing, scenario analysis, risk measurement, risk reporting, and risk mitigation strategies. Moreover, the software can help automate various financial risk management tasks, such as monitoring compliance with regulations and policies.

Growth in complexity of financial instruments is a major driving factor for the financial risk management software market growth as financial risk management software solutions helps institutions manage the complexity of financial instruments by providing advanced analytics tools and risk modeling capabilities. Furthermore, rise in global financial market volatility and the increasing regulatory compliance requirements are driving the demand for financial risk management software solutions as institutions seek to manage their risks and comply with regulatory requirements in an efficient and effective manner.

However, complexity associated with software installation and configuration is a major factor hampering the growth of the financial risk management software market share as financial institutions often have complex IT infrastructures that include multiple legacy systems, which can make the installation and configuration of new software solutions difficult and time-consuming. Furthermore, high costs of deploying financial risk management software is a major restraining factor for the market growth. On the contrary, cloud-based financial risk management software solutions are gaining popularity, as they offer greater flexibility and scalability than traditional on-premise solutions. This is likely to drive growth in the market, as more businesses look to adopt these solutions to manage their risk.

The report focuses on growth prospects, restraints, and trends of the financial risk management software market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the financial risk management software market outlook.

Financial Risk Management Software Market Segment Review

The financial risk management software market size is segmented on the basis of component, deployment mode, enterprise size and end user. Based on component, the financial risk management software market is segmented into software and service. Based on deployment mode, the financial risk management software market it is segmented into on-premise and cloud. Based on enterprise size, the financial risk management software market is bifurcated into large enterprise and small and medium-sized enterprises. On the basis of end user, the financial risk management software market is segmented into banks, insurance companies, NBFCs and credit unions. By region, the financial risk management software market is analysed across North America, Europe, Asia-Pacific, and LAMEA.

Based on component, the software segment attained the highest growth in 2021 for the financial risk management software market. This is attributed to the fact such as increasing regulatory scrutiny, the need for businesses to comply with industry standards and regulations, the exponential growth of financial data generated by businesses, the need for advanced tools to detect and prevent fraud, and the growing threat of cyber-attacks. In addition, advancements in machine learning, artificial intelligence, and other emerging technologies are further accelerating the growth of these software segment. Furthermore, the compliance management software segment is experiencing a growing focus on privacy and data protection regulations, increased use of automation to streamline compliance processes, and integration with other risk management tools for a holistic approach to compliance management.

However, the service segment is attributed to be the fastest growing segment during the forecast period for the financial risk management software market. This is due to the fact that the increasing complexity of financial risk management. As businesses face a growing number of risks, they require more specialized and sophisticated risk management solutions that often require expert consulting services. In addition, regulatory requirements are becoming increasingly stringent, and many businesses are turning to risk management service providers to ensure compliance and avoid penalties.

On the basis of region, North America attained the highest growth in 2021 for the financial risk management software market. This is driven by factors such as the increasing adoption of cloud-based solutions, the growing awareness of the importance of risk management, and the rising demand for integrated risk management solutions that can help organizations manage risks more effectively and efficiently.

Furthermore, organizations in North America are increasingly adopting cloud-based risk management software solutions due to their scalability, cost-effectiveness, and ease of use. Cloud-based solutions offer greater flexibility and accessibility, allowing organizations to manage risks from anywhere and at any time. In addition, with the growing prevalence of cyber threats, organizations in North America are placing greater emphasis on cybersecurity risk management. This has led to an increased demand for risk management software solutions that can help organizations identify, assess, and manage cybersecurity risks more effectively.

However, Asia-Pacific is considered to be the fastest growing region during the forecast period. This is due to the fact that the organizations Asia-Pacific are increasingly adopting risk analytics tools to help them gain deeper insights into their risk profiles. This is enabling them to make more informed decisions around risk management and mitigation. The use of artificial intelligence and machine learning in risk management software solutions is growing in the Asia Pacific region. These technologies can help organizations to automate and streamline risk management processes, as well as identify and mitigate risks more effectively. In addition, there is a growing trend toward integrated risk management solutions in the Asia Pacific region. These solutions combine risk management, compliance, and audit functions to provide a more comprehensive approach to risk management.

The report analyzes the profiles of key players operating in the financial risk management software market such as Abrigo, Accenture, Ernst & Young Global Limited (EY), Fiserv, Inc., LogicGate, Inc., Oracle, Riskonnect, S&P Global Inc, SAS Institute Inc. and Temenos. These players have adopted various strategies to increase their market penetration and strengthen their position in the financial risk management software industry.

Market Landscape and Trends

The financial risk management software market has seen significant growth in recent years, driven by many players offering innovative solutions to help companies manage risks and achieve their business objectives. There is a growing emphasis on data analytics in the financial risk management industry. Companies are increasingly using advanced analytics tools to better understand their risks and to develop more effective risk management strategies. In addition to the above cybersecurity risks are becoming increasingly important for financial institutions, and as a result, there is a greater focus on cyber risk management in the financial risk management software market. Companies are looking for solutions that can help them identify and mitigate cybersecurity risks more effectively. Furthermore, as financial institutions become more aware of the importance of risk management, they are investing more in risk management software. This trend is expected to continue as the consequences of inadequate risk management become more apparent. These developments demonstrate the growing popularity and versatility of financial risk management software, and are likely to continue shaping the financial risk management software market in the upcoming years.

What are the Top Impacting Factors in Financial Risk Management Software Market

Growing Complexity of Financial Instruments

Financial institutions are increasingly using complex financial instruments, such as derivatives and structured products, to manage their risks and enhance their returns. However, these instruments can be difficult to understand and manage, which expose institutions to significant risk. Thus, financial risk management software solutions helps institutions manage the complexity of financial instruments by providing advanced analytics tools and risk modeling capabilities. These solutions analyze the performance of different financial instruments and help institutions identify and mitigate risks associated with these instruments. In addition, the use of financial risk management software helps institutions to comply with regulatory requirements related to the use of complex financial instruments.

Many regulatory bodies require financial institutions to report on their use of complex financial instruments and to manage the associated risks effectively. By using financial risk management software, institutions can streamline their reporting processes and ensure that they are following regulatory requirements. Therefore, the growing complexity of financial instruments is driving the demand for financial risk management software as institutions seek to manage their risks and comply with regulatory requirements.

Rise in Global Financial Market Volatility

The financial markets have become more volatile in recent years, which has increased the risk of financial losses for institutions. This has led to a greater need for credit risk software for banks that can help banking institutions identify and manage their exposures. Moreover, financial risk management software help institutions manage the risks associated with financial market volatility by providing real-time market data and analytics. These software help institutions identify and analyze market trends, assess the impact of market events on their portfolios, and develop strategies to mitigate the risks associated with market volatility. In addition, financial risk management software can help institutions optimize their portfolios in response to changing market conditions. By using advanced analytics and modeling tools, institutions can adjust their investment strategies and asset allocations in real-time to take advantage of market opportunities and manage risk effectively. Furthermore, the rise in global financial market volatility is driving the demand for financial risk management software market as institutions seek to manage the risks associated with market volatility and optimize their investment portfolios.

Increasing Regulatory Compliance Requirements

Financial institutions are subject to numerous regulations that require them to manage their financial risks effectively. As a result, there is a growing demand for software solutions that help these institutions comply with regulatory requirements. Financial risk management software solutions can help institutions comply with regulatory requirements by providing risk modeling and analytics tools that can assess the impact of different risks on their portfolios. These solutions help institutions identify and manage risks associated with market, credit, operational, and liquidity risk, which are important for compliance with regulatory requirements.

Moreover, financial risk management software help institutions automate their regulatory reporting processes. Many regulatory bodies require financial institutions to submit regular reports on their risk exposures and risk management activities. By using risk management software, institutions can automate their reporting processes and ensure that they are following regulatory requirements. Therefore, the increase in regulatory compliance requirements are driving the demand for financial risk management software solutions as institutions seek to manage their risks and comply with regulatory requirements in an efficient and effective manner.

Complexity Associated with Software Installation and Configuration

The complexity associated with software installation and configuration is a challenge for the financial risk management software market. Financial institutions often have complex IT infrastructures that include multiple legacy systems, which can make the installation and configuration of new software solutions difficult and time-consuming. Moreover, financial risk management software solutions require significant customization to meet the specific needs of each institution. This customization can add to the complexity of installation and configuration, as it requires significant IT resources and expertise. In addition, the complexity of software installation and configuration can lead to delays and additional costs associated with the implementation of software solutions. This can result in longer implementation times and higher implementation costs, which can be a significant barrier to adoption for financial institutions.

Furthermore, the complexity of software installation and configuration can lead to challenges with software integration. Therefore, the complexity associated with software installation and configuration can be a significant factor that restrains the financial risk management software market.

High Costs of Deploying Financial Risk Management Software

Financial risk management software can be expensive, especially for smaller organizations or those with limited budgets. This can make it challenging for vendors to reach certain segments of the market and limit overall adoption rates. Deploying financial risk management software requires significant upfront investment in hardware, software, and personnel. Organizations may need to hire consultants, developers, or other IT staff to help with implementation, which can add to the overall cost of the project.

Moreover, after deployment, financial risk management software will need to be maintained and supported. This can include ongoing software updates, bug fixes, and technical support, which can be an additional ongoing cost for organizations. In addition, the high costs of deploying financial risk management software can be a significant barrier for organizations, particularly for those with limited budgets or resources. Vendors may need to develop pricing models or financing options that make their products more accessible to a wider range of customers or provide flexible deployment options such as cloud-based solutions that reduce the upfront costs associated with hardware and IT infrastructure.

Rising Adoption of Cloud-based Financial Risk Management Software

Cloud-based financial risk management software solutions have gained popularity, as they offer greater flexibility and scalability than traditional on-premise solutions. This is likely to drive growth in the market, as more businesses look to adopt these solutions to manage their risk. Cloud-based solutions are one of the best financial risk management software as they offer a number of advantages over traditional on-premise solutions, including greater scalability, flexibility, and cost-effectiveness.

Moreover, cloud-based financial risk management software solutions allow organizations to access critical risk management tools from anywhere with an internet connection, making it easier to collaborate and share information across teams and locations. These solutions typically offer automatic software updates and maintenance, reducing the burden on internal IT staff. In addition, with cloud-based solutions, organizations only pay for the resources they use, rather than investing in expensive hardware and software upfront. Furthermore, the trend toward cloud-based security solutions is expected to continue, as businesses seek out solutions that are easier to deploy and manage, while providing robust security capabilities. Financial risk management software vendors that offer cloud-based solutions are likely to benefit from this trend, as more businesses look to adopt these solutions to manage their risks.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the financial risk management software market forecast from 2021 to 2031 to identify the prevailing financial risk management software market opportunity.

- The market research for the financial risk management software market is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the financial risk management software market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global financial risk management software market trends, key players, market segments, application areas, and market growth strategies.

Financial Risk Management Software Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 9.2 billion |

| Growth Rate | CAGR of 14.4% |

| Forecast period | 2021 - 2031 |

| Report Pages | 461 |

| By Component |

|

| By Deployment Mode |

|

| By Enterprise Size |

|

| By End-User |

|

| By Region |

|

| Key Market Players | LogicGate, Inc., Accenture, Riskonnect, Temenos, Fiserv, Inc., Abrigo, S&P Global Inc, Oracle, SAS Institute Inc., Ernst & Young Global Limited (EY) |

Analyst Review

The financial risk management software market has experienced significant growth in recent years and is expected to continue to grow. One major trend is the shift toward digital financial risk management software, which offers convenience and flexibility for both consumers and retailers. Another major trend in the financial risk management software market is the financial risk management software is becoming increasingly mobile-friendly, enabling financial professionals to access risk data and analytics from their smartphones and tablets. This improves decision-making speed and efficiency. Thus, the financial risk management software market is expected to remain strong driven by change in consumer behavior and the growth in popularity of financial risk management software. In addition, there are a few other major market trends in the financial risk management software industry. One of the trends is that it can streamline workflows and reduce the need for manual processes, resulting in increased efficiency and reduced costs. Another growth factor for the market is it can provide a comprehensive view of an organization's risk exposure, allowing financial professionals to identify and mitigate risks more effectively. Moreover, environmental, social, and governance (ESG) factors are increasingly being incorporated into financial risk management software. This includes tools for analyzing the impact of ESG risks on financial performance and identifying sustainable investment opportunities. Therefore, the financial risk management software industry is expected to continue to evolve and adapt to changing consumer preferences and technological advances.

Furthermore, market players have adopted various strategies for enhancing their services in the market and improving customer satisfaction. For instance, In January 2023, Abrigo, a leader in compliance, credit risk, and lending solutions for financial institutions, announced the acquisition of DiCOM Software, LLC, and a leading provider of automated credit risk management software. The combination of Orlando, Fla.-based DiCOM Software and Abrigo is expected to provide financial institutions with access to best-in-class loan review and portfolio analysis solutions that are vital for protecting asset quality in the face of increase in pressure on borrowers. Moreover, in December 2022, EY acquired international financial and risk transformation consultancy, ifb SE. This acquisition enhanced the breadth and depth of EY finance and risk transformation and compliance capabilities, creating greater opportunities for EY to support its clients. This acquisition is projected to enhance EY consulting services, enabling EY teams to deliver complex, large-scale finance, and risk digital transformation projects for the financial services industry. These strategies by the market players operating at a global and regional level are expected to help the market to grow significantly during the forecast period.

Some of the key players profiled in the report include Abrigo, Accenture, Ernst & Young Global Limited (EY), Fiserv, Inc., LogicGate, Inc., Oracle, Riskonnect, S&P Global Inc, SAS Institute Inc. and Temenos. These players have adopted various strategies such as partnership, product launch, acquisition and others to increase their market penetration and strengthen their position in the financial risk management software market.

Growth in complexity of financial instruments is a major driving factor for the financial risk management software market as financial risk management software solutions helps institutions manage the complexity of financial instruments by providing advanced analytics tools and risk modeling capabilities. Furthermore, rise in global financial market volatility and the increasing regulatory compliance requirements are driving the demand for financial risk management software solutions as institutions seek to manage their risks and comply with regulatory requirements in an efficient and effective manner.

North America is the largest regional market for Financial Risk Management Software Market

The global financial risk management software market was valued at $2.48 billion in 2021 and is projected to reach $9.22 billion by 2031, growing at a CAGR of 14.4% from 2022 to 2031.

The report analyzes the profiles of key players operating in the financial risk management software market such as Abrigo, Accenture, Ernst & Young Global Limited (EY), Fiserv, Inc., LogicGate, Inc., Oracle, Riskonnect, S&P Global Inc, SAS Institute Inc. and Temenos. These players have adopted various strategies to increase their market penetration and strengthen their position in the financial risk management software market.

Loading Table Of Content...

Loading Research Methodology...