Financial Services Software Market Research, 2031

The global financial services software market size was valued at $118.65 billion in 2021, and is projected to reach $282.71 billion by 2031, growing at a CAGR of 9.2% from 2022 to 2031.

Financial service software has increased its adoption since financial Institutions introduced online solutions and innovations such as P2P payment, online transfers, alerts, and other such services. The two types of software such as financial advice software and financial solutions software plays an important role when organizations plan to integrate risk, performance, and compliance. It helps to monitor risks, manages the organization according to the changing trends and requirements, and also helps organizations plan and invest smarter within minimal cost and time. The banking and financial sector makes use of the technology to incorporate risks into mainstream decision-making, consistently monitoring performance, promoting a culture that incorporates risk management, delivering business and profitability insights, and providing relevant market intelligence. This facilitates an accurate assessment of the business and its potential risks.

The rise in emergence of demand for digital channels for banking, enhanced customer services offered by financial service software, and surge in demand for workforce optimization solutions drive the growth of the financial service software market. However, increase in the cost of deployment and adherence to different political factors and regulatory compliances limit the financial service software market growth. Conversely, rise in investment in big data, mobility, and cloud technologies by the fintech companies is anticipated to provide numerous opportunities for the expansion of the financial service software market during the forecast period.

The financial services software market is segmented into Component, Software Type, Deployment Model and Enterprise Size.

Segment review

The financial service software market is segmented into component, deployment model, enterprise size, software type, and region. By component, the market is divided into software and services. By software type, it is categorized into audit, risk & compliance management, BI & analytics applications, business transaction processing, customer experience, and enterprise IT. By deployment model, the market is classified into on-premise and cloud. By enterprise size, it is bifurcated into large enterprises and SMEs. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The global financial service software market is dominated by key players such as Accenture, Finastra, FIS, FIServ, Inc., IBM Corporation, Infosys, Oracle Corporation, SAP SE, TCS, and Temenos. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

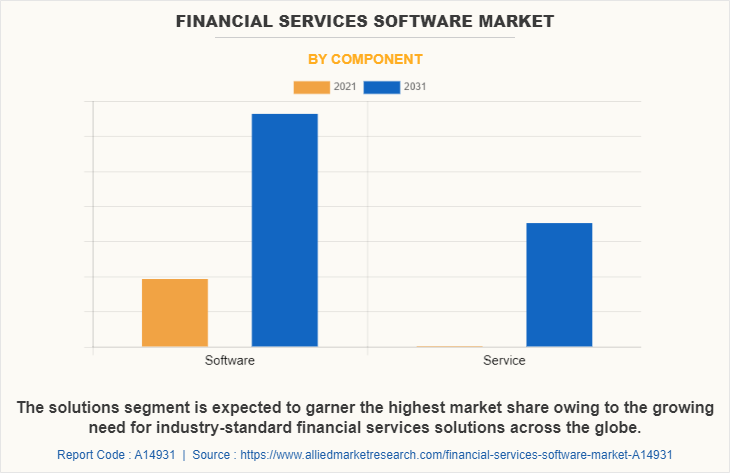

By component, the software segment dominated the financial service software market size in 2022 and is expected to continue this trend during the forecast period, owing to the rapid adoption of financial software which is capable of streamlining operations by consolidating multiple software into one fully digital ERP solution. However, the service segment is expected to witness highest growth in the upcoming years, owing to the rise in demand for advanced financial services for enhanced business process transformation and rapid innovation.

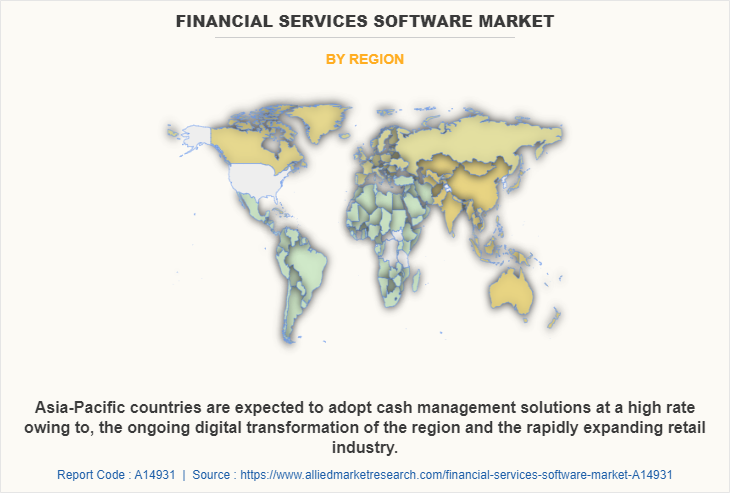

Region wise, the financial service software market was dominated by North America in 2021 and is expected to retain its position during the forecast period, owing to the increased demand from start-up businesses owing to the government initiative to support an open banking system in this region. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to the emerging digital ecosystems such as highly integrated applications which provide applications at a one-stop-shop for a variety of financial services, which is expected to fuel the market growth in this region.

The report focuses on growth prospects, restraints, and analysis of the global financial services software market trends. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, the threat of new entrants, threat of substitutes, and bargaining power of buyers on the global financial services software market share.

COVID-19 impact analysis

The financial services software industry has witnessed significant growth over the past few years owing to the surge in adoption of innovative financial services across various BFSI industries. Furthermore, during the COVID-19 pandemic outbreak, the financial services software industry witnessed a sudden increase in demand, attributed to rise in digital innovations in the financial services sector empowering the financial services software market growth. In addition, the growing range of product offerings and convenience has played a major role to boost applications of financial services during the pandemic. COVID-19 has directly affected the daily operations of the banking sector. Financial service software minimizes human-to-human interaction in day-to-day activities, which helps prevent the spread of the virus. Hence, several banks across the globe are implementing financial services application technologies such as mobile banking, and unified payment interface (UPI) to battle the COVID-19 pandemic. This is expected to provide lucrative financial services software market opportunity during the forecasted period.

Top impacting factors

The emergence of digital channels for banking

The increase in adoption of digital channels in the banking industry such as digitalization, mobile banking, UPI payments, blockchain, artificial intelligence (AI) robots, and other innovations are driving the growth of the financial service software market. For instance, in May 2022, the Indian government announced the plan to launch 75 digital banking units that are easy to use on August 15, 2022 across the country. This, in turn drives the growth of the market. Moreover, fintech companies specialize in developing technology solutions that help companies to manage financial aspects of the business, like new software, applications, processes as well as business models, which fuels the market growth. Furthermore, investments made by the fintech companies have increased drastically in the past decade which is expected to drive the market globally.

Furthermore, these recent trends have reshaped the banking and finance industry by bringing revolutionary changes to the traditional models. This shift has been encouraged by the customers as they are quite open to innovations and the government is also showing great support for these trends. This boosts the growth of the market.

Enhanced focus on customer experience

Increase in digital innovation and digitalization in financial service is helping to enhance customer experience by providing on touch payment, secure connectives and many other services. In addition, financial service companies are spending significant amounts of their budgets on customer experience (CX). According to a Microsoft Dynamics 365 survey of insurers, banks and other financial services firms, 86% assign 25% or more of their overall budget to customer experience, whereas nearly half (45%) assign 50% or more. Among the 46% of companies in the study who expect their organizations’ CX budgets to increase somewhat or substantially in the next year, 59% will invest in leveraging customer data for real-time personalization at the branch level. This drives the growth of the market.

Furthermore, development in the solutions such as the integration of live chat support with employee performance reviews help the organizations to understand consumer needs and behavior. This, in turn, boosts the market growth. For instance, In May 2022, Finastra launched its managed services in Amazon web services (AWS), to enable banks and financial institutions to access FMS (Finastra managed services) in the AWS cloud. It is also helping large multi-national U.S. banks roll out its lending solution. In addition, the surge in focus on enhancing financial services in commercial banks such as payment, deposit, or lending services is enhancing customer experience. This is expected to boost the demand for financial services applications in the market during the forecast period.

KEY BENEFITS FOR STAKEHOLDERS

- The study provides an in-depth analysis of the global financial services software market forecast along with current & future trends to explain the imminent investment pockets.

- Information about key drivers, restraints, & opportunities and their impact analysis on global financial services software market outlook is provided in the report.

- The Porter’s five forces analysis illustrates the potency of the buyers and suppliers operating in the industry.

- The financial services software market analysis from 2022 to 2031 is provided to determine the market potential.

Financial Services Software Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Software Type |

|

| By Deployment Model |

|

| By Enterprise Size |

|

| By Region |

|

| Key Market Players | TCS, FIS, Accenture plc, IBM Corporation, finastra, Infosys, SAP SE, Fiserv, Inc., Oracle Corporation |

Analyst Review

The adoption of financial service software from banks and financial institutions is due to the digitization of services to modernize their commercial lending business. This move is mainly a result of increased competition among banks and growing demand for the simplified and quick commercial lending process. Digitization leads to improved customer satisfaction in obtaining a commercial loan, which can otherwise be a complex and slow process. It also enables banks to target new customer categories and offer customer-centric solutions, which leads to improved efficiencies in the commercial lending business. Such feature sets of the financial service software are promoting the growth of the global financial service software market.

Key providers in the financial service software market are Accenture, FIS, and IBM corporation. With the growth in demand for financial service software, various companies have established acquisition to increase their solutions offerings. For instance, in June 2022, Accenture has agreed to acquire Allgemeines Rechenzentrum GmbH (ARZ), a technology service provider focused on the banking sector in Austria. Accenture's cloud-based banking platform-as-a-service capabilities, which include everything from core banking to online banking and regulatory services for banking clients across Europe, will be expanded as a result of the acquisition.

In addition, with the surge in demand for financial service software, various companies have expanded their current services to continue with the rise in demand for financial service software solutions. For instance, in April 2022, FIS introduced Banking-as-a-Service (BaaS) comes as embedded finance sees broader adoption while the financial services industry explores new ways to expand reach to consumers. API capability has been added to the software. With easy banking and payment features, BaaS Hub enables an all-in-one financial experience.

Moreover, many market players have expanded their business operations and customer base by increasing their collaboration. For instance, in July 2022, IBM and SAP to help financial institutions accelerate cloud adoption to modernize operations in a secured environment. the collaboration will be designed to help the companies address the industry's stringent compliance, security and resiliency requirements, while supporting business transformation and innovation for financial services institutions.

Region wise, the financial service software market was dominated by North America in 2021 and is expected to retain its position during the forecast period, owing to the increased demand from start-up businesses owing to the government initiative to support an open banking system in this region.

The global financial service software market size was valued at $ 10.32 billion in 2021 and is projected to reach $ 27.71 billion by 2031, growing at a CAGR of 10.5% from 2022 to 2031.

The financial service software industry has witnessed significant growth over the past few years owing to the surge in adoption of innovative financial services across various BFSI industries. Furthermore, during the COVID-19 pandemic outbreak, the financial service software industry witnessed a sudden increase in demand, attributed to rise in digital innovations in the financial services sector empowering the market growth. In addition, the growing range of product offerings and convenience has played a major role to boost applications of financial services during the pandemic.

Loading Table Of Content...