Fintech Cloud Market Research, 2031

The global fintech cloud market was valued at $44.4 billion in 2021, and is projected to reach $196.2 billion by 2031, growing at a CAGR of 16.4% from 2022 to 2031.

Implementation of cloud in fintech industry is improving the legacy system capabilities, vastly increasing the speed of data processing, and also a decreasing the infrastructure costs and simplify the configuration, security, and meet compliance challenges. The cloud computing in fintech has brought numerous advantages to the financial sector across many areas including security, service, innovation and scalability. Furthermore, cloud infrastructure enables financial companies to scale quickly and easily without barriers and is expected to prosper the future of fintech.

The management property of cloud technology for financial data and advanced security through Fintech cloud propels growth of the market. Since, the financial services sector has a responsibility to safeguard data of its customers, the market is expected to grow in fintech cloud market forecast. Hence, enhanced and advanced security provided through fintech cloud propels the fintech cloud market growth. From data encryption to zero trust verification and access control, many of the risks that traditional on-premises IT infrastructures present are being mitigated through cloud computing in financial services.

However, due to increasing security concerns among the consumers about the security of their personal data in the era of high-profile data breaches and cyber security threats limiting the growth of the market. On the contrary, geo redundant cloud data centers to help businesses preserve operational continuity in the event of calamities expected to provide lucrative growth opportunities to the market in the upcoming years. In addition, with the emergence of AI and ML technologies in fintech cloud will penetrate the entire spectrum of financial industry operations across front, middle, and back offices. Hence, technological advancements in fintech cloud further propels growth of the market.

The report focuses on growth prospects, restraints, and trends of the fintech cloud market outlook. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the fintech cloud market.

The fintech cloud market is segmented into Organization Size, Component, Service Type, Deployment Mode and Application.

Segment Review

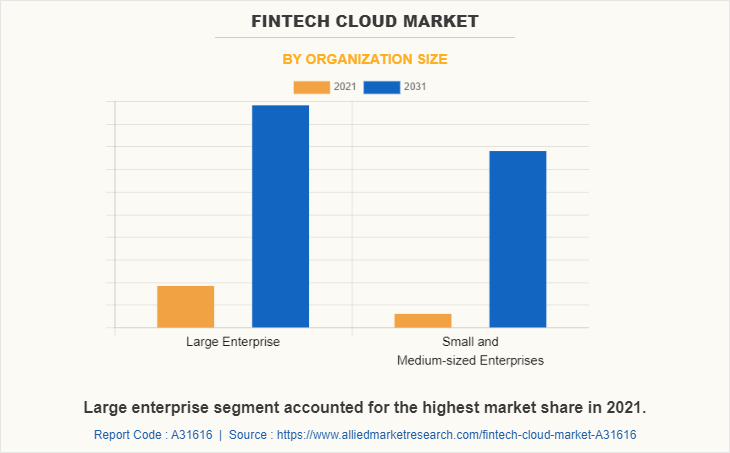

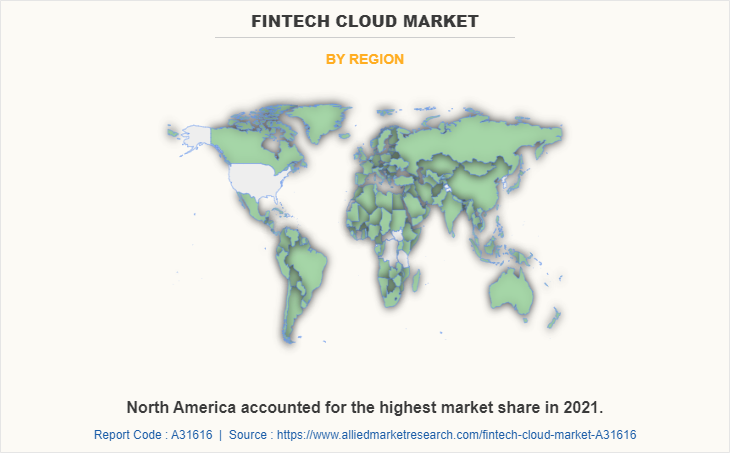

The fintech cloud market is segmented on the basis of component, deployment mode, application, organization size and region. By component, it is segmented into solution and service. By service type, the market is divided into infrastructure as a service (IaaS), platform as a service (PaaS), and software as a service (SaaS). By deployment mode, it is bifurcated into public cloud, private cloud and hybrid cloud. Based on application, it is segregated into asset management, customer relationship management (CRM), enterprise resource management (ERM), supply chain management (SCM), and others. By organization size, the market is divided into large enterprises, and small and medium-sized enterprises. By region, it is analysed across North America, Europe, Asia Pacific and LAMEA.

On the basis of component, the solution segment attained the highest fintech cloud market share in 2021. This is attributed to the fact that cloud computing solutions has been enabling businesses to access a cost-effective solution for data storage and sharing options, with added benefits of secure storage, interoperability, scalability, and 24/7 uptime.

Region wise, North America dominated the fintech cloud market size in 2021. This is attributed to the new technologies in the region are helping fintech cloud companies to better serve customers by giving them access to web portals and applications to review and answer common questions related to their accounts.

The report analyses the profiles of key players operating in the fintech cloud market such as Amazon.com, Inc., Microsoft, Google LLC, IBM, Oracle, SAP SE, VMware, Inc., Salesforce, Inc., RACKSPACE TECHNOLOGY, and Cisco Systems, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the fintech cloud industry.

COVID-19 Impact Analysis

In the wake of COVID-19 pandemic situation, it was discovered that many financial services firms use outdated technology infrastructures. As cloud technology has been developed, banks and credit unions have been hesitant to embrace it, fearful of security, unsure of the benefits, and unwilling to relinquish control of their data. Moreover, IT enterprises were highly adopting managed data center services to enhance security, avoid network downtime, and achieve operational efficiency. Thus, the increasingly mobile workforce due to lockdowns, and growing need for disaster recovery and security to avoid high network downtime costs have fueled the demand for cloud managed services in fintech cloud industry across the globe. Therefore, the COVID-19 had a positive impact on the fintech cloud market.

Top Impacting Factors

Advanced Security through Fintech Cloud

Acquiring and working with data is a primary concern for fintech’s, from onboarding and identity verification processes through account maintenance, balance, checking, analyzing spending trends, and so on therefore, data management is crucial part. Companies can use cloud technology to gather and store large quantities of data securely and make it accessible at any time. Moreover, it means there’s no need to depend on the IT specialist to clock in to access vital information, providing an employee has the correct credentials. In addition, such management of the data can be done by the fintech financial service user from anywhere at any time and often automatically. In addition, cloud set-ups offer solutions at a global level, providing access to data 24 by 7. Cloud computing allows seamless performance by giving access to high-performance servers and data storage. Cloud helps in making the production cycle continuous, thereby, reducing the time-to-market of a product or solution. Most cloud-based solutions are now one-click solutions that could also be accessed via a smartphone.

Security Concerns Related to Cloud Technology

Fintech is the use of technology and innovation to provide financial services through internet-based platforms. Companies in this market provide end-to-end process financial services and solutions to automate financial processes over the Internet. It is used by end-user organizations on the back end to automate insurance, trading, banking services, and risk management. With the usage of cloud technology in financial services there rise the concern of data security. Fintech companies collect a large quantum of data about their customers, which include personal information and other financial records and save the files on cloud for future use. Many fintech companies also collect data on a customer’s online spending behavior and social media patterns, to trace their digital footprint. This data collected is used for analysis in domains like marketing, sales, and financial decision-making like generating credit score to determine a customer’s risk profile. This means a large amount of personal and sensitive data is potentially vulnerable to breaches and can be accessed by malicious entities. For instance, hackers breached one of the top fintech companies, Equifax Inc.’s software platform and accessed sensitive personal information of 143 million+ Equifax customers in the U.S. and Canada. Such instances are resulting distrust in customers regarding secure handling of private information, thus restraining the growth of the fintech cloud market.

Opportunity for IT Companies to Focus on Fintech Companies

Big Tech companies such as Google, Amazon, Facebook and Apple have an opportunity to provide their cloud services to the financial and fintech companies, which positively impacts the growth of the FinTech cloud market. Moreover, these fintech firms keep introducing peripheral financial services to their current offerings. Which indeed helps for the data management, security, analysis, etc. for the financial institution. For instance, in 2019, Facebook, the social media firm wanted to introduce a digital currency that makes global payments cheaper and faster. Therefore, as they face competition from the similar payment apps such as Google Pay and Apple Pay in the US and Chinese payment apps such as Alipay and Wechat Pay. Thus, big tech companies have a great opportunity to focus on financial services are expected to positively impact the FinTech cloud market’s growth.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the fintech cloud market analysis from 2021 to 2031 to identify the prevailing fintech cloud market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the fintech cloud market segmentation assists to determine the prevailing fintech cloud market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global fintech cloud market trends, key players, market segments, application areas, and market growth strategies.

Fintech Cloud Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 196.2 billion |

| Growth Rate | CAGR of 16.4% |

| Forecast period | 2021 - 2031 |

| Report Pages | 251 |

| By Organization Size |

|

| By Component |

|

| By Service Type |

|

| By Deployment Mode |

|

| By Application |

|

| By Region |

|

| Key Market Players | Amazon.com, Inc., International Business Machines Corporation, Cisco Systems, Inc., SAP SE, Salesforce, Inc., RACKSPACE TECHNOLOGY, Microsoft, Oracle, Google LLC, VMware, Inc. |

Analyst Review

Fintech Cloud offers a new CompatibL cloud platform that is scalable and cost-effective open-risk banking cloud software for conducting analytics, predictive modeling, strategic planning, risk management, and enhanced BI. It is very cost-effective and widely available next-generation financial architecture for many financial institutions. Furthermore, its flexibility and customization possibilities enable every financial organization to meet their own particular set of criteria. Moreover, this cloud platform allows seamless integration of new technologies and can be deployed in the data center or private cloud, as well as in most public clouds, including AWS and Azure. In addition, with CompatibL cloud platform, user’s data and data processing operations will always be carefully protected, since it provides one of the most secure cloud banking solutions. This level of security is achieved by using only reliable cloud technologies and strictly adhering to the established regulatory standards in banking.

Oracle NetSuite, an American multinational computer technology corporation announced SuiteBanking, as the first unified suite that embeds fintech into cloud ERP, helps customers automate key financial processes and gain full visibility into cash flow. Furthermore, by bringing together automated accounts payable and accounts receivable processes, SuiteBanking makes it fast and easy to pay bills, send invoices, and get paid, all from within NetSuite. Moreover, it improves cash flow by accelerating accounts payable and accounts receivable processes, and its enhanced automation gives organizations greater control over expenses, increases the effectiveness of accounting processes, and provides detailed insights all in one system. By providing a unified system, NetSuite eliminates the need to collect and normalize data from other departments and systems, saving finance teams dozens of hours every month. In addition, integration with banking partners such as HSBC gives NetSuite customers convenient access to a variety of financial services, including a global digital wallet and virtual payment card.

Some of the key players profiled in the report include Amazon.com, Inc., Microsoft, Google LLC, IBM, Oracle, SAP SE, VMware, Inc., Salesforce, Inc., RACKSPACE TECHNOLOGY, and Cisco Systems, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry

The fintech cloud market is estimated to grow at a CAGR of 16.4% from 2022 to 2031.

The fintech cloud market is projected to reach $196.18 billion by 2031.

The fact that it aids in managing financial data, advanced security through fintech cloud and cost-effectiveness majorly contribute toward the growth of the market.

The key players profiled in the report include Amazon.com, Inc., Microsoft, Google LLC, IBM, Oracle, SAP SE, VMware, Inc., Salesforce, Inc., RACKSPACE TECHNOLOGY, and Cisco Systems, Inc.

The key growth strategies of fintech cloud market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...